If you listen frequently to the mainstream media, or take advice from friends and family who are not traders themselves, they might give some good-intentioned but ill-informed advice, which could harm your trading results.

Such dangerous myths about trading might seem to be “common knowledge” because they keep getting repeated frequently, but have you stopped to consider whether they are really true?

Here are some common myths:

- Trading is very risky because you can lose all your capital

- Forex is more risky than stocks

- Leverage increases your risk

- You need a lot of capital to start trading

- You need to trade very often if you want to make more money

- You need to monitor prices and charts 24/7

- Brokers are out to hunt your stoploss

Do these sound familiar?

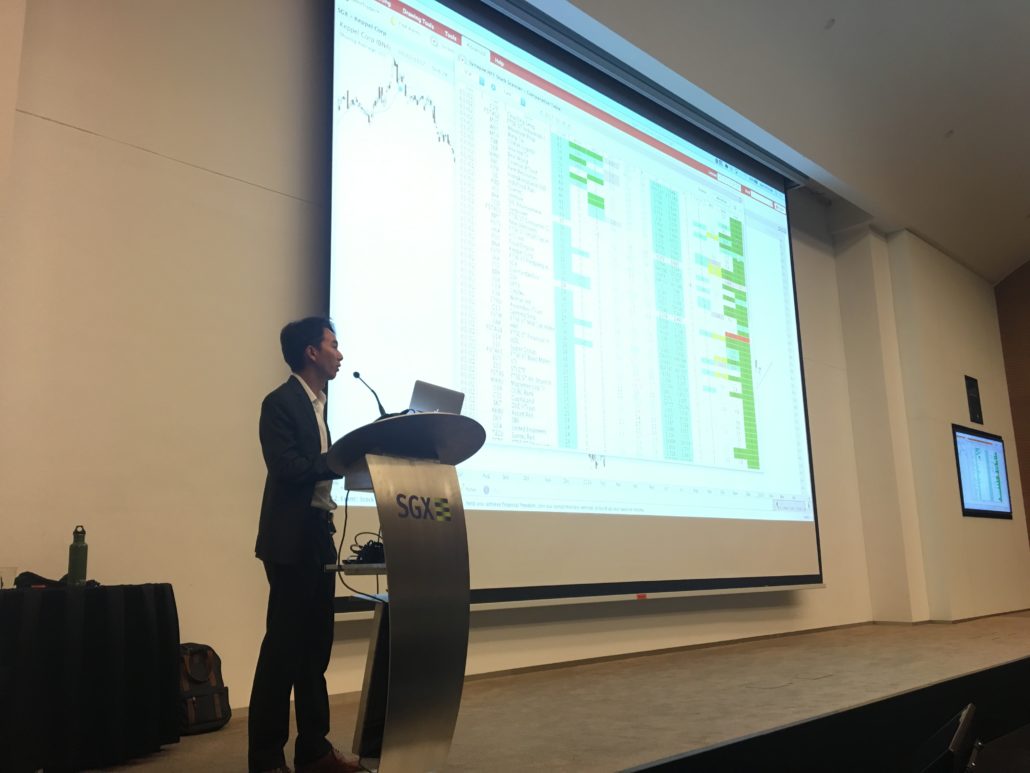

Today, I will tackle 3 of the most common myths.

MYTH #1: TRADING WITH LEVERAGE INCREASES YOUR RISK

(Reality: Trading with leverage reduces capital required, but risk can be kept the same.)

The media handles the idea of leverage very poorly, because it often sensationalizes the trader who over-leverages and blows everything.

The idea is simple: I have $100, and I leverage so that I can trade $500 or $1000 of stock/forex. I make one bad trade, and I’m wiped out.

This is true for the person without proper risk-management. After all, the temptation of leverage is to dump all your money into one trade, max out the leverage, and hopefully you make 500% on one trade and can call it a day. The truth is, these lucky trades do happen in reality. Eventually though, the trader with his newfound wealth (and greed), piles his money into another trade, and loses everything.

Leverage kills the person who abuses it. It’s like fire; it can cook food for people, or it can kill people.

Leverage, in practice, actually keeps you disciplined. In forex trading, using leverage is actually a standard practice. When you use leverage, you are actually committing less margin to a trade, and you can get comfortable with trading by committing as little margin as possible. Here’s what I mean:

For example, suppose you have a stop loss of -$10 and a target profit of +$30, and you make a trade of unknown size X.

1:100 leverage – Margin committed for X lots = $102.50 (I’m making this up)

1:500 leverage – Margin committed for X lots = $20.50 (five times smaller)

In the case of higher leverage, you stay comfortable because even though the stop loss is -$10, you see that the margin committed on your account is only $20.50. This allows you to not have to see the wild fluctuations in margin requirement, and keep your trading size small.

Also, trading with higher leverage allows you to take multiple positions with little capital. With as little as $500, you can take 3-5 forex positions with leverage, risking anywhere from $5 to $20 or so for each trade. This is a great way to start for aspiring forex traders.

