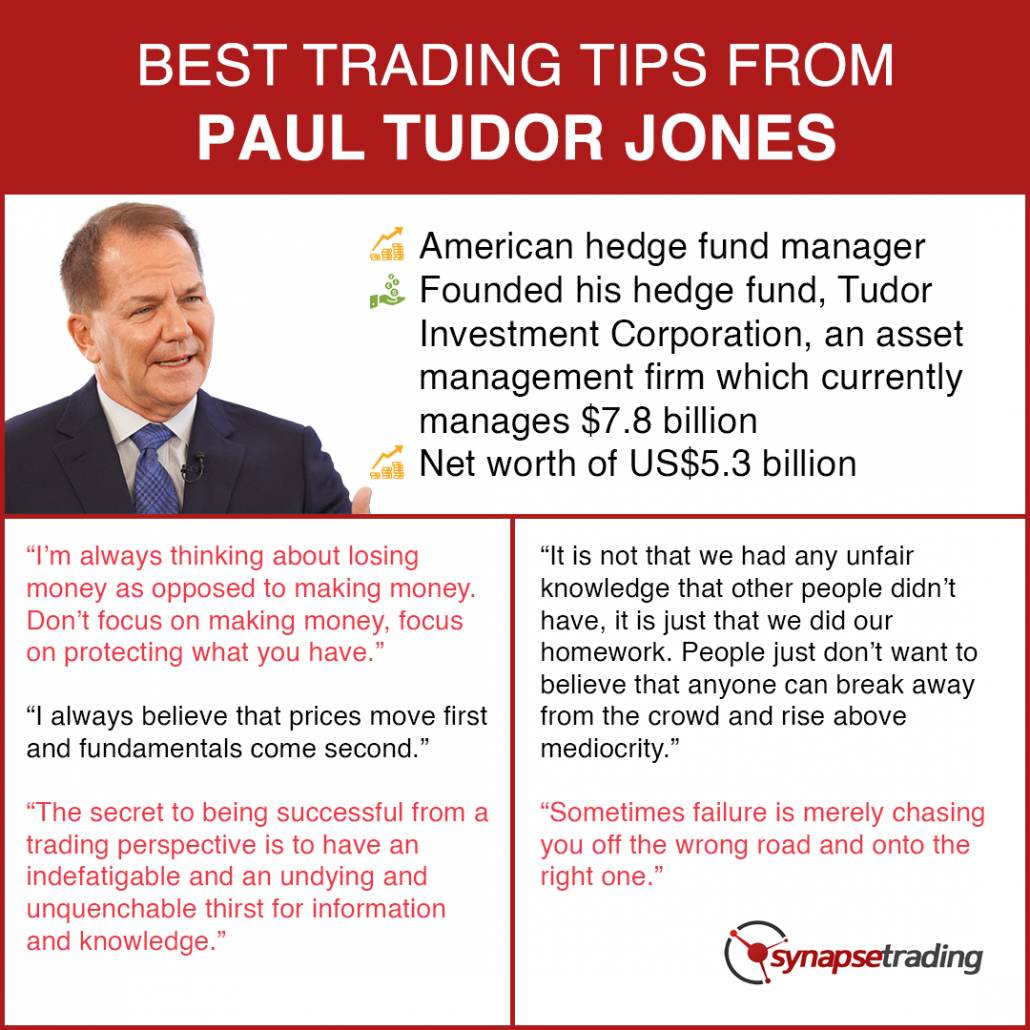

Paul Tudor Jones II (born September 28, 1954) is an American hedge fund manager, conservationist and philanthropist. In 1980, he founded his hedge fund, Tudor Investment Corporation, an asset management firm which currently manages $7.8 billion (as of June 30, 2019).

As of November 2019, Forbes Magazine estimated his net worth to be US$5.3 billion, making him the 343rd richest person on the Forbes 400 and the 7th highest-earning hedge fund manager.

In this post, I will share all the best trading tips and quotes from Paul Tudor Jones, so that we can learn from his knowledge and experience.

