Although there was a short-term bullish rebound in the markets from the UK tax cut reversal, the impact was short-lived, and in fact it provided us a good shorting opportunity to enter at better prices on the rebound.

The long-term trend is still bullish, and as I just shared in the private signals group, until our leading indicator flashes a reversal signal, I won’t be expecting a reversal in the stock market any time soon.

Our current new short positions are already in the money, so we will continue riding and managing these positions for next week as well.

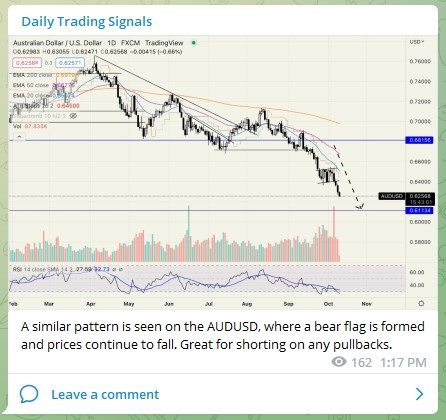

There are some good trading opportunities to sell various currencies against the US dollar, since it is expected that the USD will continue heading up.

At this point in the market, the main drivers of price are the CPI, NFP and FOMC data, so try to focus on these and filter out the noise in the market. Observe these data releases together with price action and chart patterns, and it will give clues to the market direction.

As per usual, I will be posting updates and trading opportunities in our Daily Trading Signals Telegram channel, so do join us if you are an active trader, or looking to time the market better!

[Photo: Garden Route, South Africa – See my full travel photo log!]

For our weekly market wrap, we go through some of the trade calls and analysis from last week, which gives us valuable insights for the week ahead.

We cover 3 main markets with a total of 200+ counters, so we will never run out of trading opportunities:

