Dr. Alexander Elder is a well-known trader and author who has written extensively on the topic of trading psychology.

He is a strong advocate for the importance of managing one’s emotions and developing a disciplined approach to trading.

In his book “Trading for a Living,” Elder emphasizes the importance of having a clear set of rules and sticking to them, as well as the need to manage risk and protect capital.

He also discusses the psychological pitfalls that traders can fall into, such as overconfidence and fear, and offers practical advice for overcoming these challenges.

This was one of the first few books I read when I started my trading journey, and it is a very good overview of everything you need to know to become a complete trader.

In this blog post, I will give a detailed summary of the book, and pull out the key learning points and strategies that Dr Elder has shared in the book.

About Dr. Alexander Elder

Before diving into the book, it is important to understand the author’s background, and why he has such a deep understanding of trading psychology.

Dr. Alexander Elder is a psychiatrist and trader who is known for his work on trading psychology and technical analysis.

Born in Leningrad (now St. Petersburg), Russia, Elder grew up in a family of scientists and engineers.

He studied medicine at the First Leningrad Medical Institute and later worked as a ship’s doctor in the Soviet merchant marine.

In 1977, Elder immigrated to the United States, where he completed his medical training and worked as a psychiatrist.

However, he also had a passion for the stock market, and he began trading and studying technical analysis in his spare time.

In the late 1980s, Elder began writing and teaching about trading, and he quickly gained a reputation as a leading expert on the psychological aspects of trading.

In 1995, he published his first book, “Trading for a Living”, which became a bestseller and established him as a leading authority on trading psychology.

He has also developed a number of technical indicators and trading tools, including the Elder-Ray indicator and the Force Index.

He has written several other books on trading, including “Come into My Trading Room,” which are considered classics in the field.

Elder also runs a trading school and offers courses and workshops on trading.

Overview of “Trading for a Living” Book

“Trading for a Living” is the flagship book written by Alexander Elder, which was first published in 1993 and has since become a classic in the field of trading.

In the book, Elder discusses his experiences as a trader and offers advice and strategies for how to successfully trade the financial markets.

He covers a range of topics, including risk management, trading psychology, and technical analysis, and provides practical advice for how to develop a successful trading plan.

The book is aimed at both novice and experienced traders, and Elder emphasizes the importance of discipline, patience, and self-awareness in achieving success in the markets.

He also offers guidance on how to avoid common pitfalls and mistakes that can undermine a trader’s performance.

The book also includes practical advice and real-life examples that can help traders develop a consistent and successful approach to the markets.

The 3 M’s of Trading

One of the key concept mentioned in the book is the importance of the 3 M’s of trading.

The 3 M’s of trading refer to three key factors that can affect the success of a trade. These factors are:

- Markets: A trader must have a thorough understanding of the market they are trading in, including its trends, key players, and regulatory environment. This knowledge allows the trader to make informed decisions and anticipate potential market movements.

- Methodology: A trader must have a clear and well-defined trading strategy, including entry and exit points, risk management techniques, and position sizing. This ensures that the trader is able to implement their strategy consistently and effectively.

- Mindset: A trader’s mindset is crucial to their success. A trader must be disciplined and focused, able to handle the emotional ups and downs of the market without letting them affect their decision-making. They must also be willing to continuously learn and adapt in order to stay ahead of the competition.

These 3 M’s are interdependent, and a trader must focus on all three in order to achieve success in the markets.

A trader who understands the market and has a solid trading methodology may still fail if they lack the discipline and focus to implement their strategy effectively.

Similarly, a trader with a great mindset may struggle if they do not have a deep understanding of the market or a well-defined trading plan.

The 3 M’s of trading are crucial for any trader who wants to succeed in the markets.

By focusing on markets, methodology, and mindset, traders can increase their chances of making profitable trades and achieving their financial goals.

Triple Screen System

Another popular tool created by Dr. Alexander Elder is the triple screen system, which he covered in the book.

