Best Trading Tips & Quotes from Richard Dennis

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

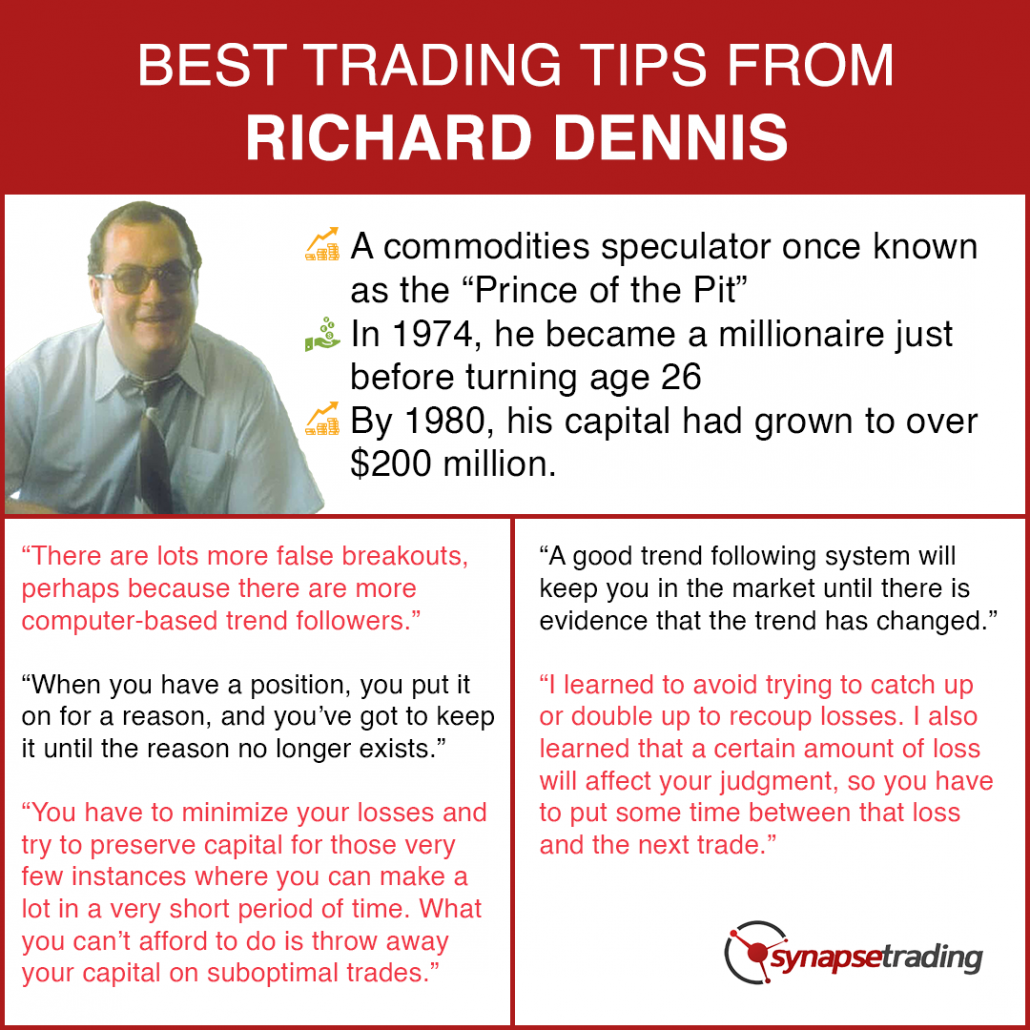

Richard J. Dennis, a commodities speculator once known as the “Prince of the Pit”, started off by borrowing $1,600 from his family, which after spending $1,200 on a seat at the MidAmerica Commodity Exchange left him $400 in trading capital.

In 1970, his trading increased this to $3,000, and in 1973 his capital was over $100,000.

He made a profit of $500,000 trading soybeans in 1974, and by the end of that year was a millionaire, just short of twenty-six years of age. By 1980, his capital had grown to over $200 million.

In this post, I will share all the best trading tips and quotes from Richard Dennis, so that we can learn from his knowledge and experience.

Here are some of the best trading tips and quotes by Richard Dennis:

- In the real world, it is not too wise to have your stop where everyone else has their stop.

- I always say that you could publish trading rules in the newspaper and no one would follow them. The key is consistency and discipline. Almost anybody can make up a list of rules that are 80 percent as good as what we taught people. What they couldn’t do is give them the confidence to stick to those rules even when things are going bad.

- When things aren’t going right, don’t push, don’t press.

- I could trade without knowing the name of the market.

- There are lots more false breakouts, perhaps because there are more computer-based trend followers.

- It is misleading to focus on short-term results.

- You have to minimize your losses and try to preserve capital for those very few instances where you can make a lot in a very short period of time. What you can’t afford to do is throw away your capital on suboptimal trades.

- When you have a position, you put it on for a reason, and you’ve got to keep it until the reason no longer exists.

- When you are getting beat to death, get your head out of the mixer.

- There is another point that I think is as important: You should expect the unexpected in this business; expect the extreme. Don’t think in terms of boundaries that limit what the market might do. If there is any lesson I have learned in the nearly twenty years that I’ve been in this business, it is that the unexpected and the impossible happen every now and then.

- Trading decisions should be made as unemotionally as possible.

- You should always have a worst case point. The only choice should be to get out quicker.

- Trade small because that’s when you are as bad as you are ever going to be. Learn from your mistakes.

- If there is any lesson I have learned in the nearly twenty years that I’ve been in this business, it is that the unexpected and the impossible happen every now and then.

- I learned to avoid trying to catch up or double up to recoup losses. I also learned that a certain amount of loss will affect your judgment, so you have to put some time between that loss and the next trade.

- Trading has taught me not to take the conventional wisdom for granted. What money I made in trading is testimony to the fact that the majority is wrong a lot of the time. The vast majority is wrong even more of the time. I’ve learned that markets, which are often just mad crowds, are often irrational; when emotionally overwrought, they’re almost always wrong.

- Almost anybody can make up a list of rules that are 80 percent as good as what we taught people.

- I’ve learned that markets, which are often just mad crowds, are often irrational; when emotionally overwrought, they’re almost always wrong.

- The market being in a trend is the main thing that eventually gets us in a trade. That is a pretty simple idea. Being consistent and making sure you do that all the time is probably more important than the particular characteristics you use to define the trend. Whatever method you use to enter trades, the most critical thing is that if there is a major trend, your approach should assure that you get in that trend.

- A good trend following system will keep you in the market until there is evidence that the trend has changed.

Now that I have shared the best trading tips and quotes from Richard Dennis, which is your favourite trading tip?

Let me know in the comments below.

If you would like to get more trading tips and quotes from all the best traders, also check out: “Best Trading Tips & Quotes from Legendary Top Traders”

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Great Tip❤️