Best Trading Tips & Quotes from Jesse Livermore

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

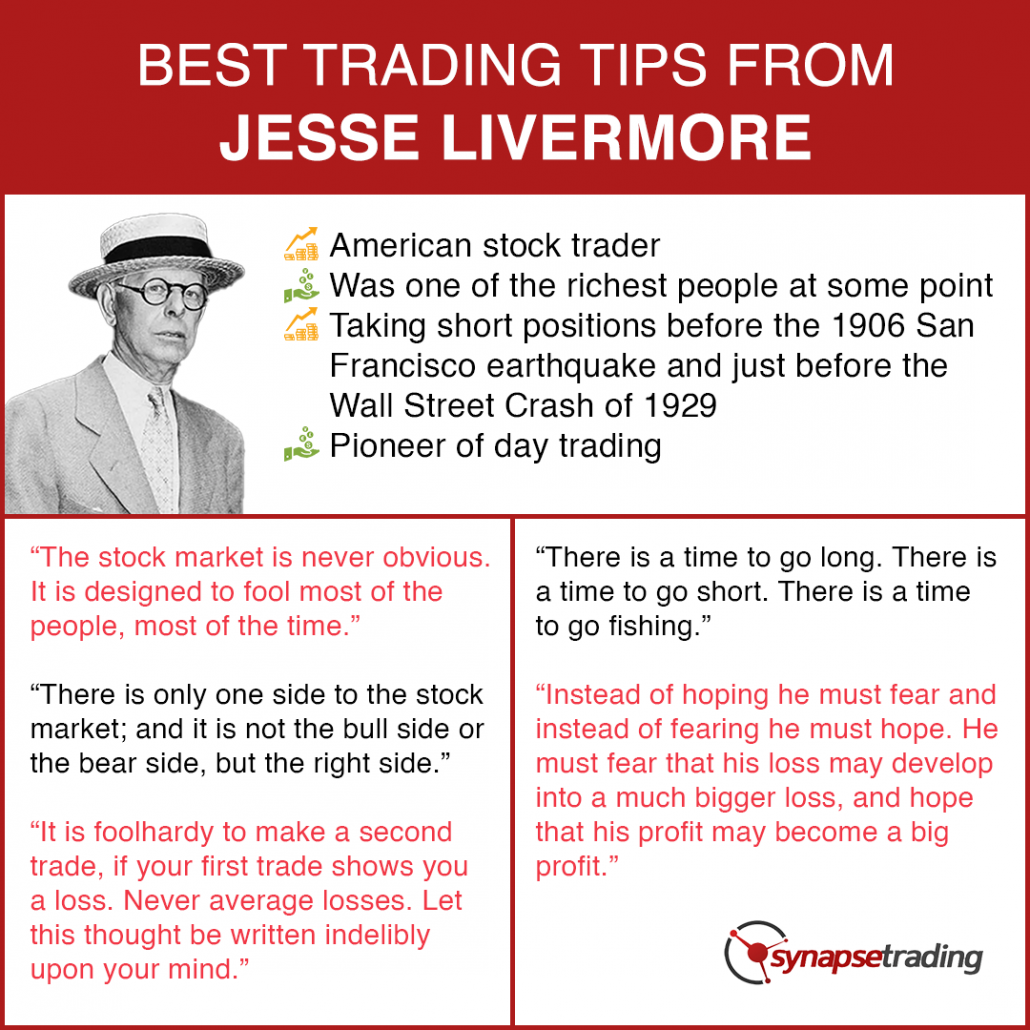

Jesse Lauriston Livermore was an American stock trader.

He is considered a pioneer of day trading and was the basis for the main character of Reminiscences of a Stock Operator, a best-selling book by Edwin Lefèvre.

At one time, he was one of the richest people in the world.

Some of Livermore’s trades, such as taking short positions before the 1906 San Francisco earthquake and just before the Wall Street Crash of 1929, are legendary and have led to his being regarded as the greatest trader who ever lived.

In this post, I will share all the best trading tips and quotes from Jesse Livermore, so that we can learn from his knowledge and experience.

