Brexit, Trump, Italy, asset bubbles all over the world… you name it, there’s probably some financial market jitters that keeps most people out of the world of investments.

On the flipside, the financial world often quips about some investment that has made xx% over a certain period of time, trying to entice visitors with a glimpse of the profits possible for anyone. In the world of investing, it is easy to find spectacular returns on hindsight, and salesmen go through great lengths to market what has already happened.

As traders, we live in a constant state of uncertainty. Every trade we make has the possibility of going wrong, and this is taken into account when a decision is made. It is the knowledge of this that gives power to a trader; if he can understand the math behind his investment decision, he can have a positive expectation and a positive traders’ equation.

There are three main reasons why trading is even more attractive these days. Indeed, with advanced technology, there has never been a better time to step into the world of finance, and grab a golden egg while you still can.

Table of Contents

GOLDEN EGG 1: TRADING GIVES A HIGHER INTEREST RATE THAN BANKS

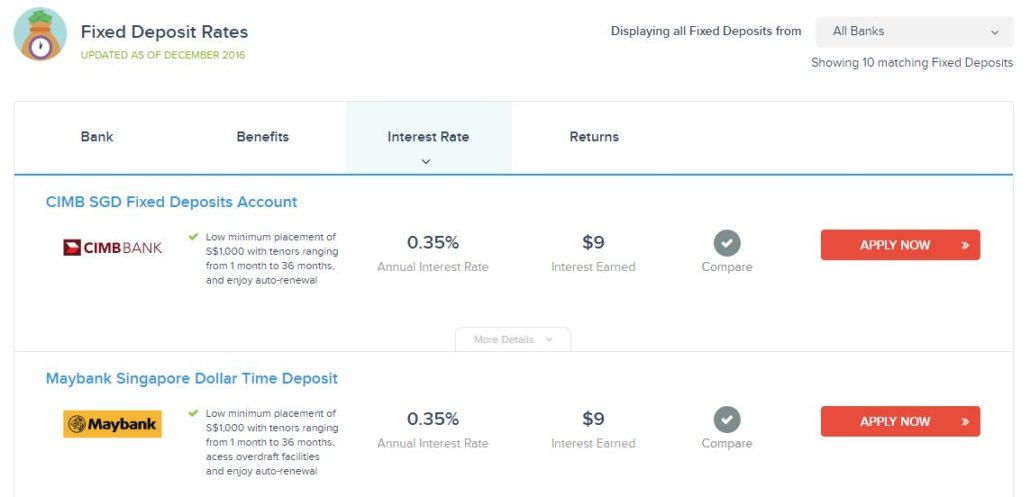

The best you can get on a fixed deposit is 0.35% a year in Singapore, as at December 2016.

The best you can get on a fixed deposit is 0.35% a year in Singapore, as at December 2016.

Source: moneysmart.sg

While inflation is a constant enemy for our savings accounts, most people do not know what to do to combat inflation. The most common quick-fix is to work harder and earn more money. While that does feed us and our families for some time, the need to build a war chest for emergencies becomes more and more real.

How much can you make from trading? Institutional traders bring in a success rate anywhere from 30%-70%. Why is this so?

The greatest insight into the markets that can make you profitable is this: 90% of the time, the odds are 50-50, while 10% of the time, the odds swing 60-40 (slightly in your favor).

That’s right. While most of the time, markets are 50-50, it is those brief moments when the market gives some opportunity, and prices quickly move to take advantage of this opportunity. That means that if you were to buy or sell randomly, you already have a 50% chance of success!

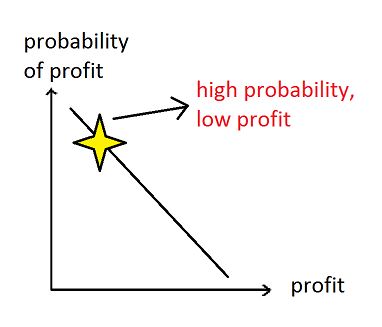

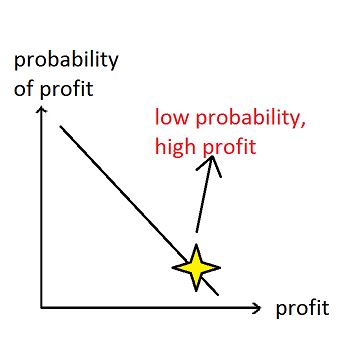

Another insight to know is that a high success rate (hit-rate) brings a lower profit target, while a low success rate brings a higher profit target.

What do I mean by this? Institutions trade using a combination of low-probability and high-probability trades.

Example: 40% (low) success rate, win = +2%, lose = -1%.”

In this case, if you were to make 100 of such low-probability trades, you would make +80% on winning trades and -60% on losing trades, bringing a 20% return on capital.