The system is based on the idea that markets move in three distinct phases: the trend, the sideways range, and the impulse.

The first step in the triple screen system is to identify the dominant time frame for the market you are trading.

This is typically the weekly chart for long-term traders, the daily chart for intermediate-term traders, and the hourly or minute chart for short-term traders.

This dominant time frame is referred to as the “screen” in the triple screen system.

Once the dominant time frame has been identified, the trader then looks at the other two time frames to see if they are in alignment with the dominant time frame.

For example, if the dominant time frame is the daily chart and it is showing an uptrend, the trader would look at the hourly and minute charts to see if they are also showing an uptrend.

If the other time frames are in alignment with the dominant time frame, the trader can enter a trade in the direction of the dominant trend.

The triple screen system also includes a number of other elements, such as the use of oscillators to identify overbought and oversold conditions and the use of moving averages to identify support and resistance levels.

However, the core of the system is the use of multiple time frames to identify the dominant trend and to confirm trades.

Overall, the triple screen trading system is a powerful approach to technical analysis that can help traders identify and confirm trade setups.

By using multiple time frames to identify the dominant trend, traders can improve their chances of success and increase their profitability.

Trading Psychology

Another key theme of the book is the role of psychology in trading.

Trading psychology refers to the study of the psychological factors that influence the behavior of traders and investors.

This includes factors such as emotions, attitudes, beliefs, and cognitive biases, as well as the psychological effects of the market environment and the individual trader’s personal circumstances.

One of the key challenges of trading psychology is the need to manage emotions effectively.

Emotions such as fear, greed, and hope can have a powerful impact on a trader’s decision-making and can lead to impulsive and irrational behavior.

For example, fear of losing money can cause a trader to exit a trade prematurely, while greed can cause a trader to hold onto a losing trade for too long.

Another challenge of trading psychology is the need to overcome cognitive biases, which are systematic errors in thinking that can lead to poor decision-making.

For example, the confirmation bias is the tendency to seek out information that supports one’s existing beliefs, while the overconfidence bias is the tendency to overestimate one’s own ability or knowledge.

Dr. Elder argues that success in trading depends not only on technical knowledge and skills, but also on a trader’s mental and emotional state.

He provides a number of practical tools and techniques that traders can use to develop a healthy and disciplined approach to trading, including the use of daily self-assessment and journaling.

Other useful ways to improve trading psychology include developing a well-defined trading plan, using risk management techniques to protect against losses, and practicing mindfulness and meditation to improve emotional control.

Trading psychology is an important aspect of successful trading, and traders who are able to manage their emotions and overcome cognitive biases are likely to be more successful in the market.

By understanding and addressing the psychological challenges of trading, traders can improve their decision-making and increase their profitability.

Additional Trading Tips & Strategies

Here are some general tips and strategies mentioned in the book:

- Develop a trading plan that outlines your goals, risk management strategies, and entry and exit rules for each trade.

- Keep a trading journal to track your performance and identify areas for improvement.

- Use technical analysis to identify potential trading opportunities and set stop-loss orders to limit your potential losses.

- Don’t let emotions, such as fear and greed, influence your trading decisions.

- Be patient and disciplined, and only take trades that have a high probability of success.

- Manage your risk by limiting the amount of capital you expose to the markets on any given trade.

