The Ultimate Guide to Candlestick Patterns

Candlestick patterns consist of small clusters of 1 to 5 candlestick bars, which offer predictive value on the direction of the short term price action.

In this guide, I will cover all the major reversal and continuation candlestick patterns, and what are the best strategies to use them to pinpoint your entries and exits in trading.

My key takeaway from this trading guide is the importance of understanding reversal and continuation candlestick patterns. It has greatly improved my ability to identify potential changes in the market trend and make better trading decisions. I also appreciate the tips provided on combining candlestick patterns with other technical indicators for more precise market timing.

The detailed list of various candlestick patterns has been an eye-opener for me. As a beginner, understanding and recognizing these patterns has helped me make more informed decisions in my trading. Moreover, I found the section on common mistakes and the wrong way to trade candlestick patterns quite insightful. It made me more aware of the pitfalls to avoid while using these patterns in my trading strategy.

The guide has emphasized the importance of practice and patience in mastering the art of reading candlestick patterns. The list of reversal and continuation patterns provided a great foundation for understanding the market’s behavior. The tips from the trading desk section were particularly helpful in fine-tuning my approach to combining these patterns with other technical indicators.

I believe the key takeaway from this trading guide is that candlestick patterns can provide valuable insights into market sentiment and potential trend changes. As a beginner trader, this knowledge has been crucial in building my confidence and understanding of the market. Additionally, the guide’s emphasis on combining candlestick patterns with other technical indicators has given me a more comprehensive view of the market.

My key takeaway is the importance of understanding the limitations of candlestick patterns. Although they can provide valuable information, they should not be solely relied upon for making trading decisions. It’s essential to combine them with other technical indicators and market analysis techniques to get a clearer picture of the market’s direction.

This trading guide has made me realize the vast array of candlestick patterns that exist, and how each pattern can provide unique insights into market trends. The guide has helped me understand the difference between reversal and continuation patterns, allowing me to better gauge potential market movements. I also found the tips on blending candles and avoiding common mistakes to be incredibly valuable in refining my trading strategy.

The trading guide has taught me the importance of understanding and recognizing various candlestick patterns to make better-informed trading decisions. The detailed list of patterns and their respective explanations has been invaluable in building my knowledge base. The guide’s emphasis on practice and patience, as well as the importance of combining candlestick patterns with other technical indicators, has greatly improved my trading strategy.

My key takeaway from this trading guide is the importance of learning and understanding different candlestick patterns. These patterns provide valuable information about the market’s sentiment and potential trend changes. By incorporating these patterns into my trading strategy and combining them with other technical indicators, I have been able to make better-informed decisions and improve my overall trading performance.

The guide provided a comprehensive list of candlestick patterns, which has helped me as a beginner trader in understanding market trends and making better decisions.

The trading guide has been a great resource for me in understanding the psychology behind the candlestick patterns. The explanations provided have given me a better understanding of market sentiment and how these patterns can be used to anticipate potential trend reversals or continuations. Additionally, the tips for combining these patterns with other technical indicators have further enhanced my trading strategy.

The detailed explanations of various candlestick patterns have been incredibly helpful in understanding market trends and making better trading decisions. As a beginner trader, I found the guide to be an excellent resource for learning about different patterns and how to recognize them in the market. The tips on combining these patterns with other technical indicators have also been invaluable in refining my trading strategy.

The key takeaway for me from this trading guide is the need to practice and develop patience in mastering the art of reading candlestick patterns. The guide provided a comprehensive list of patterns, which has been beneficial in understanding market trends and making informed trading decisions. The tips on combining these patterns with other technical indicators have further enhanced my overall trading performance.

The trading guide has helped me understand the significance of candlestick patterns in predicting market trends and changes in sentiment. The detailed explanations of reversal and continuation patterns have been particularly helpful in making more informed trading decisions. Additionally, the tips for blending candles and using other technical indicators have been instrumental in refining my trading approach.

