Greetings, fellow traders!

Recently, I embarked on a trip across these 5 new countries, to learn more about Central Asia:

- Dubai (1 day transit)

- Kyrgyzstan

- Kazakhstan

- Tajikistan

- Uzbekistan

- Turkey

I started off with a day trip in Dubai, since I had quite a few hours in transit, then moved on to cover 4 Stan countries and Turkey.

I wanted to do Turkmenistan as well, but it was still closed due to Covid.

The Stans were a lot less touristy, which meant they were slightly less developed, but the good thing is that there were less crowds.

Turkey was very touristy, and a lot more crowded.

Overall, I really liked the food and culture in Central Asia.

To see the full photo albums for all my trips, please visit: https://synapsetrading.com/travel-log/

Here are some photos from the trip, with brief intro snippets from Wikipedia:

Table of Contents

1. Desert Safari, Dubai, UAE

Dubai has a major tourist attraction called the Desert Safari where tourists get to enjoy the amazing sand dunes, cultural performances and BBQ Dinner. While there are a few different variations in this excursion, the most common one involves getting picked up in a 4×4 Toyota Land Cruiser late in the afternoon and then driving 50kms away from the city to enjoy the serene and untouched sand dunes of Dubai.

The driver is a trained professional who maneuvers the 4×4 up and down the dunes, performing daring stunts for the passengers sitting inside. Afterwards the driver takes a quick break at a sunset viewing point and later the passengers are taken to a camp site where they get to enjoy a few performances and eat delicious BBQ dinner among other things.

Click here to see full Facebook photo album!

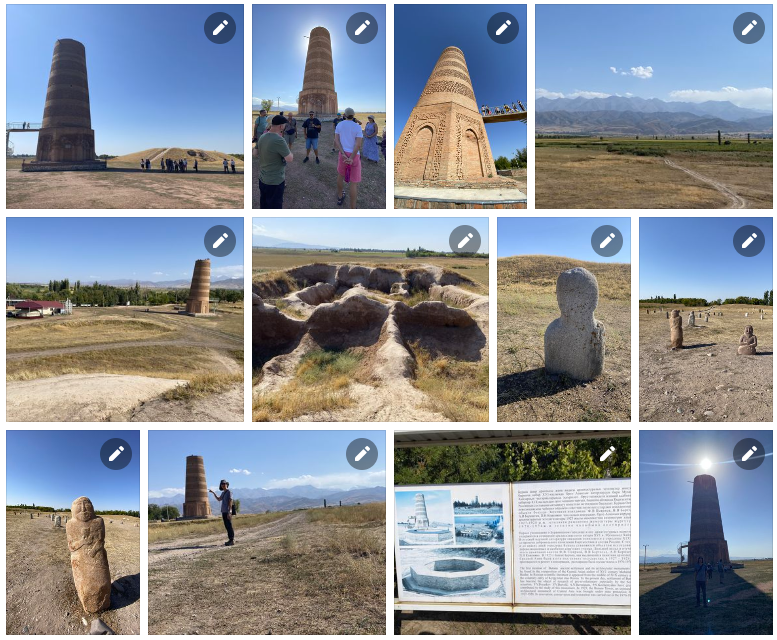

2. Bishkek & Burana Tower, Kyrgyzstan

Bishkek is the capital and largest city of Kyrgyzstan. Bishkek is also the administrative centre of the Chüy Region. The region surrounds the city, although the city itself is not part of the region but rather a region-level unit of Kyrgyzstan. Bishkek is situated near the Kazakhstan–Kyrgyzstan border. Its population was 1,074,075 in 2021.

The Burana Tower is a large minaret in the Chüy Valley in northern Kyrgyzstan. It is located about 80 km east of the country’s capital Bishkek, near the town of Tokmok. The tower, along with grave markers, some earthworks and the remnants of a castle and three mausoleums, is all that remains of the ancient city of Balasagun, which was established by the Karakhanids at the end of the 9th century. The tower was built in the 11th century and was used as a template for other minarets. It is one of the oldest architectural constructions in Central Asia.

Click here to see full Facebook photo album!

