Weekly Market Wrap: Is this Finally a New Bull Market?

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

Investors’ views on inflation, recession risk, and monetary policy were fickle throughout much of 2022.

Recently, a positive bias has emerged, reflected in the downward shift in interest rate expectations and upward move in securities prices since mid-October.

Investors appear to be interpreting economic data as evidence that a dovish pivot (Fed stopping interest rate hikes and possibly cutting them) is imminent.

Bad news (slowing job growth, dismal economic survey data, falling property values, negative real wage growth) is seen as good news when viewed through the lens of inflation and monetary policy.

But what is missing in this discussion is the real economy and what may have to happen to it for this market narrative to play out.

The dovish pivot narrative is driven by the expectation that U.S. inflation will continue to decline at a fairly rapid rate.

However, it’s also noteworthy that the Fed’s success in slowing inflation thus far has occurred while China, the world’s second-largest economy, has been hampered by pandemic-related restrictions.

The Fed is typically prone to keeping policy either too tight or too loose for too long.

Fed officials only have to look back at “the great inflation” of 1965 to 1982 to see what can happen when policy is loosened too quickly.

The market’s optimism could make it more likely that the Fed keeps tightening policy.

So, all things considered, the risk of over-tightening seems to be higher than the likelihood of a premature pivot.

What would cause the Fed to make a significant shift in policy?

Most likely a meaningful recession or market crisis – risks that aren’t being reflected in today’s earnings expectations or credit spreads.

Investors are focusing far more on what negative economic data means for interest rates than the potential implications for the real economy.

Join our “Daily Trading Signals” for real-time trading opportunities!

[Photo: Lake Aydarkul, Uzbekistan – See my full travel photo log!]

For our weekly market wrap, we go through some of the trade calls and analysis from last week, which gives us valuable insights for the week ahead.

We cover 3 main markets with a total of 200+ counters, so we will never run out of trading opportunities:

- Forex, CFDs, commodities, bonds

- US stocks, ETFs, global stock indices

- Cryptocurrencies, crypto indices

By covering a broad range of markets, we can focus our attention (and capital) on whichever market currently gives the best returns.

Table of Contents

Weekly Market Outlook Video

Weekly Market Outlook (22 January 2023)

- CNY week will see slow markets

- Watch out for tech layoffs and earnings

Portfolio Highlights

Weekly Portfolio Updates (22 January 2023)

Not much changes, since the market has not moved much.

Forex & Commodities Market Highlights

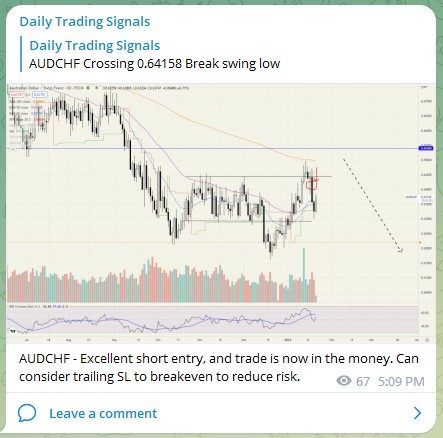

AUDCHF – Excellent short entry, and trade is now in the money. Can consider trailing SL to breakeven to reduce risk.

EURAUD – Great entry near the support level, and the trade is now in the money. Can continue to hold for more profits since the trend is still bullish.

EURCHF – Excellent entry near support, after pulling back from an ascending triangle breakout.

USDJPY (H4 chart) – Congrats to those who managed catch this short!

Gold (XAUUSD) – Still going strong, after some small profit-taking. I have circled the previous buying/consolidation points.

Probably heading up to test the previous swing highs.

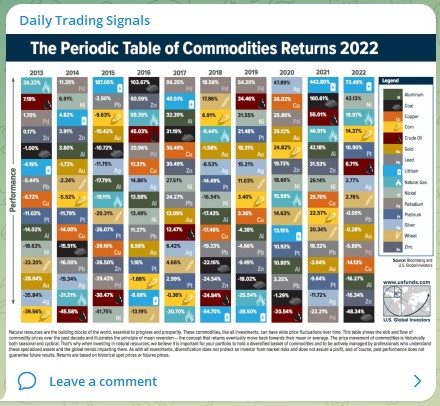

The Periodic Table of Commodities Returns 2022

Stock & Bond Market Highlights

S&P 500 (US500) – The major trendline is back in play, after the recent rally failed to break past it.

If it takes out the previous swing low (~3750), then the bears will start stepping in full force and we will probably see new lows.

Now that we are more or less certain that inflation is coming down, the next major concern is slowing growth and worse company earnings.

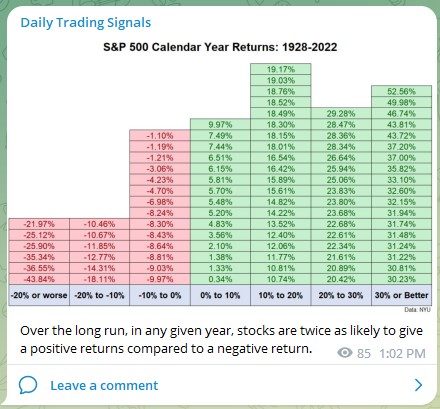

S&P 500 Calendar Year Returns: 1928-2022

200,000+ laid off in tech since the beginning of 2022. And for no reason other than “everyone else is doing it”.

Tech workers need a union.

Crypto Market Highlights

Bitcoin (BTCUSD) – After an impressive rally the last few weeks, prices are now consolidating.

If prices can break out of the small bull flag, this could spark more buyers coming in and start an uptrend.

However, if volumes falter, then traders could end up taking the chance to dump their holdings on this rally.

Good luck, and may next week bring more excellent profits!

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!