My key takeaway from this trading guide is the importance of understanding the limitations of candlestick patterns and not solely relying on them for trading decisions. The guide emphasizes the need to combine these patterns with other technical indicators and market analysis techniques to get a clearer and more accurate picture of the market’s direction.

The trading guide has provided me with a solid foundation for understanding and recognizing various candlestick patterns. As a beginner trader, this knowledge has been crucial in building my confidence and understanding of market trends. The tips on avoiding common mistakes and combining these patterns with other technical indicators have also been incredibly helpful in enhancing my trading strategy.

My key takeaway from this trading guide is the emphasis on practice and patience when it comes to mastering the art of reading candlestick patterns. The guide provided a comprehensive list of patterns, which has been valuable in understanding market trends and making better trading decisions. The tips on combining these patterns with other technical indicators have further improved my overall trading performance.

The trading guide has given me a deep understanding of various candlestick patterns and their significance in predicting market trends. The detailed list of reversal and continuation patterns has been particularly helpful in making more informed trading decisions. Additionally, the tips for blending candles and using other technical indicators have been instrumental in refining my trading approach.

My key takeaway from this trading guide is the importance of knowing when to use reversal and continuation candlestick patterns. It has helped me gain a better understanding of market trends and how to make informed decisions accordingly. The guide also provided useful tips on avoiding common mistakes and incorporating these patterns into a more comprehensive trading strategy.

The key takeaway for me from this trading guide is the importance of understanding and recognizing various candlestick patterns to make better-informed trading decisions. The detailed list of patterns and their respective explanations has been invaluable in building my knowledge base. The guide’s emphasis on practice and patience, as well as the importance of combining candlestick patterns with other technical indicators, has greatly improved my trading strategy.

Which part of candlestick patterns are you struggling with the most? For me, the most challenging aspect of candlestick patterns is identifying and differentiating between the various reversal patterns. Some of them look quite similar, and it can be tricky to recognize them in real-time while analyzing the charts. How do you guys deal with this challenge?

I agree, the reversal patterns can be quite tricky, especially when they appear in fast-moving markets. What I’ve found helpful is to practice identifying them through historical charts and then use additional technical indicators to confirm the reversal. It takes time and practice, but it’s worth it in the end.

I also faced difficulties with reversal patterns, but I found that focusing on a few key patterns and mastering them has helped me a lot. Instead of trying to memorize and recognize all the patterns, I’ve chosen a few that I find the most reliable and have spent time practicing and perfecting my understanding of those.

For me, the most challenging part is incorporating candlestick patterns into my overall trading strategy. I understand the patterns and can identify them, but knowing when to use them as part of my decision-making process has been a struggle. Anyone else facing the same issue?

I can relate to that. What has helped me is to backtest my strategy using historical data and see how the incorporation of candlestick patterns affected my trading performance. This way, I can fine-tune my strategy and build more confidence in using candlestick patterns in my decision-making process.

I understand your concern. What I usually do is to combine candlestick patterns with other technical indicators, such as moving averages or trendlines, to help confirm the continuation or reversal of the trend. It’s essential not to rely solely on candlestick patterns but use them in conjunction with other tools.

I find it hard to maintain discipline and patience when using candlestick patterns. Sometimes, I act too early or too late, leading to losses. How can I improve my discipline and patience when trading with candlestick patterns?

I faced the same problem before. What has helped me is to develop a solid trading plan and stick to it. Having a plan with clear rules on when to enter and exit a trade helps me stay disciplined and patient, even when the market is volatile.

The hardest part for me is blending candles. I understand the concept, but it’s still difficult to apply in practice, especially when the market is moving quickly. Does anyone have any tips or tricks on how to get better at blending candles?

I think practice is the key when it comes to blending candles. The more you practice, the better you’ll become at identifying blended candles in real-time. Additionally, you can try using charting software that allows you to switch between different timeframes, making it easier to spot blended candles.

