For subscribers of our “Daily Trading Signals”, we now also include a “Weekly Market Report”, where we provide a weekly deep-dive on the market, including fundamentals, technicals, economics, and portfolio management:

Click here for last week’s market report (04 September 2023)

Click here to subscribe for the latest market report (11 September 2023)

Click here to see the archives of all our past market reports

Market Recap & Upcoming Week

Last week saw a discernible shift in economic tides, particularly visible in the jolt in interest rates shaking the post-pandemic market landscape.

The Federal Reserve noted a sharp rise in rates, witnessing a stark ascent to between 5.25% and 5.5%, a scenario contrasting sharply with the average 0.5% observed from 2009 to 2021. While this phenomenon signals promising yields for retirees gravitating towards traditionally safer investments, a cloud hangs over corporates and individuals bracing for heightened costs in refinancing and credit services.

Moreover, the public and private sectors are threading carefully amidst potential vulnerabilities, including an impending significant proportion of federal debt maturing in a short span and the tremors felt by some regional banks teetering on collapse.

On the global stage, last week bore witness to concerted efforts by the Chinese government to rejuvenate its languishing property sector, a move that paid dividends as indicated by the uptick in Chinese stock indexes; the Shanghai Composite Index and Hong Kong’s Hang Seng Index both charted positive territories with gains of 1.4% and 2.5% respectively.

In parallel, the international markets were attuned to the repercussions of abrupt oil production cuts initiated by Saudi Arabia and Russia, a strategy that propelled diesel prices to spiral over 40% in the U.S. and Europe since May. Europe found itself in a tight spot, grappling with the dual challenges of sanction repercussions post the Ukraine invasion and a heightened dependency on Russian oil resources.

The ramifications of these oil cuts echoed in the trading circles, with a notable surge in trading activities around diesel and a piqued interest in heating-oil futures. Traders and consumers alike would have been wise to keep a close eye on these developments, which hint at a potentially challenging road ahead punctuated with inflated consumer and transportation costs.

For next week, all eyes will be trained on the forthcoming inflation readings for August, a significant indicator of the economic trajectory as we navigate the latter half of 2023.

Investors and market spectators alike will be keen to parse through the details of last month’s retail sales figures, a vital marker for economic health, particularly in assessing consumer confidence levels amidst fluctuating market dynamics.

Adding another layer to the economic narrative, the European Central Bank (ECB) is slated to announce its interest rate decision, a verdict that holds considerable sway in determining the economic policy landscape in Europe.

Simultaneously, the tech industry is abuzz with anticipation as we approach Apple’s annual fall event, an occasion that has historically been the birthplace of several groundbreaking products and innovations. Enthusiasts and professionals alike are holding their breaths for what is expected to be a reveal of Apple’s latest line of products, potentially setting new benchmarks in technological innovation.

Daily Trading Signals (Highlights)

We cover 3 main markets with a total of 200+ counters, so we will never run out of trading opportunities:

- Forex, CFDs, commodities, bonds

- US stocks, ETFs, global stock indices

- Cryptocurrencies, crypto indices

By covering a broad range of markets, we can focus our attention (and capital) on whichever market currently gives the best returns.

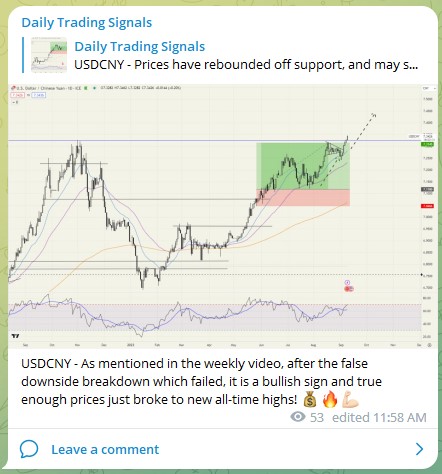

USDCNY – As mentioned in the weekly video, after the false downside breakdown which failed, it is a bullish sign and true enough prices just broke to new all-time highs! 💰🔥💪🏻

Commodities ETF (DBC) – Following up, nice strong breakout as predicted! 💰🔥💪🏻

AUDUSD – After breaking down from the bear flag, prices look poised to head lower.

GBPUSD – Prices breaking new lows after breaking down from descending triangle.

Subscribe for real-time alerts and weekly reports:

👉🏻 https://synapsetrading.com/daily-trading-signals

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.