Weekly Market Wrap: Nuclear Threat Reminiscent of Cuban Missile Crisis

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

[Photo: Former nuclear missile base in Ukraine – See my full travel photo log!]

For our weekly market wrap, we go through some of the trade calls and analysis from last week, which gives us valuable insights for the week ahead.

We cover 3 main markets with a total of 200+ counters, so we will never run out of trading opportunities:

- Forex, CFDs, commodities, bonds

- US stocks, ETFs, global stock indices

- Cryptocurrencies, crypto indices

By covering a broad range of markets, we can focus our attention (and capital) on whichever market currently gives the best returns.

Table of Contents

Forex Market Highlights

In this risk-off mode, people are moving back to safe haven assets.

EURJPY – Congrats to those who took the pullback opportunity to enter the trade, netting a profit of 200+ pips! ????

Can consider taking profits now after such a climatic move.

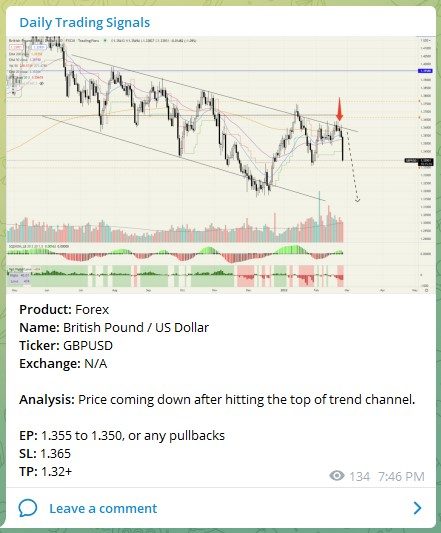

Product: Forex

Name: British Pound / US Dollar

Ticker: GBPUSD

Exchange: N/A

Analysis: Price coming down after hitting the top of trend channel.

EP: 1.355 to 1.350, or any pullbacks

SL: 1.365

TP: 1.32+

Following up on the USDSGD, it is starting to move up again. The previous price dip was a good buying opportunity, as prices stayed above the SL.

Commodities Market Highlights

Following up on Crude oil, it has gone past $100 as predicted, and the momentum is very strong due to fundamental factors.

It’s a trade-off, depending on your risk preference. Shorting earlier has lower success rate but higher RR, while waiting for more confirmation has higher success rate but lower RR.

Product: Commodities

Name: Gold (spot)

Ticker: XAUUSD

Exchange: N/A

Analysis: Due to the risk-off climate, the price of gold has spiked up significantly, and is looking to surpass the $2000 level soon.

EP: Buy on any pullbacks

SL: $1875

TP: $2070++

Stock Market Highlights

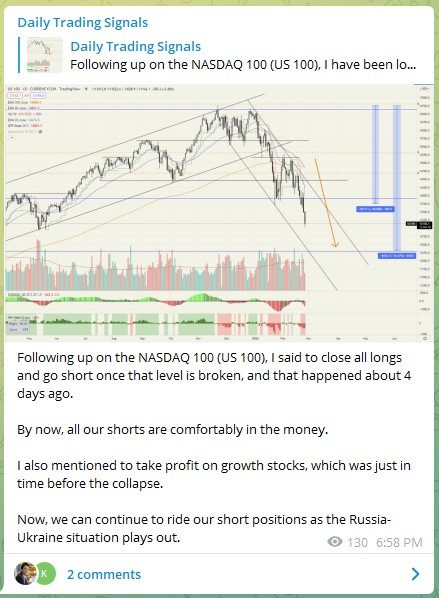

Following up on the NASDAQ 100 (US 100), I said to close all longs and go short once that level is broken, and that happened about 4 days ago.

By now, all our shorts are comfortably in the money.

I also mentioned to take profit on growth stocks, which was just in time before the collapse.

Now, we can continue to ride our short positions as the Russia-Ukraine situation plays out.

Looking at the chart of the NASDAQ, the downtrend is still in progress, and I don’t really see any bullish catalysts at the moment.

Even if Russia calls off the attack, the market was already bearish before that, because of inflation, interest rates, Covid, etc.

Crypto Market Highlights

Following up on Bitcoin (BTCUSD), it unexpectedly was not able to hold the $40k price level, but the uptrend is still intact, so I will be watching to see where this pullback ends.

Click here to receive all these signals in real-time for only $67 a month! You will get several signals a day, and even taking just 1 trade the whole month can easily cover the fee, so what are you waiting for?

Good luck, and may next week bring more excellent profits!

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!