Weekly Market Wrap: Stock Market Reacts Positively to Stronger Jobs Data

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

In the recent NFP report, the US economy added 223,000 jobs in December, which was slightly better than expected, and the unemployment rate fell to 3.5%.

Average hourly earnings increased by 4.6% year-over-year, which was lower than the expected 5.0% increase and the revised prior reading of 4.8%.

The US stock market rallied strongly after the release of this data due to the strong labor market and easing wage pressures, but we will need to see next week if this rally continues.

The focus will shift to the inflation report next week, and traders expect that inflation may fall further than expected.

The ISM services index also fell into contraction territory for the first time since May 2020, suggesting that the service sector of the economy may be struggling.

For a more detailed analysis (weekly market outlook video), and real-time trading signals, check out our “Daily Trading Signals” Telegram channel!

[Photo: Song-Kol Lake, Kyrgyzstan – See my full travel photo log!]

For our weekly market wrap, we go through some of the trade calls and analysis from last week, which gives us valuable insights for the week ahead.

We cover 3 main markets with a total of 200+ counters, so we will never run out of trading opportunities:

- Forex, CFDs, commodities, bonds

- US stocks, ETFs, global stock indices

- Cryptocurrencies, crypto indices

By covering a broad range of markets, we can focus our attention (and capital) on whichever market currently gives the best returns.

Table of Contents

Weekly Market Outlook Video

Weekly Market Outlook (01 January 2023)

Overview of 2022, and outlook for 2023.

Video is split into 2 parts due to technical issue.

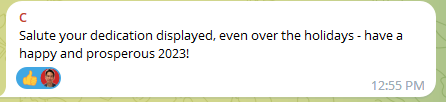

Portfolio Highlights

Weekly Portfolio Updates (01 January 2023)

Not much changes.

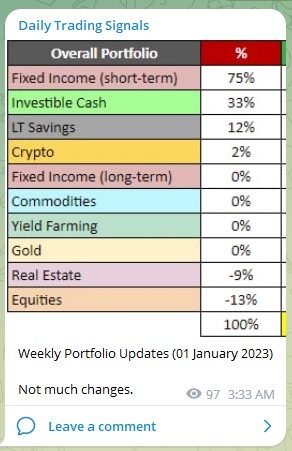

There are 4 main clusters, starting from the top:

1. These are the commodity-related products, performed the best for 2022 due to inflation.

a. DXY (US dollar index) – USD benefited from rising rates

b. GCC (General commodity ETF)

c. WTI (Crude oil)

2. These are the ones which are quite defensive, so they had a small decline during the year.

a. XAU (Gold)

b. US30 (Dow Jones Index) – less tech weightage

3. These are the blue-chip stock and bond indices, which declined roughly between 20-30% for the year.

a. US500 (S&P 500)

b. 2801 (General China stocks ETF)

c. REET (Global REITs ETF)

d. 3067 (China tech stocks ETF)

e. TLT (20-year US Treasury Bonds)

f. US100 (NASDAQ 100) – large tech stocks

4. These are the most high-risk products, including high-growth tech stocks and cryptocurrencies.

a. BTC (Bitcoin)

b. ETH (Ethereum)

c. ARKK (ARK ETF) – An ETF for high-growth stocks

Forex & Commodities Market Highlights

CADJPY – broke new lows again, congrats! 💰🔥💪🏻

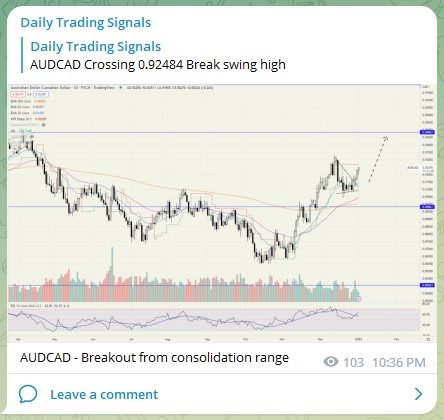

AUDCAD – Breakout from consolidation range

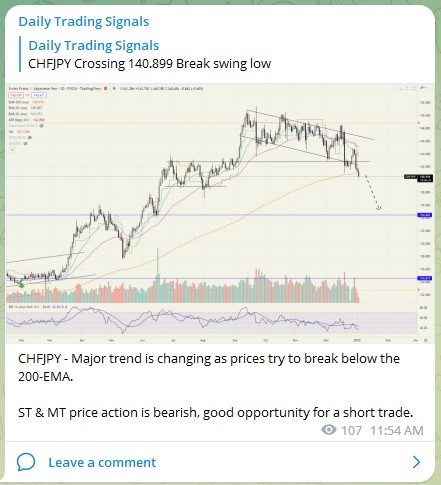

CHFJPY – Major trend is changing as prices try to break below the 200-EMA.

ST & MT price action is bearish, good opportunity for a short trade.

