Weekly Market Wrap: Bear Market Resumes after FOMC!

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

We had 2 major pieces of new last week, which was the FOMC and the NFP.

The FOMC hiked rates by 0.75%, which was in line with expectations, but they also maintained the hardline stance of aggressively increasing rates till inflation is tamed, and would rather overshoot than undershoot, because (they think) they can remedy by cutting rates if a recession happens.

The NFP data showed that although jobs increased, it seems to be reaching a gradual turning point, which suggested that the rate hikes are working to reverse the trend.

As mentioned in last week’s video, I expect the bearish trend to resume soon, with new lows perhaps as early as next week.

Besides the short position on stocks, there is also something which we have been accumulating steadily, and is now deeply in the money, with lots more room to continue going up.

What do you think this is?

Find out in our Daily Trading Signals private Telegram channel!

[Photo: Jokulsarlon Glacier Lagoon, Iceland – See my full travel photo log!]

For our weekly market wrap, we go through some of the trade calls and analysis from last week, which gives us valuable insights for the week ahead.

We cover 3 main markets with a total of 200+ counters, so we will never run out of trading opportunities:

- Forex, CFDs, commodities, bonds

- US stocks, ETFs, global stock indices

- Cryptocurrencies, crypto indices

By covering a broad range of markets, we can focus our attention (and capital) on whichever market currently gives the best returns.

Table of Contents

Weekly Market Outlook Video

Weekly Market Outlook (31 October 2022)

? 2 Nov: FOMC interest-rate decision

? 4 Nov: October NFP jobs report

? 8 Nov: mid-term elections

? 10 Nov: CPI (inflation data)

Portfolio Highlights

Weekly Portfolio Update (31 October 2022)

Increased fixed income (bonds) allocation slightly, went net positive on crypto allocation.

Forex & Commodities Market Highlights

Comparison of all major forex pairs YTD

(Note that I have put the USD as the numerator for all pairs to enable easy comparison.)

USD is the strongest currency, followed by SGD, CAD and CHF.

JPY is the weakest currency by a large margin.

The AUDNZD has traded in a wide range for many years. Recently, it tried to break out of the range but failed and went back down.

It might head back to test the bottom of the range, so we can look to short on pullbacks.

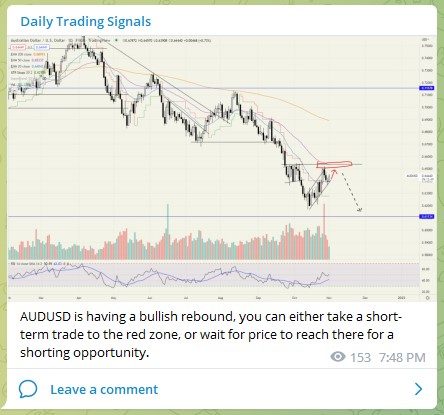

AUDUSD is having a bullish rebound, you can either take a short-term trade to the red zone, or wait for price to reach there for a shorting opportunity.

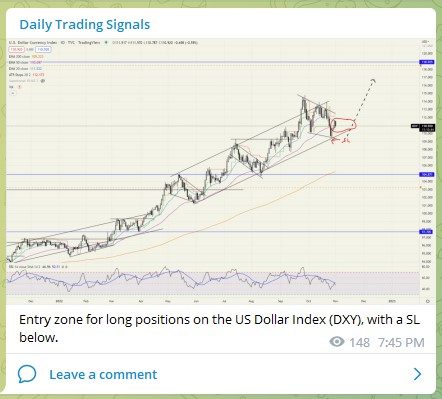

Entry zone for long positions on the US Dollar Index (DXY), with a SL below.

EURUSD is consolidating near the major 1.000 level, which is now resistance. The red zone would be a good shorting opportunity, with a SL around 1.0100.

After yesterday’s FOMC, where we saw the USDSGD spike down, but shortly after recovered and went back up.

As mentioned in the last video, that’s a strong sign that the price action remains bullish, and will likely test new highs.

Stock & Bond Market Highlights

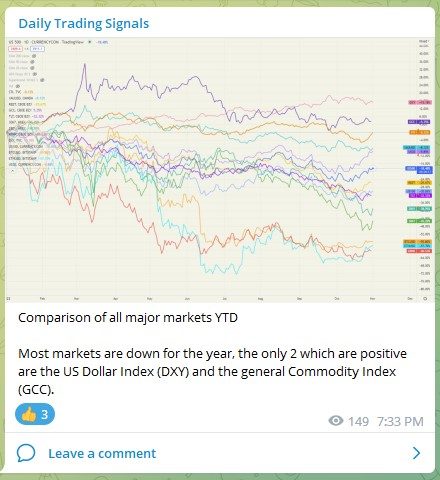

Comparison of all major markets YTD

Most markets are down for the year, the only 2 which are positive are the US Dollar Index (DXY) and the general Commodity Index (GCC).

Climatic selling on China tech stocks (3067) suggests a possible rebound, which would bring prices back to test the prior resistance.

The NASDAQ 100 (US100) is coming back down after the Fed signalled that they will continue with future rate hikes.

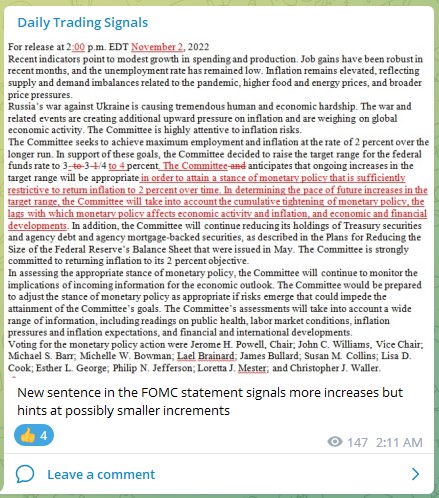

New sentence in the FOMC statement signals more increases but hints at possibly smaller increments.

ON EVERY SINGLE FOMC RATE HIKE SO FAR THIS YEAR MARKETS HAVE DUMPED AT 2:00 PM EST WHEN THE RATE HIKE CAME OUT AND RALLIED AT 2:30 EST WEHEN POWELL SPOKE $SPY $SPX pic.twitter.com/qK2jIRhcWZ

— GURGAVIN (@gurgavin) November 1, 2022

Apple plans a hiring freeze that will extend until the middle of next year. And with that all of big tech (FAAMNG) has either had layoffs or implemented a hiring freeze.

I haven’t seen a job market look this bad for college grads in my entire career.https://t.co/twoYoMqOZF

— Dare Obasanjo ? (@Carnage4Life) November 3, 2022

Crypto Market Highlights

Bull flag forming on Ethereum (ETHUSD) on smaller timeframe. Taking a small long position to see how it goes. Can put a SL around $1450 area.

Good luck, and may next week bring more excellent profits!

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

Spencer is an avid globetrotter who achieved financial freedom in his 20s, while trading & teaching across 70+ countries. As a former professional trader in private equity and proprietary funds, he has over 15 years of market experience, and has been featured on more than 20 occasions in the media.

Leave a Reply

Want to join the discussion?Feel free to contribute!