In times of economic uncertainty, central banks often turn to interest rate cuts as a key monetary policy tool to stimulate growth.

These cuts lower the cost of borrowing, encouraging individuals and businesses to take out loans, invest, and spend, which in turn supports economic expansion.

However, the implications of rate cuts extend far beyond basic borrowing; they ripple through financial markets, affecting asset prices, consumer confidence, and even international trade.

Understanding the dynamics of interest rate cuts is crucial for investors seeking to make informed decisions in an evolving economic landscape.

This blog post explores the concept of interest rate cuts, providing an in-depth analysis of their historical timeline and impact across various asset classes.

By examining past trends, we can better understand how rate cuts have influenced markets such as real estate, bonds, equities, and currencies.

Additionally, this report identifies potential investment opportunities that may arise from future rate adjustments, allowing investors to position themselves strategically in anticipation of further changes in the global financial environment.

As central banks around the world, including the Federal Reserve, continue to adjust interest rates to navigate economic challenges, investors must remain vigilant in evaluating how these changes influence the broader market.

From identifying sectors that benefit from lower borrowing costs to understanding how rate cuts can affect currency values and inflation, this report offers valuable insights into the role of interest rate policy in shaping investment opportunities over the coming years.

Table of Contents

1. What are Interest Rate Cuts?

Interest rate cuts are a core component of a central bank’s monetary policy toolkit, primarily used to stimulate economic activity by reducing the cost of borrowing.

In the U.S., the Federal Reserve (Fed) manages the federal funds rate, the key rate at which banks lend to each other overnight to meet reserve requirements.

This rate serves as a benchmark for many other interest rates across the economy, such as those on mortgages, auto loans, and business financing.

By lowering the federal funds rate, the Fed aims to reduce borrowing costs across the economy, encouraging consumer spending and business investments, which in turn boosts economic growth.

The Mechanics of Interest Rate Cuts

When the Fed cuts interest rates, it increases the availability of money in the economy.

By reducing the cost of borrowing, businesses find it more affordable to finance expansion, purchase new equipment, or hire additional workers.

Consumers, too, benefit from lower interest rates on loans, mortgages, and credit cards, encouraging them to spend on homes, cars, and other goods.

This injection of capital into the economy typically spurs demand, leading to higher levels of economic activity.

The central bank cuts interest rates in response to a variety of economic challenges.

For example, during periods of recession, deflationary pressures, or weakening employment markets, rate cuts are used to ease financial conditions and prevent further economic contraction.

The ultimate objective is to stimulate growth, keep inflation within a target range (often around 2% for the Fed), and stabilize employment.

In 2024, for instance, the Federal Reserve implemented a 50-basis point cut, bringing the federal funds rate to a range of 4.75% to 5%.

This action followed more than a year of elevated interest rates, which had been raised aggressively from near-zero levels in response to inflation surging after the COVID-19 pandemic recovery.

The September 2024 rate cut was preemptive, aimed at bolstering a labor market showing early signs of cooling, and to prevent a potential recession.

Historical Context and Precedents

Historically, interest rate cuts have been employed during major economic crises.

In 2008, for example, the Fed slashed rates from 5.25% to near zero in response to the global financial crisis. Similarly, in early 2020, the onset of the COVID-19 pandemic led the Fed to cut rates to the 0%-0.25% range to provide immediate support to a collapsing global economy.

By comparison, the September 2024 cut followed a period where the federal funds rate had risen as high as 5.25%-5.50%, the highest level since the early 2000s.

This dramatic swing in interest rate policy underscores how rate cuts are often reactive measures, used after periods of tight monetary policy aimed at controlling inflation.

The aggressive rate hikes from 2022 to 2023 were designed to combat inflation, which peaked at 9.1% in mid-2022, the highest in over 40 years.

By cutting rates in 2024, the Fed aimed to ensure that inflation stayed under control while supporting economic growth as the labor market softened.

Risks and Potential Drawbacks of Interest Rate Cuts

While interest rate cuts stimulate growth, they can also introduce risks. One primary concern is the potential for inflation. If rates are cut too much, borrowing becomes too cheap, leading to an excessive influx of money into the economy.