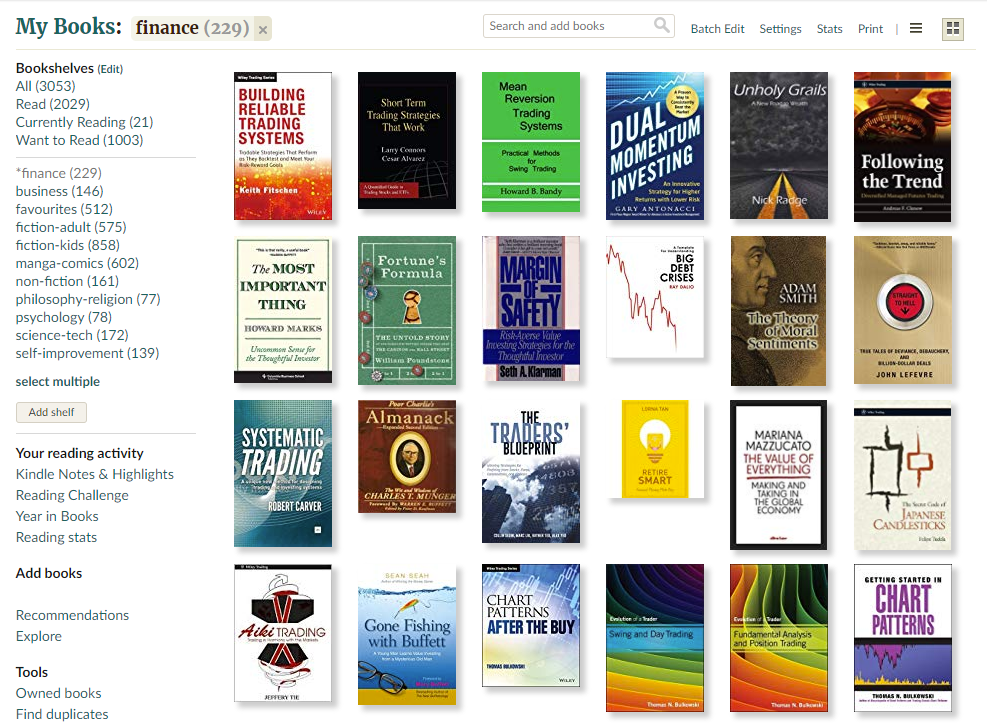

- Continuously educate yourself and stay up-to-date on market developments and trends.

- Don’t expect to get rich quick from trading; success takes time and hard work.

- Don’t be afraid to take a break from trading if you are feeling overwhelmed or stressed.

- Always have a long-term perspective and focus on developing your skills and knowledge as a trader.

Concluding Thoughts

“Trading for a Living” by Alexander Elder is an excellent book for beginners, because it is comprehensive in its coverage, and includes a clear and practical approach to tackling the markets.

In addition, the focus on psychology is a refreshing approach, especially coming from a professional psychologist, because this is one topic which is commonly overlooked in most other books.

Now that I have shared all the key lessons from this book, would you consider reading it?

And if you have already read it, what are some of your key take-aways from the book?

Let me know in the comments below!

If you would like to find more book summaries and recommendations, also check out: “Best Investing & Trading Books of All Time”

