Are you curious about what it’s like to be a trader? I know I was when I first started out. The fast-paced, ever-changing markets were daunting, but also incredibly exciting.

As a trader, I rely on a wide range of tools and technologies to stay informed and make informed trading decisions. From trading platforms to charting software and high-speed data feeds, each tool plays a critical role in helping me navigate the markets.

And when it comes to strategies and techniques, there are so many different approaches to choose from. Whether it’s technical analysis, fundamental analysis, or news trading, every trader has their own style and preference. It’s all about finding what works for you and sticking to it.

In this video collaboration with XM Global brokerage, I’ll take you through a day in the life of a trader, from pre-market preparation to end-of-day analysis, and share some useful tools to help in your trading journey.

What is the day-to-day schedule of a trader like?

The day-to-day schedule of a trader can vary depending on the type of trading they do and the market they specialize in.

However, some general activities that traders typically engage in include:

- Pre-market preparation: Traders usually start their day by reviewing news and market data that may impact their trades. They also analyze their trading strategies and review their portfolio positions.

- Market open: The first few hours after the market opens are typically the busiest for traders. They execute trades based on their analysis and strategy.

- Monitoring: Throughout the day, traders monitor the markets and track the progress of their trades. They may adjust their positions or exit trades as needed.

- Research: Traders spend time researching and analyzing market trends and news, as well as studying the performance of different companies and sectors.

- Networking: Traders often build relationships with other traders and brokers to gain insights and market information that can help inform their trades.

- End of day analysis: At the end of the day, traders review their performance and analyze their trades to identify areas for improvement.

Overall, the schedule of a trader is fast-paced and can be demanding, requiring a high level of focus, discipline, and adaptability.

What tools and technologies do traders use?

Traders use a wide range of tools and technologies to help them analyze markets, identify trends, and execute trades.

Some of the most common tools and technologies used by traders include:

