Understanding Contracts for Difference (CFDs)

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

In the world of modern finance, Contracts for Difference (CFDs) have become a popular tool for traders seeking to capitalize on market movements without owning the underlying assets.

Offering flexibility and potential for high returns, CFDs allow traders to speculate on the price movements of various financial instruments, from stocks and commodities to forex and cryptocurrencies.

But what exactly are CFDs, and how do they work?

In this blog post, I will delve into the mechanics of CFDs, the range of products available for trading, and the advantages and disadvantages they present, complete with illustrative examples of both long and short trades.

Table of Contents

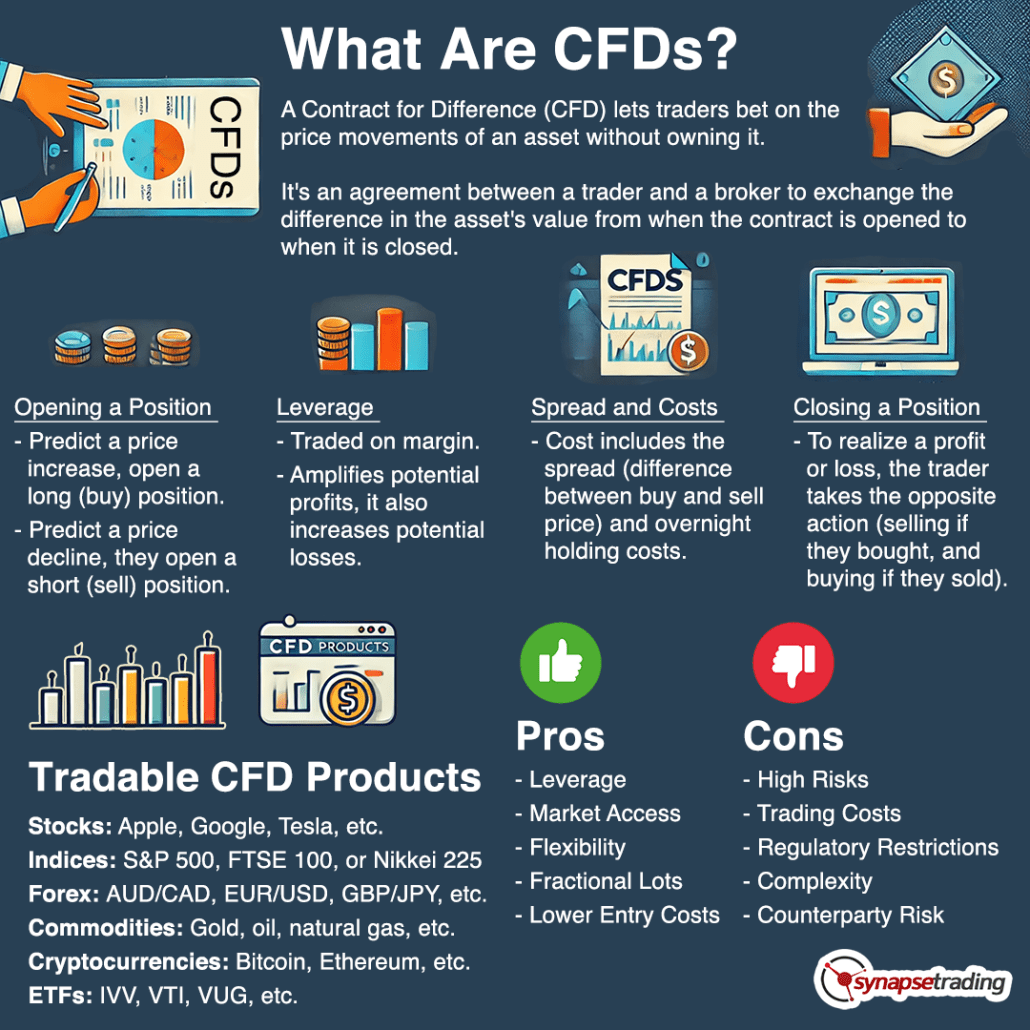

What Are CFDs and How Do They Work?

A Contract for Difference (CFD) is a financial derivative that enables traders to speculate on the price changes of an underlying asset without owning it. Essentially, a CFD is an agreement between a trader and a broker to exchange the difference in the value of an asset from the time the contract is opened to when it is closed.

- Opening a Position: When a trader anticipates that an asset’s price will increase, they open a long (buy) position. Conversely, if they predict a price decline, they open a short (sell) position.

- Leverage: CFDs are traded on margin, allowing traders to control a large position with a relatively small amount of capital. While leverage amplifies potential profits, it also increases potential losses.

- Spread and Costs: The cost of trading CFDs includes the spread (the difference between the buy and sell price) and any holding costs for positions kept open overnight.

- Closing a Position: To realize a profit or loss, the trader closes the position by taking the opposite action (selling if they bought, and buying if they sold).

History of CFDs

Early Beginnings in the 1990s

CFDs were first introduced in the early 1990s in London. They were developed by two investment bankers at UBS Warburg, Brian Keelan and Jon Wood. The initial purpose of CFDs was to serve as an equity swap that institutional traders could use to hedge their positions on the London Stock Exchange in a cost-effective manner. By using CFDs, these traders could avoid the hefty stamp duty tax imposed on physical share purchases in the UK.

