Did you know there is an epic battle between the two main cryptocurrency verification systems?

When it comes to crypto, the debate over what type of consensus mechanism or algorithm should be used to verify transactions continues to rage on.

Proof of work (or PoW) and proof of stake (or PoS) are two ways new transactions can be added to a blockchain without needing an intermediary.

While PoW has been around since the birth of Bitcoin (BTC) in 2009 and has been used by most cryptocurrencies since then, PoS is relatively new and has only been adopted by a few coins so far, including Cardano (ADA) and Solana (SOL).

In this blog post, I’m going to break down everything you need to know about this ongoing battle of cryptocurrency algorithms, and the pros and cons of each system.

What is Proof of Work (PoW)?

In a proof of work system, a group of computers compete to solve complex mathematical problems to validate transactions and add new blocks to the blockchain.

The first one to solve the problem receives a reward in the form of cryptocurrency.

Because the energy and computing resources required to solve the mathematical puzzle are often considered the digital equivalent of the actual process of mining precious metals from the earth, this process is often known as mining.

The book Digital Gold by Nathaniel Popper uses an analogy to describe the PoW function in the Bitcoin system:

It is easy to get 2,903 times 3,571 by simply writing the numbers on a piece of paper and multiplying, but it is much harder to figure out which two numbers can be multiplied together to create 10,366,613.

The miner who solves the complex mathematical problem first gets to add the next block of transactions to the blockchain and broadcast it to the network of nodes, who will then audit the existing ledger and the new block individually.

If everything checks out, the new block is linked to the preceding block, forming a transactional chain. The miner is then compensated with bitcoins for contributing their resources (energy).

PoW, Mining & Security

Mining consumes a lot of power and secures the network by ensuring that only those who can verify they have invested resources are allowed to add new transactions to the blockchain.

By virtue of this feature, attacking a PoW system like Bitcoin is exceedingly difficult, time-consuming, and expensive.

Attackers would have to buy and rig up expensive mining equipment and pay for electricity to power the equipment. They would then race to solve the problem and add a transaction block with counterfeit bitcoins to the chain.

If the unscrupulous miner solves the equation first, they will broadcast a new transaction block to the rest of the network.

The nodes of the network would then conduct an audit to evaluate the authenticity of the block and the transactions recorded within it.

The counterfeit bitcoins would be detected as soon as the nodes audited the new block against the previous version of the ledger. The consensus mechanism would then render the block invalid.

PoW makes it virtually impossible to counterfeit bitcoin unless an attacker owns over 50% of the entire network — this means they must own at least 51% of both the combined computing power of miners (the hashrate) and the network’s nodes.

If they did own over 50% of the network, they could simply broadcast a bad block to it and have their nodes accept it into the chain.

Given the size of the Bitcoin network and the amount of energy miners contribute to the PoW system, however, a 51% attack would be almost impossible today.

If PoW checks all the boxes, why is the crypto world slowly transitioning to the PoS mechanism?

