Weekly Market Wrap: Will there be a Santa Rally this Christmas?

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

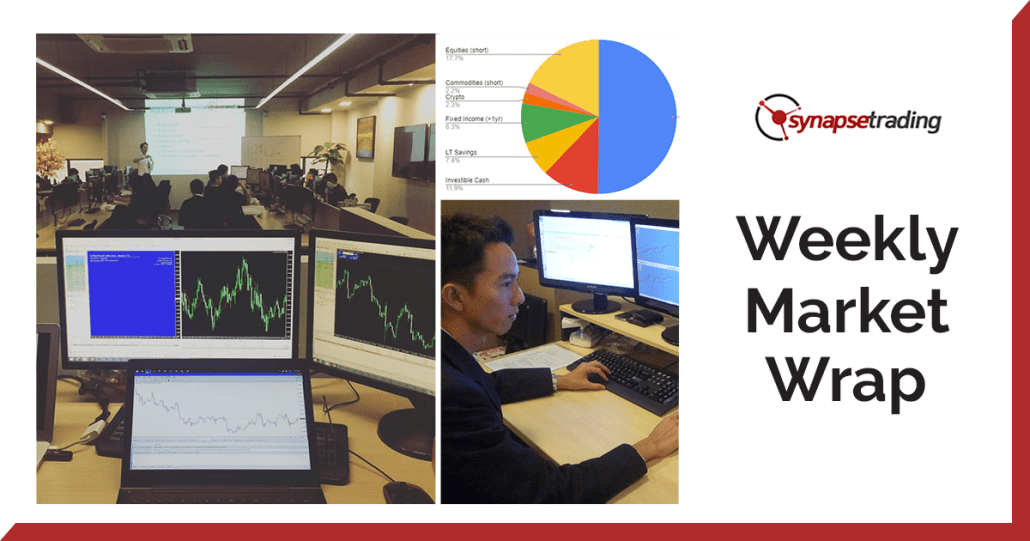

For subscribers of our “Daily Trading Signals”, we now also include a “Weekly Market Report”, where we provide a weekly deep-dive on the market, including fundamentals, technical, economics, and portfolio management:

Click here to subscribe for the latest market report (27 November 2023)

Click here to see the archives of all our past market reports

Market Recap & Upcoming Week

Last week marked a period of gratitude and reflection, coinciding with Thanksgiving 2022. Despite the stock market being down 16% for the year, 2023 has witnessed a more robust market, stirring investor optimism.

Historically, the stock market has performed well post-Thanksgiving, with an average December return of around 1% over the last 30 years. This trend, coupled with the market’s recent upswing, suggests a possible continuation of gains. Since 1950, the market has often seen significant gains in years following a strong performance leading into Thanksgiving.

The stock market’s recent rally can be attributed to several factors. Key among them is the ongoing moderation in inflation, with the October Consumer Price Index (CPI) decreasing to 3.2% year-over-year. This trend of lower inflation has played a significant role in driving Treasury bond yields down, thus fueling the market’s upward momentum.

Additionally, the Federal Reserve’s more moderate stance on interest rates, as evidenced in the November FOMC meeting, has boosted market confidence. Furthermore, a gradual cooling in the economy, marked by slightly higher jobless claims and lower retail sales, seems to be aiding the rally without triggering recessionary fears.

The small-cap stocks, particularly the Russell 2000, have underperformed compared to the S&P 500 but might offer investment opportunities as the economy shows resilience amidst slowing growth and declining inflation.

This week in the financial markets, attention will be focused on a range of key economic data releases, with the spotlight on the latest inflation figures.

The Personal Consumption Expenditures (PCE) index is particularly significant as it provides insights into the effectiveness of the Federal Reserve’s inflation-fighting measures through interest rate hikes. This data is crucial for the upcoming Federal Open Market Committee (FOMC) meeting on December 12-13, which will be pivotal in determining future interest rate decisions.

Alongside inflation data, other important economic indicators due for release include new home sales, the September home-price index, October’s new and pending home sales, and the consumer confidence index for November. Additionally, the markets are anticipating the first revision of the U.S. Gross Domestic Product for the third quarter.

In the earnings arena, a series of reports from major companies across tech, finance, and retail sectors are expected. Notable among these are Salesforce, Intuit, Workday, Crowdstrike, Dollar Tree, and Five Below, each poised to provide further insights into the health and direction of their respective industries.

Daily Trading Signals (Highlights)

Palantir Technologies (PLTR) – Prices have hit our TP a few days ago, congrats to those who took this trade! 💰🔥💪🏻

If prices hold above the breakout, we could see a consolidation and then a resumption of the uptrend.

Subscribe for real-time alerts and weekly reports:

👉🏻 https://synapsetrading.com/daily-trading-signals

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

Spencer is an avid globetrotter who achieved financial freedom in his 20s, while trading & teaching across 70+ countries. As a former professional trader in private equity and proprietary funds, he has over 15 years of market experience, and has been featured on more than 20 occasions in the media.

Leave a Reply

Want to join the discussion?Feel free to contribute!