This can result in demand outpacing supply, driving up prices and leading to inflationary pressures. For example, after the Fed slashed rates in 2020 to near zero, inflation skyrocketed in 2021 and 2022 as pent-up demand, supply chain issues, and labor shortages drove prices higher.

Another risk is the creation of asset bubbles.

Low-interest rates make borrowing cheap, which can lead to speculation and inflated prices in assets such as real estate, stocks, or commodities.

For instance, in the early 2000s, low-interest rates contributed to the housing bubble that eventually led to the 2008 financial crisis.

In the current environment, concerns about inflated equity and real estate markets are prominent, especially with borrowing costs having been historically low for extended periods.

Furthermore, prolonged periods of low rates can distort financial markets.

Savers, for example, may find it difficult to earn meaningful returns on low-risk investments such as savings accounts or government bonds, pushing them into riskier assets in search of yield.

This risk-seeking behavior can lead to financial market instability, as was observed during the era of near-zero interest rates following the 2008 crisis.

Interest Rate Cuts as Economic Signals

Interest rate cuts also serve as powerful signals to financial markets and the public about the central bank’s view of the economy.

A rate cut often signals that the central bank is concerned about the trajectory of economic growth or inflation.

When the Fed cuts rates, it is generally seen as a sign that the economy is slowing or that the central bank is preemptively acting to stave off a downturn.

For instance, in 2024, while the U.S. economy was not yet in a recession, the Fed cut rates to mitigate risks arising from a cooling labor market and other economic vulnerabilities.

This preemptive action was meant to signal that the Fed would take steps to prevent a deeper slowdown.

On the flip side, unexpected or aggressive rate cuts can sometimes lead to market uncertainty, as investors may interpret them as a sign of looming economic trouble.

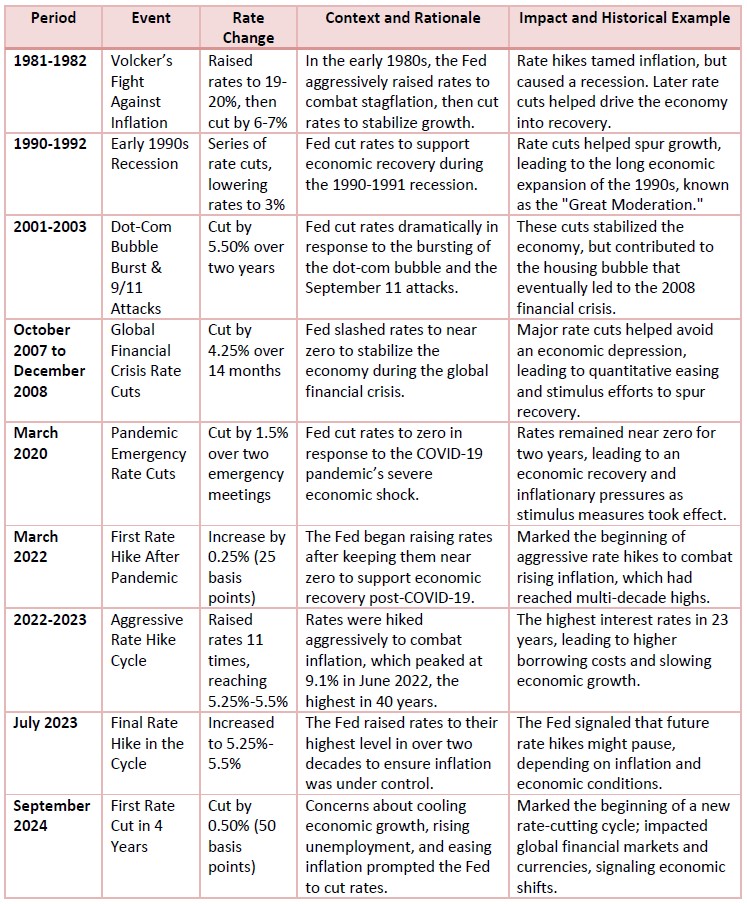

2. Timeline & Historical Analysis of Interest Rate Cuts

Interest rate cuts by the Federal Reserve are closely watched by economists, investors, and policymakers due to their profound impact on financial markets, borrowing costs, and overall economic activity.