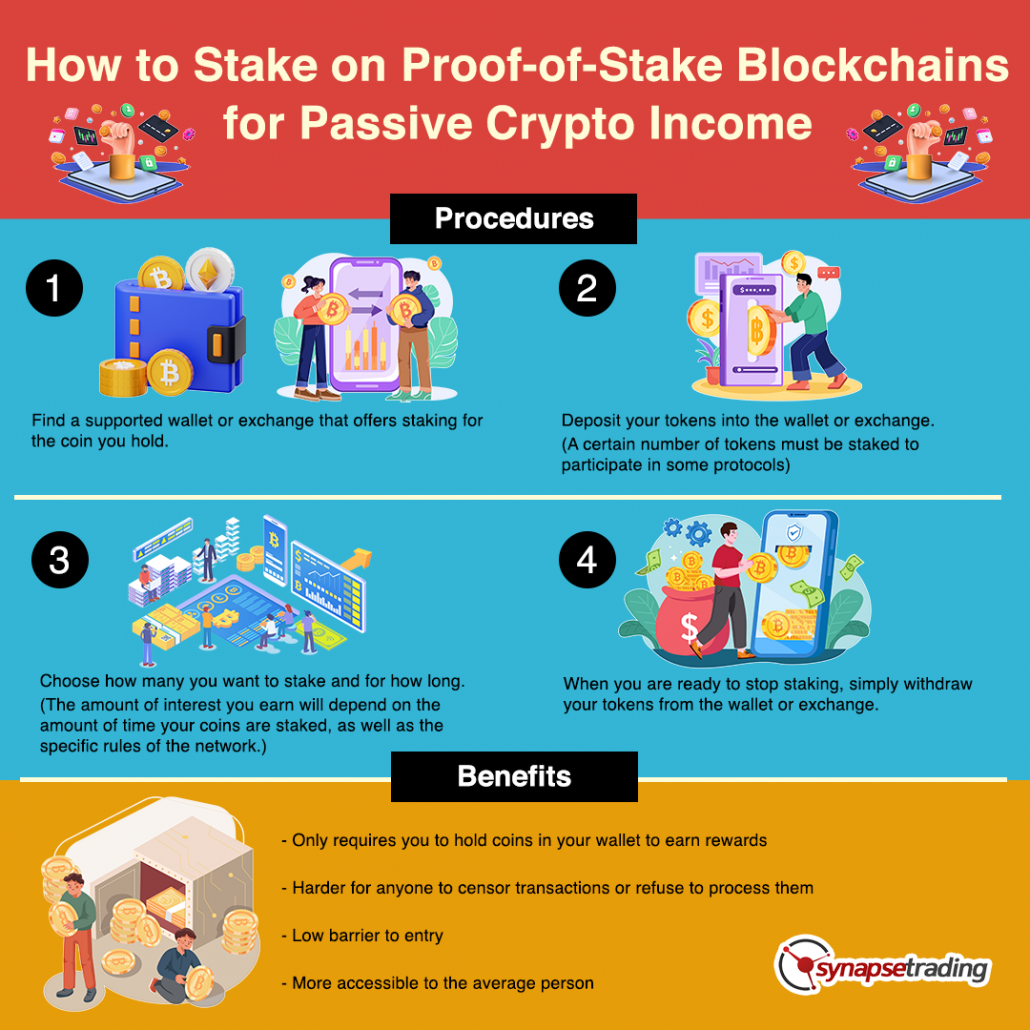

What is Proof of Stake (PoS)?

A member on the Bitcointalk forum who went by QuantumMechanic devised a mechanism he called “proof-of-stake” in 2011. The fundamental point was that it would be wasteful to open up mining to everyone and let them compete against one another.

Therefore, PoS relies on an electoral system in which one node is chosen randomly to validate the next block in the chain.

PoS does not have miners — instead, it has “validators.” PoS also does not allow people to “mine” blocks — instead, they “forge” or “mint” blocks. As a reward, the validator receives the fees associated with each transaction.

Bear in mind that the validators are not chosen in a completely arbitrary fashion. A certain amount of coins must be staked into the network by a node before it can be considered for the validator’s role.

The size of the stake has a bearing on the probability that a validator will be chosen to forge the next block.

Let’s assume that Walt contributes $100 to the network while Skyler contributes $1,000. Skyler’s chances of making the cut to forge the next block are ten times higher!

It is worth noting that the stake is always more than what the validator earns from the transaction fees to keep the validator financially motivated.

Advantages of Proof of Work

Mining cryptocurrency is a very competitive industry. Miners are always looking for ways to mine that are more efficient and cost-effective so that they can lower their costs.

Those that are able to find the least expensive forms of energy and develop innovative technological solutions that allow for the production of mining chips that are both quicker and more efficient would automatically benefit from this process.

Proof of Work has also been shown to be the most effective way to maintain consensus while simultaneously ensuring users’ security within a distributed ledger.

This is attributable to the fact that it requires the initial cost of hardware and the continued spending of resources to participate, in contrast to PoS, which just requires a single upfront payment.

Disadvantages of Proof of Work

The amount of energy that goes into powering Bitcoin’s Proof of Work algorithm is often criticized because it creates a large carbon footprint.