For me, the most challenging aspect is determining the significance of a candlestick pattern in the overall market context. Sometimes, a pattern may appear in isolation, and it’s hard to know whether it’s a meaningful signal or just noise. Any tips on how to deal with this?

One thing that has helped me is to always look for confluence. Instead of relying on a single candlestick pattern, I try to find additional evidence that supports the pattern’s interpretation. This can include other technical indicators, support and resistance levels, or even fundamental factors that align with the pattern’s message.

My issue with candlestick patterns is maintaining focus and concentration during my trading sessions. With so many patterns to keep track of, I sometimes find myself overwhelmed and unable to make quick decisions. How do you all stay focused while trading with candlestick patterns?

I see the problem. One approach that has worked for me is to limit the number of patterns I actively watch for during a trading session. By focusing on just a few high-probability patterns, I can concentrate better and avoid feeling overwhelmed.

My situation that I am facing is with the timeframe. I often find that the patterns I identify on one timeframe don’t hold true on another. How do you guys decide which timeframe to use when analyzing candlestick patterns?

Choosing the right timeframe really depends on your trading style and objectives. If you’re a short-term trader or day trader, you might want to focus on shorter timeframes like the 1-minute or 5-minute charts. On the other hand, if you’re a swing trader or position trader, you might find the daily or weekly charts more useful. Ultimately, it’s about finding the timeframe that suits your trading style and allows you to spot high-probability patterns.

My biggest challenge is dealing with false signals from candlestick patterns. Sometimes, a pattern appears to be forming, but the market doesn’t follow through as expected.

I’m curious to know which candlestick pattern you find the most useful in your trading. Personally, my favorite is the Bullish Engulfing pattern. It’s easy to spot and has been quite reliable in my experience. What about you all?

