Weekly Market Wrap: Stock Market at Crucial Turning Point?

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

Over the last 3-4 weeks, we have seen an impressive rally in the stock market, with the main US stock indices rallying 15-20% from the recent lows.

However, in the long run, the Fed is planning to continue raising interest rates, which is bearish for stocks, so I am not sure how long more this rally can sustain.

Personally I have decided to take some small short positions, to see if the market starts tipping over. I have also placed alerts to tell me when the downtrend resumes so that I can add more short positions.

Stayed tuned for more updates in our “Daily Trading Signals” Telegram channel!

[Photo: Brandenburg Gate, Berlin, Germany – See my full travel photo log!]

For our weekly market wrap, we go through some of the trade calls and analysis from last week, which gives us valuable insights for the week ahead.

We cover 3 main markets with a total of 200+ counters, so we will never run out of trading opportunities:

- Forex, CFDs, commodities, bonds

- US stocks, ETFs, global stock indices

- Cryptocurrencies, crypto indices

By covering a broad range of markets, we can focus our attention (and capital) on whichever market currently gives the best returns.

Table of Contents

Portfolio Highlights

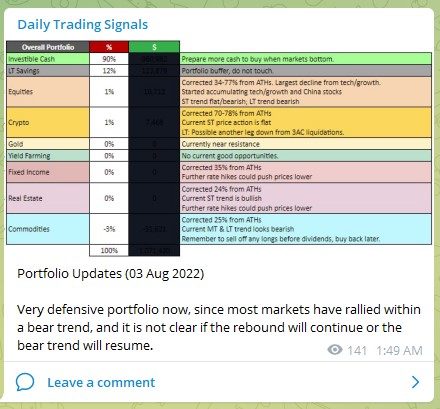

Portfolio Updates (03 Aug 2022)

Very defensive portfolio now, since most markets have rallied within a bear trend, and it is not clear if the rebound will continue or the bear trend will resume.

Forex & Commodities Market Highlights

USD continues to weaken, with other currencies starting to gain strength.

AUDUSD trade is also in the money, up 200+ pips profit! ????

GBPUSD trade is in the money, up 300+ pips profit! ????

NZDUSD trade is also in the money, up 150+ pips profit! ????

USDCHF has broken a major support level, we might see prices heading lower.

Now that the first TP for Gold (XAUUSD) is hit, it is a good idea to take at least half profits or full profits, because price is at a strong resistance level. ????

The commodities ETF (GCC) looks like it might be resuming its downward swing soon.

Stock & Bond Market Highlights

Looking at the global REIT ETF (REET), I have decided to take a small short position, with a stop above the prior swing high.

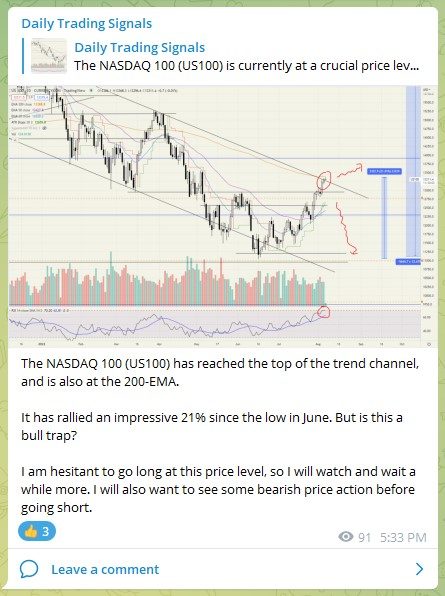

The NASDAQ 100 (US100) is currently at a crucial price level, bear the top of the channel and at resistance.

We will need to see which way it breaks out from. I am about 65% bearish and 35% bullish.

I have placed price alerts so we will know once it breaks out from either side, and I will likely go short if it breaks the swing low.

The NASDAQ 100 (US100) has reached the top of the trend channel, and is also at the 200-EMA.

It has rallied an impressive 21% since the low in June. But is this a bull trap?

I am hesitant to go long at this price level, so I will watch and wait a while more. I will also want to see some bearish price action before going short.

https://www.wsj.com/articles/investors-fear-stock-market-rally-will-be-short-lived-11659304749

https://www.wsj.com/articles/individual-investors-ramp-up-bets-on-tech-stocks-11659221897

Crypto Market Highlights

Looking at Ethereum (ETHUSD), the trend for crypto is not very clear, so I will be staying out and waiting for a better opportunity.

Good luck, and may next week bring more excellent profits!

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

Spencer is an avid globetrotter who achieved financial freedom in his 20s, while trading & teaching across 70+ countries. As a former professional trader in private equity and proprietary funds, he has over 15 years of market experience, and has been featured on more than 20 occasions in the media.

Leave a Reply

Want to join the discussion?Feel free to contribute!