Weekly Market Wrap: Will the Fed Pivot Cause a Market Reversal?

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

Last week, the Fed mentioned that they will be slowing down the interest rate hikes, and the market reacted positively to this news.

This was a bit different from what I was expecting, but the rule of trading is to go with the flow of the market and trade according, which means that if my positions are on the wrong side, I am ready to close them and switch sides.

As I mentioned in last week’s video, in such choppy markets, we should not be taking large positions, instead we should be saving most of our ammunition for when the trend becomes clear.

If the Fed decides to slow the rate hikes, this could hint that the market has already bottomed, but on the other hand, even keeping rates at current elevated levels for a year could trigger a recession, so which is the more likely outcome for the stock market?

I will be covering that in this week’s market outlook video, as well as the direction for all major asset classes.

Stay tuned, and see you in our Daily Trading Signals private Telegram channel!

[Photo: Antalya, Turkey – See my full travel photo log!]

For our weekly market wrap, we go through some of the trade calls and analysis from last week, which gives us valuable insights for the week ahead.

We cover 3 main markets with a total of 200+ counters, so we will never run out of trading opportunities:

- Forex, CFDs, commodities, bonds

- US stocks, ETFs, global stock indices

- Cryptocurrencies, crypto indices

By covering a broad range of markets, we can focus our attention (and capital) on whichever market currently gives the best returns.

Table of Contents

Weekly Market Outlook Video

Weekly Market Outlook (27 November 2022)

NFP is this Friday, so all eyes on this data. Strong jobs might actually be bad for the market.

Unrest in China is another bearish factor for global markets.

Either stay flat, or take small short positions.

Portfolio Highlights

Weekly Portfolio Updates (27 November 2022)

Added more US T-bills to my portfolio, since the markets are quite flat, and yields are above 4.5%.

Forex & Commodities Market Highlights

Following up on the EURCAD, if there is follow-through on today’s strong white bar, there is a good chance of prices continuing higher.

AUDJPY Crossing 91.797

Euro vs Japanese Yen

Break swing low

EURAUD Crossing 1.55769

Break swing highs!

Stock & Bond Market Highlights

The NASDAQ 100 (US100) still hovering at resistance, but get ready to short once it breaks the red level.

Finally the action is starting on the NASDAQ 100 (US100), after breaking back into the range.

Added on more short positions, but still not going all-in yet because of NFP this Friday.

This is the final monthly employment report before the Fed’s two-day meeting on Dec. 13 and 14, in which the central bank is expected to raise its fed funds target rate by a half percentage point. A 50 basis point increase would mark a slowing from the prior 75 basis point rate hikes set by the central bank.

https://www.cnbc.com/2022/12/01/stock-market-futures-open-to-close-news.html

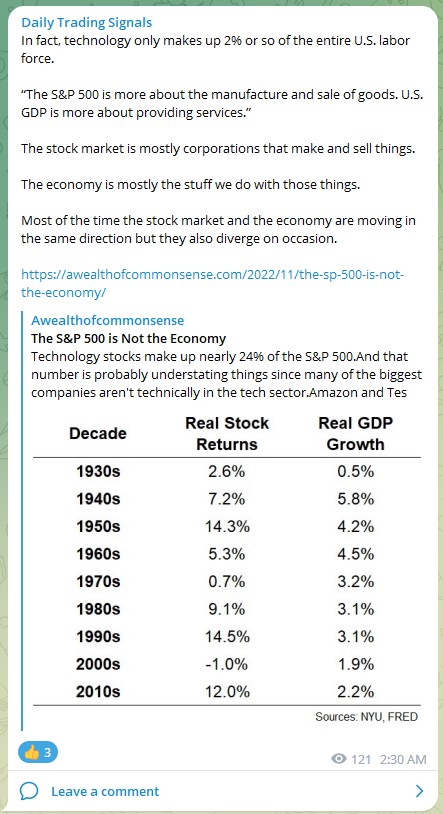

https://awealthofcommonsense.com/2022/11/the-sp-500-is-not-the-economy/

Crypto Market Highlights

Bitcoin (BTCUSD) still looking bearish, with prices forming a small bear flag after breaking new lows.

Good luck, and may next week bring more excellent profits!

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!