To understand the significance of the Federal Reserve’s decisions, it is essential to explore the timeline and context of major rate cuts, especially in recent decades.

The 2020 Rate Cuts: Response to the COVID-19 Pandemic

The Federal Reserve’s most significant recent rate-cutting event occurred in March 2020, during the early days of the COVID-19 pandemic.

As the virus spread globally, triggering widespread economic shutdowns and financial market turmoil, the Fed moved swiftly to cut interest rates.

In a series of emergency actions, the federal funds rate was slashed from a range of 1.50%-1.75% down to 0%-0.25%.

This drastic reduction was an attempt to stave off a deep economic recession by providing cheap credit to businesses and households.

It was the first time since the 2008 financial crisis that rates had been brought down to near-zero levels.

The results of these rate cuts were immediate. Liquidity surged into financial markets, and borrowing costs for consumers and businesses fell sharply.

For instance, the average 30-year fixed mortgage rate dropped below 3%, spurring a housing boom as buyers sought to lock in historically low rates.

Stock markets, which had plunged in early 2020, rebounded strongly. The S&P 500 recovered from its March lows to reach new record highs by the end of the year.

The 2022-2023 Rate Hikes and the Return of Inflation

However, the recovery from the pandemic brought about new challenges.

The rapid injection of liquidity into the economy, coupled with supply chain disruptions, labor shortages, and rising consumer demand, led to a significant spike in inflation.

By mid-2021, inflation had reached levels not seen in decades, with the Consumer Price Index (CPI) climbing over 9% year-over-year in June 2022.

In response, the Federal Reserve shifted from an accommodative policy stance to a hawkish one, raising interest rates aggressively.

From March 2022 through July 2023, the Fed hiked interest rates 11 times, pushing the federal funds rate from near-zero to a range of 5.25%-5.5%, the highest level in more than two decades.

The purpose of these rate hikes was to cool the overheated economy and bring inflation back under control. While inflation did begin to decline toward the Fed’s 2% target—falling to around 3% by mid-2024—the hikes also began to weigh on economic growth, particularly in sectors sensitive to interest rates, such as housing and technology.

The September 2024 Rate Cut: A Pivotal Moment

After more than a year of holding rates at elevated levels, the Federal Reserve made a pivotal decision in September 2024 to cut interest rates by 50 basis points, bringing the federal funds rate to 4.75%-5%.

This marked the first rate cut in over four years and was widely anticipated by financial markets, which had been pricing in a potential easing of monetary policy due to signs of slowing economic growth and a softening labor market.

The September 2024 cut was described by the Fed as a preemptive move to support the labor market, which had been showing signs of cooling. Unemployment had ticked up slightly from its post-pandemic lows, and job growth had begun to slow.

Although inflation was no longer the immediate threat it had been in 2022, the Fed was concerned about the risk of a broader economic slowdown. By cutting rates, the Fed aimed to stimulate demand without stoking a new round of inflation.

This cut also signaled the beginning of a potential new rate-cutting cycle. With the economy entering a period of slower growth, many analysts predicted that the Fed could lower rates further in 2025, depending on the trajectory of inflation and employment.

Financial markets reacted positively to the cut, with major stock indices rising as investors anticipated that lower rates would boost corporate earnings and consumer spending.

Historical Context: Comparing Recent Cuts to Past Cycles

To fully understand the impact of the 2024 rate cut, it’s important to place it within the context of past rate-cutting cycles.

Since 1990, the Federal Reserve has undergone six major rate-cut and rate-hike cycles, each corresponding to different economic crises or recessions.

For example:

1990-1992: In response to a recession caused by rising oil prices and tighter monetary policy in the late 1980s, the Fed cut rates from 8% to 3% over a period of 18 months.

2001-2003: Following the burst of the dot-com bubble and the 9/11 terrorist attacks, the Fed slashed rates from 6.5% to 1% to stimulate a struggling economy.

2007-2009: During the global financial crisis, the Fed cut rates from 5.25% to near-zero, a period marked by massive economic contraction and financial instability.

Each of these rate-cutting cycles was followed by a period of recovery, though the speed and magnitude of the recovery varied based on the underlying causes of the economic downturn.

