Best Investing Tips & Quotes from Warren Buffett

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

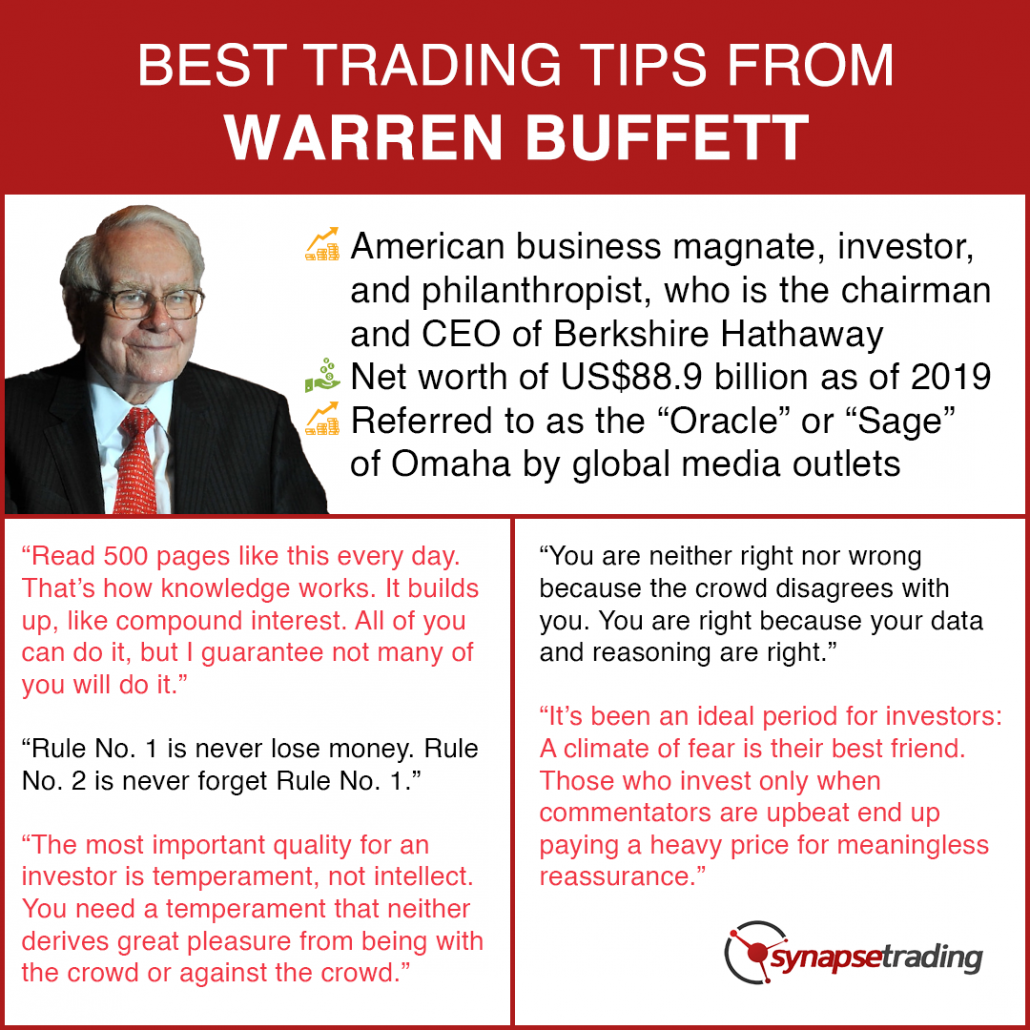

Warren Edward Buffett is an American business magnate, investor, and philanthropist, who is the chairman and CEO of Berkshire Hathaway.

He is considered one of the most successful investors in the world and has a net worth of US$88.9 billion as of December 2019, making him the fourth-wealthiest person in the world.

He has been referred to as the “Oracle” or “Sage” of Omaha by global media outlets.

He is noted for his adherence to value investing and for his personal frugality despite his immense wealth.

In this post, I will share all the best investing tips and quotes from Warren Buffett, so that we can learn from his knowledge and experience.

Here are some of the best investing tips and quotes by Warren Buffett:

- Rule No. 1 is never lose money. Rule No. 2 is never forget Rule No. 1.

- Price is what you pay. Value is what you get.

- Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble.

- Widespread fear is your friend as an investor because it serves up bargain purchases.

- Whether we’re talking about socks or stocks, I like buying quality merchandise when it is marked down.

- We simply attempt to be fearful when others are greedy and to be greedy only when others are fearful.

- The best thing that happens to us is when a great company gets into temporary trouble…We want to buy them when they’re on the operating table.

- It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.