3. Chong-Kemin Valley, Kyrgyzstan

Chong-Kemin Nature Park is a park in Kemin District of Chüy Region of Kyrgyzstan established in August 1997. The purpose of the park is conservation of the unique nature complexes in Chong-Kemin Valley of the Kemin District and organization of recreation for local and foreign tourists. The area of the park is 123,564 hectares. The park is located in 30 km from the regional center Kemin and in 135 km from Bishkek.

This national park is one of the most picturesque parts of Kyrgyzstan. The 116 km long river Chong-Kemin flows through the park, and there are seven lakes in its basin.

The ecosystem is diverse and is home to rare species, such as the snow leopard, golden eagle and maral (the smallest cervid in Central Asia).

Click here to see full Facebook photo album!

4. Kochkor & Issy-Kul Lake & Karakol, Kyrgyzstan

Kochkor is a large village in northern Naryn Region of Kyrgyzstan, at an altitude of 1,800 m. Its population was 11,373 in 2021. It is on the main A365 highway from Torugart Pass (China) north to Bishkek, and about 45 km northeast along the highway is Balykchy on Lake Issyk-Kul.

Issyk-Kul is an endorheic lake (without outflow) in the Northern Tian Shan mountains in Eastern Kyrgyzstan. It is the seventh-deepest lake in the world, the tenth-largest lake in the world by volume and the second-largest saline lake after the Caspian Sea. Issyk-Kul means “warm lake” in the Kyrgyz language; although it is located at a lofty elevation of 1,607 metres and subject to severe cold during winter, it never freezes.

Karakol is the fourth-largest city in Kyrgyzstan, near the eastern tip of Lake Issyk-Kul, about 150km from the Kyrgyzstan–China border and 380km from the capital Bishkek. It is the administrative capital of Issyk-Kul Region.

Click here to see full Facebook photo album!

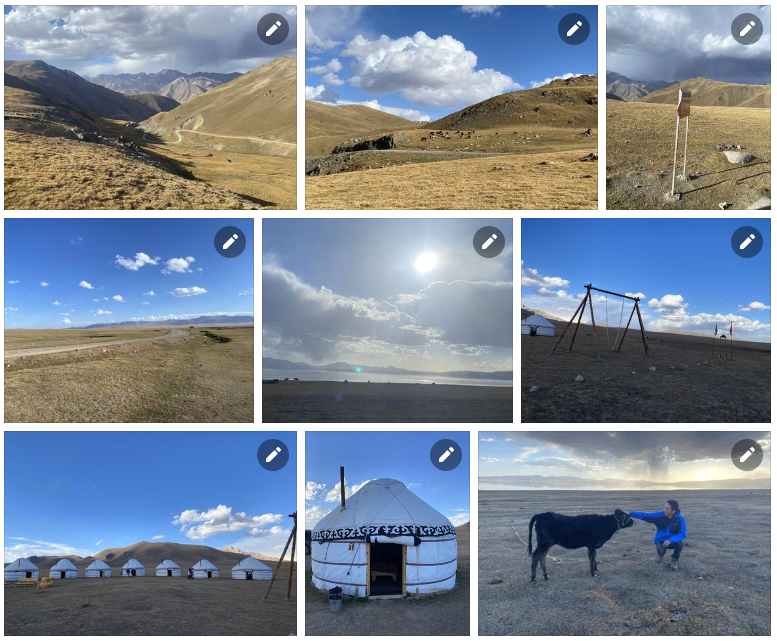

5. Song-Kol Lake, Kyrgyzstan

Song-Köl (literally “following lake”) is an alpine lake in northern Naryn Region, Kyrgyzstan. It lies at an altitude of 3016 m, and has an area of about 270 km2 and volume of 2.64 km3. The lake’s maximum length is 29 km, breadth about 18 km, and the deepest point is 13.2 m. It is the second largest lake in Kyrgyzstan after Issyk-Kul, and the largest fresh water lake in Kyrgyzstan.

Click here to see full Facebook photo album!

