Weekly Market Wrap: Fully Loaded on Short Positions!

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

Last week, as the market continued to edge higher on weakness, we started initiating large short positions on stocks, crypto and REITs.

This was due to many bearish overbought technical indicators, as well as bearish price patterns like bear flags or head and shoulders patterns.

Markets were mostly flat the whole week until Friday, when stocks plummeted after Federal Reserve Chair Jerome Powell said in his Jackson Hole speech the central bank won’t back off in its fight against rapid inflation.

Now our shorts are greatly in the money, and we will monitor our positions to see if the decline continues next week.

This could potentially be the biggest trade of the year, if markets continue to fall.

Stay tuned for more real-time updates in our “Daily Trading Signals” Telegram channel!

[Photo: Vernice, Italy – See my full travel photo log!]

For our weekly market wrap, we go through some of the trade calls and analysis from last week, which gives us valuable insights for the week ahead.

We cover 3 main markets with a total of 200+ counters, so we will never run out of trading opportunities:

- Forex, CFDs, commodities, bonds

- US stocks, ETFs, global stock indices

- Cryptocurrencies, crypto indices

By covering a broad range of markets, we can focus our attention (and capital) on whichever market currently gives the best returns.

Table of Contents

Portfolio Highlights

Portfolio updates:

Mainly riding the bearish momentum now, and seeing if it leads to a resumption of the bear trend.

Forex & Commodities Market Highlights

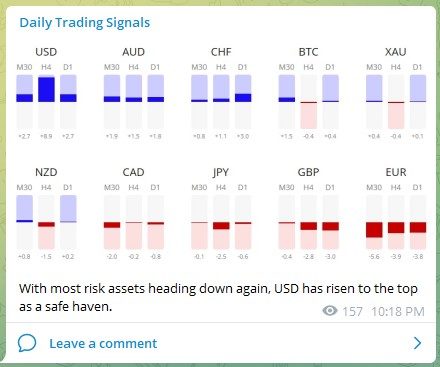

With most risk assets heading down again, USD has risen to the top as a safe haven.

Looking at the weekly chart of the EURUSD, you can see that we started calling for shorts since 1.14, and now prices have declined more than 12%.

EURUSD has now broken the crucial 1.000 price level again, and is likely to continue heading downwards.

We can look for more pullback opportunities to short.

GBPCHF is bearish on the daily chart, but having bullish momentum on the H1 (hourly) chart.

Watch and see if there is any price rejection at the resistance zone here to initiate a short trade.

Following up on the H1 chart of GBPCHF, the trade has triggered and is starting to head down.

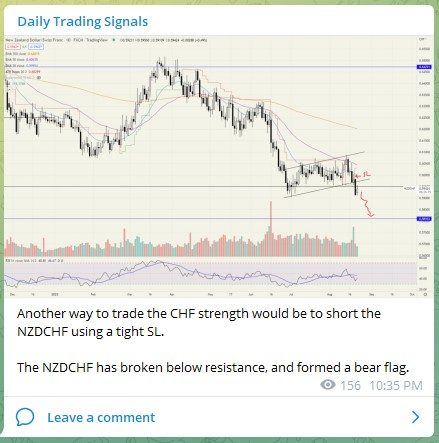

Another way to trade the CHF strength would be to short the NZDCHF using a tight SL.

The NZDCHF has broken below resistance, and formed a bear flag.

Besides all the USD trading positions we have been posting the past few weeks, you can also consider looking at the CHF.

The CHFJPY is breaking out of a small rectangle pullback, and we can enter early using a tight SL.

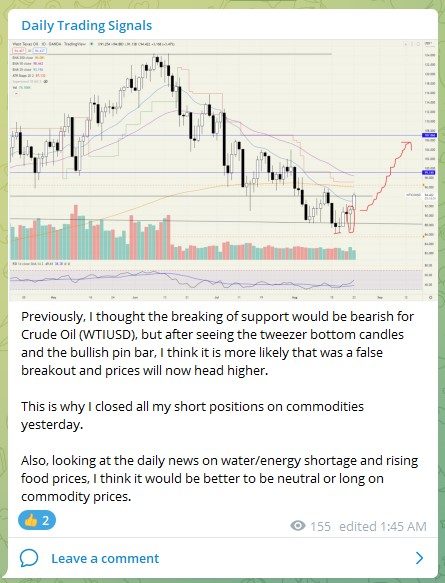

Previously, I thought the breaking of support would be bearish for Crude Oil (WTIUSD), but after seeing the tweezer bottom candles and the bullish pin bar, I think it is more likely that was a false breakout and prices will now head higher.

This is why I closed all my short positions on commodities yesterday.

Also, looking at the daily news on water/energy shortage and rising food prices, I think it would be better to be neutral or long on commodity prices.

Power prices in Germany surging

Stock & Bond Market Highlights

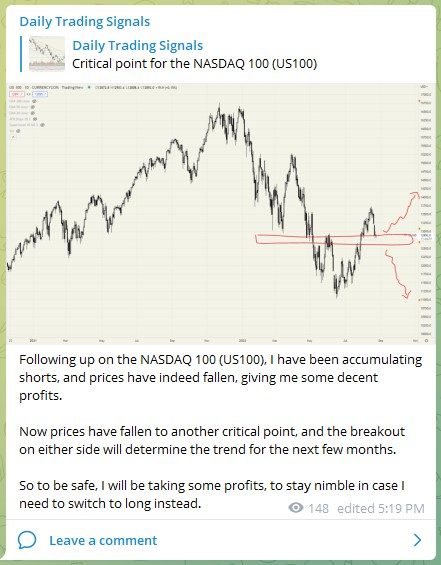

Following up on the NASDAQ 100 (US100), I have been accumulating shorts, and prices have indeed fallen, giving me some decent profits.

Now prices have fallen to another critical point, and the breakout on either side will determine the trend for the next few months.

So to be safe, I will be taking some profits, to stay nimble in case I need to switch to long instead.

We have hit the top of the trendline for S&P 500 (US500), and the RSI oscillator is showing an overbought signal.

There might be some correction soon.

Crypto Market Highlights

Bitcoin (BTCUSD) looks like it might finally have broken out of the bear flag pattern, have added more short positions to this.

Monthly and annual performance (%) of Bitcoin and Ethereum over the years.

Good luck, and may next week bring more excellent profits!

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!