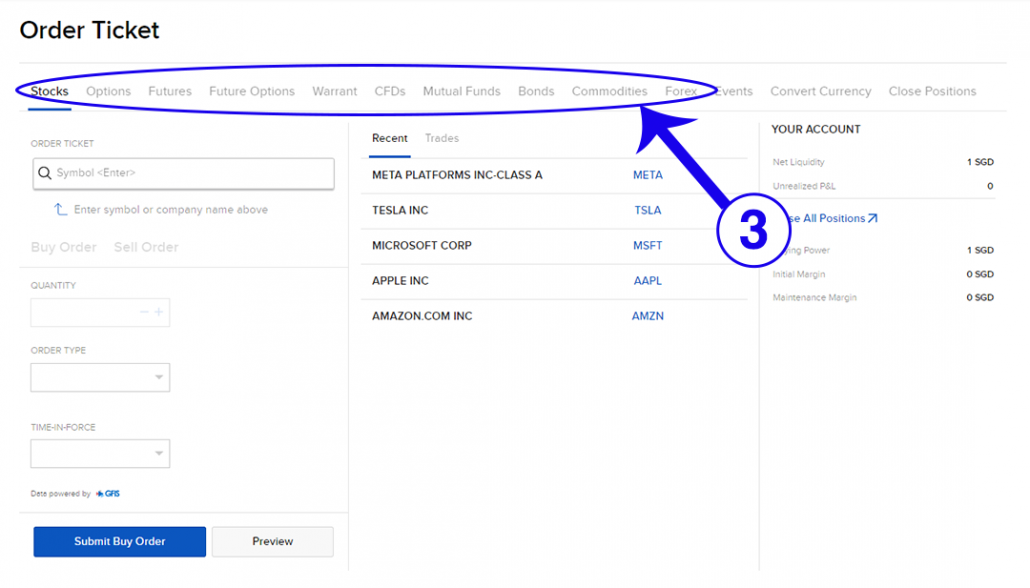

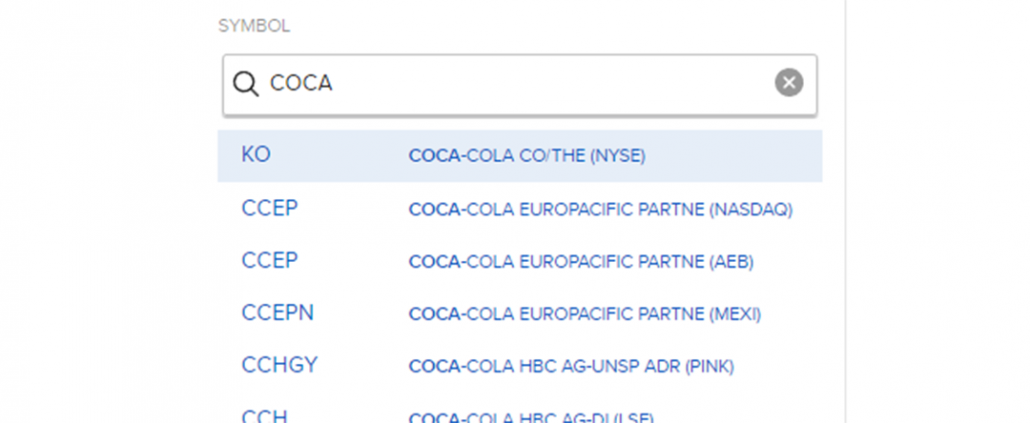

- Trading platforms: These are software applications that allow traders to access financial markets, view real-time prices and charts, and place trades.

- Charting software: Traders use charting software to create visual representations of price movements and identify patterns in the market.

- News feeds: Traders rely on news feeds to stay up-to-date with the latest developments in the markets, including economic data releases, corporate announcements, and geopolitical events.

- Algorithmic trading systems: These are computer programs that execute trades automatically based on pre-set rules and parameters.

- Risk management software: Traders use risk management software to monitor and control their exposure to market risks, including volatility, liquidity, and counterparty risk.

- Electronic trading networks: These are online platforms that connect traders with each other and with liquidity providers, allowing them to trade directly with one another without the need for a broker.

- Mobile trading apps: Traders use mobile trading apps to access the markets and manage their trades from their mobile devices.

- High-speed data feeds: Traders require real-time market data to make informed trading decisions. High-speed data feeds provide up-to-the-millisecond pricing information that traders use to execute trades.

What are some strategies and techniques used by traders?

There are various strategies and techniques used by traders, and different traders may prefer different methods depending on their personal preferences and risk tolerance.

Here are some common strategies and techniques:

- Technical analysis: This involves studying price charts and using technical indicators to identify trends, patterns, and potential trading opportunities.

- Fundamental analysis: This involves analyzing economic and financial data, such as company earnings reports, economic indicators, and news events, to make trading decisions.

- Trend following: This involves identifying the direction of a trend and entering trades in the same direction, hoping to ride the trend for profit.

- Scalping: This involves making numerous trades over a short time frame to take advantage of small price movements.

- Swing trading: This involves holding positions for a few days or weeks, aiming to capture price movements within a longer-term trend.

- Position trading: This involves holding positions for several months to a year or more, taking a long-term view on the markets.

- News trading: This involves taking advantage of market volatility caused by news events, such as interest rate changes, economic data releases, and geopolitical events.

- Arbitrage: This involves taking advantage of price differences between different markets or assets to make a profit.

Traders may also use various risk management techniques, such as setting stop-loss orders to limit losses, using leverage to amplify gains, and diversifying their portfolio to reduce risk.

My trading journey and challenges

My trading journey has been a rollercoaster ride, filled with ups and downs. When I first started trading, I was filled with excitement and optimism. I was eager to learn and I spent countless hours reading books, attending seminars, and watching educational videos. However, as I started trading with real money, I quickly realized that things were not as easy as they seemed.

One of the biggest challenges I faced was my emotions. I found it difficult to stay disciplined and stick to my trading plan. I would often get too caught up in the moment and make impulsive decisions, which led to losses. It took a lot of self-reflection and practice to develop the mental fortitude required to be a successful trader.

Another challenge I faced was finding a reliable trading strategy that worked for me. I tried out several different approaches, from day trading to swing trading, but I struggled to find a consistent method that produced the results I was looking for. It wasn’t until I discovered price action trading that I finally found a strategy that resonated with me.

