The Definitive Guide to Trading Price Chart Patterns

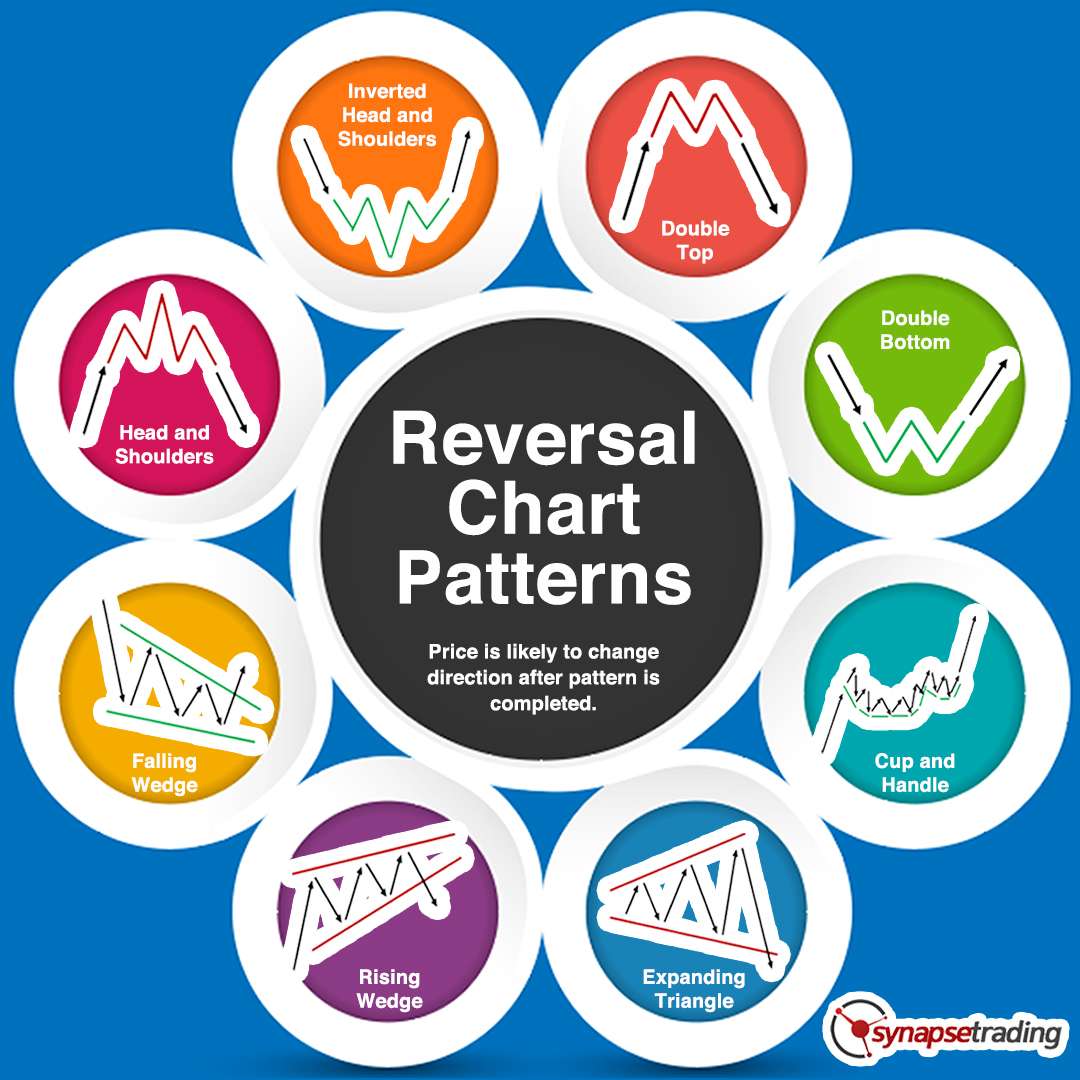

On a price chart, you will notice many recurring and repeated price patterns that not only form curious shapes, but also provide predictive value which way price is going to move once the pattern is completed.

Thus, learning how to identify and trade these patterns can be very lucrative.

I’m learning to be a scalp trader I’m going to implement patterns into my trading strategy which I haven’t before. My strategy is reading candle sticks but not the patterns. Thank you

You are welcome! As I mentioned in my “Beginner’s Guide”, there are 3 main kinds of analysis: classical (including chart patterns), price action (including candlestick patterns), and indicators. It is best to combine these methods together.

