For many people looking to start investing in the Singapore stock market, one of the challenges faced is expensive brokerage fees from the incumbent local-based brokerages.

For decades, this problem went unresolved, until in recent years when Singapore started opening up to allow foreign-based brokerages to offer stocks on SGX.

This means potentially lower fees for new traders and investors, especially those with small accounts, since the local-based brokerages usually charge a minimum fee per transaction, which is disadvantageous for small accounts.

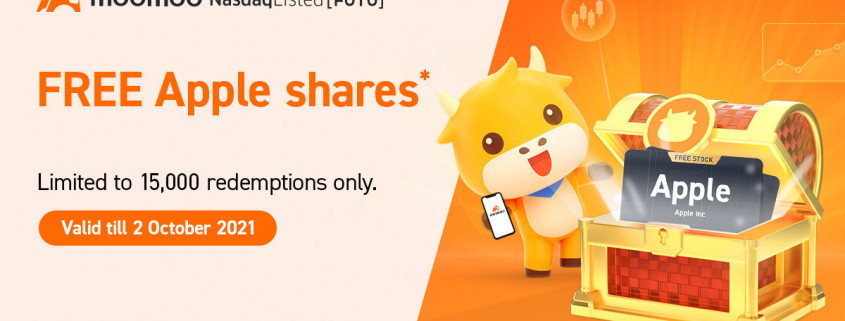

Latest Promotion: Free Apple Shares!

One of these new brokerages coming into Singapore is FUTU Singapore Pte. Ltd. (FUTU SG) and its parent company FUTU Holdings Limited, a NASDAQ-listed company and backed by Tencent. In Singapore, FUTU SG’s trading app Moomoo is currently running an attractive limited-period promotion.

From now to 02 October 2021, 1959hr, they are offering the following benefits:

- 1 Free Apple (AAPL) share worth around SGD 200*

- For the first deposit of ≥ SGD 2,700 , USD 2,000 or HKD 16,000 before the promotion ends.

- Make 5 trades on any markey and any product (excluding futures)

- Limited number of 15,000 AAPL shares available for redemption.

- 180 days unlimited commission-free trading for the US, HK & SG stock market

- Free access to market data:

- Lvl 2 Market Data for the US stock market

- Lvl 1 Market Data for the SG stock market

- Lvl 1 Market Data for China A Shares market data

As an ongoing incentive, you can also redeem merchandise (figurines, neck pillows and cushions) using points earned from trading!

Click here to open a FUTU SG securities account! (use this link for extra perks!)

If you are looking to take your first step into stock trading, but have not opened a trading account, this would be a good time to do so.

And even if you are not ready to trade, there is no harm getting the free Apple shares!

What Makes them Different?

Here are their 3 main areas of customer-focus:

- Free real-time quotes and competitive commissions

- Centralised information & global community

- 24 hours customer service

By offering some of the lowest fees and trading minimums in Singapore for investing in Hong Kong and U.S. securities, futures and options, this makes it easier and more affordable for new traders and investors get started.

With lower commissions, it also comparatively increases your profit on each trade, and improves your overal returns. With many trades, a small difference can ad up over time to a significant difference.

24 hours Customer Support

One of the major concerns as a trader is the customer support, because when something happens, such as a technical glitch, you need to be able to resolve the issue immediately.

To give customers a peace of mind, Moomoo (powered by FUTU) provides 24 hours customer service on trading days.

Within their Moomoo app, customers can use the in-app live chat function via “customer service”, where a human customer service representative will attend to your questions.

Additional customer service support is also available via the in-app “Help Center”, hotline, email and social media platforms:

- “Help Center” via in-app

- Email: clientservice@futusg.com

- Hotline: +65 6439 1100 (Weekdays: 9am – 6pm)

- Social media: @moomoosingapore

Background of Moomoo

In Singapore, capital markets products and services on moomoo are offered by FUTU Singapore Pte. Ltd., which is licensed and regulated by the Monetary Authority of Singapore (MAS) (Licence No. CM101000).

FUTU and its subsidiaries have 43 licenses globally in major financial markets such as United States, Hong Kong, Singapore and others.

FUTU SG’s comparative advantage to its peers is known for being reliable, secure and stable, low commissions and seamless investing experience whilst both licensed and regulated (by the MAS).

Moomoo’s trading capabilities are also backed by its self-developed, proprietary trading system, and world-class strategic investors including venture capital affiliates of Tencent, Sequoia Capital and Matrix Partners.

After almost 9 years of development, FUTU’s trading platforms has garnered over 15 million users from more than 200 regions and regions around the world, with more than one million average daily active users.

With their Moomoo app, FUTU has one of the fastest growing investor communities in the region, and its share price has more than quadrupled since its opening in 2020.

Click here to open a FUTU SG securities account! (use this link for extra perks!)

Note: This post is sponsored by Moomoo app (powered by FUTU).

Our policy & disclaimer on 3rd party products & services: https://synapsetrading.com/disclaimer/

For sponsored posts or other marketing opportunities, please contact us at https://synapsetrading.com/partnership-opportunities/