Weekly Market Wrap: Profit Taking on Crude Oil Shorts!

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

For subscribers of our “Daily Trading Signals”, we now also include a “Weekly Market Report”, where we provide a weekly deep-dive on the market, including fundamentals, technicals, economics, and portfolio management:

Click here for last week’s market report (1 May 2023)

Click here to subscribe for the latest market report (8 May 2023)

Click here to see the archives of all our past market reports

Market Recap & Upcoming Week

Last week, stock markets ended on a high note due to a strong jobs report and impressive first-quarter results from Apple. The S&P 500, Dow Jones, and Nasdaq Composite all rose significantly, with 253,000 jobs added in April and unemployment dropping to 3.4%.

Although the labor market recovery is ongoing, with downward revisions to previous months and mixed results, investors seemed optimistic that a recession is not imminent.

The Federal Reserve’s weekly balance sheet showed the biggest plunge in 14 years, reflecting the impact of the banking crisis and quantitative tightening. In Europe, the ECB raised policy rates by 25 basis points in response to the worst inflation in four decades, with plans to accelerate its Quantitative Tightening program.

Despite assurances of a stable banking system, regional bank stocks declined as investors expressed concern about the impact of regional banking problems on the broader economy.

Oil prices tumbled due to concerns that higher interest rates might slow the economy and curb energy demand, while corporate profit margins dropped less than expected despite inflation and aggressive interest-rate hikes.

The Federal Reserve raised policy rates amid these economic uncertainties, and the Eurozone grappled with record-high inflation in the services sector, prompting the ECB to maintain rate hikes as it approached its policy meeting.

This week, investors should look out for earnings reports from several major companies, including PayPal, Airbnb, The Walt Disney Company, Electronic Arts, Toyota, and Honda.

These reports could provide insights into the performance of various sectors and the impact of current economic conditions.

Additionally, important economic data will be released with the Consumer Price Index (CPI) and Producer Price Index (PPI) for April, which may reveal more about the ongoing inflationary trends.

Another key event to watch is the Bank of England’s (BoE) policymaker meeting on interest rates scheduled for Thursday. This meeting could offer clues regarding the central bank’s monetary policy stance amid rising inflation concerns.

Lastly, the U.K.’s gross domestic product (GDP) reading on Friday will provide further information on the country’s economic performance, potentially influencing markets and investor sentiment.

Daily Trading Signals (Highlights)

We cover 3 main markets with a total of 200+ counters, so we will never run out of trading opportunities:

- Forex, CFDs, commodities, bonds

- US stocks, ETFs, global stock indices

- Cryptocurrencies, crypto indices

By covering a broad range of markets, we can focus our attention (and capital) on whichever market currently gives the best returns.

Subscribe for real-time alerts and weekly reports:

👉🏻 https://synapsetrading.com/daily-trading-signals

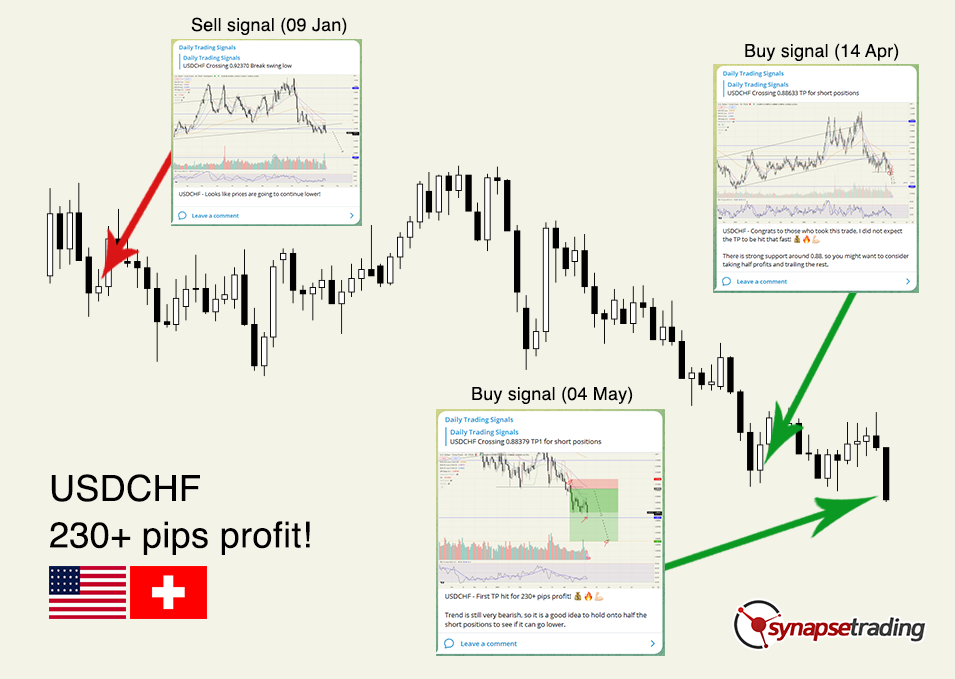

USDCHF – First TP hit for 230+ pips profit! 💰🔥💪🏻

Trend is still very bearish, so it is a good idea to hold onto half the short positions to see if it can go lower.

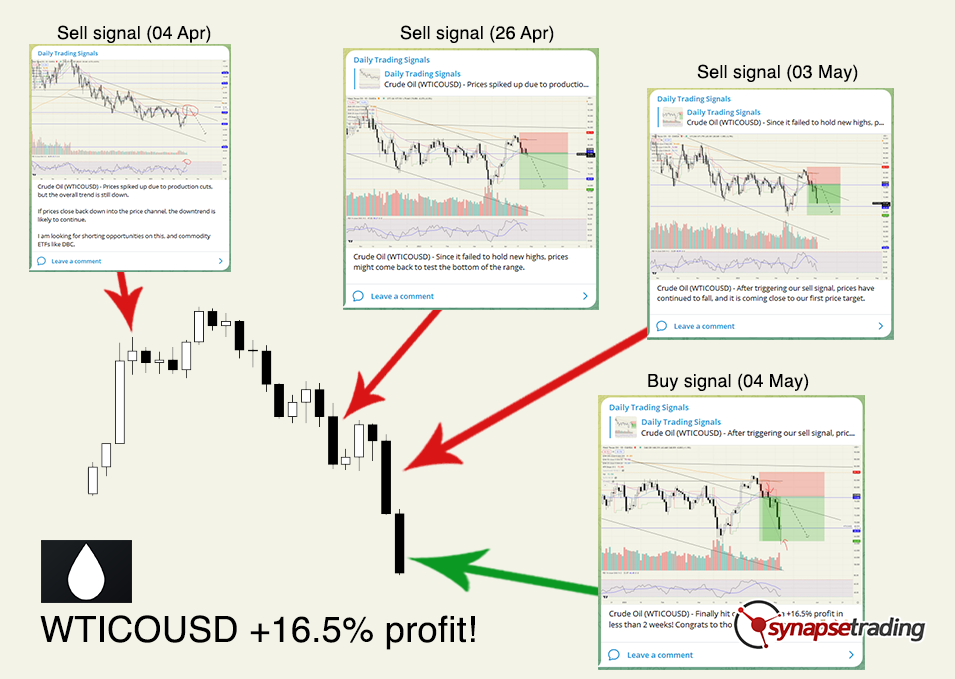

Crude Oil (WTICOUSD) – Finally hit our TP giving a +16.5% profit in less than 2 weeks! Congrats to those who took this trade! 💰🔥💪🏻

CADJPY – Following up, the breakout turned out to be a false breakout, as prices quickly fell back into the range.

If this long bearish bar closes near the lows, we can consider re-entering the short trade.

Gold (XAUUSD) – If you have any long positions, this might be a good time to take some profits, since it is very near the the major resistance level.

NZDCHF – Going for another leg of profits, after pulling back to test the breakout and 20-EMA.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

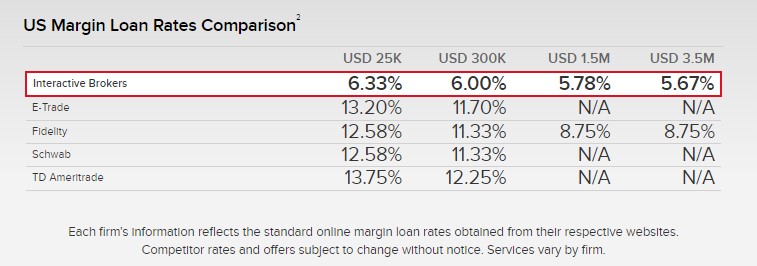

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!