Here are some of the best trading tips and quotes by Jesse Livermore:

- The stock market is never obvious. It is designed to fool most of the people, most of the time.

- There is only one side to the stock market; and it is not the bull side or the bear side, but the right side.

- A man must believe in himself and his judgement if he expects to make a living at this game. That is why I don’t believe in tips.

- A man must study general conditions, to seize them so as to be able to anticipate probabilities.

- To anticipate the market is to gamble. To be patient and react only when the market gives the signal is to speculate.

- Don’t take action with a trade until the market, itself, confirms your opinion. Being a little late in a trade is insurance that your opinion is correct. In other words, don’t be an impatient trader.

- A prudent speculator never argues with the tape. Markets are never wrong, opinions often are.

- If I buy stocks on Smith’s tip I must sell those same stocks on Smith’s tip. I am depending on him. Suppose Smith is away on a holiday when the selling time comes around?

- If you can’t sleep at night because of your stock market position, then you have gone too far. If this is the case, then sell your position down to the sleeping level.

- The average man doesn’t wish to be told that it is a bull or a bear market. What he desires is to be told specifically which particular stock to buy or sell. He wants to get something for nothing. He does not wish to work. He doesn’t even wish to have to think.

- He really meant to tell them that the big money was not in the individual fluctuations but in the main movements that is, not in reading the tape but in sizing up the entire market and its trend.

- People who look for easy money invariable pay for the privilege of proving conclusively that it cannot be found on this earth.

- It is foolhardy to make a second trade, if your first trade shows you a loss. Never average losses. Let this thought be written indelibly upon your mind.

- Nobody can catch all the fluctuations. In a bull market your game is to buy and hold until you believe that the bull market is near its end. To do this you must study general conditions and not tips or special factors affecting individual stocks. Then get out of all your stocks; get out for keeps! You have to use your brains and your vision to do this; otherwise my advice would be as idiotic as to tell you to buy cheap and sell dear. One of the most helpful things that anybody can learn is to give up trying to catch the last eighth-or the first. These two are the most expensive eighths in the world.

- Remember this: when you are doing nothing, those speculators who feel they must trade day in and day out, are laying the foundation for your next venture. You will reap benefits from their mistakes.

- It is literally true that millions come easier to a trader after he knows how to trade, than hundreds did in the days of his ignorance.

- Professional traders have always had some system or other based upon their experience and governed either by their attitude towards speculation or by their desires.

- I think it was a long step forward in my trading education when I realized at last that when old Mr. Partridge kept on telling other customers, “Well, you know this is a bull market!” he really meant to tell them that the big money was not in the individual fluctuations but in the main movements that is, not in reading the tape but in sizing up the entire market and its trend.

- I never hesitate to tell a man that I am bullish or bearish. But I do not tell people to buy or sell any particular stock. In a bear market all stocks go down and in a bull market they go up.

- After spending many years in Wall Street and after making and losing millions of dollars I want to tell you this: It never was my thinking that made the big money for me. It always was my sitting. Got that? My sitting tight!

- The “lucky” trader is one who minimizes mistakes and, if they do make a mistake, acts to minimize the damage by exiting from the situation quickly. In practice this means having a written plan for each trade you enter, the most important element of which is the stop-loss.

- “I can’t sleep” answered the nervous one. “Why not?” asked the friend. “I am carrying so much cotton that I can’t sleep thinking about. It is wearing me out. What can I do?” “Sell down to the sleeping point”, answered the friend.

- Speculation is far too exciting. Most people who speculate hound the brokerage offices… the ticker is always on their minds. They are so engrossed with the minor ups and downs, they miss the big movements.

- The semi-sucker had read books about trading – usually written by yet higher grade suckers – but he did not realize that reading books was not the same as trading experience. This type of sucker could quote all sorts of wise sayings about the operations of the stock market. He did not lose money as quickly as the beginning sucker because he had learned some of the most rudimentary trading rules.

- A loss never bothers me after I take it. I forget it overnight. But being wrong – not taking the loss – that is what does damage to the pocketbook and to the soul.

- The market does not beat them. They beat themselves, because though they have brains they cannot sit tight.

