Have you faced a market where there are large price swings and high volatility? How do you profit from such markets?

The expanding triangle pattern is one such example, where buyers and sellers fight for control, until one side capitulates and the other side takes control of the market.

While this fight is going on, there are several ways to take advantage and profit from these large price movements, either by trading the swing themselves, or waiting till a clear direction is established before taking a position.

In this post, I will show you how to take advantage of the expanding triangle pattern to trade ranges, breakouts, and reversals, by using the best trading strategies for this price pattern.

What is an Expanding Triangle?

The expanding triangle, as its name suggests, is a triangle, but it differs from the other 3 types of triangle patterns which we covered in the previous chapter.

All triangle patterns consist of 2 lines, but in the previous 3 triangles (symmetrical, ascending, descending), the lines were converging, whereas for the expanding triangle, the lines are diverging.

This means that instead of compressing prices into a fixed breakout point some time within the pattern, this pattern sees prices moving further and further away from each line in the pattern.

This ultimately leads to wider swings (higher highs and lower lows) and increased volatility, making it harder to predict when a breakout will happen. Also, since it neither exhibits higher highs and higher lows (uptrend) nor lower highs and lower lows (downtrend), this makes it hard to pinpoint the current trend.

Historically, it also has many names associated with the same pattern:

- Expanding triangle

- Broadening triangle

- Megaphone formation

- Broadening formation

The expanding triangle can be either bullish or bearish, giving rise to the bullish expanding triangle or the bearish expanding triangle.

For stock markets, the bearish version seems to be more common, since market bottoms tend to be faster (due to the faster decrease of prices during the crash), so we tend to see it more during market tops.

Expanding Triangle Psychology

When you see the expanding triangle and its widening swings, it is a clear sign of uncertainty in the market.

Bulls and bears are fighting to gain control, but it is not clear which side is winning because each time price makes a new high or low, it appears that either side is winning, only to see the other side gain back control.

This makes it hard for market players to fully commit until there is more clarity.