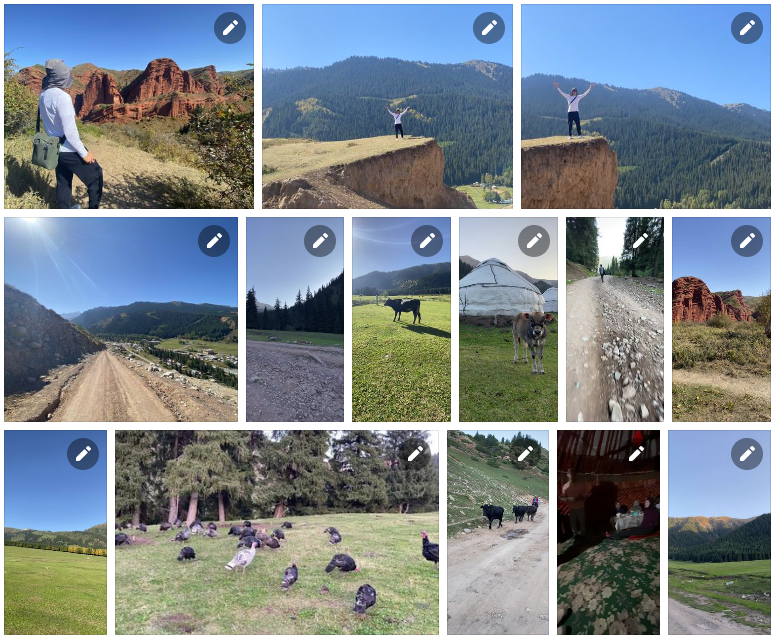

6. Jeti-Oguz, Kyrgyzstan

Jeti-Ögüz (seven bulls) is a district of Issyk-Kul Region in north-eastern Kyrgyzstan. Its seat lies at Kyzyl-Suu. Its area is 14,499 square kilometres, and its resident population was 93,392 in 2021. It comprises much of the eastern end of the Terskey Ala-Too Range.

Click here to see full Facebook photo album!

7. Kolsay Lakes National Park, Kazakhstan

Kolsay Lakes National Park is located on the north slope of the Tian Shan Mountains, southeast Kazakhstan (10km from the border with Kyrgyzstan). Often referred to as “Pearls of Tien Shan”, the park’s main feature are the Kolsay Lakes located between the Raiymbek District and Talgar District of Almaty Region. The scenic Lake Kaindy is also within the park. The park boundary is 120km southeast of Almaty. Lakes of landslide-tectonic origin, approximately formed in 1887 and 1911 on the Kaindy and Kolsay rivers.

Click here to see full Facebook photo album!

8. Charyn Canyon, Kazakhstan

Charyn Canyon (also known as Sharyn Canyon) is a canyon on the Sharyn River in Kazakhstan (200km east of Almaty, close to the Chinese border). The canyon is roughly 154km in length, and is part of the Charyn National Park (established on 23 February 2004). Over time, the canyon has gained colorful formations of varying shapes and sizes. Though it is much smaller than the Grand Canyon, it has been described as being equally impressive.

Charyn Canyon is a unique natural object with peculiar relief forms in the form of chapels, towers, animals, etc., which were formed by the weathering of sedimentary rock.

Click here to see full Facebook photo album!

9. Almaty, Kazakhstan

Almaty, formerly known as Alma-Ata, is the largest city in Kazakhstan, with a population of about 2 million. It was the capital of Kazakhstan from 1929 to 1936 as an autonomous republic as part of the Soviet Union, then from 1936 to 1991 as a union republic and finally from 1991 as an independent state to 1997 when the government relocated the capital to Akmola.

Almaty is still the major commercial, financial, and cultural centre of Kazakhstan, as well as its most populous and most cosmopolitan city.

Click here to see full Facebook photo album!

10. Dushanbe, Tajikistan

Dushanbe (literally ’Monday’) is the capital and largest city of Tajikistan. As of January 2020, Dushanbe had a population of 863,400 and that population was largely Tajik. Until 1929, the city was known in Russian as Dyushambe, and from 1929 to 1961 as Stalinabad, after Joseph Stalin.

In ancient times, what is now or is close to modern Dushanbe was settled by various empires and peoples, including Mousterian tool-users, various neolithic cultures, the Achaemenid Empire, Greco-Bactria, the Kushan Empire, and the Hephthalites. In the Middle Ages, more settlements began near modern-day Dushanbe such as Hulbuk and its famous palace.

Click here to see full Facebook photo album!

11. Iskanderkul Lake & Waterfall, Tajikistan

Iskanderkul is a mountain lake of glacial origin in Tajikistan’s Sughd Province. It lies at an altitude of 2,195m on the northern slopes of the Gissar Range in the Fann Mountains.

