For subscribers of our “Daily Trading Signals”, we now also include a “Weekly Market Report”, where we provide a weekly deep-dive on the market, including fundamentals, technicals, economics, and portfolio management:

Click here for last week’s market report (10 July 2023)

Click here to subscribe for the latest market report (17 July 2023)

Click here to see the archives of all our past market reports

Market Recap & Upcoming Week

Last week, market watchers were eagerly anticipating the release of US inflation data, which was expected to provide a much-needed direction for future monetary policy decisions. Experts predicted a notable slowdown in both headline and core inflation, with a projected modest rise of 0.2% from May to June.

This projection represented the smallest potential increase in core inflation since last year and signified a potential turning point for policymakers as they grapple with managing rising costs against the Federal Reserve’s 2% target. Despite the anticipated inflation slowdown, the current rate still indicated a possible resumption of interest-rate hikes by the Federal Reserve.

In addition to the inflation data, the resilience of the economy was put under the spotlight last week, as recent jobs reports showcased solid wage growth and a healthy yet slightly lower than expected payroll increase.

The Federal Reserve’s track record of ten consecutive meetings with interest rate hikes led many to expect a continuation of this trend in the upcoming meeting on July 25-26. However, the potential easing in inflation data could have led to a pause in interest rate hikes, adding another layer of complexity to the economic forecast for the rest of the year.

The earnings season is set to intensify in the week ahead, with several heavy hitters from various industries slated to release their financial reports.

Investors will be keeping a close eye on results from major institutions such as Bank of America, Morgan Stanley, and Goldman Sachs, along with powerhouse corporations including Lockheed Martin, Tesla, Netflix, IBM, Johnson & Johnson, and United Airlines.

The market will be keen to see how these giants have fared amid the ongoing economic conditions, and the updates could trigger significant market movements. Furthermore, the financial health and outlook of these influential companies can provide invaluable insights into the broader economic landscape and future trends.

Economic data releases in the upcoming week promise to offer a wealth of information on the global economy’s health.

In the U.S., the focus will be on the retail sales data for June released by the Census Bureau, shedding light on consumer spending patterns amid fluctuating inflation and employment dynamics. Additionally, several housing market indicators, including building permits, housing starts, and existing home sales for June, along with the NAHB’s Housing Market Index, will provide insight into the state of the U.S. real estate market.

International attention will be directed towards the latest inflation readings from the U.K., eurozone, and Japan, which will be closely monitored by investors and policymakers for signs of inflationary trends outside the U.S.

Daily Trading Signals (Highlights)

We cover 3 main markets with a total of 200+ counters, so we will never run out of trading opportunities:

- Forex, CFDs, commodities, bonds

- US stocks, ETFs, global stock indices

- Cryptocurrencies, crypto indices

By covering a broad range of markets, we can focus our attention (and capital) on whichever market currently gives the best returns.

Subscribe for real-time alerts and weekly reports:

👉🏻 https://synapsetrading.com/daily-trading-signals

GBPUSD – Following up on this, we are up by 700+ pips profit, and very near to our TP!

Congrats to all those who took this trade! 💰🔥💪🏻

USDCHF – Following up on this, it has hit and even exceed our 2nd TP! 💰🔥💪🏻

Congrats to those who held on!

Palantir (PLTR) – Following up from the video, prices have rebounded off the strong support!

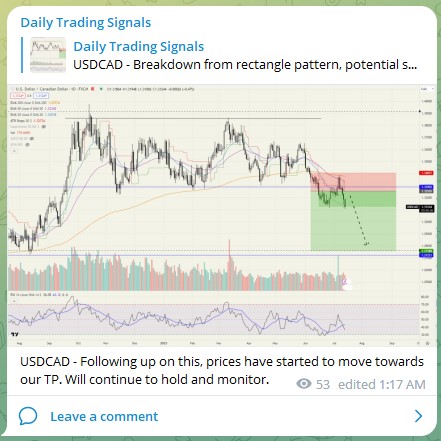

USDCAD – Following up on this, prices have started to move towards our TP. Will continue to hold and monitor.

USDSGD – Unfortunately, prices did not trigger the upside breakout, and instead broke to the downside. This is why patience is important before entering a trade.