MYTH #2: BROKERS ARE OUT TO HIT YOUR STOP LOSSES

(Reality: You get stopped out because of the market, not because of the broker.)

Many people who have been trading for some time get convinced that the broker wants them to be stopped out of their positions. I’ve heard of this and seen it happen: the trade hits your stop loss, then immediately goes in your favour and flies in the direction you want, and then you beat yourself up and say “I was supposed to make $XYZ on this trade but I got stopped out because of the stupid broker!”

The truth is, the broker has better things to do than to keep hunting the stoploss on your account.

At least, this is for brokers who want to remain in business over the long-term. How do brokers make money? They make money only if you keep trading. Why would any broker want you to stop trading? They would actually want you to be profitable, because for every trade you make, they get a small cut from the spread (also known as the bid-ask spread). Essentially, they want you to love trading and trade so much and so often that they get large revenues from spreads.

Why in the world would the broker want to stop you out?The reason why we get stopped out, is because we are bad traders.

Professionals are buying or selling exactly where your stop loss is placed, because they know that the average investor would place their stop loss there.

The solution to not getting stopped out, is to first acknowledge that trading involves some positions getting stopped out. Being right 40-50% of the time is already sufficient for you to be profitable, so don’t be surprised if half your positions get stopped out.

One example is a sideways market. Beginners love to enter on sideways markets because it presents many signals in both directions. However, professionals are buying and selling at the extremes of the sideways markets, causing beginners to get stopped out repeatedly, while professionals make money repeatedly.Remember that there is another trader on the other side who is filling your order; if you are losing money, it is because someone else is taking money from your account, and putting it in their account.

MYTH #3: FOREX IS MORE RISKY THAN STOCKS

(Reality: Risk is independent on the product, and forex actually requires less capital.)

In the forex market, you can ‘get a feel of the game’ by risking a few dollars per trade. By trading the smallest lot size (0.01 lots), you can easily make many trades and rack up trading experience by “trading live” without incurring hefty losses. By learning to make many decisions and experiencing all the different conditions of the market, you would become seasoned enough to trade a bigger size, and fine-tune your own trading strategy to become profitable in the long-run.

Many traders discover they have certain characteristics about themselves that hinder success. In trading a ‘live’ account with a small sum of money, they are putting in some skin in the game, and getting used to the ups and downs of their account. The best part about forex is that there are no fixed commission charges (stocks tend to have a fixed minimum fee regardless of trade size), making the ‘tuition’ fees a lot less than trading in stocks.

Another great thing about forex is that thee market is open 24/7 on weekdays, so you can decide when to trade based on your schedule. That helps people who have busy working schedules: trading in the middle of the night, or during lunch, on a daily basis, works out to a trading schedule that accommodates your lifestyle needs.

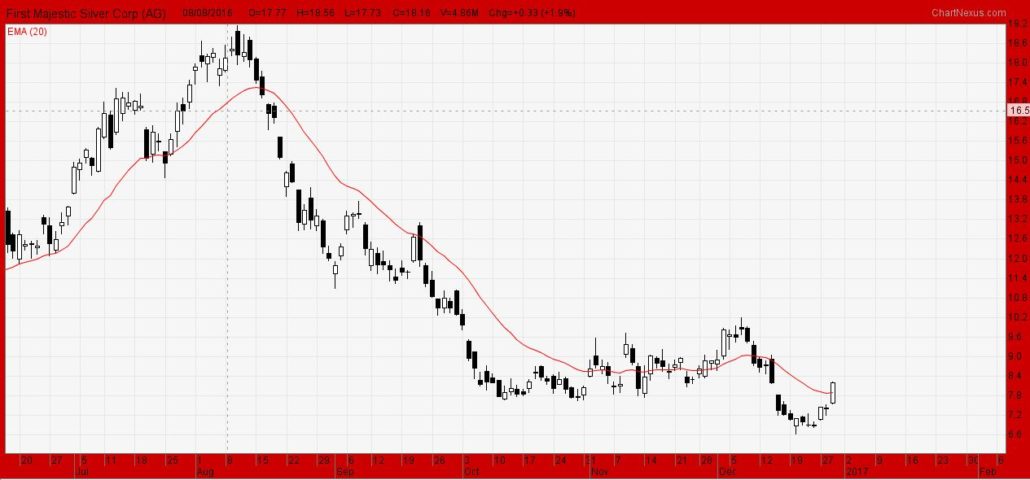

Lastly, with regards to price movements, stocks tend to see bigger gaps between days. Here’s what I mean:

Forex pairs/currency futures tend to have less gaps between bars; bars close and open at roughly the same price.

Forex pairs/currency futures tend to have less gaps between bars; bars close and open at roughly the same price.

Most stocks have gaps between the candlesticks/bars, due to the opening and closing of the market every day.

Most stocks have gaps between the candlesticks/bars, due to the opening and closing of the market every day.

Gaps make the analysis a little more complex, because you have to take into account the size of the gap along with the actual candlestick printed on the chart. Forex allows you to employ technical analysis more simply, and learn how to read price action without the distraction of having to figure out what the gap means.