Weekly Market Wrap: FTX Crash, Lower Inflation, Fed Pivot?

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

This week was a crazy week, which saw the collapse of FTX, one of the largest crypto brokerages.

This will likely have more domino-effect impact on various crypto markets in the weeks to come, and not in a good way.

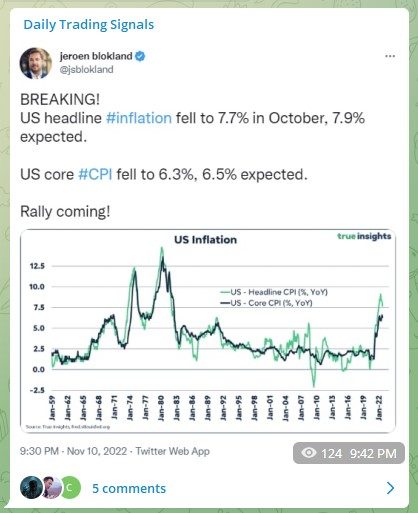

On the plus side, the recent CPI data shows a slowing of inflation, which caused stock markets to spike and the USD to plunge.

Is this sufficient for a Fed pivot (or at least a slow in rate hikes), which could hint at a market bottom?

Find out in my “weekly market outlook” video tomorrow, which I will post in my Daily Trading Signals private Telegram channel!

[Photo: Dushanbe, Tajikistan – See my full travel photo log!]

For our weekly market wrap, we go through some of the trade calls and analysis from last week, which gives us valuable insights for the week ahead.

We cover 3 main markets with a total of 200+ counters, so we will never run out of trading opportunities:

- Forex, CFDs, commodities, bonds

- US stocks, ETFs, global stock indices

- Cryptocurrencies, crypto indices

By covering a broad range of markets, we can focus our attention (and capital) on whichever market currently gives the best returns.

Table of Contents

Weekly Market Outlook Video

Weekly Market Outlook (07 November 2022)

CPI data on 10 Nov is expected to be the main market mover this week, best not to take any major positions ahead of this news.

Portfolio Highlights

Weekly Portfolio Update (07 November 2022)

Largest position is now short-term T-bills, which are giving 4+% risk-free returns.

Forex & Commodities Market Highlights

USDSGD Crossing 1.40143

Break swing low

WTICOUSD Crossing 85.061

Crude Oil

Break swing low

Stock & Bond Market Highlights

ARK Innovation ETF (ARKK) which represents high growth tech stocks broke new lows yesterday, putting it now at a major support level.

IF this level breaks, it will be hitting lows last seen in 2017. Not looking good.

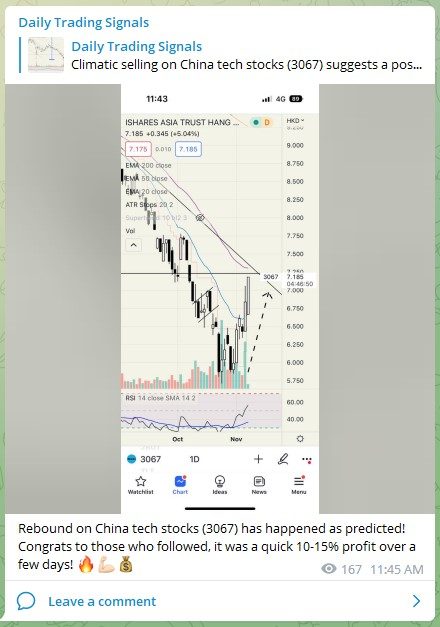

Rebound on China tech stocks (3067) has happened as predicted! Congrats to those who followed, it was a quick 10-15% profit over a few days! ????

BREAKING!

US headline #inflation fell to 7.7% in October, 7.9% expected.

US core #CPI fell to 6.3%, 6.5% expected.

Rally coming!

Layoffs announced in the last day:

– Lyft 13% of workers

– Opendoor 18%

– Stripe 14%

– Chime 12%

– Twitter 50%

– Morgan Stanley (% unknown)

—-

Delivery Hero is laying off as we speak. Don’t have numbers yet. Also, Pleo (expense management) let go 15% of staff.

Lyft, Stripe, CloudKitchens all doing layoffs today. OpenDoor, Chime, Dapper Labs, Gem, MessageBird, Kry this week.

Source: Twitter (GergelyOrosz, GRDecter)

Compared to a month ago, the expected peak interest rate has gone up, but the duration to the peak has shifted from 2.5yrs to 1yr.

This suggests they are expecting the Fed to aggressively hike so the peak can be reached faster, but the peak keeps getting higher.

Crypto Market Highlights

Bitcoin (BTCUSD) and Ethereum (ETHUSD) having huge selldowns after the FTX fiasco.

There is likely a lot more selling/iquidations/margin calls coming up, so it is better not to try and catch the falling knife at this point.

Summary of the whole saga: https://newsletter.banklesshq.com/p/the-shocking-collapse-of-the-ftx

Good luck, and may next week bring more excellent profits!

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!