Bull Flag & Bear Flag Pattern Trading Strategy Guide

In this pennant & flag pattern guide, you will learn:

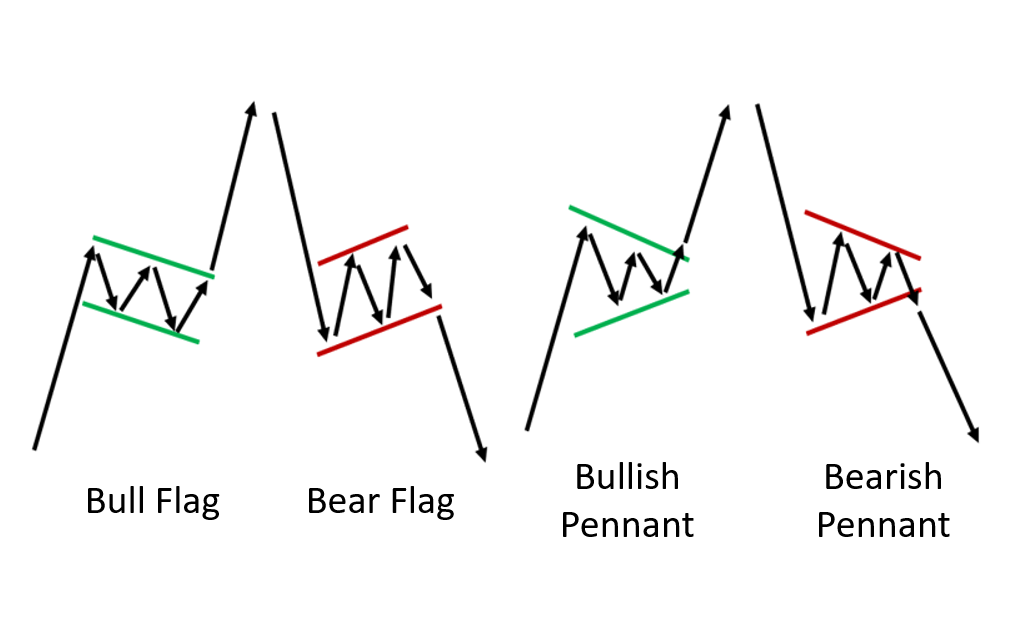

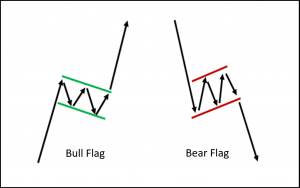

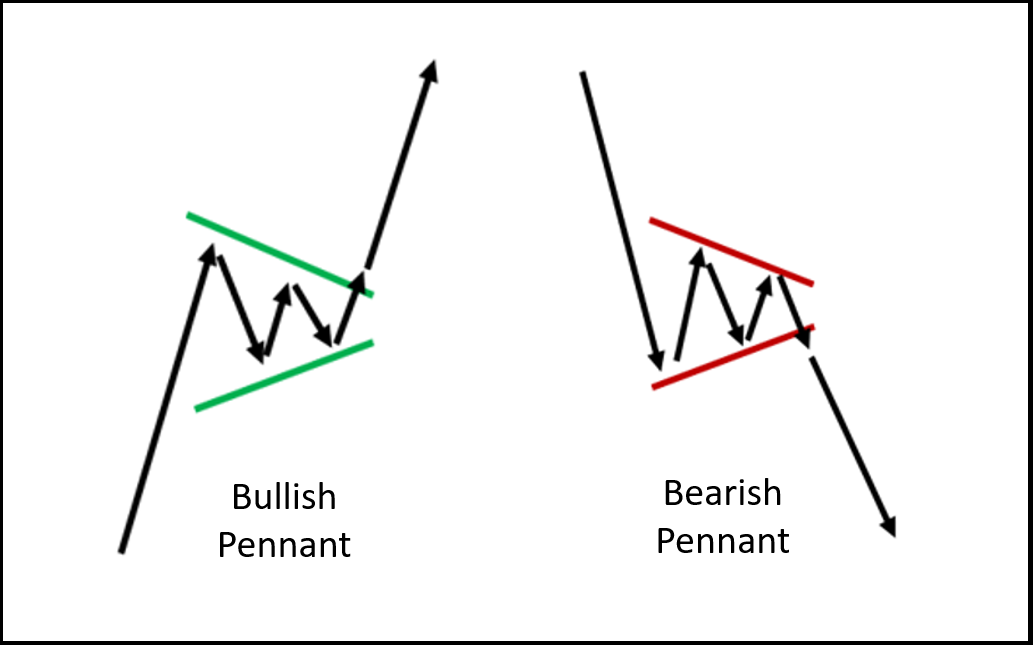

- How to trade the different types of pennant & flag patterns – bull flag, bear flag, bullish pennant, bearish pennant

- Specific trading strategies to profit from the pennant & flag price pattern

- Practical tips from the trading desk for live trading

Leave a Reply

Want to join the discussion?Feel free to contribute!