Consider this: “Despite the fact that more than 90% of car accidents involve human error, three-quarters (73 percent) of drivers consider themselves better-than-average drivers.”

This might sound delusional, but we also see this phenomenon in trading.

Most people think they can beat the markets. But is this true?

If you would like to learn all about investing and trading psychology, also check out: Complete Guide to Investing & Trading Psychology

In this post, I’m going to share about overconfidence, and how this behavioral bias affects your trading decisions.

What is Overconfidence Bias?

Firstly, what is confidence?

According to Wikipedia, “confidence is a state of being clear-headed either that a hypothesis or prediction is correct or that a chosen course of action is the best or most effective. Confidence comes from a Latin word ‘fidere’ which means “to trust”; therefore, having self-confidence is having trust in one’s self.”

So confidence is a good thing to have.

But too much of a good thing can make it bad. What happens when there is too much confidence?

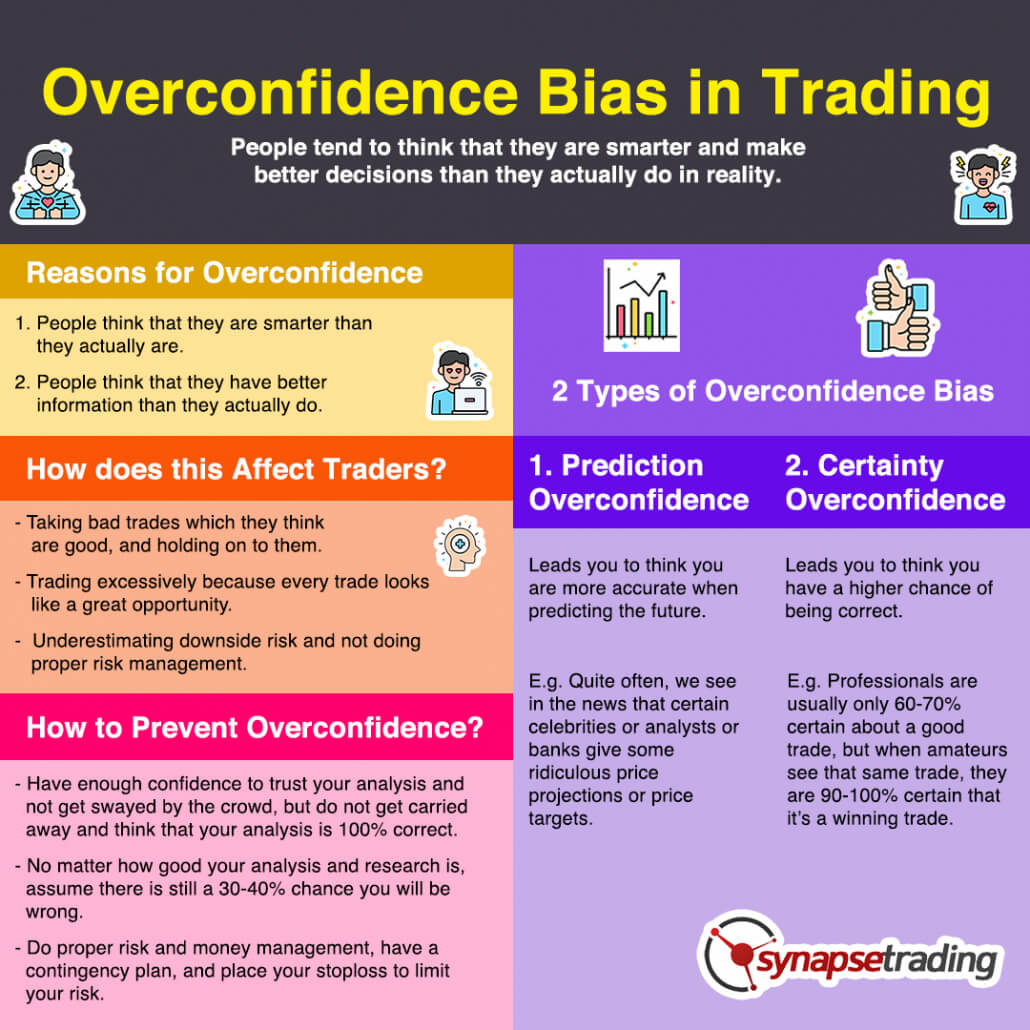

Overconfidence bias is the unwarranted faith in one’s intuitive reasoning, judgments, and cognitive abilities.

