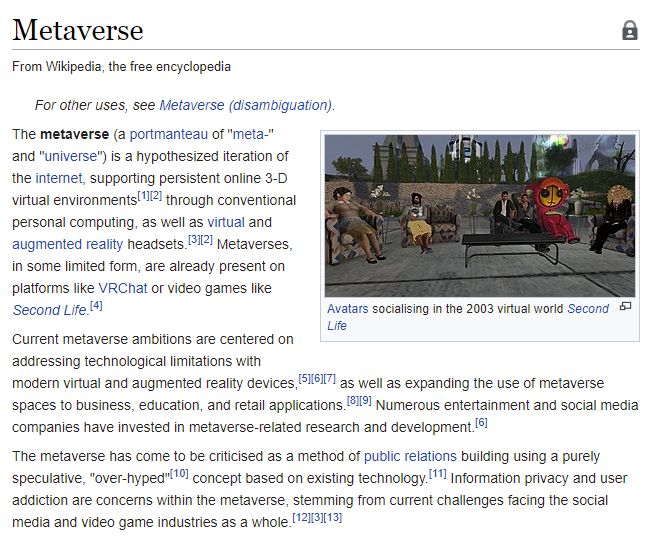

Seems like nowadays, everyone is talking about the Metaverse, and every company is following Facebook’s (now called Meta) lead in pivoting to a Metaverse company.

So what exactly is the Metaverse?

What is the Metaverse?

If you have watched movies/shows like “Ready Player One” or “Sword Art Online”, you will have a pretty good idea.

The origin of the term comes from science-fiction writer, Neal Stephenson, who coined the term “metaverse” in his 1992 novel “Snow Crash,” which envisions a virtual reality-based successor to the internet. In the novel, people use digital avatars of themselves to explore the online world, often as a way of escaping a dystopian reality.

In short, it is like creating a virtual world which mimics the actual world, so activities like socialising, learning, gaming, working which you normally do in the real world, can also be done in the virtual world.

By now, you probably get the idea that this is something big, judging by how every major company is looking to get a slice of the pie.

But the big question is, what is the best way to invest in the Metaverse?

If you are not an expert in the industry, it will be hard to pick the correct stocks that give the best exposure, and have the most potential.

So here are some easy ways to do it:

Metaverse Index for Stocks (META)

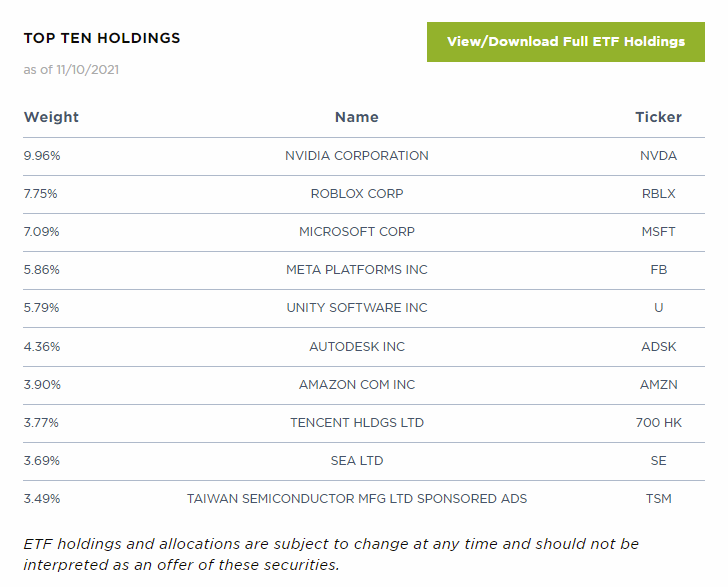

The first way to get exposure is to invest in stocks that are related to developing the Metaverse, and an easy way to do it is via an ETF (exchange-traded fund) which allows you get diversified exposure without needing to do much research.

Here is the current most popular ETF:

The Ball Metaverse Index is the first index globally designed to track the performance of the Metaverse. The Index consists of a tiered weight portfolio of globally-listed companies who are actively involved in the Metaverse.

Source: https://www.roundhillinvestments.com/etf/meta/

Metaverse Index for Crypto (MVI)

Besides stocks, there is another possibility that the Metaverse might develop independently in the crypto space, via DAOs or decentralised projects.

The metaverse is a broad term to define the ever-expanding virtual reality worlds where players can create an avatar, buy land, build experiences, import NFTs, and trade with other users. Here are some projects and tokens:

CUBE is the ERC-20 token native to Somnium Space, a virtual world that offers both community-led events and an in-game economy. CUBE can be used to purchase virtual assets and pay for goods and services in the metaverse. Participants can join via virtual reality (VR) headsets or mobile and web browsers.

MANA is the ERC-20 token used to pay for goods and services in Decentraland. In Decentraland, users connect and interact with each other, create content, and play games. It even has a virtual economy where users can monetize the content and applications they build.

SAND is the ERC-20 token used in The Sandbox virtual world. The Sandbox virtual world is made up of LAND – digital pieces of real estate – that players can buy, and on which they can build games and other virtual experiences.

So it makes sense to get some exposure to this as well.

The easiest way to do it is also via an “ETF”, which is not really an ETF but it is a token which mimics the performance of a variety of Metaverse-related projects.

Here is one such index:

The Metaverse Index (MVI) is designed to capture the trend of entertainment, sports and business shifting to take place in virtual environments.

Source: https://www.indexcoop.com/mvi

In conclusion, these are the 2 easiest ways to get exposure to both stocks and crypto in the Metaverse space, for people who do not want to spend too much time or effort doing rsearch.

If you interested to take it to the next level, then you can do more precise targeting by buying specific stocks and projects, but that will involve more research.