The 2024 rate cut is likely to be compared most closely to the rate cuts made in the aftermath of the 2001 recession and the 2008 financial crisis, as these events also followed aggressive periods of rate hikes.

Projections for Future Rate Cuts

Looking forward, many analysts expect that the Fed’s September 2024 cut could be the first in a series of reductions, depending on economic data in the coming months. Current forecasts suggest that the Fed could lower rates by an additional 100 to 150 basis points by the end of 2025 if inflation remains under control and growth continues to slow. However, the pace of these cuts will be highly dependent on the labor market and inflation data.

A key factor to watch will be whether the economy can avoid slipping into a recession. If the labor market weakens significantly or if inflation falls below the Fed’s 2% target, the central bank may opt for a more aggressive rate-cutting cycle. Conversely, if inflation begins to reaccelerate, the Fed could pause or slow the pace of cuts to avoid stoking new price pressures.

3. Impact on Various Asset Classes & Investment Opportunities

Interest rate cuts by the Federal Reserve have wide-reaching effects across all asset classes, from fixed income to equities, real estate, and commodities.

When the Fed lowers interest rates, the cost of borrowing declines, which directly and indirectly influences the returns on different investments.

Investors tend to shift their strategies in response to rate cuts, reallocating their portfolios to take advantage of lower borrowing costs and the potential for economic growth.

In this section, we will explore how interest rate cuts affect major asset classes, including bonds, equities, real estate, and currencies, supported by historical examples and current forecasts.

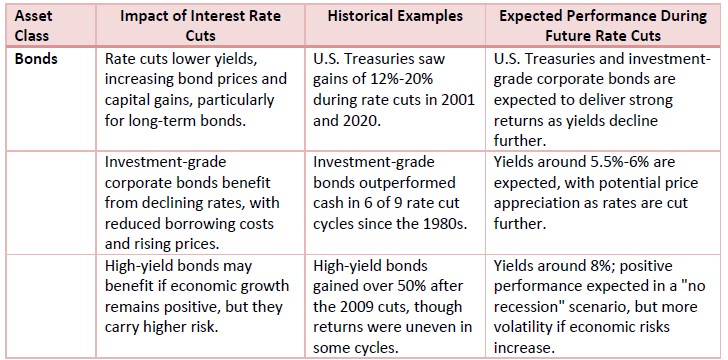

Bonds: The Primary Beneficiary

Fixed income assets, particularly government bonds, are usually the biggest beneficiaries of interest rate cuts.

Bond prices have an inverse relationship with interest rates—when rates fall, bond prices rise.

This is because new bonds issued after a rate cut offer lower yields, making existing bonds with higher coupon rates more attractive.

As demand for these higher-yielding bonds increases, their prices rise, providing capital gains to bondholders.

High-Yield Bonds

High-yield bonds, also known as “junk bonds,” can have a more mixed performance during rate-cut cycles.

These bonds, which are rated below investment grade (BB or lower), offer higher yields to compensate for their higher default risk.

In a “no recession” scenario, high-yield bonds often perform well as lower borrowing costs allow companies to refinance their debt more easily.

However, in the lead-up to or during a recession, high-yield bonds may underperform due to heightened credit risk.

For example, during the 2020 rate cuts, high-yield bonds experienced significant volatility.

While they rebounded strongly after the initial market panic subsided, many investors remained cautious due to concerns about rising default rates among riskier borrowers.

In 2024, high-yield bonds could see similar volatility, particularly if the U.S. economy enters a slowdown or mild recession.

However, if the Fed’s rate cuts successfully prevent a downturn, high-yield bonds could deliver strong returns, especially in sectors like energy and industrials.