- Forex, CFDs, commodities, bonds

- US stocks, ETFs, global stock indices

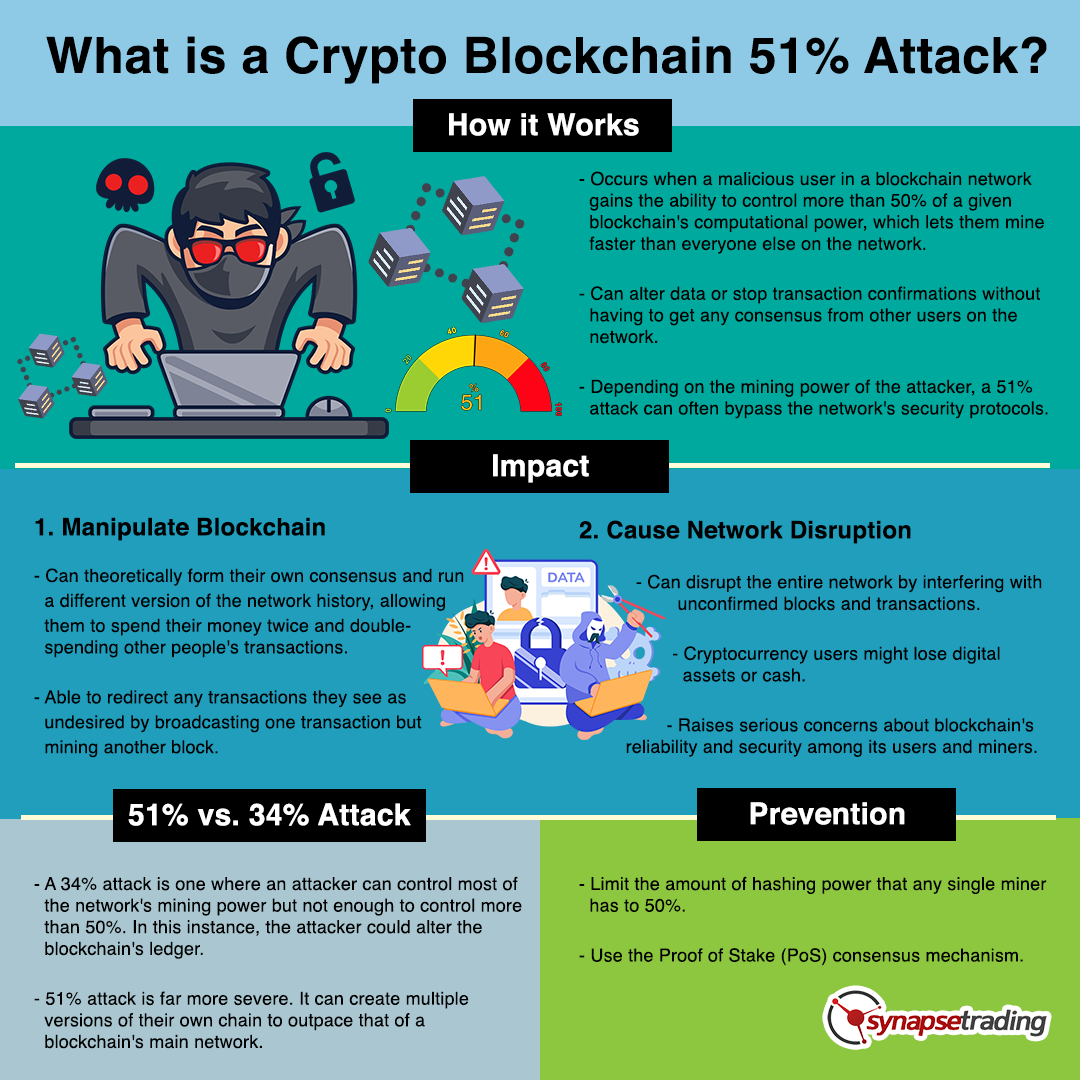

- Cryptocurrencies, crypto indices

By covering a broad range of markets, we can focus our attention (and capital) on whichever market currently gives the best returns.

Table of Contents

Weekly Market Outlook Video

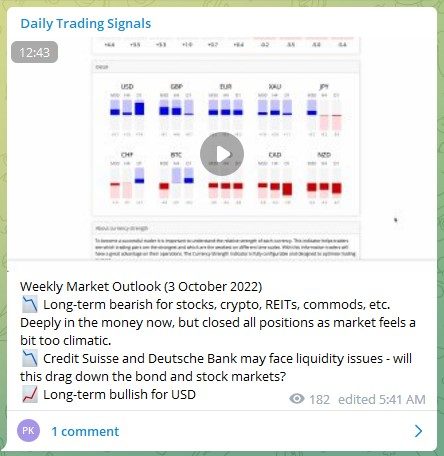

Weekly Market Outlook (18 October 2022)