Example 2: 75% (high) success rate, win = +0.5%, lose = -1%

In this case, if you made 100 high-probability trades, you made 37.5% on winning trades and -25% on losing trades, bringing +12.5% return on capital.

It is impossible for the market to give high-probability trades with a high profit potential. This would be quickly detected by institutional traders, who have mathematicians, PhD staff, and computer science experts who can quickly make adjustments and profit from it. With hundreds of millions of dollars at stake, these people would do all they can to bring profits for their firm.

That is why if anyone quips that they have a 80-90% success rate, they are probably having many small wins but a few gigantic losses. If you don’t believe me, try trading forex and planting random trades with low profit potential and high loss potential. The numbers indeed prove to be true!

That is also why it is important to understand the traders’ equation. With a reasonable success rate and an appropriate win-loss ratio (or risk-reward ratio, RRR), you would be profitable over the long-run.

I have had days where I ran 7-8 trading losses in a row, but because I trusted in the probabilities, the next 3-4 trades ended up profitable, as long as I stuck to my trade setups and didn’t let the emotions get the better of me.

GOLDEN EGG 2: TRADING DOES NOT REQUIRE LOTS OF CAPITAL

If you have $500 to invest: trade forex.

In the Forex market, you are entitled to ‘get a feel of the game’ by risking a few dollars per trade. By trading the smallest lot size (0.01 lots), you can learn to make a few dollars here, lose a few dollars there, and rack up trading experience and learn to trade ‘live’ without incurring hefty losses.

By learning to make many decisions and experiencing all the different conditions of the market, you would become seasoned enough to trade a bigger size, and fine-tune your own trading strategy.

Many traders discover they have certain characteristics about themselves that hinder success. In trading a ‘live’ account with a small sum of money, they are putting in some skin in the game, and getting used to the ups and downs of their account.

The best part about forex is that there are no commission charges. The broker makes money from the bid-ask spread, which is the difference between the buy/sell price, and most brokers charge reasonable spreads, allowing you to trade with almost negligible transaction cost.

If you have $3000 to invest: explore stock CFDs.

Stock CFDs have low commissions and can be bought in small quantities – a few thousand dollars can allow you to have a portfolio of 5-10 stock positions.

For people with less time and more money, stock CFDs can be a great way to learn to deal with commissions, spreads, fee structures, and the whims and fancies of the stock market.

The stock market is only open during working hours, unlike the forex market. Someone who is interested to take longer-term positions may be open to trading stock CFDs, risking small amounts of money, and yet racking up trading experience.

Some people quip that the forex market is more difficult to trade than the stock market. I beg to differ, because it is your circle of competence that determines your success, not the actual characteristics of the market.

If I were to ask you to drive a Formula 1 race car, you probably would kill yourself within the next few hours or so. However, if you were progressively taught how to drive the race car, it doesn’t become dangerous, and because of the progressive nature of your learning, the high speeds don’t come as a shock to you.

Driving this car is dangerous, only if you are not trained.

Driving this car is dangerous, only if you are not trained.

Source: wallscorner.com

Many people get shocked at the speed by which forex markets move during the Non-Farm Payroll Announcements and FOMC Interest Rate Announcements; prices can move 10-50 times faster than normal during those crazy periods! However, with practice, these sessions can become a profitable time for traders with experience and proper risk management.

If you have $10,000 to invest: trade everything.

People with more money have the luxury of trading a combination of stocks, forex, commodity, bonds, and index trades. These can be accessed through any decent forex broker, and you’ll be surprised to find that most forex brokers let you trade forex, oil, gold, the Dow Jones Index, the S&P, the bond markets, wheat, corn, natural gas, and more. These of course come with higher margin requirements, but exploring all the asset classes makes you a seasoned, well-rounded investor that can take any market condition.

Sideways in the forex market? Maybe there is a trending opportunity in the oil market. There’s always something to trade if you have the experience and know where to look.

However, in my opinion, the greatest investment is Golden Egg 3.

GOLDEN EGG 3: TRADING BOOKS ARE CHEAP AND EASY TO FIND

John Murphy: Technical Analysis of the Financial Markets. One of the great trading classics that builds a strong foundation.

John Murphy’s book on technical analysis reveals the fundamental nature of financial markets. Prices move in patterns and cycles, and understanding history helps you to cope with what is to come.

In my trading journey, I’ve read more than 200 books, and found only about 11 of them that are useful in my trading career. These books were either borrowed from the library, or bought only for $30-$50 a book, which is a very good price (since stock commissions can be $15-$25 already!).

Buying a few good trading books can completely change your destiny.

If you are starting out, why not invest in 3-5 good trading books, before getting your hands wet in the financial markets? These books would build a strong foundation, and you would start off with a better understanding of why things happen.

Some of the more famous online bookstores.