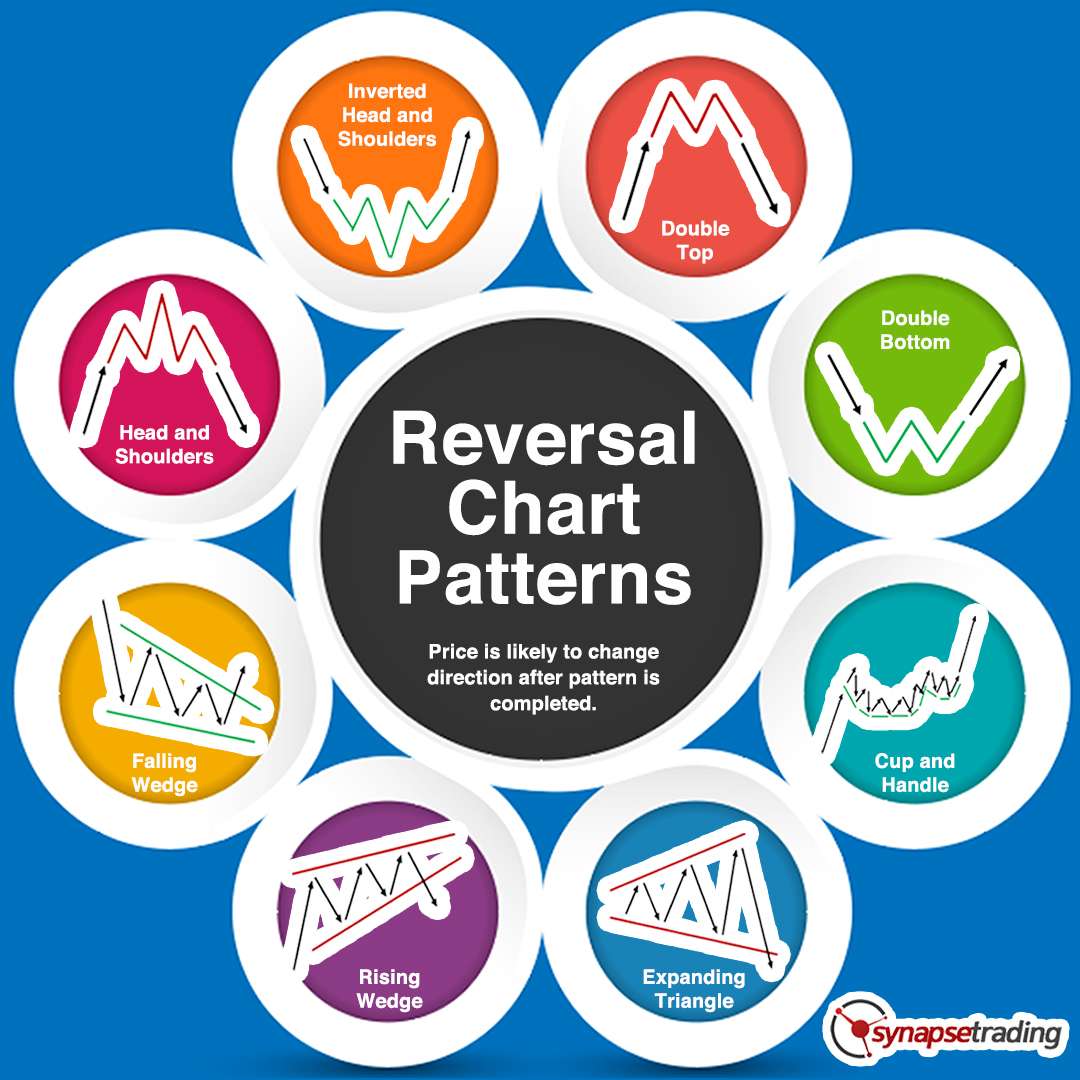

The reason why this is classified as a reversal pattern is because the larger and larger swings point to increasing uncertainty, and the higher the uncertainty, the more chance that the prior trend will reverse.

Expanding Triangle Trading Strategies

There are 3 main strategies, of which the first exploits the wide swings to attempt range trading, while the other two attempt to trade the breakout of prices.

- Range trading (using the swings)

- Breakout (with trend)

- Reversal (change of trend)

Since this pattern is inherently uncertain (and hence risky), good risk management and precision of entry is important to get a good entry price, because the chance of getting stopped out is high if your entry is less than ideal.

Now, let’s go through each strategy in greater detail.

Expanding Triangle Trading Strategy #1

Our first strategy for the expanding triangle pattern is make use of the wide swings between the range of the triangle pattern, and aim to take positions near the extremes of the swings.

This is very similar to range trading, or a rectangle pattern, where we go long near support levels and go short near resistance levels, except that this time the support and resistance levels are diverging lines instead of horizontal lines.

In the example above, we see that prices bounce off the lines on both sides, and I have highlighted the potential buying and selling opportunities with green and red arrows respectively.

For trading, we would look to enter near the lines of the expanding triangle, while using a wider stoploss, since this pattern is know for its high volatility.

As the lines diverge and the swings get wider, the reward to risk for each trade actually becomes better, because the risk remains the same (based on your entry technique), but the reward increases as the target moves further away.

Do note, however, that eventually the pattern will lead to a breakout, so remember to manage your trading position as prices move within the expanding triangle.

Expanding Triangle Trading Strategy #2

In the first strategy, we treated the expanding triangle as a trading range, and traded the price movements within the range.

The second strategy we are going for is to treat the expanding triangle as a continuation pattern, and look for a breakout in the same direction as the prior trend.

Personally, I do not like this strategy, as I feel that the odds are not as good, and it is hard to find many instances of a successful breakout. The probability of a reversal is higher due to uncertainty of the pattern.

As such, I was unable to find a good chart example, and I have simulated a price breakout instead.

In the example above, we see a prior uptrend, followed by the expanding triangle, then we see prices break out (simulated prices in blue dotted lines).

The breakout is inherently challenging because prices are trying to break above a line which is sloping upwards, which means prices need to move up a lot in a short period of time. If the breakout is too gradual, it will appear to just be moving along the edge of the line, making it hard to tell whether a real breakout has taken place.

The best breakdown will be one in which prices shoot past the line, then pulls back to form a stable base.

For trading, we would look to enter near the stable base once it has been established, to act as a launchpad for the next leg of movement upwards.

Note that this strategy works just as well in a downtrend, you’ll just have to flip the pattern around for a downside breakout.

This strategy works best if the prior trend (before forming the triangle pattern) is strong, and has a higher chance of success if the triangle is smaller, in terms of height and duration.

Expanding Triangle Trading Strategy #3

In our final strategy, instead of looking for a breakout in the prior trend direction (strategy #2), we now look for a breakout in the opposite direction, in other words a trend reversal.

To be more specific, we are not looking for a breakout per se, but rather an opportunity to initiate a position in the opposite direction of the prevailing trend.

This means that instead of a breakout, we can look for a low-risk entry point for our first entry. Recall the technique we used in strategy #1 for trading the range, and entering near the extreme swing.

In the example above, which features the same chart as strategy #2, instead of looking for an upside breakout, we will be looking for a reversal trade opportunity.

