Weekly Market Wrap: Market Rebound Continues!

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

Last week, the stock and crypto market continued to rally, despite the rate hikes by the Fed, and the mixed bag of company earnings.

If this is indeed a bear market rally (aka. temporary rebound), stocks have gone up 10-20% from the lows, while crypto has gone up 30-100% from the lows.

We seem to have a strange situation where there is a lot of bad news – inflation, rate hikes, recession, bad earnings, companies firing staff, higher oil prices, war, etc, but the markets seem to keep rebounding higher.

So could it be a case where the experts are wrong and the market has already bottomed, or is this rally simply a bull trap before another sell-down?

Stay tuned for more real-time updates and trading opportunities in my “Daily Trading Signals” Telegram channel!

[Photo: Zakopane, Poland – See my full travel photo log!]

For our weekly market wrap, we go through some of the trade calls and analysis from last week, which gives us valuable insights for the week ahead.

We cover 3 main markets with a total of 200+ counters, so we will never run out of trading opportunities:

- Forex, CFDs, commodities, bonds

- US stocks, ETFs, global stock indices

- Cryptocurrencies, crypto indices

By covering a broad range of markets, we can focus our attention (and capital) on whichever market currently gives the best returns.

Table of Contents

Portfolio Highlights

Portfolio Updates (29 Jul 2022)

Portfolio Updates (30 Jul 2022)

Forex & Commodities Market Highlights

USD seems to have weakened in recent weeks, relative to other currencies.

USDSGD Crossing 1.38216

US Dollar vs. Singapore Dollar

Reached bottom of trend channel

After hitting the target at the bottom of the channel, the USDSGD looks like it might resume the uptrend.

I have set the alert to trigger once it breaks a new swing high.

Now that Gold (XAUUSD) has hit strong support, we could see a rebound.

Stock & Bond Market Highlights

Stock Futures Rise Ahead of Fed Decision.

https://www.wsj.com/articles/global-stocks-markets-dow-update-07-27-2022-11658907223

Markets largely expected the move after Fed officials telegraphed the increase in a series of statements since the June meeting. Stocks hit their highs after Fed Chair Jerome Powell left the door open about its next move at the September meeting, saying it would depend on the data. Central bankers have emphasized the importance of bringing down inflation even if it means slowing the economy.

https://www.cnbc.com/2022/07/27/fed-decision-july-2022-.html

The S&P just had a record two-day, post-Fed meeting rally, gaining nearly 4% today and yesterday. The second biggest post-Fed rally was in March, followed by the meeting in August 1971.

https://www.wsj.com/articles/global-stocks-markets-dow-update-07-29-2022-11659080320

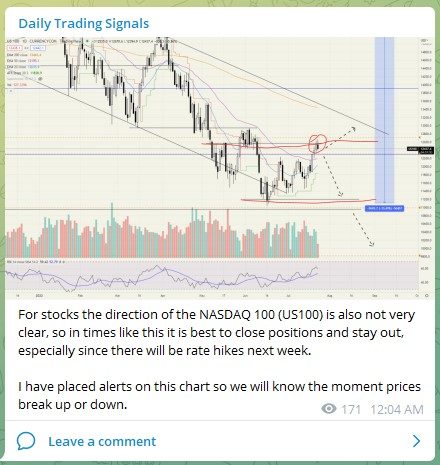

For stocks the direction of the NASDAQ 100 (US100) is also not very clear, so in times like this it is best to close positions and stay out, especially since there will be rate hikes next week.

I have placed alerts on this chart so we will know the moment prices break up or down.

Crypto Market Highlights

Does Ethereum (ETHUSD) look like a potential rising 3 methods pattern?

Decided to take some short positions on Ethereum (ETHUSD) and Bitcoin (BTCUSD), let’s see how it turns out!

SL on the chart is hit, I think now it’s bullish.

After the failed downside breakout of Ethereum (ETHUSD), it now looks bullish. Can consider taking a small long position instead.

Good luck, and may next week bring more excellent profits!

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

Spencer is an avid globetrotter who achieved financial freedom in his 20s, while trading & teaching across 70+ countries. As a former professional trader in private equity and proprietary funds, he has over 15 years of market experience, and has been featured on more than 20 occasions in the media.

Leave a Reply

Want to join the discussion?Feel free to contribute!