? Next rate hike in about 25 days

? UK reverses tax cuts, short-term bullish for risk assets

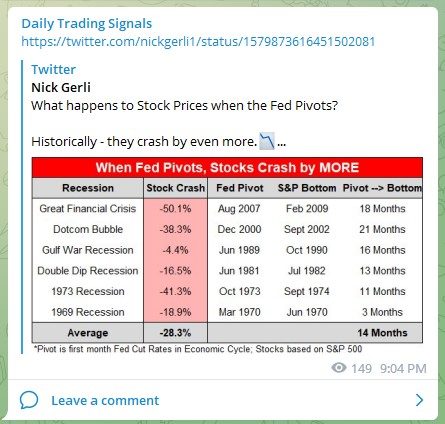

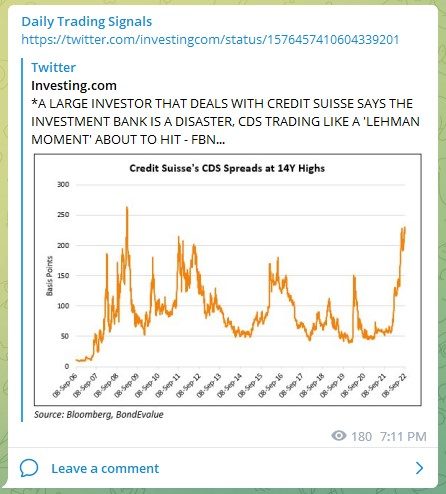

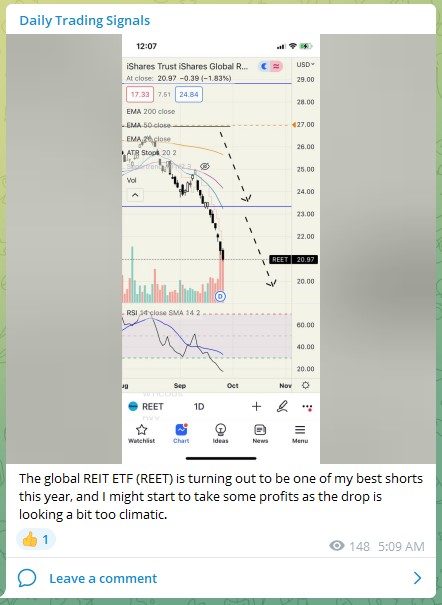

? Long-term bearish for stocks, crypto, REITs, commods, etc.

? Long-term bullish for USD, but short-term bearish

Portfolio Highlights

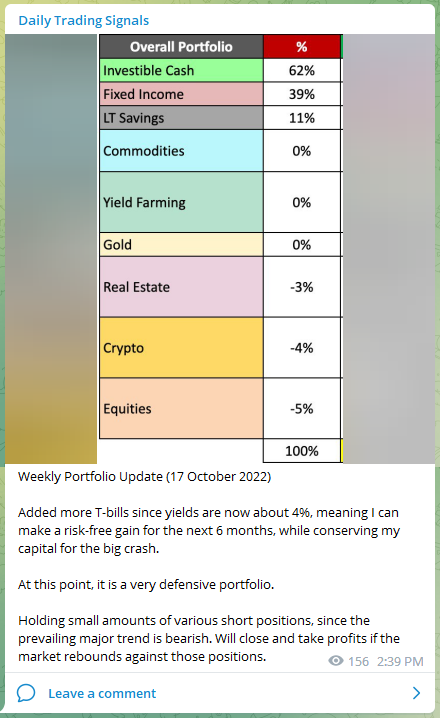

Weekly Portfolio Update (17 October 2022)

Added more T-bills since yields are now about 4%, meaning I can make a risk-free gain for the next 6 months, while conserving my capital for the big crash.

At this point, it is a very defensive portfolio.

Holding small amounts of various short positions, since the prevailing major trend is bearish. Will close and take profits if the market rebounds against those positions.

