Weekly Market Wrap: Profits from Shorting Stocks & Crypto!

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

With markets in turmoil, I am currently short on stocks, crypto, commodities (not shown yet, but in the latest updates), which means I effectively have a leveraged cash position.

In addition, all my cash is held in USD, which has gone up about 4% this year, possibly making it one of the best asset class this year. ?

My current strategy is to continue shorting the market to the bottom, then start accumulating (and eventually going all-in) stocks and crypto to ride the next bull market.

Stay tuned for my real-time portfolio updates in my “Daily Trading Signals” Telegram channel!

[Photo: Cape Town, South Africa – See my full travel photo log!]

For our weekly market wrap, we go through some of the trade calls and analysis from last week, which gives us valuable insights for the week ahead.

We cover 3 main markets with a total of 200+ counters, so we will never run out of trading opportunities:

- Forex, CFDs, commodities, bonds

- US stocks, ETFs, global stock indices

- Cryptocurrencies, crypto indices

By covering a broad range of markets, we can focus our attention (and capital) on whichever market currently gives the best returns.

Table of Contents

Portfolio Highlights

Portfolio updates: Mainly just short on stocks, crypto and real estate for now.

This is why the USD is my largest portfolio position. ?

https://www.wsj.com/articles/it-was-a-lousy-second-quarterexcept-for-the-u-s-dollar-11656667800

Forex & Commodities Market Highlights

Oil is up again, pushing up the 2 oil-linked currencies.

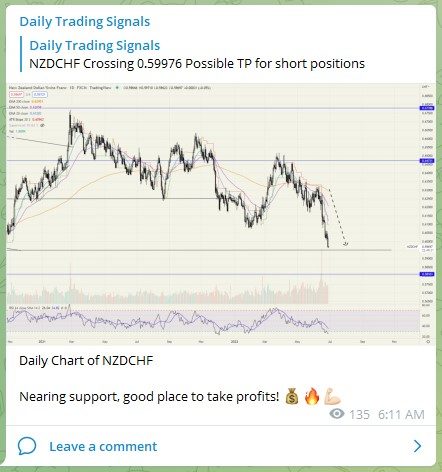

Daily Chart of NZDCHF

Nearing support, good place to take profits! ????

USDSGD Crossing 1.39710

US Dollar vs. Singapore Dollar

TP1 for long positions

Update on Commodity ETF (GCC)

As predicted in my last analysis, it might have hit the top of the long-term cycle, and has started to come down.

On the daily chart, it has broken down from a consolidation pattern.

This is in line with the bonds > stocks > commodities cycle, and we have already seen bonds and stocks decline.

With the Fed aggressively raising interest rates to fight inflation, this should be bearish for commodities.

Stock & Bond Market Highlights

2801 Crossing 24.06

China Stocks ETF

Breaking out of ascending triangle!

SL: 21.80

TP: 27.52

3067 Crossing 10.320

Hang Seng Tech ETF

Breaking out of ascending triangle!

SL: 9.165

TP: 12.065

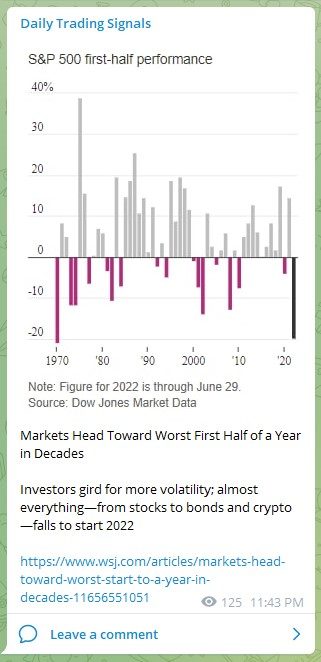

Markets Head Toward Worst First Half of a Year in Decades

Investors gird for more volatility; almost everything—from stocks to bonds and crypto—falls to start 2022

https://www.wsj.com/articles/markets-head-toward-worst-start-to-a-year-in-decades-11656551051

Daily Chart of NASDAQ (US100)

Looks like the stock market is ready for the next leg down.

Update on NASDAQ (US100)

Since we shorted near the top as well, there also isn’t much for us to do except wait patiently for the profits to grow. ????

Crypto Market Highlights

“There are companies that are basically too far gone and it’s not practical to backstop them.”

More hedge funds are betting against tether as crypto melts down

Looking at the recent price action in Bitcoin (BTCUSD) and Ethereum (ETHUSD), I have decided to take profits on my short-term trading long positions, since it has gone up 20-40% from the lows.

I have taken a small short position instead.

Daily Chart of Ethereum (ETHUSD)

Note how low the volume is during this bullish rebound, and the new high volume coming in at the end.

Update on Ethereum (ETHUSD)

Since we shorted near the top, and it has moved about 15% in our favour, there isn’t much for us to do except wait patiently for the profits to grow. ????

Good luck, and may next week bring more excellent profits!

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

Spencer is an avid globetrotter who achieved financial freedom in his 20s, while trading & teaching across 70+ countries. As a former professional trader in private equity and proprietary funds, he has over 15 years of market experience, and has been featured on more than 20 occasions in the media.

Leave a Reply

Want to join the discussion?Feel free to contribute!