This article is going to be a little longer than usual, as I endeavor to make a balanced view about exactly why price action is preferred in the marketplace.

If you’re keen to expand your mind, deepen your knowledge, or simply learn something new about the financial markets, then please read on.

Throughout the centuries, traders around the world have tried to find every method possible to exploit the market for profits. The search for a trading edge has led to countless hours of research, hard work, and dedication. More recently, programming has become the rage as hedge funds, institutions, and large traders seek to find the optimal way to extract profits from the market.

While the internet is rife with methods, formulas, and patterns that claim to bring in profits, through my years of trading, I’ve found that trading plan or strategies fall into these 3 simple categories.

Most Trading Strategies Fall into 3 Categories

1. Trend-following

Many beginners make the mistake of asking these 2 questions: “When should I buy? When should I sell?”

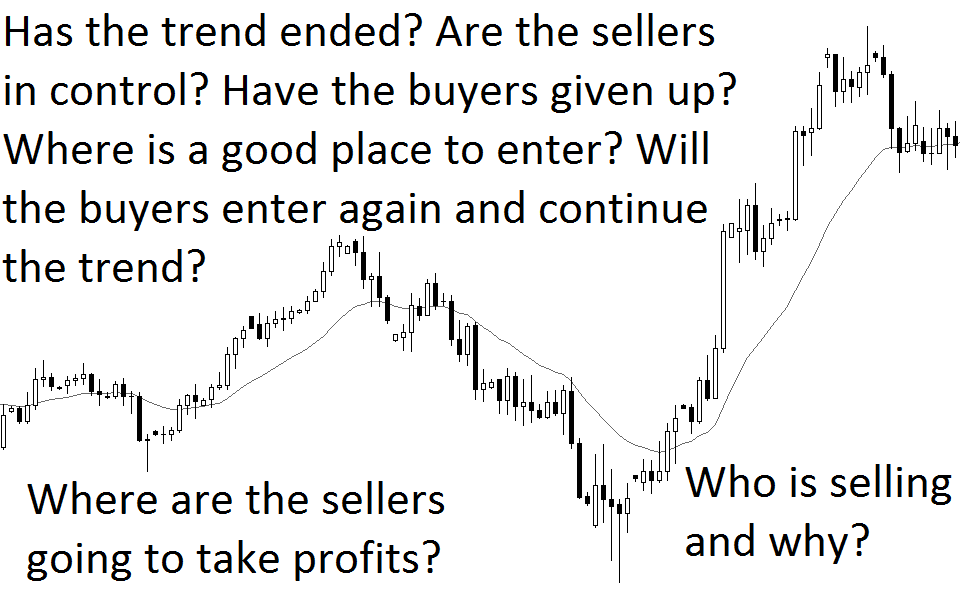

Beneath these two questions, are actually several important questions to ask before deciding when to buy and sell. You see, trend-following is the act of buying in an uptrend, and selling in a downtrend. It sounds simple, but several questions come to mind when a trader attempts to follow a trend:

- Has the trend started? When did it start?

- When will the trend end?

- Where should I get in on the trend?

- Is it a volatile trend, or a gentle trend?

- Is it a strong trend, or a weak trend?

All of this has to be taken into account as the market unfolds before a trader’s eyes. The confluence of answers to these questions would allow a price action trader to buy or to sell. While it is impossible to predict what would happen, the better a trader can answer the above questions, the better he or she is positioned to make some money.

Why is price action preferred by professional traders?

Price action involves reading clean price charts, and understanding the motivation of buyers and sellers when taking trades. With proper training, a trader can answer all the above questions, and make the most efficient trade during a trending market situation.