Key Motivations for Development:

- Tax Efficiency: CFDs provided a way to avoid the stamp duty tax, which was particularly appealing for institutional investors trading large volumes.

- Leverage: CFDs allowed traders to use leverage, enabling them to control large positions with a relatively small amount of capital. This amplified potential profits, but also potential losses.

- Flexibility: CFDs offered the ability to take both long and short positions, providing flexibility in various market conditions.

Evolution and Popularization

1990s – Early 2000s: Initially, CFDs were primarily used by institutional investors. However, their benefits soon attracted the attention of retail traders. By the late 1990s and early 2000s, advancements in internet technology and the rise of online trading platforms made CFDs accessible to a broader audience.

Key Developments:

- Online Trading Platforms: The rise of online brokerage firms and trading platforms made it easier for retail traders to access CFDs.

- Global Expansion: Although CFDs were initially a UK-centric product, their popularity quickly spread to other countries, especially in Europe and Australia. Different regions adapted the product to fit their regulatory environments.

Regulatory Changes and Modern Era

2000s – Present: As CFDs grew in popularity, regulatory bodies worldwide began to scrutinize and regulate them to protect retail investors. This led to various changes in how CFDs were offered and traded.

Key Regulatory Developments:

- Increased Oversight: Regulatory bodies like the Financial Conduct Authority (FCA) in the UK and the Australian Securities and Investments Commission (ASIC) implemented rules to ensure transparency and protect investors.

- Leverage Limits: To mitigate the high risks associated with leveraged trading, regulators imposed limits on the maximum leverage that brokers could offer to retail clients.

- Risk Warnings: Brokers are now required to provide clear risk warnings and ensure that clients understand the risks involved in CFD trading.

Products You Can Trade with CFDs

One of the appealing aspects of CFDs is the wide range of markets they provide access to:

- Stocks: Trade shares of companies like Apple, Google, and Tesla.

- Indices: Speculate on the performance of market indices such as the S&P 500, FTSE 100, or Nikkei 225.

- Forex: Engage in the dynamic forex market with currency pairs like EUR/USD, GBP/JPY, and more.

- Commodities: Trade precious metals like gold and silver, as well as energy commodities like oil and natural gas.

- Cryptocurrencies: Dive into the volatile world of cryptocurrencies, including Bitcoin, Ethereum, and others.

- ETFs: Gain exposure to various sectors and asset classes through exchange-traded funds.

Pros and Cons of Using CFDs

While CFDs offer many advantages, they also come with inherent risks that traders should be aware of.

Pros:

- Leverage: Allows for potentially higher returns with a smaller initial investment.

- Market Access: Provides access to a variety of global markets from a single platform.

- Flexibility: Enables traders to profit from both rising and falling markets.

- No Ownership: No need to handle the underlying asset directly, simplifying the trading process.

- Lower Entry Costs: Generally lower capital requirements compared to traditional trading.

Cons:

- High Risk: Leverage can lead to significant losses, potentially exceeding the initial investment.

- Trading Costs: Includes the spread, holding costs, and sometimes commission fees.

- Regulatory Restrictions: CFDs are not available in some countries due to regulatory constraints.

- Complexity: Managing leveraged positions requires a good understanding of financial markets and risk management.

- Counterparty Risk: The risk that the broker might default, impacting the trader’s positions.

Trading Examples

To illustrate how CFD trading works, let’s look at two examples: one long trade and one short trade.

Long Example (Stocks):

- Product: Apple (AAPL) shares.

- Scenario: A trader believes that Apple’s stock price will rise.

- Action: The trader buys 100 CFD shares of Apple at $150.

- Outcome: Apple’s price rises to $160.

- Profit Calculation:

- Opening position: 100 shares * $150 = $15,000.

- Closing position: 100 shares * $160 = $16,000.

- Profit: $16,000 – $15,000 = $1,000 (excluding costs).

Short Example (Commodities):

- Product: Gold.

- Scenario: A trader predicts a decline in the price of gold.

- Action: The trader sells 10 CFDs of gold at $1,800 per ounce.

- Outcome: Gold’s price falls to $1,750.

- Profit Calculation:

- Opening position: 10 ounces * $1,800 = $18,000.

- Closing position: 10 ounces * $1,750 = $17,500.

- Profit: $18,000 – $17,500 = $500 (excluding costs).

Concluding Thoughts

CFDs offer a compelling way to engage in the financial markets, providing the ability to trade a wide array of assets with the flexibility of leveraging both rising and falling prices. However, the high-risk nature of leveraged trading and the complexities involved mean that CFDs are best suited for experienced traders with a solid understanding of market dynamics and risk management strategies.

Now that I have shared all about CFDs, how can novice traders effectively manage the risks associated with CFD trading while leveraging its benefits? And with the increasing popularity of cryptocurrencies, how might CFDs evolve to offer more innovative and secure trading options for digital assets?

Let me know your answers in the comments below.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

Spencer is an avid globetrotter who achieved financial freedom in his 20s, while trading & teaching across 70+ countries. As a former professional trader in private equity and proprietary funds, he has over 15 years of market experience, and has been featured on more than 20 occasions in the media.

Leave a Reply

Want to join the discussion?Feel free to contribute!