- For the investor, a too-high purchase price for the stock of an excellent company can undo the effects of a subsequent decade of favorable business developments.

- The key to investing is not assessing how much an industry is going to affect society, or how much it will grow, but rather determining the competitive advantage of any given company and, above all, the durability of that advantage.

- On the margin of safety, which means, don’t try and drive a 9,800-pound truck over a bridge that says it’s, you know, capacity: 10,000 pounds. But go down the road a little bit and find one that says, capacity: 15,000 pounds.

- Someone’s sitting in the shade today because someone planted a tree a long time ago.

- If you aren’t willing to own a stock for ten years, don’t even think about owning it for ten minutes.

- When we own portions of outstanding businesses with outstanding managements, our favorite holding period is forever.

- An investor should act as though he had a lifetime decision card with just twenty punches on it.

- Since I know of no way to reliably predict market movements, I recommend that you purchase Berkshire shares only if you expect to hold them for at least five years. Those who seek short-term profits should look elsewhere.

- Buy a stock the way you would buy a house. Understand and like it such that you’d be content to own it in the absence of any market.

- All there is to investing is picking good stocks at good times and staying with them as long as they remain good companies.

- Do not take yearly results too seriously. Instead, focus on four or five-year averages.

- I never attempt to make money on the stock market. I buy on the assumption that they could close the market the next day and not reopen it for five years.

- It is a terrible mistake for investors with long-term horizons — among them pension funds, college endowments, and savings-minded individuals — to measure their investment ‘risk’ by their portfolio’s ratio of bonds to stocks.

- Should you find yourself in a chronically leaking boat, energy devoted to changing vessels is likely to be a more productive than energy devoted to patching leaks.

- The most important thing to do if you find yourself in a hole is to stop digging.

- It takes 20 years to build a reputation and five minutes to ruin it. If you think about that, you’ll do things differently.

- Lose money for the firm, and I will be understanding. Lose a shred of reputation for the firm, and I will be ruthless.

- The most important quality for an investor is temperament, not intellect. You need a temperament that neither derives great pleasure from being with the crowd or against the crowd.

- The stock market is a no-called-strike game. You don’t have to swing at everything — you can wait for your pitch.

- Success in investing doesn’t correlate with IQ … what you need is the temperament to control the urges that get other people into trouble in investing.

- You don’t need to be a rocket scientist. Investing is not a game where the guy with the 160 IQ beats the guy with 130 IQ.

- When trillions of dollars are managed by Wall Streeters charging high fees, it will usually be the managers who reap outsized profits, not the clients.

- Wall Street is the only place that people ride to in a Rolls Royce to get advice from those who take the subway.

- If returns are going to be 7 or 8 percent and you’re paying 1 percent for fees, that makes an enormous difference in how much money you’re going to have in retirement.

- Only when the tide goes out do you discover who’s been swimming naked.

- The years ahead will occasionally deliver major market declines — even panics — that will affect virtually all stocks. No one can tell you when these traumas will occur.

- Predicting rain doesn’t count, building the ark does.

- The best chance to deploy capital is when things are going down.

- It’s been an ideal period for investors: A climate of fear is their best friend. Those who invest only when commentators are upbeat end up paying a heavy price for meaningless reassurance.

- Too-big-to-fail is not a fallback position at Berkshire. Instead, we will always arrange our affairs so that any requirements for cash we may conceivably have will be dwarfed by our own liquidity.

- We never want to count on the kindness of strangers in order to meet tomorrow’s obligations. When forced to choose, I will not trade even a night’s sleep for the chance of extra profits.

- Cash … is to a business as oxygen is to an individual: never thought about when it is present, the only thing in mind when it is absent.

- The one thing I will tell you is the worst investment you can have is cash. Everybody is talking about cash being king and all that sort of thing. Cash is going to become worth less over time. But good businesses are going to become worth more over time.

- If you like spending six to eight hours per week working on investments, do it. If you don’t, then dollar-cost average into index funds.

- Charlie and I view the marketable common stocks that Berkshire owns as interests in businesses, not as ticker symbols to be bought or sold based on their “chart” patterns, the “target” prices of analysts, or the opinions of media pundits.

- Buy into a company because you want to own it, not because you want the stock to go up.

- Never invest in a business you cannot understand.

- Risk comes from not knowing what you’re doing.

- If you don’t feel comfortable making a rough estimate of the asset’s future earnings, just forget it and move on.

- Buy companies with strong histories of profitability and with a dominant business franchise.

- We want products where people feel like kissing you instead of slapping you.

- It’s better to have a partial interest in the Hope diamond than to own all of a rhinestone.

- In the business world, the rearview mirror is always clearer than the windshield.