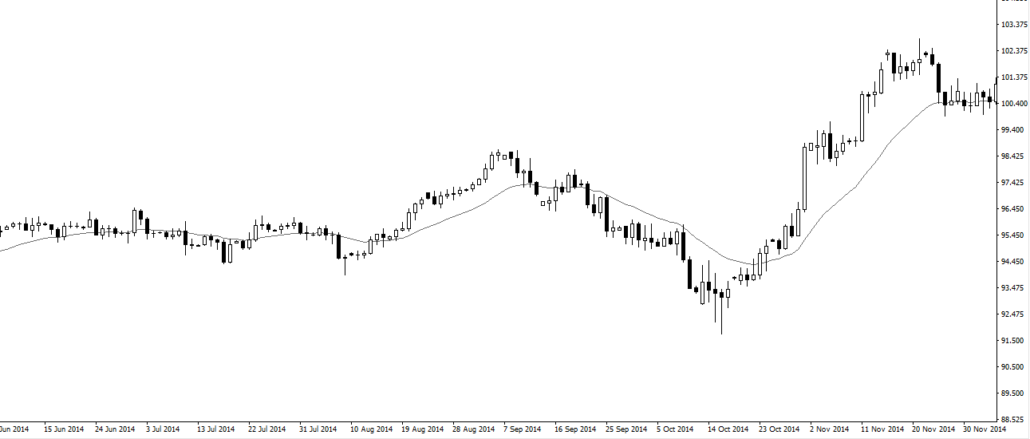

Traders have to process large quantities of information at a go. Making the price chart as clean as possible allows the trader to clearly see what is happening, and simplifies his analysis. For example, in the above chart, buyers are committed during the most recent 10 bars, and a reasonable trade would be to buy on a pullback to the EMA or trendline.

2. Mean-reversion

Mean-reversion is simply doing the opposite of a trend-follower. In essence, a mean-reversion trader would be asking the following questions:

- Has the trend ended?

- Where might the trend end?

- Are the traders taking profits, or are they initiating new positions?

- What price levels are mean-reversion traders looking at?

Based on my experience, beginners should not look to be mean-reversion traders until they are profitable trend-followers. It is much harder than it looks when taking a trade in the opposite direction of the trend.

In my trading foundation workshops, I emphasize time and again that a trade setup must occur in the opposite direction before taking a reversal trade. In fact, instead of going against the trend, I would much prefer that the trend has already changed direction, and then I hop on to that new trend for a lower-risk trade.

Price action traders consider many more options and ask more questions than indicator-based or value-based traders.

The financial marketplace is filled with professional traders seeking to make a quick buck out of unsuspecting, ill-disciplined, or even lazy traders. It is just like in the Olympics; at the highest level of sporting excellence, sportsmen that miscalculate their aim or fail to squeeze out that last ounce of energy could miss finishing in the top 3.

In a bull market, going against the trend is much harder than you think. That is why price action is so important; it helps you decipher when the trend is going to end, and whether it is wise to enter or not.

3. Spread-Betting (Betting during volatility)

Spread-betting is used by institutional traders and proprietary funds to make short-term bets during times of volatility. The software and execution technology required is often expensive, and is not suitable for a retail trader. The strategy is complex, because bets are placed on both sides during a volatile event, and it requires strict discipline when trading. I won’t go into great detail on how this is done, but you can read up about it.

Why Then, is Price Action Preferred by Professional Traders?

1. CLARITY

Price action trading is trading with clean charts. The only information you need is the current price, and these are displayed using candlestick charts. In the charts below, we see that the blank chart is far clearer and easier to read than the complicated one with many indicators.

2. SPEED

When trading intra-day, traders need to quickly make a decision when the price action unfolds before them. While checklists and criteria do help, having a solid price action foundation would allow the trader to make a decision quickly. How would you make a trading decision, if you had to look at 12 screens at once?

Image Source: LifeHacker.com

In contrast, I can make my trades on a single laptop computer, or even on my mobile devices. Something like this is more than sufficient:

Image Source: MyCompas.com

3. UNIVERSALITY

Perhaps the biggest reason why price action is preferred, is that price action is universal. You can trade commodities, currencies, stocks, bonds, ETFs, REITs, futures on just about anything, and even options, because every product has a price chart. You can be just as sure that Coffee Futures have the same price action mechanics as Apple stock, and you wouldn’t have a problem transiting between products.

Trading is very much like selecting from a diverse menu in a fancy restaurant; while there are many products to trade, many traders settle on trading a few products and get proficient at them.

Price action works on just about anything with a price chart and a liquid secondary marketplace.

Image Source: TheActuary.com

How Can I Get Started On Price Action Trading?

For a start, I recommend using the old-school way by getting your hands on a few solid price action books. Many of these are available in public libraries, and if you have some spare cash, you can consider buying them on amazon.

Next, is to practice! While reading books and watching others trade is a great way to learn, nothing beats learning to trade by actually making trades yourself.

If you currently use many indicators and are not profitable, perhaps the question to ask yourself is whether you would like to understand what is behind the price chart and the indicators. It is not enough to use a formula, because market conditions change over time.

Here’s to wishing you all the best on your trading journey, and I hope this article has expanded your mind just a little more!

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.