What is the FOMC (Federal Open Market Committee) Meeting and How to Trade it?

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

One of the most important piece of news data for traders and investors is the FOMC meeting, so you probably have heard it many times on the news.

But what exactly do they discuss, and why is it so important?

The Federal Open Market Committee, or FOMC, is a powerful branch of the Federal Reserve System that plays a crucial role in shaping the U.S economy.

In this blog post, you’ll learn about the origin and responsibilities of the FOMC, how it operates, and how its decisions can impact traders and investors.

We’ll also explore how traders and investors use the information from the FOMC to make their investment decisions.

Table of Contents

What is the FOMC and its Origin?

The FOMC is a branch of the Federal Reserve System, which is the central banking system of the United States.

The FOMC was created by the Banking Act of 1935, which also created the Federal Reserve System.

The FOMC is responsible for making monetary policy decisions, which can include changes in interest rates or other measures to influence the economy.

The FOMC is made up of 12 voting members, including the seven members of the Board of Governors of the Federal Reserve System and five of the 12 Federal Reserve Bank presidents.

The Board of Governors is appointed by the President of the United States, subject to Senate confirmation, and serves for a 14-year term.

The five Reserve Bank presidents who serve on the FOMC are chosen by their respective Reserve Banks and serve one-year terms.

How Does the FOMC Operate?

The Federal Open Market Committee (FOMC) typically meets eight times per year, with meetings held about every six weeks.

Meetings are held on a schedule that is set well in advance.

The schedule of meetings can be found on the Federal Reserve’s website.

The meetings are held in Washington, D.C. and typically last two days.

What are the Outcomes of FOMC Meetings?

The outcomes of Federal Open Market Committee (FOMC) meetings are typically published in a statement released after the meeting.

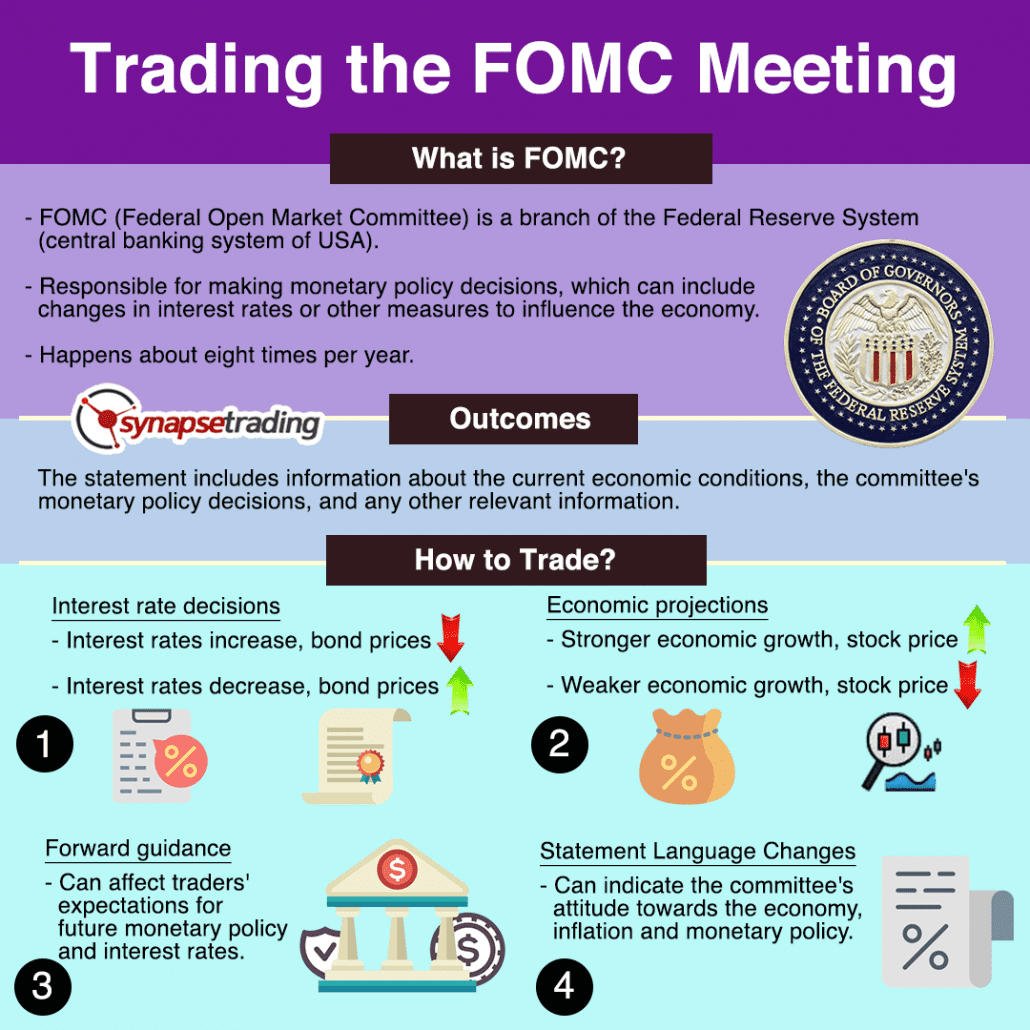

The statement includes information about the current economic conditions, the committee’s monetary policy decisions, and any other relevant information.