Some of the more famous online bookstores.

Source: Company websites

Amazon.com and bookdepository.com provide great options and they ship almost anywhere in the world. Personally, I found that bookdepository has the more exotic books, but it is a little pricey (yet still worth it since you can’t find the books easily!)

Second-hand books: Carousell if you live in Singapore! If you’re lucky you can find good books at a discounted price. Even though the books may be a little dusty and yellowed, it’s the content that you want to really absorb. You can always find what you want if you search hard enough!

TRADING & INVESTING EDUCATION IS WITHIN OUR GRASP

If you are still thinking about it, here’s why you should pick up investing education:

- Historical chart data is free (we used to need to pay in the 1990s and 2000s)

- Free resources are available

- Books are cheap and easy to find

- Starting cost is as low as $500

- Cost of failure is low

- Experience can be racked up with very little capital

- There is a market for every type of investor

And most of all, it can bring higher returns in the long-run than placing your capital in the bank account. Sure, you might risk losing a couple of dollars at the start, but the cost of ignorance is a lot higher when compounded over the next 5, 10, or 20 years!

Wishing you all the best in your trading journey, and I do hope this article serves as a pump to start you on your quest for investment expertise!

Cheers!

RESEARCH SOURCES & REFERENCES

http://www.moneysmart.sg/fixed-deposit

http://www.lifehack.org/articles/money/15-best-online-bookstores-for-cheap-new-and-used-books.html

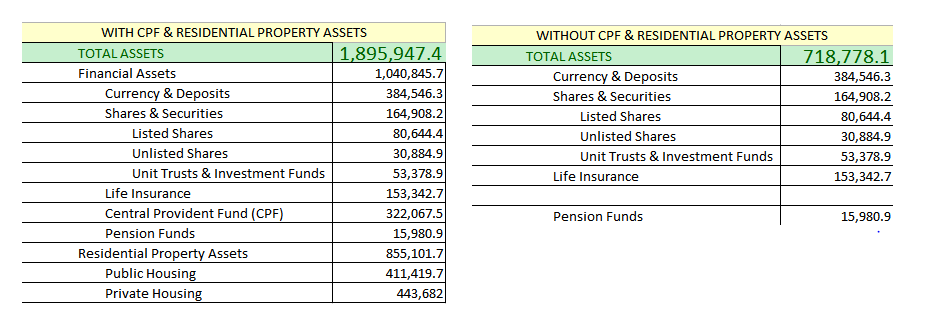

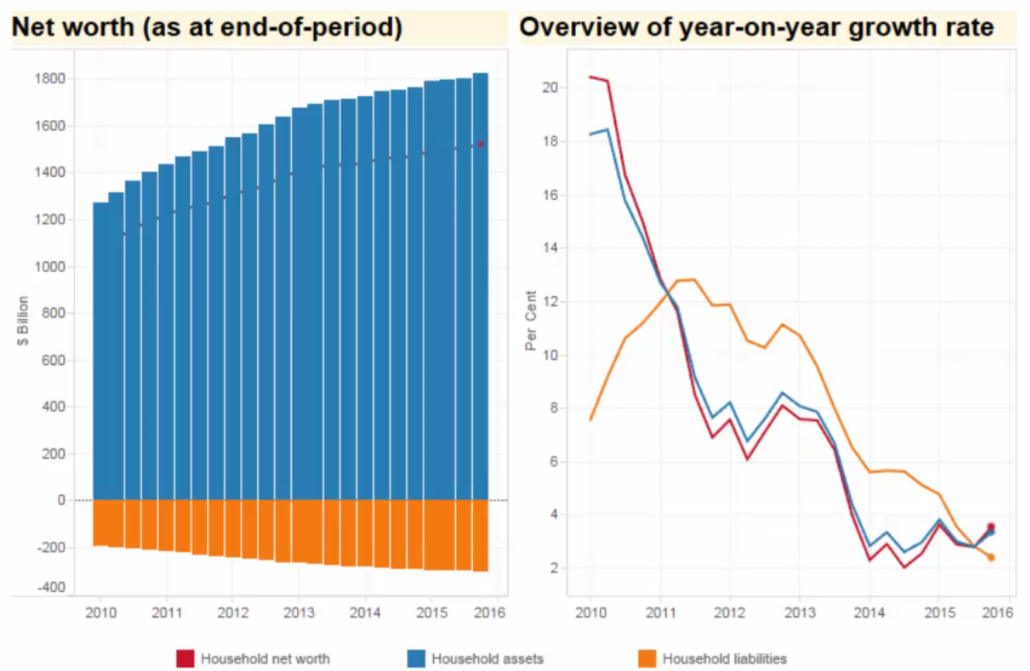

Most of the wealth is still held in financial assets, rather than in homes.

Most of the wealth is still held in financial assets, rather than in homes.