Weekly Market Wrap: When Will the Fed start Cutting Rates?

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

Currently, there is a potential clash between investors’ hopes for the Federal Reserve (Fed) to cut interest rates and the Fed’s current stance that it is too early to consider such action.

This has caused uncertainty in financial markets for 2023.

Many investors believe that inflation has peaked and that price pressures will fall quickly, leading the Fed to cut rates by the end of the year, as they did in 2019.

However, Fed officials have stated that the current inflation rate is higher than in previous years and therefore, this time will be different.

Despite the slower pace of inflation in December, evidence of inflation pulling back has fueled bets that the Fed will cut rates as early as the second half of the year.

Traders in interest-rate derivatives markets see a high chance of the Fed raising rates twice more this year and then cutting at least once by December.

However, Fed officials have projected that interest rates will continue rising through the spring and have not planned for cuts this year.

The Fed is concerned that a strong labor market could sustain wage growth and keep inflation above their 2% target.

Investors are at risk of being incorrect if they believe interest rates will fall.

The S&P 500 and government bonds have risen but there are concerns that Fed policy could be tougher than expected, leading to a potential decline in the economy and market.

The disconnect between the Fed and investors is caused by differing views on the rate of inflation decline.

For real-time trading signals and daily updates, join our “Daily Trading signals” Telegram channel!

[Photo: Brokenheart Mountain, Kyrgyzstan – See my full travel photo log!]

For our weekly market wrap, we go through some of the trade calls and analysis from last week, which gives us valuable insights for the week ahead.

We cover 3 main markets with a total of 200+ counters, so we will never run out of trading opportunities:

- Forex, CFDs, commodities, bonds

- US stocks, ETFs, global stock indices

- Cryptocurrencies, crypto indices

By covering a broad range of markets, we can focus our attention (and capital) on whichever market currently gives the best returns.

Table of Contents

Weekly Market Outlook Video

Weekly Market Outlook (08 January 2023)

1. Bearishness of USD

2. No clear direction of US stock market

3. Bullishness of China stock market

4. Watch for TLT as early indicator

Portfolio Highlights

Weekly Portfolio Updates (08 January 2023)

Not much changes.

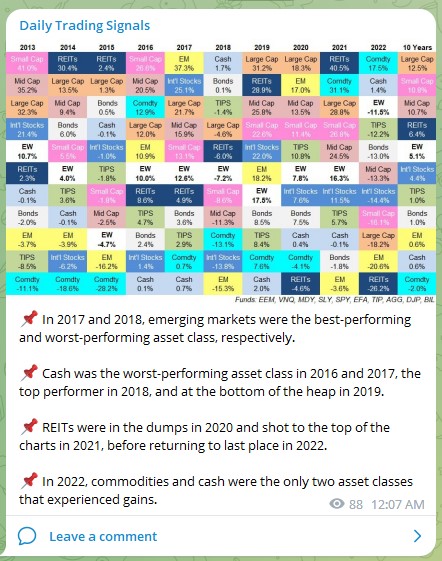

📌 In 2017 and 2018, emerging markets were the best-performing and worst-performing asset class, respectively.

📌 Cash was the worst-performing asset class in 2016 and 2017, the top performer in 2018, and at the bottom of the heap in 2019.

📌 REITs were in the dumps in 2020 and shot to the top of the charts in 2021, before returning to last place in 2022.

📌 In 2022, commodities and cash were the only two asset classes that experienced gains.

📌 8 out of the 10 tracked asset classes had ….

Check out this free video breakdown of the various asset classes:

Forex & Commodities Market Highlights

USDCNY – Congrats on hitting the profit target! 💰🔥💪🏻

Momentum is still strong, so can consider taking half profits and trailing the rest.

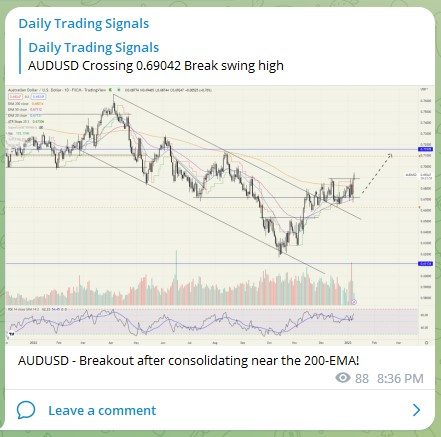

AUDUSD – Breakout after consolidating near the 200-EMA!

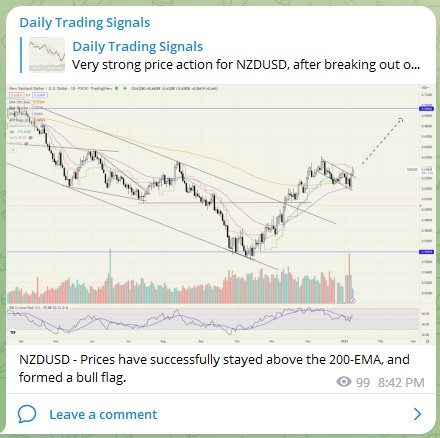

NZDUSD – Prices have successfully stayed above the 200-EMA, and formed a bull flag.

USDJPY – Prices are now in a downtrend channel

CHFJPY – Excellent shorting opportunity!

Stock & Bond Market Highlights

Global REITs (REET) – Could this be the start of a major bullish reversal?

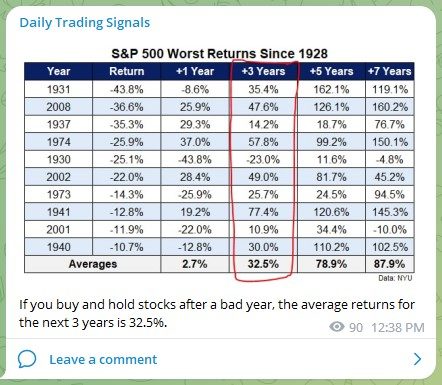

If you buy and hold stocks after a bad year, the average returns for the next 3 years is 32.5%.

Good luck, and may next week bring more excellent profits!

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!