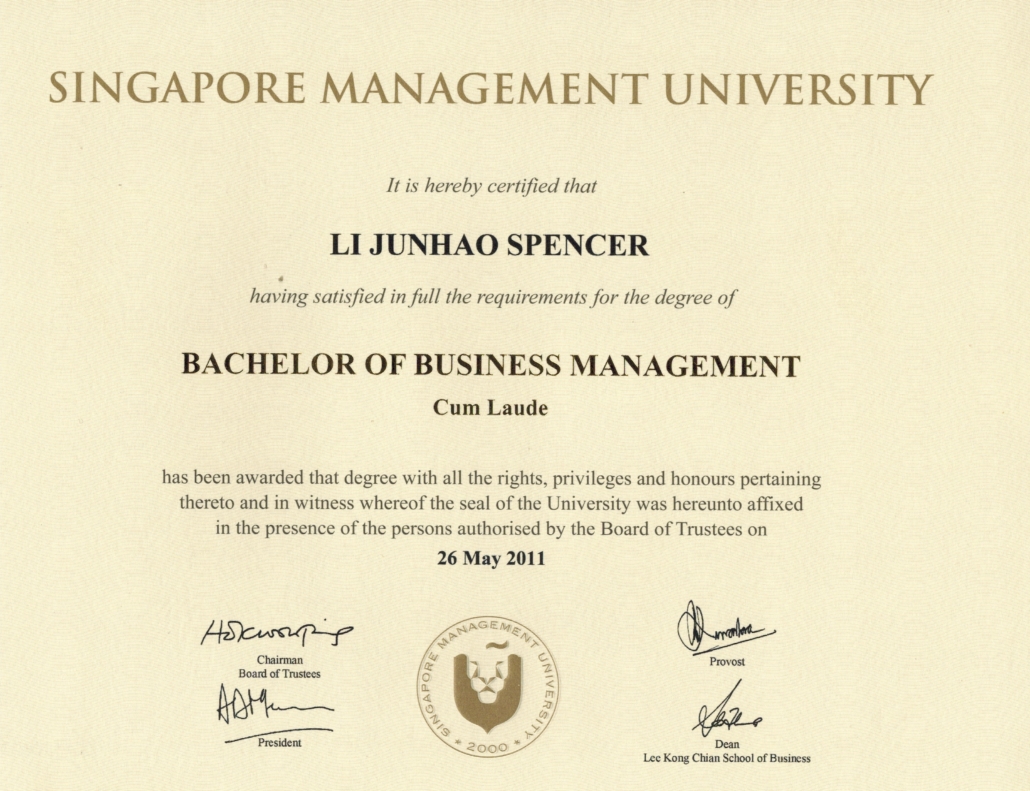

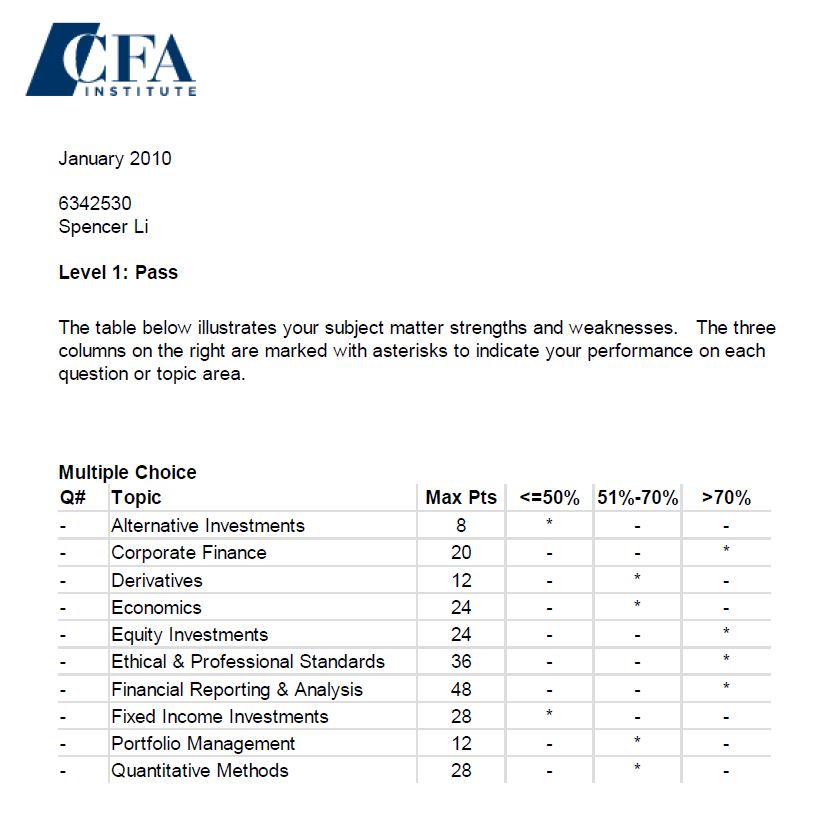

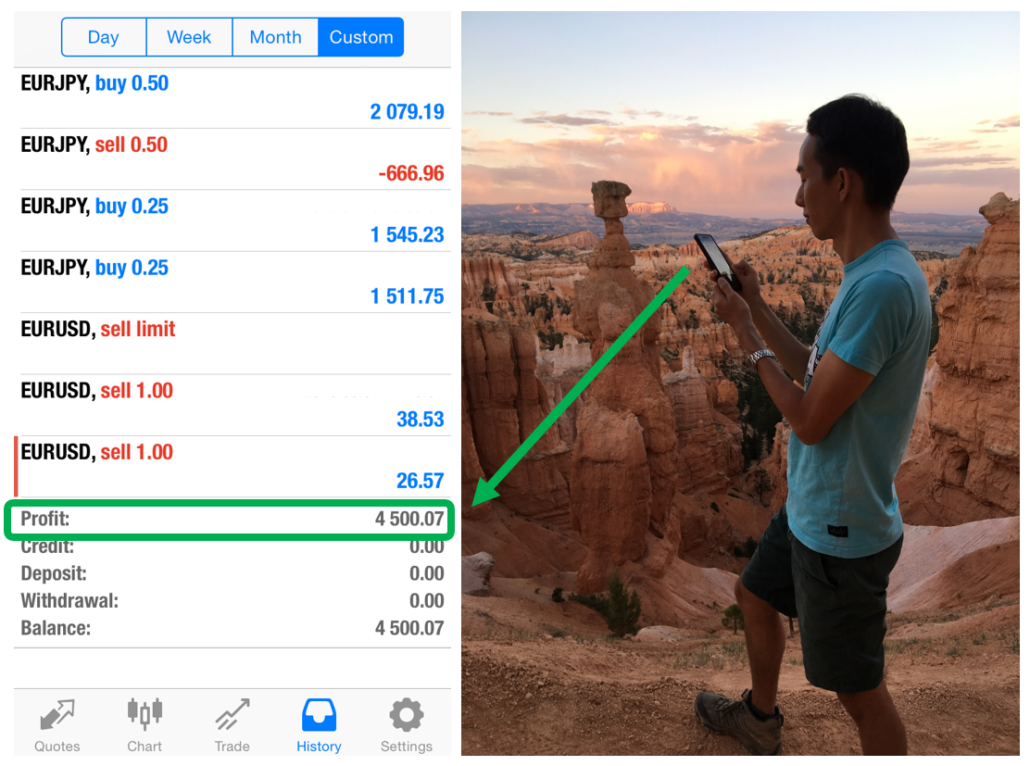

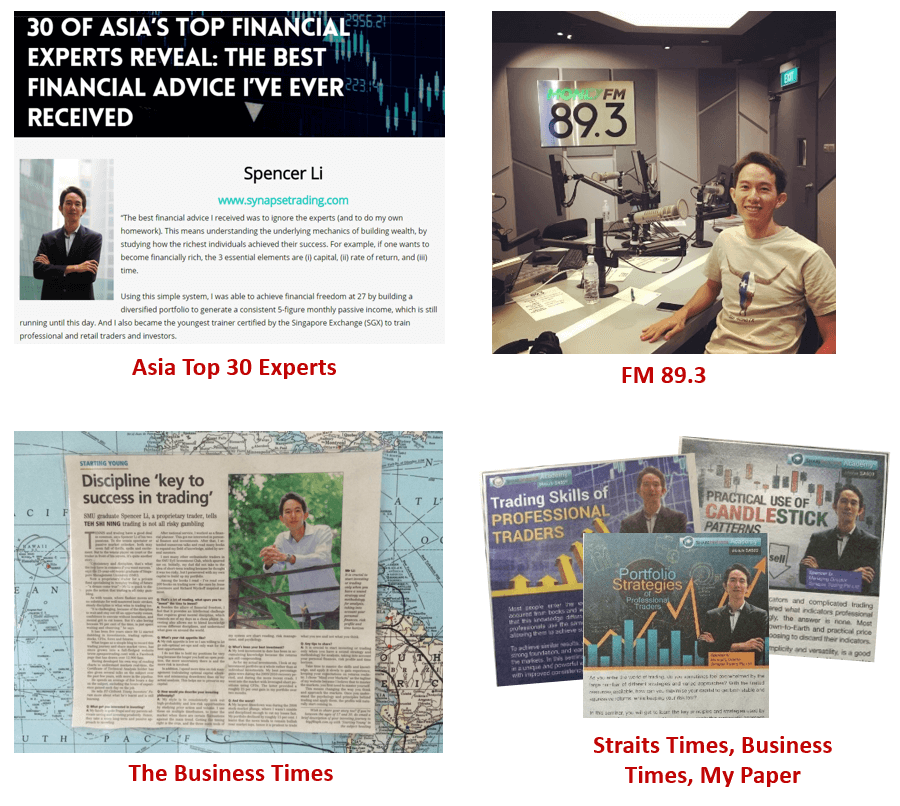