Hey Spencer, I usually prefer not to overclutter my trading charts with too many indicators. How many do you usually use yourself? I mean as a scalper, if there are too many indicators, I would have missed the opportunity.

I try to use as little as possible as well, so usually just a few moving averages and price action.

Good read thanks!

You’re welcome!

Appreciate the hard work done here!

You’re welcome!

I will say this website is beginner friendly. However, there is not much content after you have learned the ropes. Being a busy woman balancing work and family, I will appreciate if you have a daily market outlook report or some sort.

There are new market outlook that are posted every 2 to 3 weeks on his youtube and in his blog.

You can join our free Telegram channel for daily trading tips and market analysis: https://t.me/synapsetrading

Thank you so much for compiling all the information into one place, saved me a lot of time researching online!

You’re welcome! Our intention is to help people save time by compiling all the best learning resources in one place, glad you found it useful!

Hope to see more guides from you soon!

You’re welcome, and thanks for the support!

Very useful information. Bookmarked!

You’re welcome, I will continue to update and improve the guide!

Nicely summarized information and easy to digest. Thanks for the effort.

You’re welcome, I will continue to update and improve the guide!

Cool Stuff! I like the video tutorials 😀

You’re welcome! Let us know what new topics you would like to see!

Just here to leave a thank you note for the patterns. The pictures are helpful.

You’re welcome! Thanks for your feedback!

Will you be covering other topics like Ichimoku Cloud and Heinkin-Ashi Strategies in the future?

That is definitely possible, once we have covered all the more “mainstream” indicators and techniques. Stay tuned!

Waiting for more guides on such indicators 😀

Hey! Do you think if Fundamental Analysis is crucial as part of the analysis of what stocks to buy?

If you are looking to invest in stocks long-term, or as part of your portfolio, then you definitely will want to look at the fundamentals (solid business model, good growth prospects for the industry and stock, revenue, cashflow, etc). However, if you are trading it medium-term or short-term, then the fundamentals do not play such a major role.

Thanks for sharing about this. Got lost in whether I should use FA or TA for investing.

I am also not sure if I should be doing swing trading or position trading.

Hey mate, thanks for sharing these info. Do you have a video tutorial or podcast on this?

You’re welcome! Yes, we do have video tutorials, which you can find on our Youtube channel, and as for podcasts, that is something which we will be exploring this year. Stay tuned!

Do you have a tiktok account? It’s quite popular among my friends now.

Yes we do, you can search for @synapsetrading

Will you be covering on indicators which I saw like stochastic or which MAs do you use for trading?

Yes, we will definitely be covering those topics, but it will be in a different guide, likely one dedicated to indicators. Stay tuned!

You should cover Ichimoku Kinko Hyo. I highly recommend it.

Thanks for the suggestion, I will definitely touch on it when I have the time!

For the double top and double bottom pattern, must the 2nd top be higher or equal to the 1st top for us to consider it as a double top?

For the double top and double bottom, the 2nd top/bottom should be almost the same height as the 1st one, although quite often it can be slightly higher or lower.

Your information for the TA is well organized and detailed. Will you be doing something like that for fundamental analysis?

You are welcome! We might consider that in the future, but for now we want to complete all the different aspects of trading and chart analysis, before we go into fundamentals.

Hey, saw your website from the telegram channel. Btw, how do you use these techniques to determine when is the right price to enter during the Gamestop Stock Frenzy?

Firstly, that move was a fast and furious move that was news driven, so using price action and volume analysis would be more useful in this case. Secondly, price chart patterns tend to work better on a medium-term timeframe, where there us more time for the pattern to form. In such a fast-paced environment, maybe the flag pattern might have been useful.

I love your white board series video that I saw on your Tik Tok! Thats how I chance upon your free information guides.

You’re welcome!

Your tik tok videos are more interesting though!

Yup I am also subscribed to his tiktok channel. He has a recent one on Chinese chess too!

I love price action and the patterns. Already committed them to my brain but not to my heart.

Practice makes perfect!

Chart patterns feels like astrology. It gives you an insight on how active a market is from them. I focus more on volumes traded and directional (momentum) rather than a particular pattern instead.

Chart patterns actually give you an insight into human psychology, because it is a reflection of buyers and selling fighting to gain control. It can be used in conjunction with price action and volume as well.

Like how big whales like me can control the market sentiments by sharing and tweeting what I feel. Purely market emotions!

“When you are studying the chart pattern on the current timeframe, thinking about how the pattern on the larger timeframe looks like literally gives you a bigger picture, allowing you to strategize your trades better.”