For trading, we can initiate a low-risk short position near the upper bound of the range, indicated by the yellow highlight and red arrow. As prices start to form lower highs and lower lows (thus confirming the downtrend), we can choose to add short positions.

Note that this strategy works just as well in a bullish trend reversal, you’ll just have to flip the pattern around for an upside reversal.

This strategy works best if the prior trend (before forming the triangle pattern) is weak and in a relatively late stage, and has a higher chance of success if the triangle is larger, in terms of height and duration.

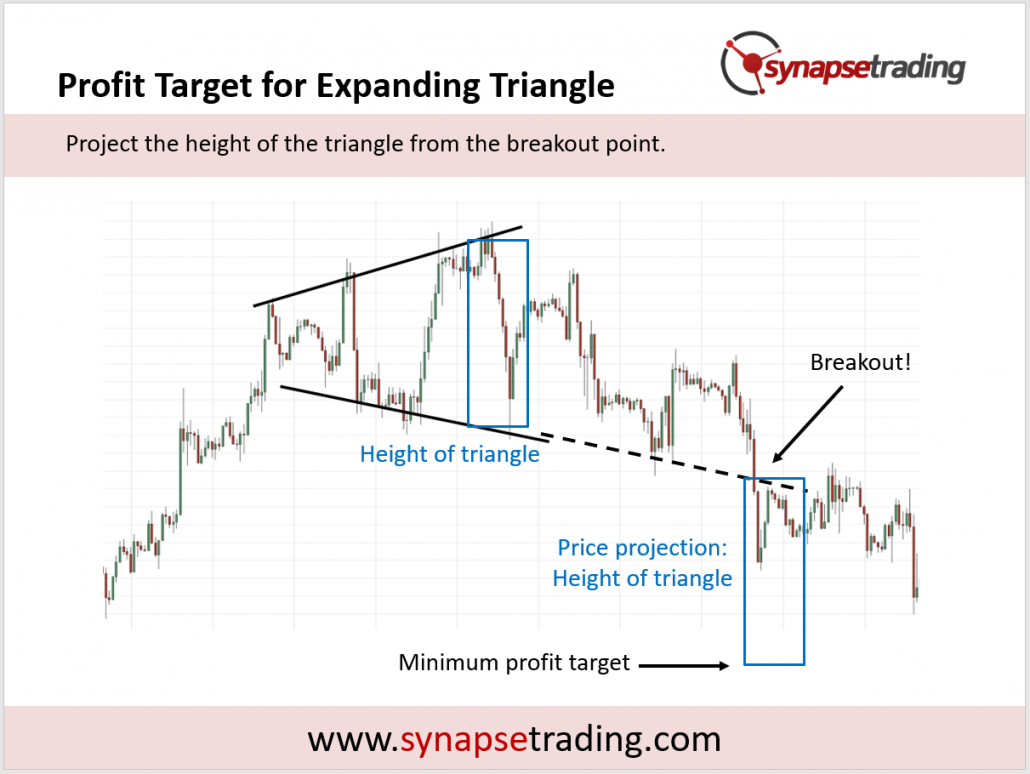

Profit Target for Expanding Triangle

Once an expanding triangle pattern is completed, one of the most useful things about it is its ability to provide a price projection, which can be used to estimate a minimum profit target for your trade.

This can be done by taking the maximum height of the triangle, and projecting that distance from the breakout point.

In the chart above, the maximum height of the expanding triangle is indicated by the blue rectangular box, which is then used as a price projection at the breakout point.

The black horizontal arrow indicates the price level which serves as the minimum profit target for the expanding triangle pattern breakout.

This price projection technique can be used in conjunction with other methods, such as support and resistance levels, and if there is any confluence, gives an added layer of confirmation.

Tips from the Trading Desk

- With much uncertainty surround this pattern, it is better to look for low risk entries to enter early into the trend reversal, rather than look for breakouts to continue the existing trend

- Look to fade both sides (trade within the range) if there are extreme moves

- Avoid trading when price is in the middle of the range

When prices are in the middle of the expanding triangle, there is no edge because the odds of going up or down are about 50-50.

And as you can see in the yellow circles, when prices are in the middle, they can “look” like they are breaking out in one direction, and make a 180 U-turn just a few bars later.

This means that if you try to trade these breakouts in the middle of the range, you will get whipsawed terribly.

Hence, it is better to avoid taking a position when prices are in the middle of the pattern, and instead wait till there is a good setup.

Now that I have shared the various trading strategies for the expanding triangle price pattern, which is your favourite strategy?

Let me know in the comments below.

If you would like to learn all the different price chart patterns, also check out: “The Definitive Guide to Trading Price Chart Patterns”

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.