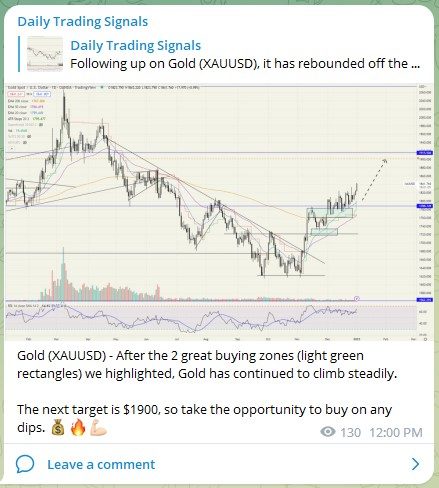

Gold (XAUUSD) – After the 2 great buying zones (light green rectangles) we highlighted, Gold has continued to climb steadily.

The next target is $1900, so take the opportunity to buy on any dips. 💰🔥💪🏻

Stock & Bond Market Highlights

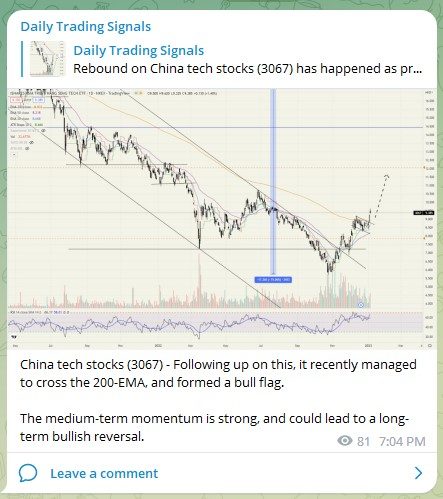

China tech stocks (3067) – Following up on this, it recently managed to cross the 200-EMA, and formed a bull flag.

The medium-term momentum is strong, and could lead to a long-term bullish reversal.

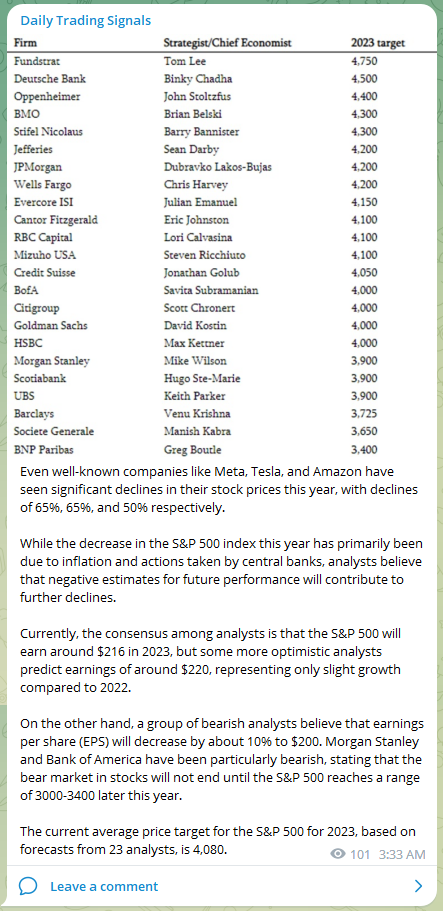

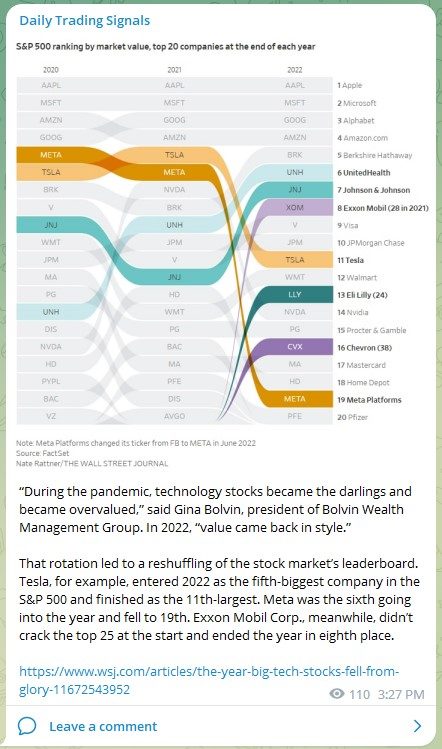

Even well-known companies like Meta, Tesla, and Amazon have seen significant declines in their stock prices this year, with declines of 65%, 65%, and 50% respectively.

While the decrease in the S&P 500 index this year has primarily been due to inflation and actions taken by central banks, analysts believe that negative estimates for future performance will contribute to further declines.

Currently, the consensus among analysts is that the S&P 500 will earn around $216 in 2023, but some more optimistic analysts predict earnings of around $220, representing only slight growth compared to 2022.

On the other hand, a group of bearish analysts believe that earnings per share (EPS) will decrease by about 10% to $200. Morgan Stanley and Bank of America have been particularly bearish, stating that the bear market in stocks will not end until the S&P 500 reaches a range of 3000-3400 later this year.

The current average price target for the S&P 500 for 2023, based on forecasts from 23 analysts, is 4,080.

https://www.wsj.com/articles/the-year-big-tech-stocks-fell-from-glory-11672543952

Good luck, and may next week bring more excellent profits!

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!