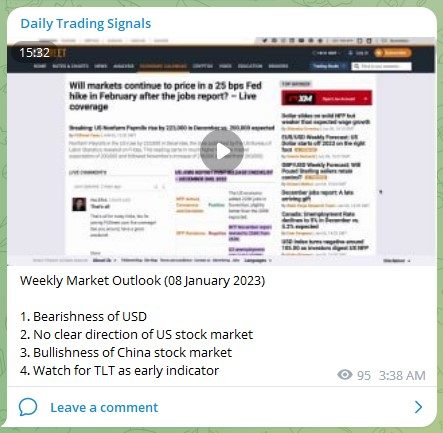

In last week’s NFP (non-farm payroll) report, the US added 517,000 jobs in January, higher than expected and pushing the unemployment rate down to 3.4%, its lowest since 1969.

Job growth was revised higher for November and December, adding an additional 71,000 jobs.

The strong job growth may not be welcomed by the Federal Reserve, which is looking to slow job gains and wage growth to reduce inflation and pause its interest rate hike campaign.

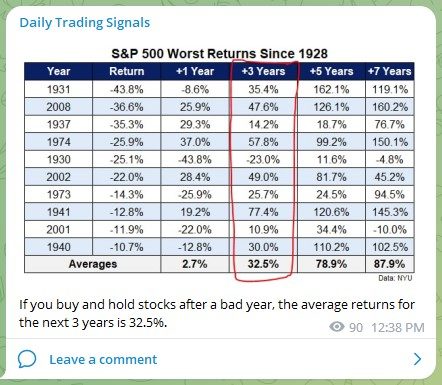

The Federal Reserve raised its interest rate target by 0.25% last week, and plans to continue raising rates with the aim of bringing inflation down to 2%.

However, investors believe the Fed may cut rates back to current levels by the end of next year.

The recent surge in crypto saw a rebound in Bitcoin and Ether by 51% and 47% respectively.

The shift in trading patterns shows a pullback from retail investors and a rise in the influence of institutions such as hedge funds.

The Big Tech Earnings Season saw a decline in revenue growth compared to 2021 with combined growth of only 7% for Apple, Amazon, Alphabet, Microsoft, and Facebook, compared to 28% in 2021.

The companies are engaged in significant headcount reductions, costing more than 50,000 jobs.

The time for a correction or pullback may be as soon as next week.

Stay tuned for more real-time updates in our “Daily Trading Signals” Telegram channel!

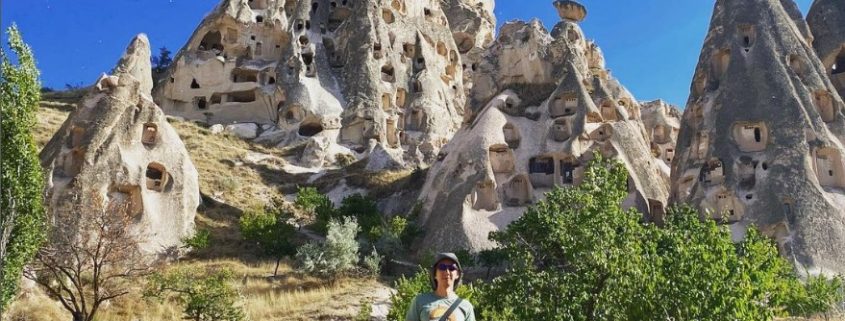

[Photo: Bukhara, Uzbekistan – See my full travel photo log!]

For our weekly market wrap, we go through some of the trade calls and analysis from last week, which gives us valuable insights for the week ahead.

We cover 3 main markets with a total of 200+ counters, so we will never run out of trading opportunities:

- Forex, CFDs, commodities, bonds

- US stocks, ETFs, global stock indices

- Cryptocurrencies, crypto indices

By covering a broad range of markets, we can focus our attention (and capital) on whichever market currently gives the best returns.

Weekly Market Outlook Video

Weekly Market Outlook (29 January 2023)

📌 Wednesday: FOMC

📌 Friday: NFP

Portfolio Highlights

Weekly Portfolio Updates (29 January 2023)

Not much changes, since the market has not moved much.

