The Piercing Pattern is a bullish candlestick pattern that is typically formed after a downtrend and indicates a potential trend reversal.

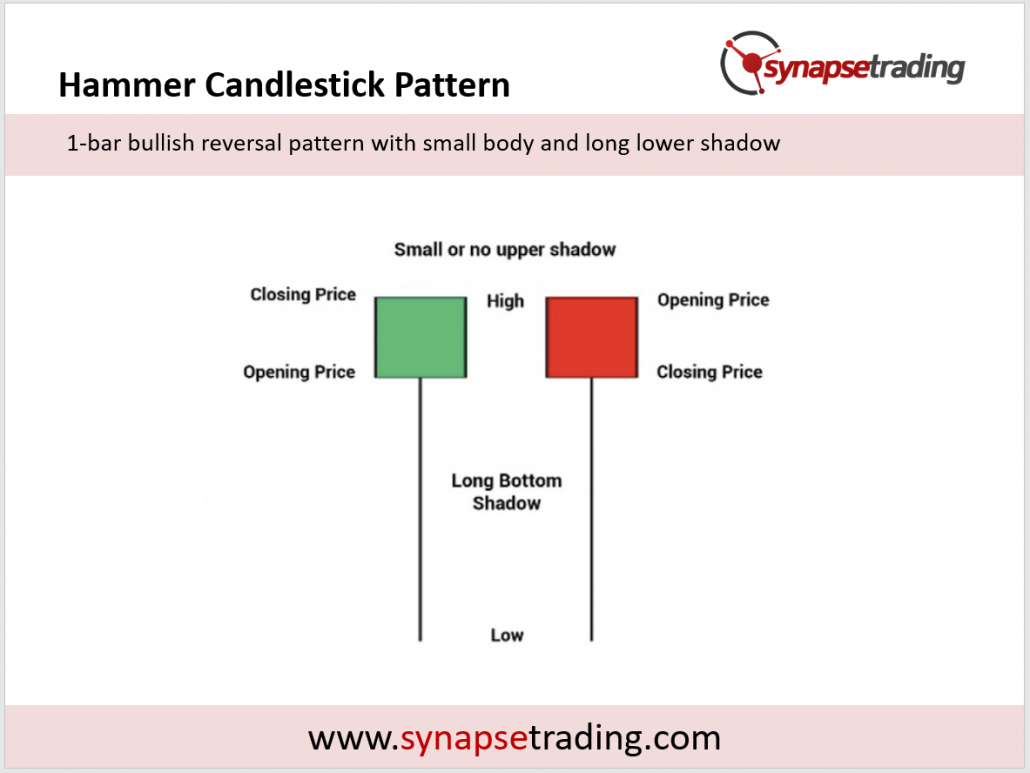

It is characterized by the following:

- A long black candlestick

- A short white candlestick that opens below the close of the previous day’s black candlestick

To identify the Piercing Pattern, traders can look for the following:

- A downtrend: The pattern is typically formed after a downtrend, as it indicates a potential trend reversal.

- A long black candlestick: This indicates that the bears are in control and are driving the price lower.

- A short white candlestick: This indicates that the bulls have taken control and are pushing the price higher.

The psychology behind the Piercing Pattern is that it represents a shift in sentiment from bearish to bullish.

During a downtrend, the bears are in control and are driving the price lower. However, when the Piercing Pattern forms, it indicates that the bulls have taken control and are pushing the price higher.

This can be seen as a sign of strength and a potential reversal in the trend.

To use the Piercing Pattern for trading, it is important to confirm the pattern with other technical analysis techniques and indicators.

One way to do this is to look for a break above the resistance level, which can be identified using trendlines.

To confirm the trend reversal with trendlines, traders can draw a downtrend line and wait for the price to break above it.

This indicates that the bears have lost control and the bulls are now in control.

Another way to confirm the Piercing Pattern is to use support and resistance levels.

The pattern is typically formed at a key support level, and a break above the resistance level can indicate a potential trend reversal.

Traders can use previous highs and lows, or moving averages, to identify key support and resistance levels.

In addition to trendlines and support and resistance levels, traders can also combine the Piercing Pattern with price patterns and price action.

For example, traders can look for other bullish patterns such as the Bullish Engulfing Pattern or the Morning Star Pattern to confirm the trend reversal.

They can also look for bullish price action such as a long white candlestick or a series of higher highs and higher lows to further confirm the trend reversal.

Traders can also use trend-following technical indicators such as moving averages and the moving average convergence divergence (MACD) to confirm the trend reversal.

These indicators can help identify the direction of the trend and confirm that the bulls are in control.

Oscillator indicators such as the relative strength index (RSI) and stochastics can also be used to confirm the trend reversal.

These indicators can help identify overbought or oversold conditions and confirm the strength of the trend reversal.

When trading the Piercing Pattern, it is important to consider where to enter the trade, where to place the stop loss, and where to take profit.

To enter the trade, it is recommended to wait for the white candlestick to close and then enter on a break above the high of the white candlestick.

The stop loss can be placed below the low of the white candlestick, while the take profit can be set at a key resistance level or based on the trader’s risk-reward ratio.

There are some limitations to the Piercing Pattern that traders should be aware of.

One limitation is that the pattern is not always reliable and may not always signal a trend reversal.

In addition, the pattern can be easily faked out by false breaks or by the bears regaining control and pushing the price lower.

In conclusion, the Piercing Pattern is a bullish candlestick pattern that is formed after a downtrend and indicates a potential trend reversal.

It is important to confirm the pattern with other technical analysis techniques and indicators, such as trendlines, support and resistance levels, price patterns, price action, and technical indicators.

When trading this pattern, traders should consider where to enter, where to place the stop loss, and where to take profit.

While the pattern has some limitations, it can be a useful tool for traders looking to identify potential trend reversals.

If you would like to learn more about all the different candlestick patterns, also check out: “The Definitive Guide to Candlestick Patterns”