Weekly Market Wrap: All Quiet on the Western Front…

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

Last week, the markets were pretty quiet, after the sharp rebound in the previous weeks.

It seems like the rebound has run out of steam, and there is no major news to influence the direction of the market either way.

The direction might only be clearer after the next major news announcement (NFP, CPI, FOMC), so it is best not to take any large bets in the meantime.

That said, on the forex and crypto front, there were many good swing trading opportunities.

There is a good chance that price might break out next week, so I have placed price triggers to alert me (and all my subscribers) the moment any breakout happens.

Stay tuned in our Daily Trading Signals private Telegram channel!

[Photo: Cappadocia, Turkey – See my full travel photo log!]

For our weekly market wrap, we go through some of the trade calls and analysis from last week, which gives us valuable insights for the week ahead.

We cover 3 main markets with a total of 200+ counters, so we will never run out of trading opportunities:

- Forex, CFDs, commodities, bonds

- US stocks, ETFs, global stock indices

- Cryptocurrencies, crypto indices

By covering a broad range of markets, we can focus our attention (and capital) on whichever market currently gives the best returns.

Table of Contents

Weekly Market Outlook Video

Weekly Market Outlook (20 November 2022)

Best trades this week are shorting crypto and going long on USD rebound.

Stocks have been flat almost 2 weeks, so I have placed price alerts for when it breaks out of either side.

Portfolio Highlights

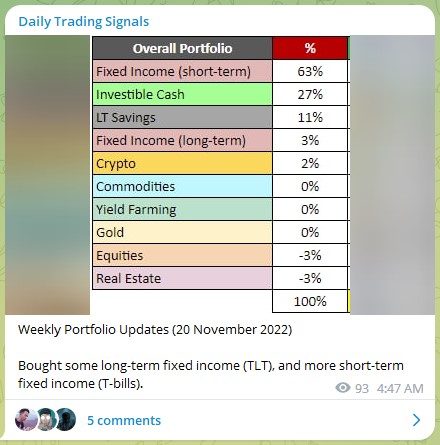

Weekly Portfolio Updates (20 November 2022)

Bought some long-term fixed income (TLT), and more short-term fixed income (T-bills).

Forex & Commodities Market Highlights

Following up on EURCAD, there was a perfect long pullback opportunity as we mentioned, and prices have started heading up.

Will continue to add longs on any pullback, or pullbacks on a smaller timeframe.

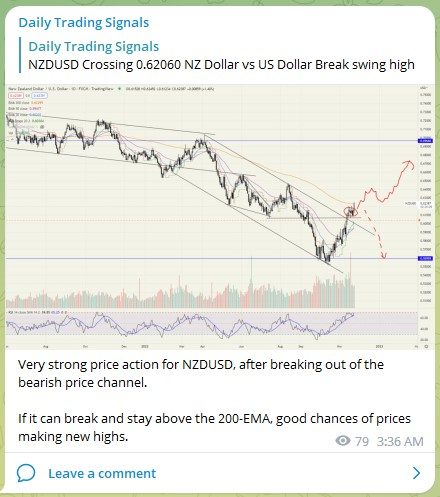

Very strong price action for NZDUSD, after breaking out of the bearish price channel.

If it can break and stay above the 200-EMA, good chances of prices making new highs.

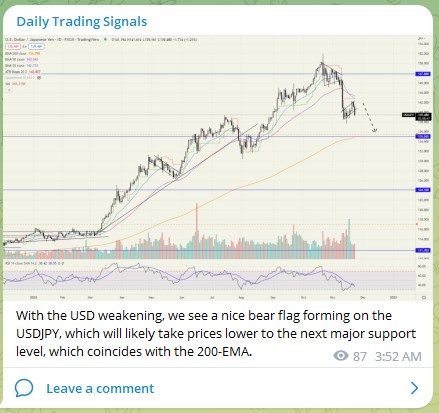

With the USD weakening, we see a nice bear flag forming on the USDJPY, which will likely take prices lower to the next major support level, which coincides with the 200-EMA.

Gold (XAUUSD) rebounding off strong support, with 2 major resistance levels ahead that can serve as targets.

Stock & Bond Market Highlights

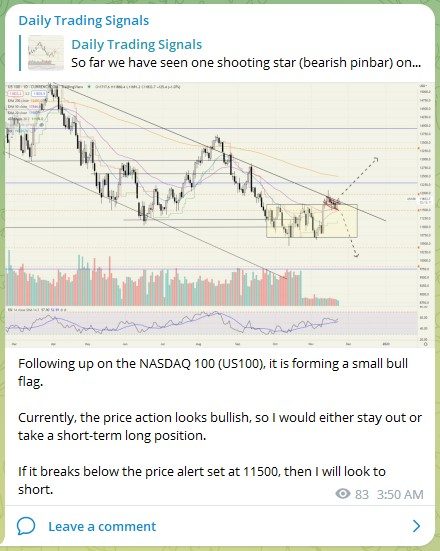

Following up on the NASDAQ 100 (US100), it is forming a small bull flag.