Despite the challenges, I persisted in my trading journey, and over time I learned to manage my emotions and stick to my trading plan. I also became more confident in my trading abilities as I saw my profits grow. Looking back on my journey, I am proud of the progress I have made and the lessons I have learned. Trading is not easy, but with the right mindset and approach, it is possible to succeed.

Looking for a professional trading platform to give you an edge?

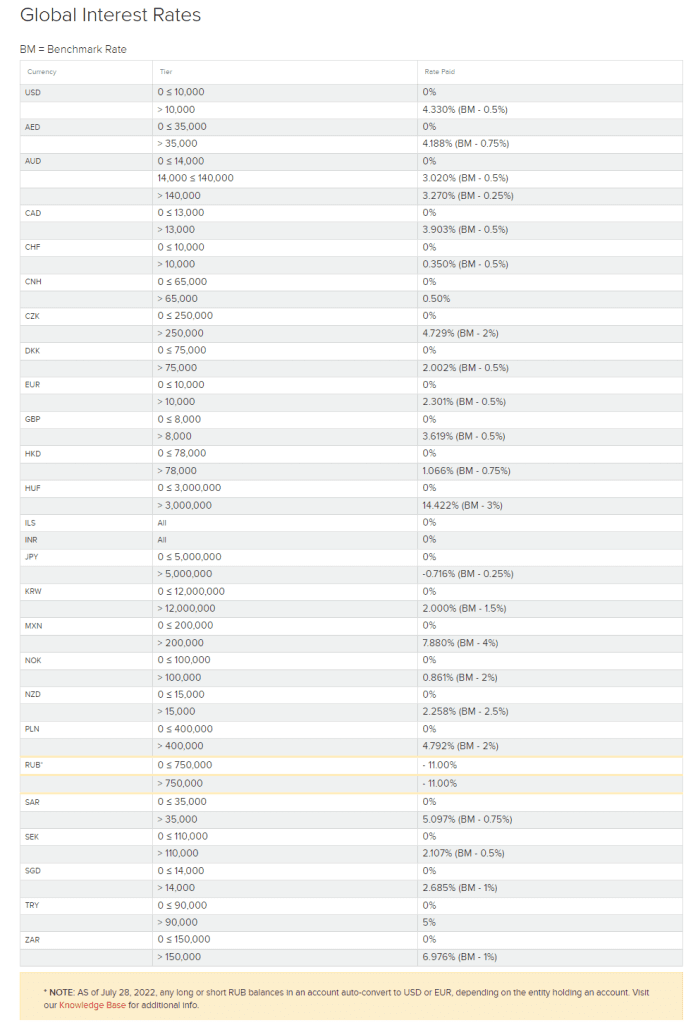

XM Global is a leading brokerage company that is dedicated to providing traders with a seamless and efficient trading experience, providing access to more than 50 currency pairs. As a trusted platform for many traders, XM is committed to helping traders improve their skills and succeed in the trading world.

To further assist traders in their trading journey, XM provides ongoing EN Live Education sessions with experts and global instructors around the world. They have 2 rooms, one for beginners and one for advanced traders, and both rooms are live everyday from 3PM – 12 AM SGT to cover a wide variety of topics to help traders improve their trading. These live education sessions are also a great opportunity for traders to learn valuable insights and strategies that can help them achieve their trading goals.

For traders looking for a reliable and trusted trading platform, XM is the ideal choice. Sign up now using the link below to join their EN Live Education and learn from some of the well-known experts in the industry.

Schedule: Monday – Friday (3PM – 12AM SGT)

Refer here for more information: https://www.xm.com/english-education-schedule

Concluding Thoughts

In summary, trading is not without its challenges. It can be difficult to stay disciplined and stick to your trading plan when the markets are constantly in flux. And finding a reliable trading strategy that works for you is easier said than done.

But despite the challenges, being a trader is incredibly rewarding. I’ve learned so much over the years and have seen my profits grow as I become more confident in my trading abilities.

Now that I have shared all about the daily life of a trader, is this something that you would consider doing full time?

Also, for those who are actively trading, what are some challenges you face in your trading?

Let me know in the comments below.

If you are keen on any partnerships or sponsored content, check out:

🤝 https://synapsetrading.com/?p=28772

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.