In fact, it is estimated that the Bitcoin network alone consumes as much energy as the entire countries of Ukraine and Norway.

This high level of energy consumption is due to the fact that miners need to solve complex math problems to validate transactions and add new blocks to the blockchain.

The solution to these problems requires a lot of computational power 24/7, which in turn requires a lot of electricity.

The traceability of blockchain can also be a double-edged sword. On the one hand, it adds transparency and builds trust between users.

On the other hand, it also means that every single transaction is out there for everyone to see. This could be a problem for people who value their privacy.

For example, the US Internal Revenue Service (IRS) has successfully tracked down suspected tax evaders by matching records from bitcoin exchanges with data obtained from other financial institutions such as banks and brokerages.

Traceability will likely remain an issue as long as cryptocurrencies are used as a payment system rather than just an investment vehicle.

Advantages of Proof of Stake

One major advantage of Proof of Stake (PoS) over Proof of Work (PoW) is that it is more energy efficient.

With PoW, miners need to expend a lot of energy to power their computers and solve complex mathematical problems to earn rewards. This can be expensive and damaging to the environment.

With PoS, however, miners do not need to use as much energy since they are not solving complex mathematical problems.

Instead, they can simply stake their coins and earn rewards based on how many coins they have staked.

Proof of Stake algorithms also tend to be more censorship resistant than PoW algorithms.

This is because, in a PoS system, the network is not controlled by a small group of miners who can choose to censor certain transactions.

Instead, everyone who has a stake in the network (i.e., everyone who owns coins) has a say in what happens.

This makes it much harder for anyone to censor transactions or refuse to process them.

Proof of Stake also has a lower barrier to entry. To start mining a PoS coin, you only need an Internet connection and enough money to buy a fraction of a coin.

That’s it! You can even mine from your smartphone.

Since there is no need for expensive hardware, PoS is much more accessible to the average person.

Disadvantages of Proof of Stake

There is no Proof of Stake system currently that can scale to the level of Bitcoin or Ethereum. These systems are not yet as decentralized or safe as the most advanced PoW systems.

However, these flaws could be fixed with more advanced consensus mechanisms like Casper (CSPR).

When the validator does not show up to complete their job, this might be another source of possible issues. However, this problem can be easily solved by choosing a large number of backup validators in case the primary ones fail.

And though Proof of Stake systems might use fewer resources overall, they can be less secure than PoW systems.

One reason is that the hashing power in a PoS system is spread out among all users, while in a PoW system, it is centralized among miners.

This means that a Proof of Stake system is more vulnerable to a Sybil attack, where an attacker creates multiple fake identities to gain control of the network.

Another issue with PoS is that it can be more vulnerable to 51% attacks, where one entity controls more than half of the currency.

PoW vs. PoS: Which is Better?

It is safe to say that both PoW and PoS have their pros and cons.

And while there is no clear winner, each algorithm seems to have its own strengths and weaknesses.

Ultimately, it will be up to the developers and miners to decide which algorithm is best for their needs.

But one thing is for sure; the cryptocurrency world is in for an exciting ride as these two algorithms battle it out.

Concluding Thoughts

The cryptocurrency world has been buzzing about the future of the blockchain, especially the debate between Proof of Work (PoW) and Proof of Stake (PoS).

While PoW has led to some of the most famous cryptocurrencies like Bitcoin and Ethereum, it may not be long before PoS takes over as the dominant algorithm.

For example, in the upcoming Ethereum merge, Ethereum will be transiting from a PoW system to a PoS system.

So far, PoW has also been the most proven way to maintain consensus and security within a distributed ledger.

This is because it requires the initial cost of hardware and the ongoing expenditure of resources rather than a single upfront expense to participate like PoS.

On the other hand, PoW is unsustainable due to high energy consumption, and runs into scaling problems, for example high fees and slow transactions.

Now that you know the difference between Proof of Work (PoW) and Proof of Stake (PoS), which system do you think is better in the long run?

Which consensus mechanism do you think will dominate future cryptocurrencies and tokens?

Let me know in the comments below.