Currently, the price action looks bullish, so I would either stay out or take a short-term long position.

If it breaks below the price alert set at 11500, then I will look to short.

S&P500: Morgan Stanley YE 2023 Price Targets

Once inflation breaks above 8%, they find, “reverting to 3% usually takes 6 to 20 years, with a median of over 10 years.”

Only 30% of the time in the past 52 years has inflation peaked between 8% and 10% and then gone back down. In the other 70% of the time, once it’s made it over 8% it had risen above 10%.

https://www.marketwatch.com/story/history-says-inflation-could-persist-for-a-decade-11668642697

Good luck, and may next week bring more excellent profits!

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

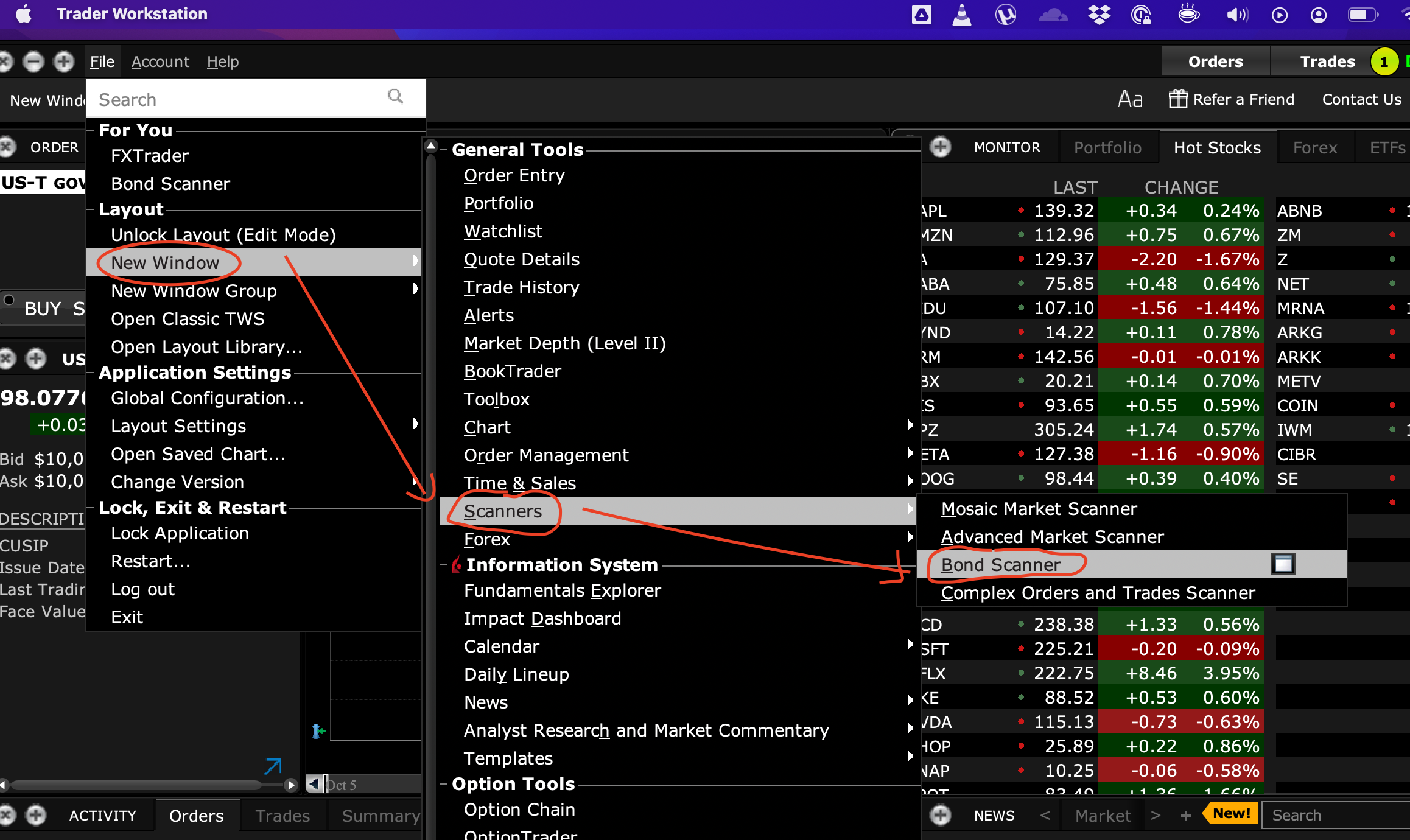

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!