The lake takes its name from Alexander the Great’s passage in Tajikistan: Iskander is the Persian pronunciation of Alexander, and kul means lake in many Turkic languages. There are two legends connecting the lake to Alexander. The first one states it used to be a location the inhabitants of which resisted Alexander’s rule, and in fury, the king ordered to divert a river and annihilate them. The second legend states that Bucephalus had drowned in the lake.

Click here to see full Facebook photo album!

12. Fann Mountains, Tajikistan

The Fann Mountains are part of the western Pamir-Alay mountain system in Tajikistan’s Sughd Province, between the Zarafshan Range to the north and the Gissar Range to the south. In an east-west direction, they extend from the Fan Darya to the Archimaydan River.

The Fanns boast about a hundred peaks, with several rising to altitudes of more than 5,000 meters and relative elevations of up to 1,500m. The highest point in Fann Mountains is Chimtarga peak (5,489 m).

Click here to see full Facebook photo album!

13. Khujand, Tajikistan

Khujand is the second-largest city of Tajikistan and the capital of Tajikistan’s northernmost Sughd province.

Khujand is one of the oldest cities in Central Asia, dating back about 2,500 years to the Persian Empire. Situated on the Syr Darya river at the mouth of the Fergana Valley, Khujand was a major city along the ancient Silk Road. After being captured by Alexander the Great in 329 BC, it was renamed Alexandria Eschate and has since been part of various empires in history, including the Umayyad Caliphate (8th century), the Mongol Empire (13th century) and the Russian empire (19th century).

Click here to see full Facebook photo album!

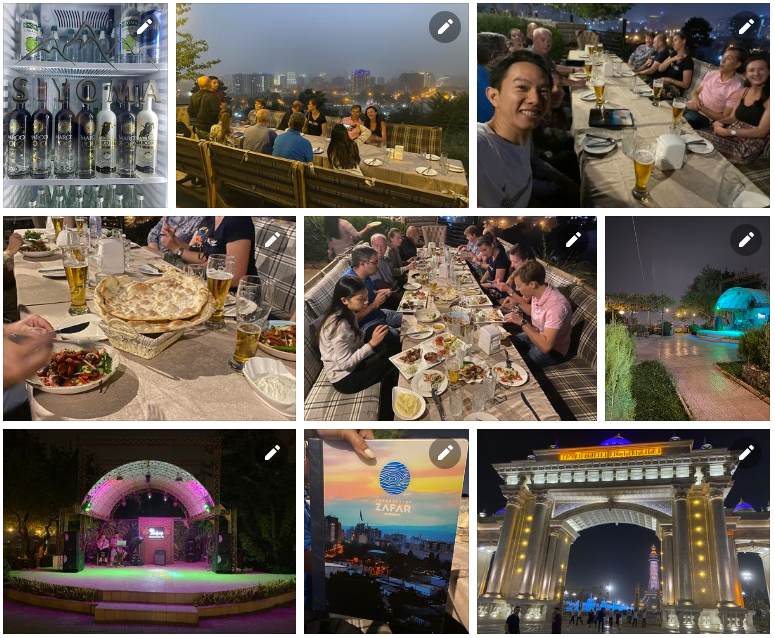

14. Tashkent, Uzbekistan

Tashkent, also historically known as Chach is the capital and largest city of Uzbekistan, as well as the most populous city in Central Asia, with a population of 2,909,000 (2022). It is in northeastern Uzbekistan, near the border with Kazakhstan. Tashkent comes from the Turkic tash and kent, literally translated as “Stone City” or “City of Stones”.

Before Islamic influence started in the mid-8th century AD, Tashkent was influenced by the Sogdian and Turkic cultures. After Genghis Khan destroyed it in 1219, it was rebuilt and profited from the Silk Road. From the 18th to the 19th century, the city became an independent city-state, before being re-conquered by the Khanate of Kokand. In 1865, Tashkent fell to the Russian Empire; it became the capital of Russian Turkestan.

Click here to see full Facebook photo album!

15. Samarkand, Uzbekistan

Samarkand is a city in southeastern Uzbekistan and among the oldest continuously inhabited cities in Central Asia. There is evidence of human activity in the area of the city from the late Paleolithic Era. Though there is no direct evidence of when Samarkand was founded, several theories propose that it was founded between the 8th and 7th centuries BCE.