- I did precisely the wrong thing. The cotton showed me a loss and I kept it. The wheat showed me a profit and I sold it out. Of all the speculative blunders there are few greater than trying to average a losing game. Always sell what shows you a loss and keep what shows you a profit.

- Whenever I have had the patience to wait for the market to arrive at what I call a Pivotal Point before I started to trade; I have always made money in my operations.

- Losing money is the least of my troubles. A loss never troubles me after I take it. I forget it overnight. But being wrong – not taking the loss – that is what does the damage to the pocket book and to the soul.

- It is what people actually did in the stock market that counted – not what they said they were going to do.

- Play the market only when all factors are in your favor. No person can play the market all the time and win. There are times when you should be completely out of the market, for emotional as well as economic reasons.

- The desire for constant action irrespective of underlying conditions is responsible for many losses on Wall Street even among the professionals, who feel that they must take home some money every day, as though they were working for regular wages.

- Do not use the words “Bullish” or “Bearish.” These words fix a firm market-direction in the mind for an extended period of time. Instead, use “Upward Trend” and “Downward Trend” when asked the direction you think the market is headed. Simply say: “The line of least resistance is either upward or downward at this time.” Remember, don’t fight the tape!

- The game of speculation is the most uniformly fascinating game in the world. But it is not a game for the stupid, the mentally lazy, the person of inferior emotional balance, or the get-rich-quick adventurer. They will die poor.

- He will risk half his fortune in the stock market with less reflection that he devotes to the selection of a medium-priced automobile.

- The only thing to do when a person is wrong is to be right, by ceasing to be wrong. Cut your losses quickly, without hesitation. Don’t waste time. When a stock moves below a mental-stop, sell it immediately.

- Emotional control is the most essential factor in playing the market. Never lose control of your emotions when the market moves against you. Don’t get too confident over your wins or too despondent over your losses.

- In a narrow market, when prices are not getting anywhere to speak of but move within a narrow range, there is no sense in trying to anticipate what the next big movement is going to be. The thing to do is to watch the market, read the tape to determine the limits of the get nowhere prices, and make up your mind that you will not take an interest until the prices breaks through the limit in either direction.

- All through time, people have basically acted and reacted the same way in the market as a result of: greed, fear, ignorance, and hope. That is why the numerical formations and patterns recur on a constant basis.

- Men who can both be right and sit tight are uncommon. I found it one of the hardest things to learn. But it is only after a stock operator has firmly grasped this that he can make big money.

- Experience has proved to me that real money made in speculating has been in commitments in a stock or commodity showing a profit right from the start.

- There is a time to go long. There is a time to go short. There is a time to go fishing.

- I can only rise by knowledge, If I fall it must be by my own blunders.

- Watch the market leaders, the stocks that have led the charge upward in a bull market. That is where the action is and where the money is to be made. As the leaders go, so goes the entire market. If you cannot make money in the leaders, you are not going to make money in the stock market. Watching the leaders keeps your universe of stocks limited, focused, and more easily controlled.

- One of the most helpful things that anybody can learn is to give up trying to catch the last eighth – or the first. These two are the most expensive eighths in the world. They have cost stock traders, in the aggregate, enough millions of dollars to build a concrete highway across the continent.

- I don’t know whether I make myself plain, but I never lose my temper over the stock market. I never argue with the tape. Getting sore at the market doesn’t get you anywhere.

- Failure to take advantage of a serendipitous act of good luck in the stock market is often a mistake.

- There is nothing new on Wall Street or in stock speculation. What has happened in the past will happen again, and again, and again. This is because human nature does not change, and it is human emotion, solidly build into human nature, that always gets in the way of human intelligence. Of this I am sure.

- Instead of hoping he must fear and instead of fearing he must hope. He must fear that his loss may develop into a much bigger loss, and hope that his profit may become a big profit.

Now that I have shared the best trading tips and quotes from Jesse Livermore, which is your favourite trading tip?

Let me know in the comments below.

If you would like to get more trading tips and quotes from all the best traders, also check out: “Best Trading Tips & Quotes from Legendary Top Traders”

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!