Weekly Market Wrap: Market Rebound on Higher Inflation Data??!!!

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

Last week, all eyes were on the CPI (Consumer Price Index) data, because if inflation does not slow down, it suggests that the measures taken so far are insufficient, then there is a high chance that the Fed will continue raising rates more aggressively (which is bad for markets).

As markets drifted downwards, we continued to manage our shorts, and take profits on our open positions. I also advised to rotate out of USD to SGD, since there might be a weakening of USD.

Surprisingly, even though the CPI was much higher than expected, prices behaved erratically, by first plunging, then recovering and closing up. Thus it is possible that markets have been oversold and much has been priced in.

Now, how should we approach such a market, especially ahead of the rate hikes coming in about 2-3 weeks?

Stayed tuned for my Weekly Market Outlook video in the Daily Trading Signals Telegram channel!

[Photo: Yurt Camping, Kyrgyzstan – See my full travel photo log!]

For our weekly market wrap, we go through some of the trade calls and analysis from last week, which gives us valuable insights for the week ahead.

We cover 3 main markets with a total of 200+ counters, so we will never run out of trading opportunities:

- Forex, CFDs, commodities, bonds

- US stocks, ETFs, global stock indices

- Cryptocurrencies, crypto indices

By covering a broad range of markets, we can focus our attention (and capital) on whichever market currently gives the best returns.

Table of Contents

Weekly Market Outlook Video

Weekly Market Outlook (10 October 2022)

? More rate hikes coming on 2nd Nov? CPI release on 13 October.

? Long-term bearish for stocks, crypto, REITs, commods, etc. Slightly in the money now, continue to add more short positions on pullbacks.

? Long-term bullish for USD

Portfolio Highlights

Weekly Portfolio Update (11 October 2022)

Reinstated short positions on stocks, crypto, REITs. Bought some short-term fixed income products to generate yield in the short/medium-term while waiting for buying opportunities.

Forex & Commodities Market Highlights

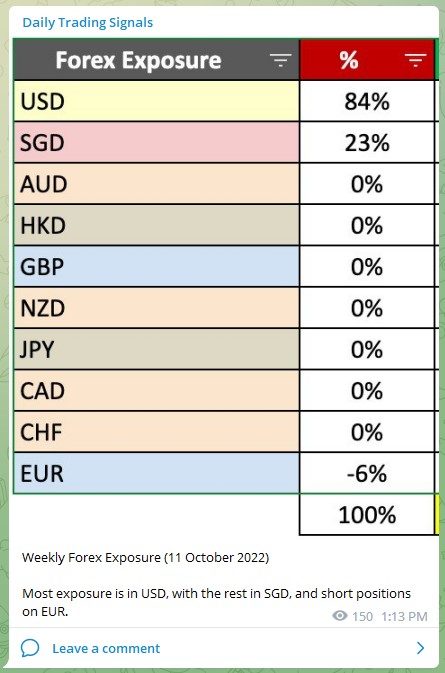

Weekly Forex Exposure (11 October 2022)

Most exposure is in USD, with the rest in SGD, and short positions on EUR.

NZD is weak against the USD, and NZDUSD has formed a bear flag and is continuing to head downwards.

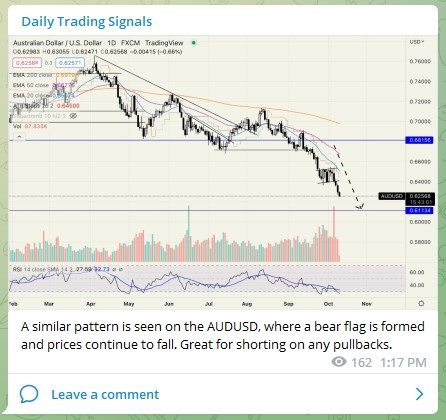

A similar pattern is seen on the AUDUSD, where a bear flag is formed and prices continue to fall. Great for shorting on any pullbacks.

MAS might take steps to strengthen the SGD, which will cause the USDSGD to fall.

Technicals-wise, there is strong resistance at the 1.44 level, with price getting rejected twice at that level.

The RSI is also turning down from an overbought region.

There might be a correction, so I am reducing my USD exposure.

Gold (XAUUSD) continues to be bearish, as the Fed continues to hike rates to push inflation down. Gold is a leading indicator of inflation.

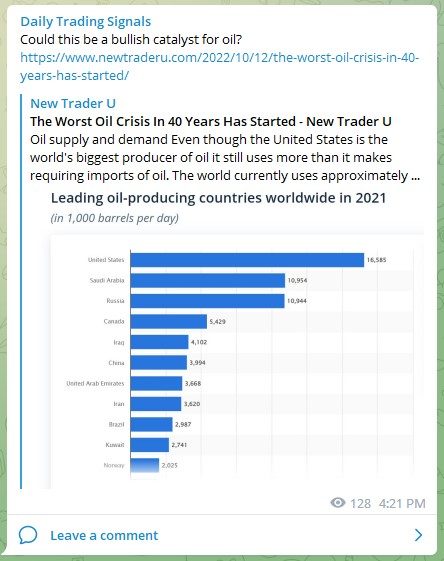

Could this be a bullish catalyst for oil? https://www.newtraderu.com/2022/10/12/the-worst-oil-crisis-in-40-years-has-started/

Stock & Bond Market Highlights

Global Inflation Rates

? Simple guide for those who have been asking me how to buy T-bills for 4% yield. (You might want to bookmark it.)

(Check out the full guide in our Daily Trading Signals Telegram channel.

‘It’s the interest-rate outlook determining the equity market, and the key to the interest-rate outlook is the labor market.’

https://www.wsj.com/articles/global-stocks-markets-dow-update-10-07-2022-11665139154

More bad earnings to come? https://www.wsj.com/articles/a-jittery-stock-market-heads-into-earnings-season-11665258248

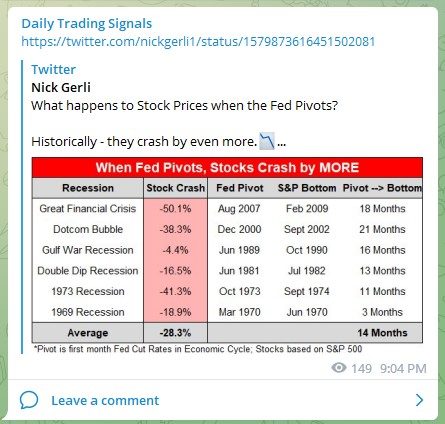

What happens to Stock Prices when the Fed Pivots?

Historically – they crash by even more.?

Over the last 6 Major Recessions, Stocks Crashed an average of 28% AFTER the Fed did 1st Rate Cut.

Taking another 14 Months to get to the "Bottom". pic.twitter.com/raiUpZ9OD6

— Nick Gerli (@nickgerli1) October 11, 2022

Crypto Market Highlights

After a long wait on my shorts, Ethereum (ETHUSD) is finally breaking down! ?

Good luck, and may next week bring more excellent profits!

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!