Prospering from its location on the Silk Road between China and Europe, at times Samarkand was one of the largest cities of Central Asia.[3] Most of the inhabitants of this city are native Persian-speakers and speak the Tajik Persian dialect. This city is one of the historical centers of the Tajik people in Central Asia, which in the past was one of the important cities of the great empires of Iran.

Click here to see full Facebook photo album!

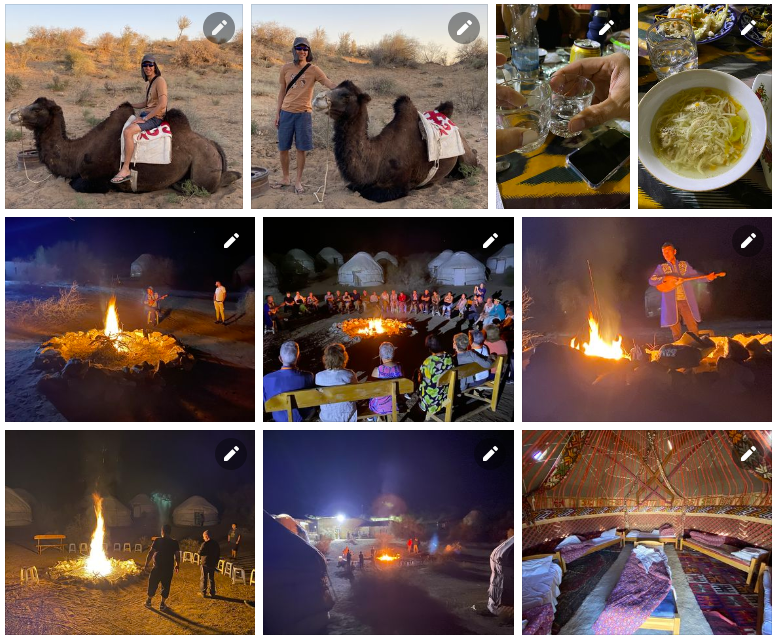

16. Lake Aydarkul, Uzbekistan

The Aydar Lake (Lake Aydarkul) is part of the man-made Aydar-Arnasay system of lakes, which covers 4,000 square kilometres. This has 3 brackish water lakes (the two others being Arnasay and Tuzkan), deep basins of the south-eastern Kyzyl Kum (now in Uzbekistan and Kazakhstan). The lakes are expansive reservoirs of Soviet planning.

Being brackish rather than saline they have high rates of evaporation, prompting a moist summer microclimate, often attracting rain clouds, which has led to the replenishment of the North Aral Sea.

Click here to see full Facebook photo album!

17. Bukhara, Uzbekistan

Bukhara is the seventh-largest city in Uzbekistan, with a population of 280,187 as of 1 January 2020, and the capital of Bukhara Region. People have inhabited the region around Bukhara for at least five millennia, and the city has existed for half that time. Located on the Silk Road, the city has long served as a center of trade, scholarship, culture, and religion. The mother tongue of the majority of people of Bukhara is Tajik, a dialect of the Persian language, although Uzbek is spoken as a second language by most residents.

Bukhara served as the capital of the Samanid Empire, Khanate of Bukhara, and Emirate of Bukhara and was the birthplace of scholar Imam Bukhari.[4] The city has been known as “Noble Bukhara”. Bukhara has about 140 architectural monuments. UNESCO has listed the historic center of Bukhara (which contains numerous mosques and madrasas) as a World Heritage Site.

Click here to see full Facebook photo album!

18. Khiva, Uzbekistan

Khiva is a district-level city of approximately 93,000 people in Xorazm Region, Uzbekistan. According to archaeological data, the city was established around 1500 years ago. It is the former capital of Khwarezmia, the Khanate of Khiva, and the Khorezm People’s Soviet Republic.

Itchan Kala in Khiva was the first site in Uzbekistan to be inscribed in the World Heritage List (1991). The astronomer, historian and polymath, Al-Biruni[4] (973-1048 CE) was born in either Khiva or the nearby city of Kath.

Click here to see full Facebook photo album!

19. Istanbul, Turkey

Istanbul, formerly known as Constantinople, is the largest city in Turkey, serving as the country’s economic, cultural and historic hub. The city straddles the Bosporus strait, lying in both Europe and Asia, and has a population of over 15 million residents, comprising 19% of the population of Turkey. Istanbul is the most populous European city, and the world’s 15th-largest city.

