The latest CPI data showed that inflation was almost flat for the month of July, which suggested the possibility that inflation had peaked, and might be turning down soon. But is this scenario likely?

Since there are so many factors that affect inflation, it is really impossible to tell at this point, so a simple way is to wait for the next 2-3 months and see if the CPI continues to make new lows, or proceeds to make new highs.

Because long-term trends like these take months or years to play out, so trying to predict the trend using 1 month of data is not very useful.

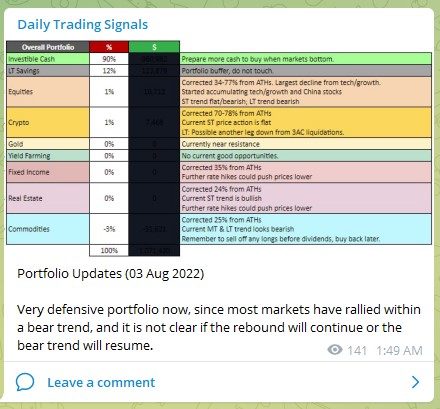

If we look at risk assets like stocks and crypto, they have all rallied a lot since the lows, so I’m not sure how much more they can go from these levels even if the Fed decides to keep the current interest rate levels at status quo.

This is because the impact of increased interest rates are still gradually taking effect throughout the economy, and might lead to further bearish impact. And the Fed is also unlikely to start cutting rates so soon either.

At this point I am more inclined to look for potential shorting opportunities in the stock market, but I will not pull the trigger until the trade signals are given.

Stay tuned!

[Photo: Milan, Italy – See my full travel photo log!]

For our weekly market wrap, we go through some of the trade calls and analysis from last week, which gives us valuable insights for the week ahead.

We cover 3 main markets with a total of 200+ counters, so we will never run out of trading opportunities:

- Forex, CFDs, commodities, bonds

- US stocks, ETFs, global stock indices

- Cryptocurrencies, crypto indices

By covering a broad range of markets, we can focus our attention (and capital) on whichever market currently gives the best returns.

Table of Contents

Forex & Commodities Market Highlights

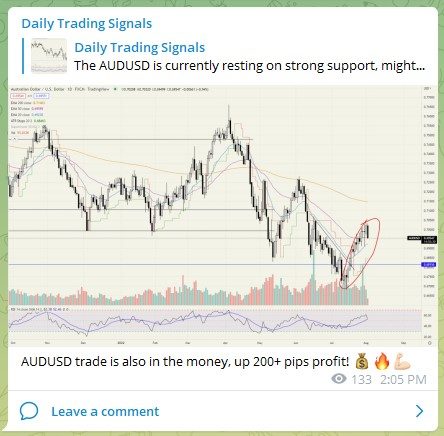

On the forex front, the USD has weakened considerably in recent weeks, which is why I hedged my USD exposure by diversifying in these other currencies.

This AUDUSD trade is almost 400 pips profit! ????

This NZDUSD trade is now 300+ pips profit! ????

This USDCHF trade is now 150+ pips profit in the money! ????

Keeping an eye on the Clean Energy ETF (ICLN) weekly chart as a potential long-term investment, since the US is looking to reduce its reliance on oil.

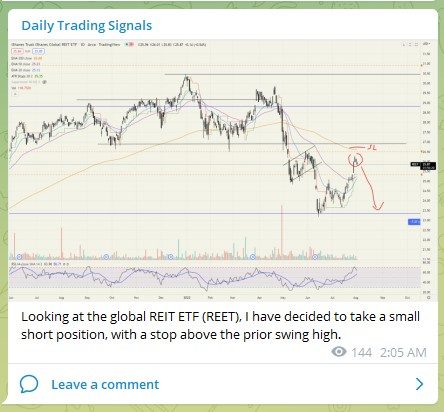

Stock & Bond Market Highlights

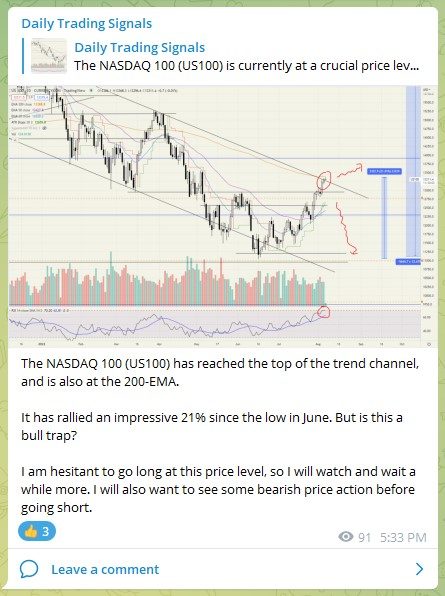

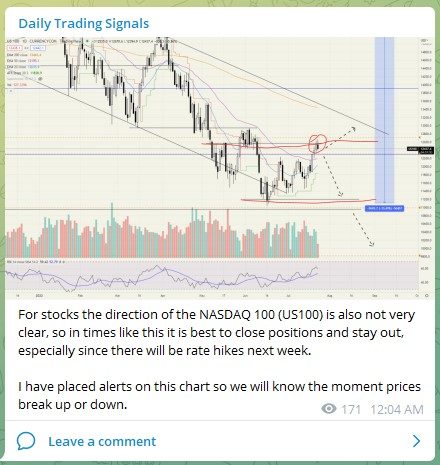

Not much change on the NASDAQ 100 (US100), so we need to exercise patience and not act rashly if the market is not moving much. If price start breaking lower, we can get ready to short.

https://awealthofcommonsense.com/2022/08/the-michael-scott-economy/

https://www.wsj.com/articles/feds-inflation-battle-is-far-from-won-11660144110

Crypto Market Highlights

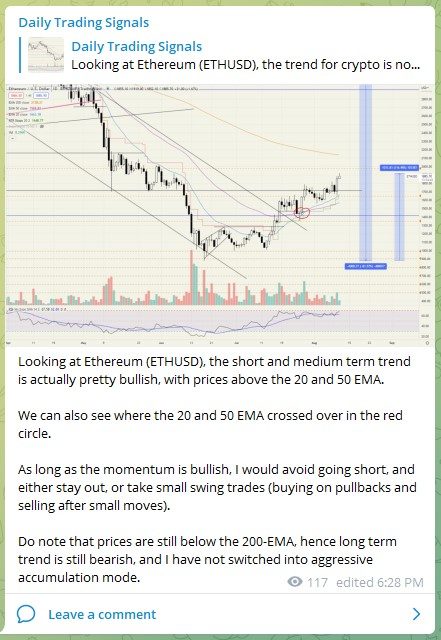

Looking at Ethereum (ETHUSD), the short and medium term trend is actually pretty bullish, with prices above the 20 and 50 EMA.

We can also see where the 20 and 50 EMA crossed over in the red circle.

As long as the momentum is bullish, I would avoid going short, and either stay out, or take small swing trades (buying on pullbacks and selling after small moves).

Do note that prices are still below the 200-EMA, hence long term trend is still bearish, and I have not switched into aggressive accumulation mode.

? CeFi degeneracy knows no bounds. Here's a case study into Hodlnaut – a centralized yield platform – and why I believe they have both lied to & misrepresented stablecoin staking risks to customers. These websites are not as trustworthy as you may think. (1/25)

— FatMan (@FatManTerra) June 26, 2022

Good luck, and may next week bring more excellent profits!