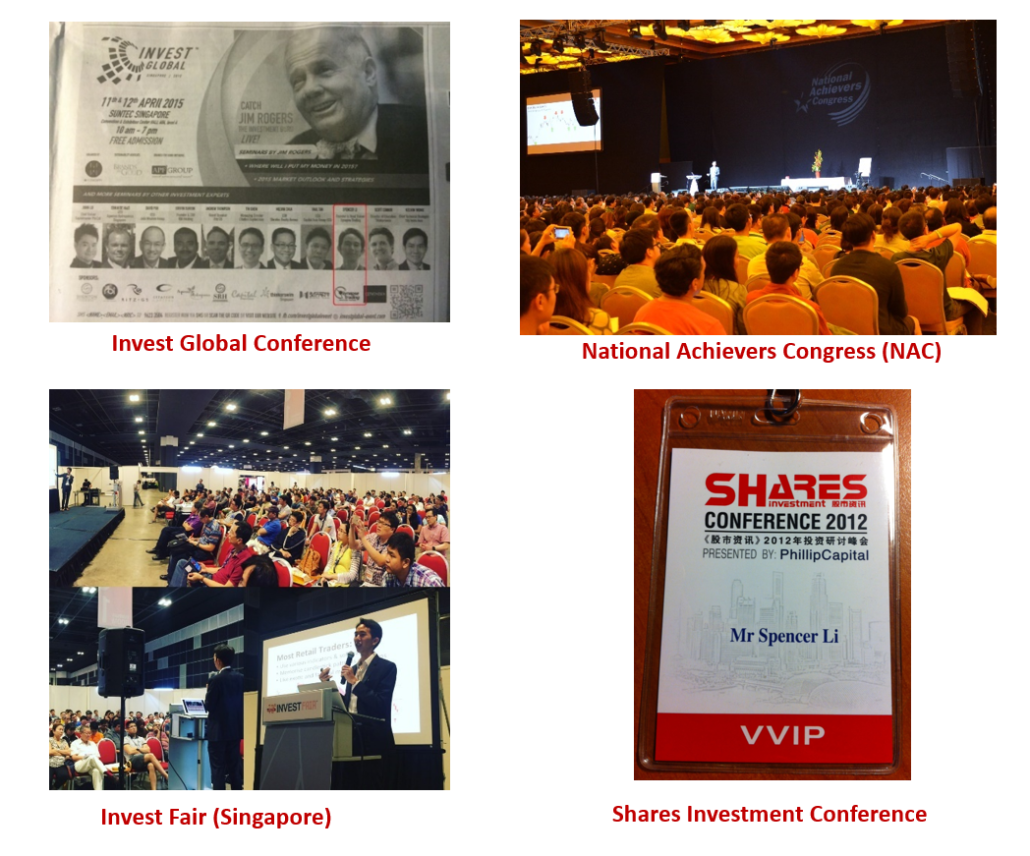

Spencer is an avid globetrotter who achieved financial freedom in his 20s, while trading & teaching across 70+ countries. As a former professional trader in private equity and proprietary funds, he has over 15 years of market experience, and has been featured on more than 20 occasions in the media.