The Math Behind Trading

New: Join our 3-hour live workshop with Spencer to learn the basics of trading and make your first live trade!

Before making your first trade, you need to understand the mathematical logic behind trading.

This will allow you to balance risk versus reward.

Determine when to enter and exit a trade and ensure that you win in the long run.

In general, the profitability of your investment account depends on two factors: your hit rate and the risk to reward ratio of each trade.

Your hit rate is the percentage of winning trades, so if you make ten trades and win six, your hit rate is 60%.

Now, your hit rate doesn’t factor in how much money you made or lost in those trades, just whether or not you won.

If you trade using good setups and solid strategies, you should achieve a hit rate of about forty to sixty percent.

The next thing to look out for is the risk to reward ratio of a trade, otherwise known as the RR ratio.

This will help you achieve big wins, while keeping your losses low.

After all, like the famous financier George Soros once said, it’s not how often you’re right or wrong, but rather how much you make when you’re right and how much you lose when you’re wrong.

So if you only get it right 40 percent of the time, you want to make sure those trades make way more than all the losing trades.

The RR is calculated using three numbers. First, the EP or entry price: this is the price at which you enter the trade.

Next, the TP or target profit: this is the price you expect the stock to reach.

Finally, the SL or stop-loss: this is the price at which you will definitely get out of the position.

To calculate reward, you take the difference between the TP and the EP; while the risk is the difference between the EP and the SL.

The RR ratio is then calculated by taking the reward and dividing by the risk. Hence, the higher the reward, the better the RR, and the lower the risk, the better the RR.

Generally, you should be aiming for an RR of at least two to three, this means that your potential upside is two to three times your potential downside on some trades.

It might even be possible to get an RR of seven to ten.

Risk management is such an important part of trading and has such a huge impact on your profit and loss.

For instance, if you have a hit rate of only 40% but an RR of two, you’ll still end up profitable in the long run because remember, success isn’t about winning every trade, it’s about making those wins count.

New to Trading? Make your first live trade today in this workshop! Meet Spencer live for 3 hours of hands-on training! No prior experience required! Learn all the basics of trading, and step-by-step guidance to make your first trade!

New to Trading? Make your first live trade today in this workshop! Meet Spencer live for 3 hours of hands-on training! No prior experience required! Learn all the basics of trading, and step-by-step guidance to make your first trade!

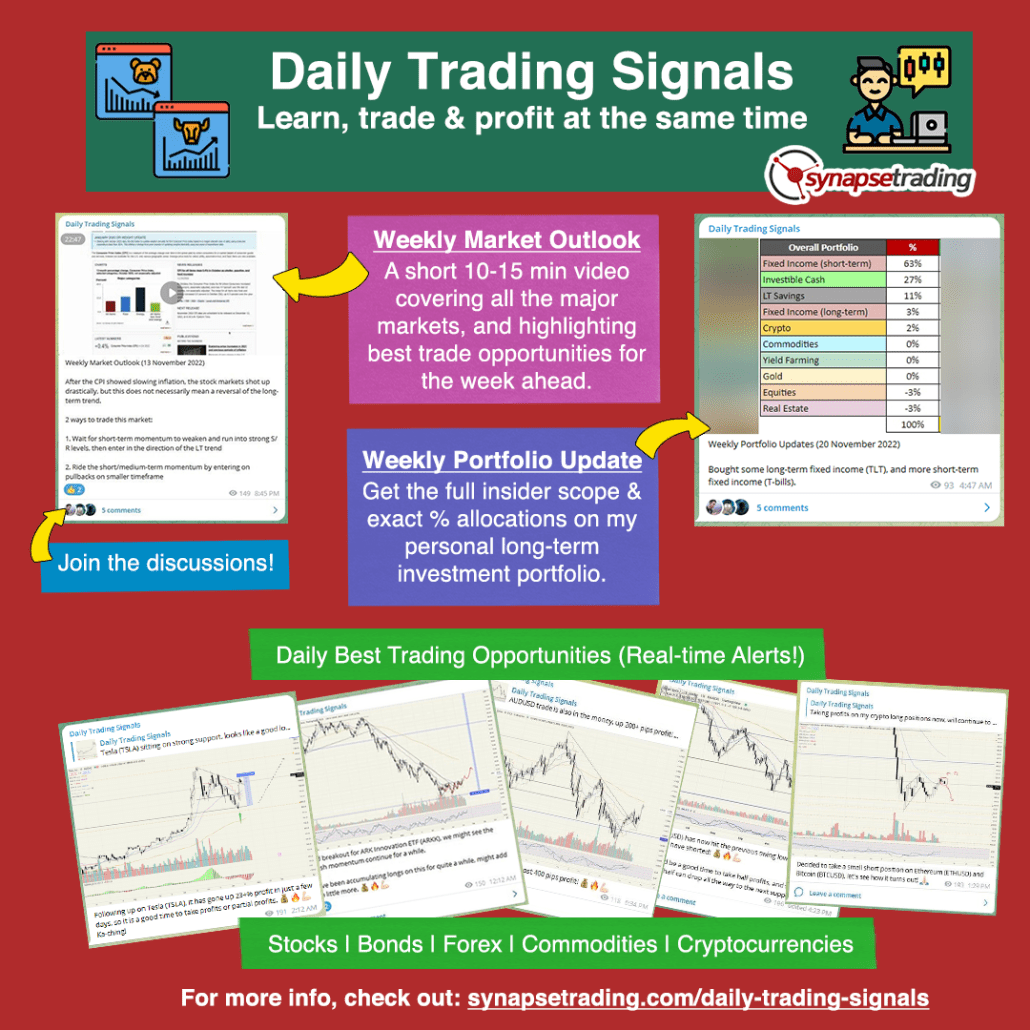

If you're looking for the best trading opportunities every day across various markets, and don't want to spend hours doing the research yourself, check out our private Telegram channel!

If you're looking for the best trading opportunities every day across various markets, and don't want to spend hours doing the research yourself, check out our private Telegram channel!

Spencer is an avid globetrotter who achieved financial freedom in his 20s, while trading & teaching across 70+ countries. As a former professional trader in private equity and proprietary funds, he has over 15 years of market experience, and has been featured on more than 20 occasions in the media.

Leave a Reply

Want to join the discussion?Feel free to contribute!