- One thing that could help would be to write down the reason you are buying a stock before your purchase. Write down “I am buying Microsoft at $300 billion because…” Force yourself to write this down. It clarifies your mind and discipline.

- I just sit in my office and read all day.

- I insist on a lot of time being spent, almost every day, to just sit and think. That is very uncommon in American business.

- The most important investment you can make is in yourself.

- One can best prepare themselves for the economic future by investing in your own education. If you study hard and learn at a young age, you will be in the best circumstances to secure your future.

- Read 500 pages like this every day. That’s how knowledge works. It builds up, like compound interest. All of you can do it, but I guarantee not many of you will do it.

- In the 54 years (Charlie Munger and I) have worked together, we have never forgone an attractive purchase because of the macro or political environment, or the views of other people. In fact, these subjects never come up when we make decisions.

- In the 20th century, the United States endured two world wars and other traumatic and expensive military conflicts; the Depression; a dozen or so recessions and financial panics; oil shocks; a flu epidemic; and the resignation of a disgraced president. Yet the Dow rose from 66 to 11,497.

- We’ve long felt that the only value of stock forecasters is to make fortune tellers look good. Even now, Charlie and I continue to believe that short-term market forecasts are poison and should be kept locked up in a safe place, away from children and also from grown-ups who behave in the market like children.

- Most people get interested in stocks when everyone else is. The time to get interested is when no one else is. You can’t buy what is popular and do well.

- Don’t get caught up with what other people are doing. Being a contrarian isn’t the key but being a crowd follower isn’t either. You need to detach yourself emotionally.

- You are neither right nor wrong because the crowd disagrees with you. You are right because your data and reasoning are right.

- After 25 years of buying and supervising a great variety of businesses, Charlie and I have not learned how to solve difficult business problems. What we have learned is to avoid them.

- Speculation is most dangerous when it looks easiest.

- Investors should remember that excitement and expenses are their enemies.

- Keep things simple and don’t swing for the fences. When promised quick profits, respond with a quick “no.”

- Half of all coin-flippers will win their first toss; none of those winners has an expectation of profit if he continues to play the game.

- What we learn from history is that people don’t learn from history.

- There is nothing wrong with a ‘know nothing’ investor who realizes it. The problem is when you are a ‘know nothing’ investor but you think you know something.

- You only have to be able to evaluate companies within your circle of competence. The size of that circle is not very important; knowing its boundaries, however, is vital.

- We believe that a policy of portfolio concentration may well decrease risk if it raises, as it should, both the intensity with which an investor thinks about a business and the comfort-level he must feel with its economic characteristics before buying into it.

- Diversification is a protection against ignorance. It makes very little sense for those who know what they’re doing.

- I believe in giving my kids enough so they can do anything, but not so much that they can do nothing.

- If you’re smart, you’re going to make a lot of money without borrowing.

- If you buy things you do not need, soon you will have to sell things you need.

- You can’t borrow money at 18 or 20 percent and come out ahead.

- If you’re in the luckiest 1% of humanity, you owe it to the rest of humanity to think about the other 99%.

- We have learned to turn out lots of goods and services, but we haven’t learned as well how to have everybody share in the bounty. The obligation of a society as prosperous as ours is to figure out how nobody gets left too far behind.

- The difference between successful people and really successful people is that really successful people say no to almost everything.

- It’s better to hang out with people better than you. Pick out associates whose behavior is better than yours and you’ll drift in that direction.

- When you have able managers of high character running businesses about which they are passionate, you can have a dozen or more reporting to you and still have time for an afternoon nap. Conversely, if you have even one person reporting to you who is deceitful, inept or uninterested, you will find yourself with more than you can handle.

- And so the important thing we do with managers, generally, is to find the .400 hitters and then not tell them how to swing.

- When stock can be bought below a business’s value it is probably the best use of cash.

- What is smart at one price is stupid at another.

- Many management [teams] are just deciding they’re gonna buy X billions over X months. That’s no way to buy things. You buy when selling for less than they are worth. … It’s not a complicated equation to figure out whether it is beneficial or not to repurchase shares.

- Among the various propositions offered to you, if you invested in a very low cost index fund — where you don’t put the money in at one time, but average in over 10 years — you’ll do better than 90% of people who start investing at the same time.

- Just pick a broad index like the S&P 500. Don’t put your money in all at once; do it over a period of time.

- It is not necessary to do extraordinary things to get extraordinary results.

Now that I have shared the best investing tips and quotes from Warren Buffett, which is your favourite investing tip?

Let me know in the comments below.

If you would like to get more trading tips and quotes from all the best traders, also check out: “Best Trading Tips & Quotes from Legendary Top Traders”

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!