Forex & Commodities Market Highlights

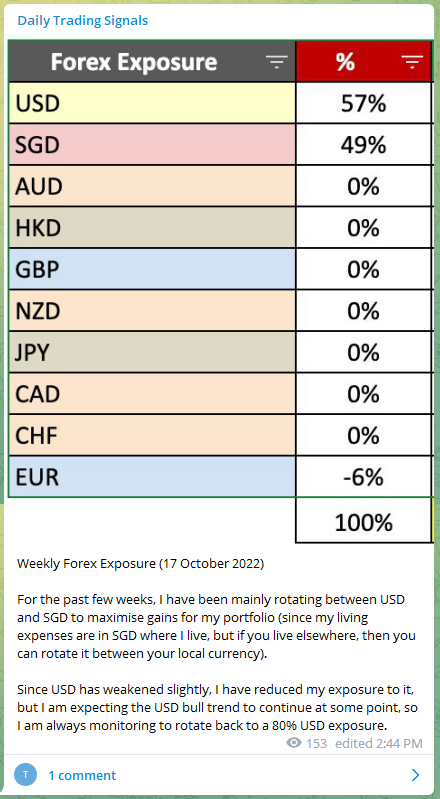

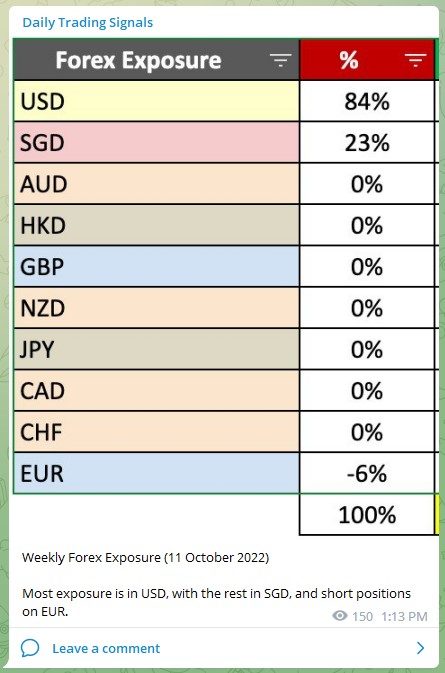

Weekly Forex Exposure (17 October 2022)

For the past few weeks, I have been mainly rotating between USD and SGD to maximise gains for my portfolio (since my living expenses are in SGD where I live, but if you live elsewhere, then you can rotate it between your local currency).

Since USD has weakened slightly, I have reduced my exposure to it, but I am expecting the USD bull trend to continue at some point, so I am always monitoring to rotate back to a 80% USD exposure.

The AUDNZD has broke down from its trendline, and it is likely to be bearish/sideways. Look for small consolidations to initiate short positions.

Potential bullish reversal for the EURCHF if the inverse H&S pattern completes and price manages to break the neckline.

I have placed a price alert so that we will know the moment it happens.

Bullish H&S continuation pattern on the EURJPY, making it a good opportunity to long on any pullbacks or on smaller timeframes.

The GBPCAD recently broke the bearish trendline, as it turned up from a very oversold position.

Short/medium-term price action is strong, so I will not be surprised if it manages to head up to test the next resistance level.

After a 1-month ABC correction, the USDSGD might start to resume its uptrend. I have rotated more of my SGD into USD to prepare for this.

Stock & Bond Market Highlights

If the NASDAQ 100 (US100) is unable to clear this zone and stay above it, then there is a good chance we will see more downside.

Same for general China stocks (2801), which is down about 60% from all-time highs.

China tech stocks (3067) are still in free fall, after breaking down from a recent bear flag. Currently down about 72% from all-time highs.

Worldwide Inflation

$ARKK officially in the red over the last 5 years. pic.twitter.com/04JjQro6Kf

— Oktay Kavrak, CFA (@OKavrak) October 14, 2022

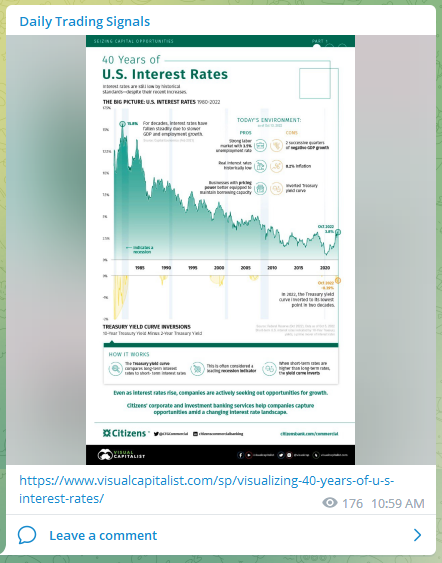

The gap between 2-year and 10-year Treasury yields has reached the most inverted since the early 1980s. pic.twitter.com/ywCx0XQPP7

— Lisa Abramowicz (@lisaabramowicz1) October 14, 2022

Good luck, and may next week bring more excellent profits!