I don’t get it. How will my strategy change just because a triangle pattern change to a pennant pattern?

For example, if a triangle pattern turns out to be a pennant on a larger timeframe, it means there is even more room for the trade to go, because you can then use the pennant on the larger timeframe to do another price projection. This means that you might want to hold the trade (or part of the trade) longer.

i actually printed some of the price patterns and paste them next to my screen, especially those reversal ones. Still new at this. So many patterns, not sure which one to apply.

I like your new layout for your guide now. Not so overwhelming.

Thank you for the concise guide. Fascinating to see triangles appearing near Support and resistance lines.

You are welcome!

Do these patterns apply for the cryptocurrenices too?

Yes, theses are universal patterns that work for all markets and timeframes!

From the information about continuation and reversal price patterns, I have learned that traders can use these patterns to determine the momentum and direction of a trend. Continuation patterns are useful for trend-followers and breakout traders, while reversal patterns are useful for contrarian traders. I also found the different types of patterns and trading strategies guides helpful, such as the head and shoulders pattern and the double top and double bottom pattern.

I like to use the Head and Shoulders pattern in combination with my moving averages. When I see a Head and Shoulders pattern forming, I wait for the price to break below the neckline and then confirm with the moving average crossover to enter a short position.

My go to is use the Cup and Handle pattern in combination with my Fibonacci retracement tool. I wait for the price to break out of the handle and then use the Fibonacci levels to set my profit targets.

My favourite way is to use the Expanding Triangle pattern in combination with my trend lines. I wait for the price to break out of the triangle and then confirm with the trend line to enter a long or short position.

The Double Top and Double Bottom pattern in combination with stochastic oscillator. I wait for the price to test the previous high or low and then confirm with the stochastic oscillator to enter a long or short position.

For me, I prefer to use the Head and Shoulders pattern in combination with my RSI indicator. When the price break below the neckline and then confirm with the RSI to enter a short position.

Regarding the advanced trading tips, I found it interesting that traders need to consider other factors besides price patterns, such as the importance of the trend, combining chart patterns with other tools, and analyzing price patterns on multiple timeframes. This shows that successful trading involves a holistic approach and requires careful consideration of various factors that can affect the probability of success. Overall, I found the information provided to be informative and useful for anyone interested in trading using price patterns.

I found the information about advanced trading tips for price patterns to be especially helpful. It’s important to remember that there are many other factors to consider beyond just the patterns themselves. I appreciate the emphasis on the importance of analyzing price patterns in the context of the trend and on multiple timeframes. Combining chart patterns with other technical analysis tools and indicators can also greatly improve the probability of success in trading. Overall, this guide has provided valuable insights and strategies for identifying and trading price patterns.

like the way you put the TA info into visualize format !!!

BTW, do you have training on Price Chart Pattern, Swing trading and Strategy…

My favorite price pattern setup for trading is the rectangle pattern. It’s a continuation pattern that indicates a pause in the trend before it continues in the same direction. It’s easy to identify and provides a clear entry and exit point for a trade. Have any of you had success trading this pattern?

I prefer the bullish pennant pattern. It’s a continuation pattern that signals a short period of consolidation before the trend continues upward. It’s easy to spot and provides a great opportunity to enter a trade with a tight stop loss. Anyone else trading this pattern?

I love trading the ascending triangle pattern. It’s a continuation pattern that signals a short period of consolidation before the trend continues upward. It’s easy to spot and provides a great entry point for a long position.

I have had great success trading the symmetrical triangle pattern. It’s a continuation pattern that signals a period of consolidation before the trend continues in either direction. It’s a bit harder to identify than some of the other patterns, but once you do, it provides a great opportunity to enter a trade with a tight stop loss.

I prefer the descending triangle pattern. It’s a continuation pattern that signals a short period of consolidation before the trend continues downward. It’s easy to identify and provides a great opportunity to enter a short position. Have any of you had success trading this pattern?

I prefer the symmetrical triangle pattern. It’s a continuation pattern that signals a period of consolidation before the trend continues in either direction. It’s a bit harder to identify than some of the other patterns, but once you do, it provides a great opportunity to enter a trade with a tight stop loss. What are your thoughts on this pattern?

For me, my favorite price pattern setup is the bear flag pattern. It’s a continuation pattern that signals a pause in the downtrend before it continues downward. It’s easy to spot and helps me a lot in my trades!