Here are some of the best trading tips and quotes by Paul Tudor Jones:

- Where you want to be is always in control, never wishing, always trading, and always first and foremost protecting your ass. That’s why most people lose money as individual investors or traders because they’re not focusing on losing money. They need to focus on the money that they have at risk and how much capital is at risk in any single investment they have. If everyone spent 90 percent of their time on that, not 90 percent of the time on pie-in-the-sky ideas on how much money they’re going to make, then they will be incredibly successful investors.

- I’m always thinking about losing money as opposed to making money. Don’t focus on making money, focus on protecting what you have.

- The most important rule is to play great defense, not great offense. Everyday I assume every position I have is wrong. I know where my stop risk points are going to be. I do that so I can define my maximum drawdown. Hopefully, I spend the rest of the day enjoying positions that are going in my direction. If they are going against me, then I have a game plan for getting out.

- I believe the very best money is made at the market turns. Everyone says you get killed trying to pick tops and bottoms and you make all your money by playing the trend in the middle. Well for twelve years I have been missing the meat in the middle but I have made a lot of money at tops and bottoms.

- If I have positions going against me, I get right out; if they are going for me, I keep them Risk control is the most important thing in trading. If you have a losing position that is making you uncomfortable, the solution is very simple: Get out, because you can always get back in.

- Don’t be a hero. Don’t have an ego. Always question yourself and your ability. Don’t ever feel that you are very good. The second you do, you are dead.

- I always believe that prices move first and fundamentals come second.

- And then at the end of the day, the most important thing is how good are you at risk control. Ninety-percent of any great trader is going to be the risk control.

- Fundamentals might be good for the first third or first 50 or 60 percent of a move, but the last third of a great bull market is typically a blow-off, whereas the mania runs wild and prices go parabolic… There is no training, classroom or otherwise, that can prepare for trading the last third of a move, whether it’s the end of a bull market or the end of a bear market.

- The secret to being successful from a trading perspective is to have an indefatigable and an undying and unquenchable thirst for information and knowledge.

- Don’t ever average losers. Decrease your trading volume when you are trading poorly; increase your volume when you are trading well. Never trade in situations where you don’t have control. For example, I don’t risk significant amounts of money in front of key reports, since that is gambling, not trading.

- I am more scared now that I was at any point since I began trading, because I recognize how ephemeral success can be in this business. I know that to be successful, I have to be frightened. My biggest hits have always come after I have had a great period and I started to think that I knew something.

- Sometimes failure is merely chasing you off the wrong road and onto the right one.

- First of all, never play macho man with the market. Second, never overtrade.

- When you get a range expansion, the market is sending you a very loud, clear signal that the market is getting ready to move in the direction of that expansion.

- It is not that we had any unfair knowledge that other people didn’t have, it is just that we did our homework. People just don’t want to believe that anyone can break away from the crowd and rise above mediocrity.

- You learn more from your losses, than from your gains.

- Failure was a key element to my life’s journey.

- I spend my day trying to make myself as happy and relaxed as I can be. If I have positions going against me, I get right out; if they are going for me, I keep them.

- The concept of paying one-hundred-and-something times earnings for any company for me is just anathema. Having said that, at the end of theday, your job is to buy what goes up and to sell what goes down so really who gives a damn about PE’s?

- Trading gives you an incredibly intense feeling of what life is all about.

- You adapt, evolve, compete or die.

- You cannot have significance in this life if it is all about you. You get your significance, you find your joy in life through service and sacrifice – it’s pure and simple.

- After awhile size means nothing. It gets back to whether you’re making 100% rate of return on 10k or 100 million dollars. It doesn’t make any difference.

- Intellectual capital will always trump financial capital.

Now that I have shared the best trading tips and quotes from Paul Tudor Jones, which is your favourite trading tip?

Let me know in the comments below.

If you would like to get more trading tips and quotes from all the best traders, also check out: “Best Trading Tips & Quotes from Legendary Top Traders”