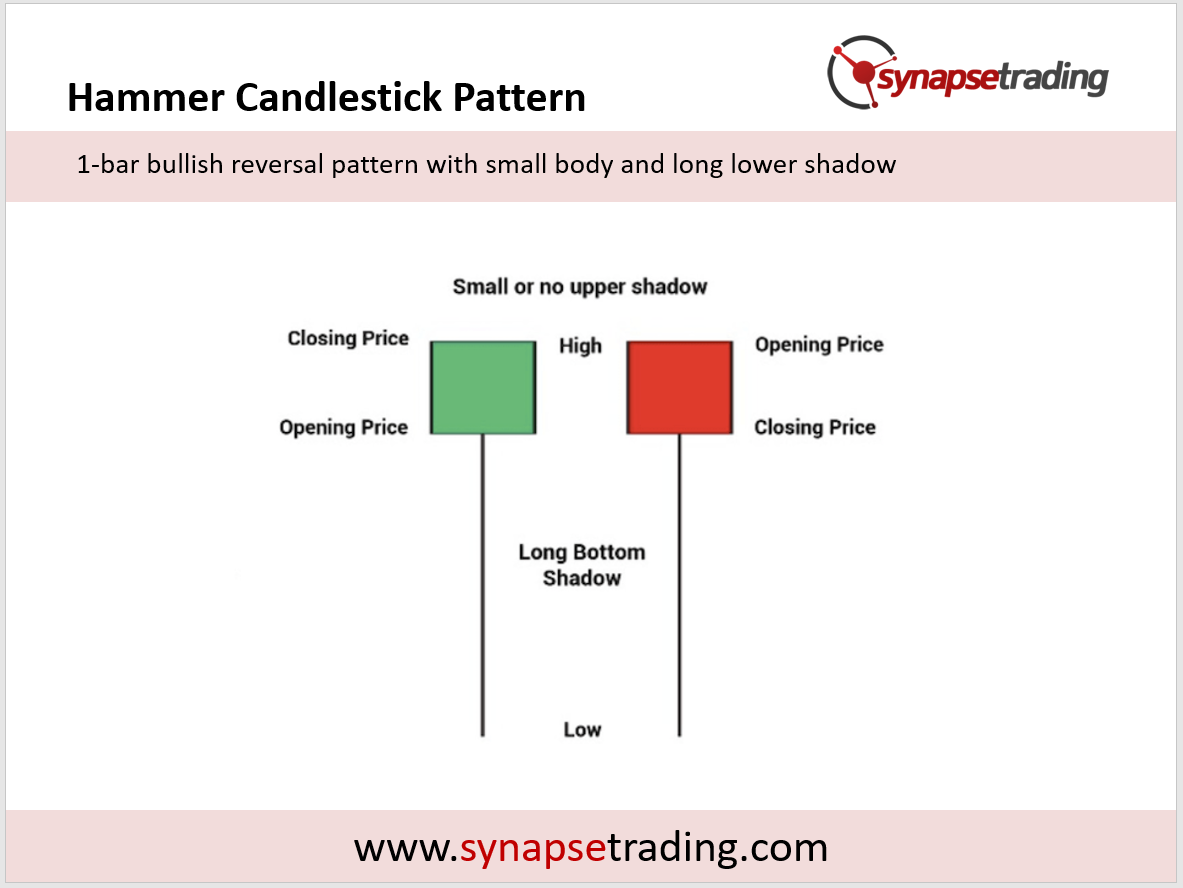

My go-to pattern is the Hammer pattern. I’ve found that it often signals a reversal in a downtrend, which has helped me spot some great buying opportunities.

For me, it’s the Morning Star pattern. I find it to be a strong indication of a bullish reversal after a downtrend, and it has provided me with some profitable trading opportunities.

I like the Three White Soldiers pattern. It’s a clear sign of a strong bullish trend, and I’ve found it to be quite consistent in predicting further upward movement.

I’m a big fan of the Shooting Star pattern. It’s been quite reliable in signaling a potential reversal in an uptrend, which has helped me to time my short positions effectively.

The Piercing Pattern has been my favorite. It often appears at the end of a downtrend and signals the start of a bullish reversal. I’ve had some great success trading with this pattern.

I love the Bullish Harami pattern. It’s easy to identify and has been a reliable signal for a potential bullish reversal in my experience.

My favorite pattern is the Falling Three Methods. I find it to be a reliable continuation pattern in a downtrend, helping me to stay confident in my short positions.

I’ve had success with the Bearish Engulfing pattern. It’s a clear indication of a potential bearish reversal, and it has helped me time my short positions well.

The Evening Star pattern has been my go-to for spotting potential bearish reversals in an uptrend. It’s easy to spot, and I’ve found it to be quite reliable.

For me, it’s the Bullish Harami Cross pattern. It’s not as common as some other patterns, but when it appears, it has been a strong signal for a potential bullish reversal.

I really like the Tweezer Bottom pattern. It has helped me spot some excellent buying opportunities at the end of a downtrend.

My favorite pattern is the Bullish Belt Hold. It’s not as well-known as some other patterns, but I’ve found it to be a strong indication of a bullish reversal after a downtrend.

I prefer the Gravestone Doji pattern. It’s a rare pattern, but when it appears, it has been a reliable signal for a potential bearish reversal in an uptrend.

My favorite is the Bearish Harami Cross pattern. It’s not as common, but it has been a strong signal for a potential bearish reversal when it does appear.

I like the Rising Window pattern. It’s a clear sign of a strong bullish trend, and I’ve found it to be quite consistent in predicting further upward movement.

My favorite pattern is the Dragonfly Doji. It has served as a reliable indicator of a bullish reversal at the end of a downtrend, helping me spot potential buying opportunities.

I’ve had success with the Dark Cloud Cover pattern. It’s a bearish reversal signal that has helped me identify when to exit long positions or initiate short positions in an uptrend.

I prefer the Bullish Tri-Star Doji pattern. Although it’s quite rare, I find that when it appears, it’s a strong indication of a bullish reversal after a downtrend, and has provided me with some profitable trades.