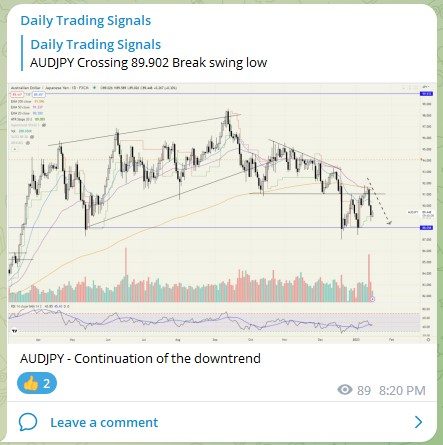

Forex & Commodities Market Highlights

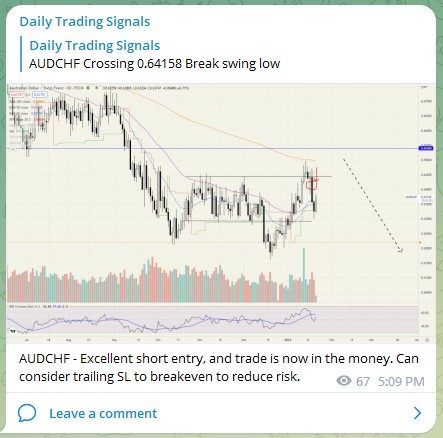

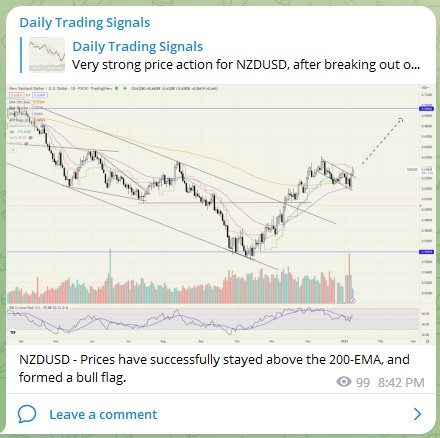

AUDCAD – rebounding off strong resistance, good for a short trade with SL above the prior swing high.

AUDCHF – Also another short trade after running into strong resistance.

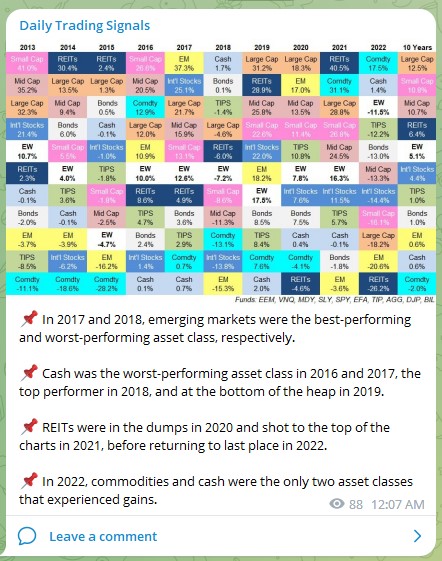

Stock & Bond Market Highlights

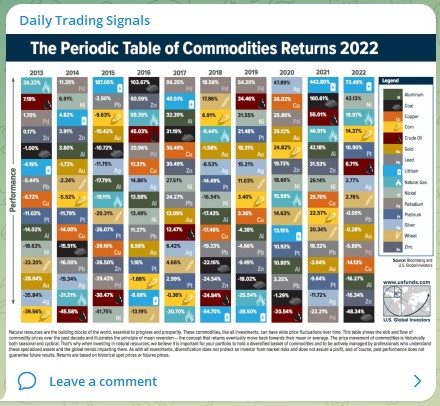

Stock sector comparisons for 2022

The Federal Reserve raised rates. Chair Powell says it’s ‘premature’ to declare victory against inflation.

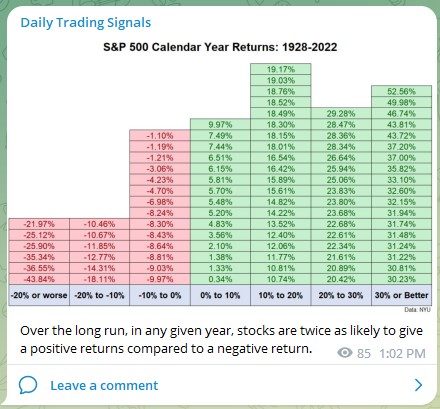

In 2007. the Fed and major banks were predicting a soft landing. We all know how that turned out. Will this time be different?

Wow quite a large deviation from expectations!

Wonder if this will lead to a more aggressive stance on rate hikes.

Traders have never been this bearish on Treasuries.

Crypto Market Highlights

ETHUSD Crossing 1694.81

Break swing high

(Charts posted in Telegram channel)

Good luck, and may next week bring more excellent profits!

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.