In other words, people tend to think that they are smarter and make better decisions than they actually do in reality.

“Too many people overvalue what they are not and undervalue what they are.” – Malcolm S. Forbes

Reasons for Overconfidence Bias

What leads to overconfidence bias?

Studies conducted have shown that people overestimate both:

- Their own predictive abilities and

- The precision of information that they have been given.

In the first instance, people think that they are smarter, while in the second instance, people think that they have better information than they actually do.

For example, someone might get a tip from a broker or read something off the internet, and based on that information, they are ready to take action, such as placing a trade, based on the perceived knowledge advantage.

If there is no logical basis for the advantage, then this perceived edge does not exist at all, despite what the trader thinks he knows.

In other words, they are overly-confident that the information they got is accurate and gives them an advantage, without taking the necessary measures to verify the accuracy of the information before acting on it.

In addition, people are poorly calibrated in estimating probabilities – events which they think are certain to happen are often less than 100% certain to happen.

Types of Overconfidence Bias

There are two kinds of overconfidence bias:

- Prediction overconfidence bias and

- Certainty overconfidence bias.

The latter leads you to think you have a higher chance of being right, while the former leads you to think of how accurately right you are.

Let’s look at how each type of behavioral bias affects your trading.

1. Prediction Overconfidence Bias

In prediction overconfidence bias, the confidence intervals that traders assign to their predictions are too narrow.

An example of this is when “experts” try to forecast precise price targets.

Quite often, we see in the news that certain celebrities or analysts or banks give some ridiculous price projections or price targets.

It is simply not possible to forecast with such accuracy.

Even for professional traders, they can only get an idea of the direction and some idea of magnitude, but no way is anyone going to be able to pinpoint exactly what price a particular stock is going to reach in a particular number of days.

That is prediction overconfidence, or most of the time, just fabricating numbers for attention.

b) Certainty Overconfidence Bias

In certainty overconfidence bias, traders are too certain of their judgments.

At the professional level, even when you find a good trade, you are at most 60-70% certain, and that is good enough to make you profitable in the long-run.

But when amateurs see that same trade, they become 90-100% certain that that is going to be a winning trade.

As a result of that overconfidence bias, amateurs think that every trade they enter is a “sure-win” trade, and they become blind to the prospect of a loss, and then feel disappointed or surprised that the trade performs poorly.

This also leads them to take larger positions, higher risk, and have no contingency plan or stoploss. After all, why would you need a stoploss if your trade is a “sure-win”?

How Does this Affect your Trading?

The dangers of overconfidence are numerous.

For example, if traders overestimate their ability to pick a winning trade, they become blind to warning signs or information that indicate that their decision was wrong.

This might make them enter bad trades or hold on to losing positions.

On the other hand, if traders believe they have special knowledge, they may also end up trading excessively.

Overconfidence can also cause traders to underestimate downside risk, and in worse cases not using a stoploss.

How to Prevent Overconfidence Bias?

Like I mentioned earlier, there is a fine line between confidence and overconfidence.

You need to have enough confidence to trust your analysis and not get swayed by the crowd, yet not get carried away and think that your analysis is 100% correct.

So no matter how good your analysis and research is, always assume that the edge you have is at most 60-70%, meaning there is still a 30-40% chance you will be wrong.

If you enter the trade with that mentality, you will still do your proper risk and money management, have a contingency plan, and place your stoploss to limit your risk.

This prevents you from succumbing to the overconfidence bias.

Always keep in mind that trading is a game of probabilities, and nothing is 100%.

Now that I have shared what the overconfidence bias is, how do you think it has affected your trading decisions?

Let me know in the comments below.

If you would like to learn more about trading psychology, also check out: “The Complete Guide to Investing & Trading Psychology”

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.