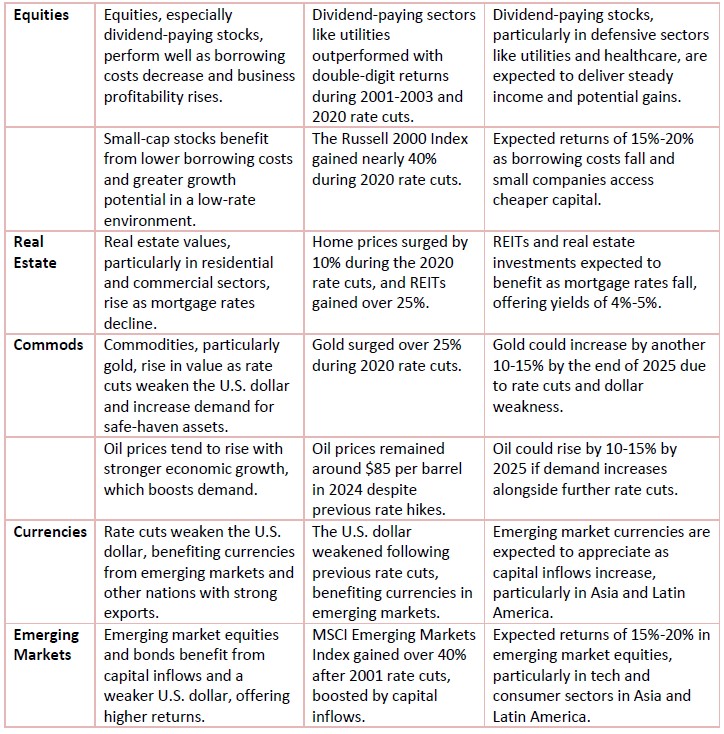

Equities: Mixed Performance Depending on Economic Context

Stocks, or equities, typically benefit from lower interest rates, as cheaper borrowing costs support corporate profitability and boost economic activity.

However, the degree of impact varies depending on the broader economic context and the specific sector in question.

Growth Stocks vs. Value Stocks

Growth stocks, which are companies expected to grow at above-average rates, often benefit significantly from rate cuts.

These companies tend to rely more on external financing for expansion, and lower rates reduce the cost of this capital.

In past rate-cutting cycles, technology stocks have been major beneficiaries.

For instance, during the rate cuts following the 2008 financial crisis, the NASDAQ-100, heavily weighted toward tech companies, outperformed broader market indices, growing by over 50% in the first year of rate cuts.

In contrast, value stocks—companies trading below their intrinsic value, often with stable cash flows—may not benefit as much from rate cuts, although they still provide solid returns in certain environments. Value stocks in sectors like utilities and consumer staples tend to perform better in recessionary periods, as they are less sensitive to economic downturns and provide reliable dividends.

In 2024, with the Federal Reserve initiating a new cycle of rate cuts, growth stocks, particularly in sectors like technology and healthcare, are expected to outperform.

Companies such as Apple, Amazon, and Microsoft, which have large cash reserves and significant growth potential, stand to benefit from lower rates as their future cash flows are discounted at a lower rate, increasing their present value.

Value stocks, particularly in sectors like energy and financials, may lag behind but could still provide attractive dividend yields.

Small-Cap vs. Large-Cap Stocks

Small-cap stocks, which are companies with smaller market capitalizations, often benefit more from rate cuts than their larger counterparts.

These companies typically rely more heavily on short-term borrowing, so lower interest rates reduce their financing costs, boosting their bottom lines.

During the Fed’s last rate-cutting cycle in 2020, the Russell 2000, a small-cap index, outperformed the S&P 500, gaining nearly 40% by the end of the year.

In 2024, small-to-mid cap stocks are once again poised to outperform, particularly if the U.S. economy avoids a recession.

Analysts have noted that many small-cap companies are already seeing earnings acceleration, while large-cap companies are facing slowing profit growth.

As rate cuts reduce borrowing costs, small-cap companies in sectors like industrials and consumer discretionary could deliver significant returns, with some forecasts projecting gains of 15%-20% in 2025.

Real Estate: A Significant Beneficiary of Rate Cuts

Real estate, particularly through vehicles like real estate investment trusts (REITs), tends to benefit strongly from rate cuts.

Lower interest rates reduce mortgage costs for both commercial and residential real estate, making property more affordable and increasing demand.

This leads to rising property values and higher rental incomes for REITs.

In the 2020 rate-cutting cycle, real estate experienced a boom, with home prices soaring as mortgage rates dropped to historic lows.

The average 30-year fixed mortgage rate fell below 3%, spurring a wave of home buying and refinancing.