Over 13.4 million foreign visitors came to Istanbul in 2018, eight years after it was named a European Capital of Culture, making it the world’s eighth most visited city. Istanbul is home to several UNESCO World Heritage Sites, and hosts the headquarters of numerous Turkish companies, accounting for more than thirty percent of the country’s economy.

Click here to see full Facebook photo album!

20. Cappadocia, Turkey

Cappadocia or Capadocia, is a historical region in Central Anatolia, Turkey. It largely is in the provinces Nevşehir, Kayseri, Aksaray, Kırşehir, Sivas and Niğde.

According to Herodotus, in the time of the Ionian Revolt (499 BC), the Cappadocians were reported as occupying a region from Mount Taurus to the vicinity of the Euxine (Black Sea). Cappadocia, in this sense, was bounded in the south by the chain of the Taurus Mountains that separate it from Cilicia, to the east by the upper Euphrates, to the north by Pontus, and to the west by Lycaonia and eastern Galatia.

The name, traditionally used in Christian sources throughout history, continues in use as an international tourism concept to define a region of exceptional natural wonders, in particular characterized by fairy chimneys and a unique historical and cultural heritage.

Click here to see full Facebook photo album!

21. Antalya, Turkey

Antalya is the fifth-most populous city in Turkey as well as the capital of Antalya Province. Located on Anatolia’s southwest coast bordered by the Taurus Mountains, Antalya is the largest Turkish city on the Mediterranean coast outside the Aegean region with over one million people in its metropolitan area.

Antalya is Turkey’s biggest international sea resort, located on the Turkish Riviera. Large-scale development and governmental funding has promoted tourism. A record 13.6 million tourists passed through the city in 2019.

Click here to see full Facebook photo album!

22. Pamukkale, Turkey

Pamukkale, meaning “cotton castle” in Turkish, is a natural site in Denizli Province in southwestern Turkey. The area is famous for a carbonate mineral left by the flowing of thermal spring water. It is located in Turkey’s Inner Aegean region, in the River Menderes valley, which has a temperate climate for most of the year.

The ancient Greek city of Hierapolis was built on top of the travertine formation which is in total about 2,700 metres long, 600m wide and 160m high. It can be seen from the hills on the opposite side of the valley in the town of Denizli, 20 km away. This area has been drawing visitors to its thermal springs since the time of classical antiquity. The Turkish name refers to the surface of the shimmering, snow-white limestone, shaped over millennia by calcite-rich springs. Dripping slowly down the mountainside, mineral-rich waters collect in and cascade down the mineral terraces, into pools below.

It was added as a UNESCO World Heritage Site in 1988 along with Hierapolis.

Click here to see full Facebook photo album!

23. Kusadasi, Turkey

Kuşadası is a large resort town on Turkey’s Aegean coast, and the center of the seaside district of the same name within Aydın Province. Kuşadası is 95 km south of İzmir, and about 60 km from Aydın. The municipality’s primary industry is tourism.

The district of Kuşadası had a total residential population of 121,493 in 2020, though the actual population is thought to rise to well over half a million in the summer months due to a significant influx of both domestic and international tourists as well as those visiting family or returning to their summer residence.

Click here to see full Facebook photo album!

24. Ephesus, Turkey

Ephesus was a city in ancient Greece on the coast of Ionia, 3 kilometres southwest of present-day Selçuk in İzmir Province, Turkey. It was built in the 10th century BC on the site of Apasa, the former Arzawan capital, by Attic and Ionian Greek colonists. During the Classical Greek era, it was one of twelve cities that were members of the Ionian League. The city came under the control of the Roman Republic in 129 BC.

The city was famous in its day for the nearby Temple of Artemis (completed around 550 BC), which has been designated one of the Seven Wonders of the Ancient World. Its many monumental buildings included the Library of Celsus and a theatre capable of holding 24,000 spectators.

Today, the ruins of Ephesus are a favourite international and local tourist attraction, being accessible from Adnan Menderes Airport and from the resort town Kuşadası. In 2015, the ruins were designated a UNESCO World Heritage Site.

Click here to see full Facebook photo album!

Once again, to see the full photo albums for all my trips, please visit: https://synapsetrading.com/travel-log/

Enjoy!