The statement is closely watched by investors and market participants, as it provides insight into the committee’s thinking and can affect financial markets.

The FOMC statement typically includes the following information:

- The current target range for the federal funds rate (the interest rate at which banks lend money to each other overnight)

- The outcome of the vote, including any dissents

- Economic projections, including the expected path of interest rates, GDP, unemployment rate, and inflation

- An assessment of the current economic conditions and the balance of risks

- Any other relevant information, such as changes to the statement language or the forward guidance.

The data published in the FOMC statement is not revised or updated after the meeting, but the committee releases new economic projections and updates the statement language at each meeting.

The committee also releases the minutes of the meeting three weeks after the meeting which provides more detailed information about the discussions and the reasoning behind the decisions.

How is this Data Relevant to Traders and Investors?

The data and information published by the FOMC is closely watched by traders and investors, as it provides insight into the committee’s thinking and can affect financial markets.

The statement and the economic projections released after the FOMC meetings can affect the direction of interest rates, and in turn, the value of stocks, bonds, and other financial assets.

Traders and investors typically use the information from the FOMC statements and economic projections to inform their investment decisions.

They pay attention to the current target range for the federal funds rate and any changes to it, as changes in interest rates can affect the value of bonds and other fixed-income securities.

They also pay attention to the economic projections, as they can provide insight into the committee’s view on the future performance of the economy and can affect the direction of stocks and other riskier assets.

For example, if the FOMC projects that the economy will perform well in the future, traders and investors may be more likely to invest in stocks, as they expect the market to perform well.

On the other hand, if the FOMC projects that the economy will perform poorly, traders and investors may be more likely to invest in bonds, as they expect the market to be more stable.

Traders and investors also pay attention to the forward guidance provided by the FOMC, as it can affect the expectations of future monetary policy.

For example, if the FOMC states that it expects to keep interest rates low for an extended period, traders and investors may be more likely to invest in stocks, as they expect the market to perform well in the short-term.

On the other hand, if the FOMC states that it expects to raise interest rates soon, traders and investors may be more likely to invest in bonds, as they expect the market to be more stable in the short-term.

News Trading on FOMC Data

Traders use the information from the Federal Open Market Committee (FOMC) meetings and statements to make trading decisions in a variety of ways.

Here are a few examples:

- Interest rate decisions: If the FOMC raises interest rates, it can lead to higher bond yields, which can cause bond prices to fall. Similarly, if the FOMC lowers interest rates, bond prices may rise and traders may adjust their positions accordingly.

- Economic projections: If the FOMC’s economic projections indicate stronger-than-expected economic growth, traders may anticipate that this could lead to higher stock prices. Conversely, if the FOMC’s projections indicate weaker-than-expected economic growth, traders may anticipate that this could lead to lower stock prices.

- Forward guidance: If the FOMC changes its forward guidance, this can affect traders’ expectations for future monetary policy and interest rates. For example, if the FOMC signals that it plans to raise interest rates in the near future, traders may anticipate that this will cause bond prices to fall.

- Statement Language Changes: FOMC statement language changes can indicate the committee’s attitude towards the economy, inflation and monetary policy. Traders can use this information to make predictions about the future direction of interest rates, GDP, unemployment rate, and inflation, which can help them to make trading decisions.

Concluding Thoughts

In summary, the FOMC is a vital component of the Federal Reserve System that is responsible for making monetary policy decisions.

These decisions can have a significant impact on financial markets, making it essential for traders and investors to stay informed about the FOMC’s actions.

Whether you’re new to the world of finance or a seasoned professional, understanding the FOMC is crucial to making informed investment decisions.

Now that I have covered all about the importance of the FOMC meeting, is it something that you will add to your trading toolbox?

Let me know in the comments below.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

Spencer is an avid globetrotter who achieved financial freedom in his 20s, while trading & teaching across 70+ countries. As a former professional trader in private equity and proprietary funds, he has over 15 years of market experience, and has been featured on more than 20 occasions in the media.

Leave a Reply

Want to join the discussion?Feel free to contribute!