Similarly, commercial real estate saw a recovery as businesses took advantage of lower borrowing costs to expand or refinance existing debt.

In 2024, as rates begin to decline again, real estate markets are expected to benefit. REITs, which offer higher-than-average dividend yields, are particularly attractive to income-seeking investors.

The Vanguard Real Estate ETF (VNQ), a broad-based REIT index, could see significant inflows, with some analysts predicting returns of 10%-12% over the next 12 months as property values and rental incomes rise.

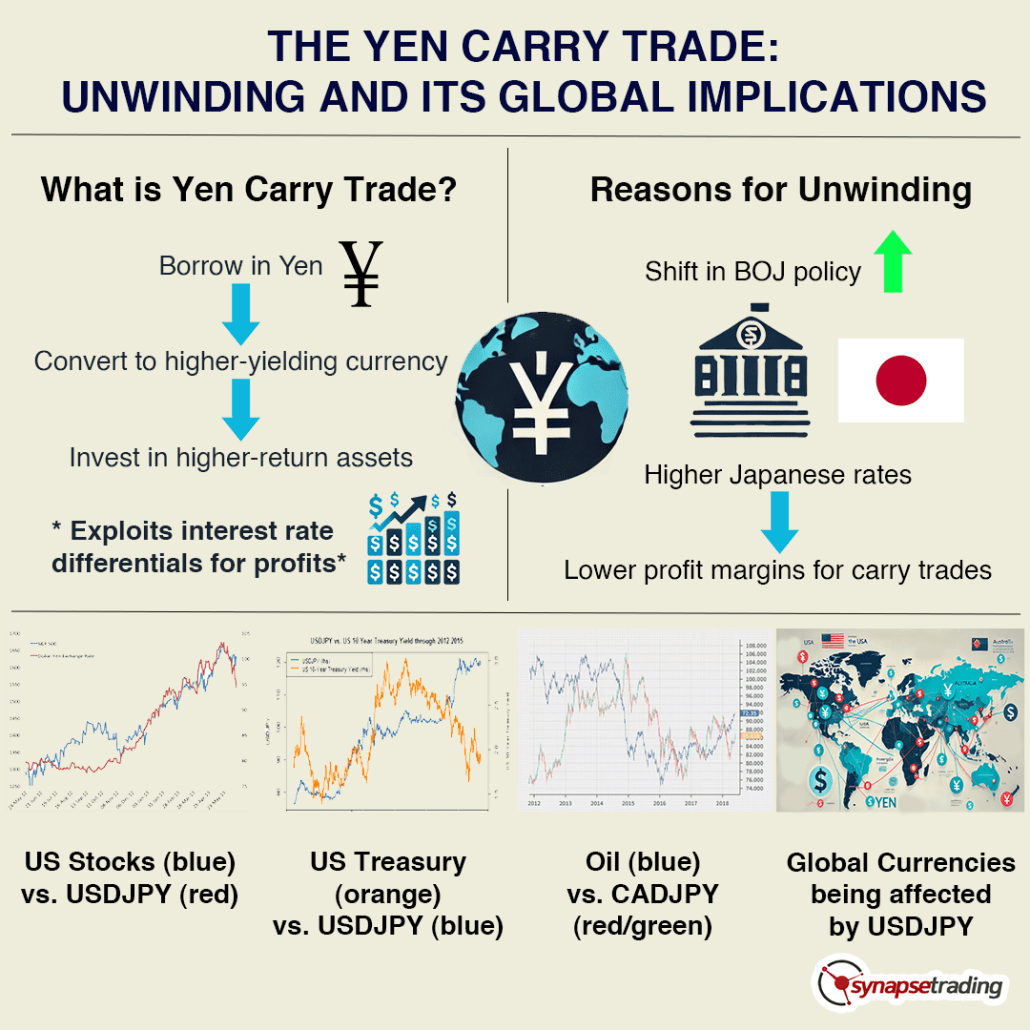

Currencies

When the Fed cuts interest rates, the U.S. dollar tends to weaken relative to other major currencies, as lower rates reduce the yield on dollar-denominated assets, making them less attractive to foreign investors. In 2024, following the September rate cut, the U.S. dollar index (DXY) fell by around 1%, and further cuts are expected to push the dollar down by an additional 3%-5% in 2025.