My favorite price pattern setup is the bearish flag pattern. It’s a continuation pattern that signals a pause in the downtrend before it continues downward. It’s easy to identify and provides a good opportunity to short the market.

I’ve had success trading the bearish pennant pattern. It’s a continuation pattern that signals a short period of consolidation before the trend continues downward. It’s easy to identify and provides a good opportunity to short the market.

Do you have any difficulty identifying the patterns on your charts? Personally, I sometimes struggle with identifying certain patterns, especially when there are a lot of price movements in the market.

I also sometimes have difficulty identifying patterns, especially when they are more complex. I find it helpful to take a step back and look at the bigger picture before zooming back in to look for patterns.

I’ve found that watching tutorial videos by Spencer on pattern identification has been helpful for me. Seeing a visual representation of the patterns and how they form on a chart has made it easier for me to identify them on my own charts.

When I have difficulty identifying patterns, I try to consult with Spencer or other traders in the private signals group. Sometimes getting a second opinion or another perspective can help me see things I may have missed.

One thing that has helped me is to focus on a few key patterns that I’m comfortable with rather than trying to identify every single pattern that appears on my chart.

I’ve also found it helpful to practice identifying patterns on historical charts. This has allowed me to become more familiar with different patterns and their variations.

Finally, I think it’s important to remember that pattern identification is not an exact science. Sometimes patterns don’t work out as expected, and that’s okay. It’s important to have a solid risk management plan in place to limit potential losses.

I couldn’t agree more with the sentiment that pattern identification is not an exact science. It’s important to always keep in mind that patterns can fail and that’s why having a solid risk management plan is key. No matter how much experience you have, you can never be 100% certain about the market. The best you can do is to have a risk management plan in place that limits your potential losses.

I’ve had situations where I thought I had identified a pattern perfectly, but the market didn’t behave as expected, and I ended up losing money. That’s why I always tell myself that it’s better to be safe than sorry. As much as we want to make money, we have to remember that risk management is more important. Limiting losses is key to staying in the game for the long run.

One way to minimize the risk of pattern identification errors is to use multiple time frames. By using multiple time frames, you can confirm patterns that appear on the shorter time frames with those on the longer time frames. This approach can help you make more informed trading decisions and minimize the risk of losses.

Another thing to keep in mind is that sometimes the market can be unpredictable. Even if a pattern looks perfect, it might not work out as expected. That’s why it’s essential to always keep an eye on the market and be prepared to change your trading strategy if necessary. Sticking to a losing strategy just because it worked in the past is a sure way to lose money.

One way to improve pattern identification skills is to practice. By backtesting different patterns, you can get a better understanding of how they work and under what conditions they are likely to succeed. Additionally, practicing can help you develop a “feel” for the market, which can be invaluable when trading live.

I’ve found that it’s essential to approach pattern identification with an open mind. Sometimes we can get so fixated on finding a particular pattern that we ignore what the market is telling us. By being open to different possibilities, we can make more informed decisions and avoid costly mistakes.

Another thing to keep in mind is that patterns can take time to play out. It’s important not to jump in too early and to wait for confirmation before taking a trade. Patience is key when it comes to pattern identification.

It’s important to remember that no trading strategy is foolproof. Even the best traders experience losses from time to time. The key is to have a risk management plan in place that limits potential losses and allows you to stay in the game for the long run. As with anything in life, practice makes perfect, so keep practicing, and you’ll improve your pattern identification skills over time.

I find that using different colors and charting tools can help me identify patterns more easily. For example, I use green and red arrows to indicate bullish and bearish patterns, respectively.

Another thing I struggle with is identifying false breakouts. Sometimes it’s hard to tell if a pattern is legitimate or if it’s just a temporary price movement.

After reading this trading guide, my key take-away is that understanding price patterns is crucial for successful trading, but it’s important to remember that pattern identification is not an exact science. We must also consider other factors, such as the trend and multiple timeframes when making our trades.

My key take-away is that it’s important to have a solid risk management plan in place to limit potential losses. It’s easy to get caught up in the excitement of trading, but we need to be disciplined and protect our capital.

We need to be patient and wait for the right opportunities to present themselves. Sometimes the best trade is no trade at all, and it’s better to sit on the sidelines than to take unnecessary risks.

We should never rely solely on price patterns to make our trading decisions. We need to combine them with classical technical analysis and indicators to increase our chances of success.

My key take-away is that we need to be adaptable and willing to change our trading strategy as the market evolves. What works today may not work tomorrow, so we need to be open-minded and willing to try new approaches.