A weaker dollar benefits U.S. exporters by making American goods cheaper abroad, which could boost sectors like manufacturing and agriculture.

Commodities

Commodities such as gold and oil often react differently to rate cuts.

Gold, traditionally seen as a hedge against inflation and currency depreciation, tends to rise when interest rates fall, as the opportunity cost of holding non-yielding assets decreases.

In 2020, gold prices surged by over 25% as rates dropped to near zero.

In 2024, with further rate cuts on the horizon, gold is expected to perform well, with some analysts forecasting prices to reach $2,200 per ounce by mid-2025.

Oil prices, on the other hand, are more sensitive to global economic growth.

While lower rates can boost demand by stimulating economic activity, oil markets are also affected by supply dynamics and geopolitical events.

In 2024, oil prices remained relatively stable following the Fed’s rate cut, hovering around $85 per barrel.

However, if rate cuts successfully stimulate growth in emerging markets, demand for oil could increase, pushing prices higher in 2025.

4. Conclusion

Interest rate cuts represent one of the most powerful tools that central banks, such as the Federal Reserve, have at their disposal to influence economic conditions.

These cuts lower the federal funds rate, making borrowing cheaper for businesses and consumers.

The main objective is to stimulate economic activity by encouraging spending and investment, particularly during times of economic slowdown or financial distress.

The Fed’s recent 50-basis point cut in September 2024, the first in over four years, marks a pivotal shift in its monetary policy after an extended period of aggressive rate hikes to combat inflation.

Historically, rate cuts aim to stabilize inflation, support the labor market, and mitigate the risks of a recession, but the effectiveness of these cuts depends heavily on the broader economic context and timing.

The timeline of rate cuts and hikes reveals that these shifts often come in response to economic crises.

Since 1990, six major rate-cut cycles have occurred, often following periods of financial stress, such as the dot-com bubble, the 2008 global financial crisis, and the COVID-19 pandemic.

The 2024 cuts, coming after an aggressive hiking cycle that pushed rates to a 23-year high, signal the Fed’s concerns over cooling economic growth and rising unemployment.

These cuts are expected to continue into 2025, potentially providing significant relief to global economies, particularly those with dollar-denominated debt.

The impact of interest rate cuts spans multiple asset classes, with bonds typically being the primary beneficiaries. U.S. Treasuries, investment-grade corporate bonds, and high-yield bonds all perform well when rates fall, as the cost of borrowing decreases, leading to capital gains.

Equities, particularly dividend-paying stocks and small-cap companies, also tend to benefit from rate cuts, as lower interest rates support higher corporate earnings and growth potential.

Real estate, both residential and commercial, sees increased demand due to lower mortgage rates, making real estate investment trusts (REITs) a key area of opportunity for income-seeking investors.

Commodities like gold often rise as rate cuts weaken the U.S. dollar, while oil prices can increase with stronger economic demand.

Looking ahead, the current rate-cut cycle presents a range of potential investment opportunities.

Bonds, especially U.S. Treasuries and investment-grade corporate bonds, are poised for capital gains as yields decline.

Dividend-paying stocks and small-cap equities may outperform, driven by lower financing costs and improved earnings. Real estate remains a significant beneficiary, with REITs offering attractive yields in a low-rate environment.

Commodities, particularly gold and oil, could experience price appreciation, while emerging markets stand to gain from increased capital inflows and a weaker dollar.

Investors should consider these opportunities and adjust their portfolios accordingly as the Fed continues its rate-cutting policy into 2025.

As we come to the end of the report, here are some questions to ponder about:

1. With interest rates expected to decline further, how can investors balance the risks of inflation with the potential for growth in fixed-income assets like bonds?

2. As emerging markets stand to benefit from a weaker U.S. dollar and lower rates, what are the potential geopolitical risks that could influence their long-term growth prospects?

3. Given that rate cuts can stimulate both positive economic growth and excessive risk-taking, how can central banks effectively manage the delicate balance between fostering growth and preventing asset bubbles in financial markets?

Let me know your answers in the comments below!