After a tight consolidation the past 2 weeks, the stock and crypto markets finally broke down, and resumed the downtrend.

Hence, we have large short positions on stocks, and I only have a small position in crypto, after selling off most of my holdings.

The current strategy now is to stay in cash or stay short, until the crash is over, then start buying cautiously once there are reasonable signs of a market reversal.

Riding the big market trends means being able to actively rotate between different asset classes to maximise returns and minimise drawdowns.

[Photo: Lake Titicaca, Peru, Bolivia – See my full travel photo log!]

For our weekly market wrap, we go through some of the trade calls and analysis from last week, which gives us valuable insights for the week ahead.

We cover 3 main markets with a total of 200+ counters, so we will never run out of trading opportunities:

- Forex, CFDs, commodities, bonds

- US stocks, ETFs, global stock indices

- Cryptocurrencies, crypto indices

By covering a broad range of markets, we can focus our attention (and capital) on whichever market currently gives the best returns.

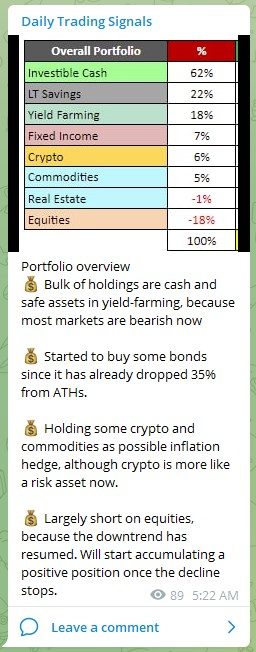

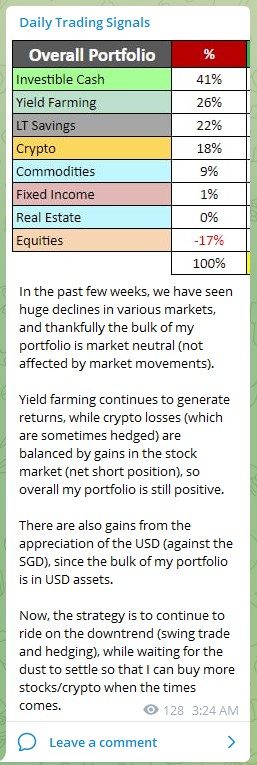

Portfolio Highlights

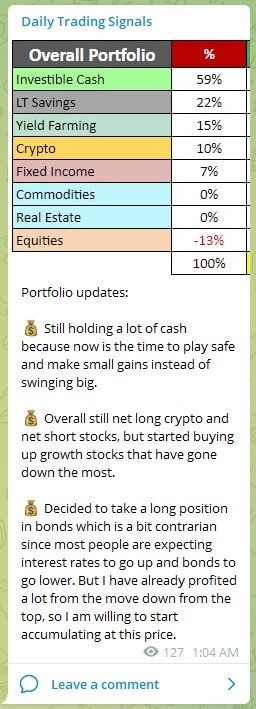

Portfolio overview

? Bulk of holdings are cash and safe assets in yield-farming, because most markets are bearish now

? Started to buy some bonds since it has already dropped 35% from ATHs.

? Holding some crypto and commodities as possible inflation hedge, although crypto is more like a risk asset now.

? Largely short on equities, because the downtrend has resumed. Will start accumulating a positive position once the decline stops.

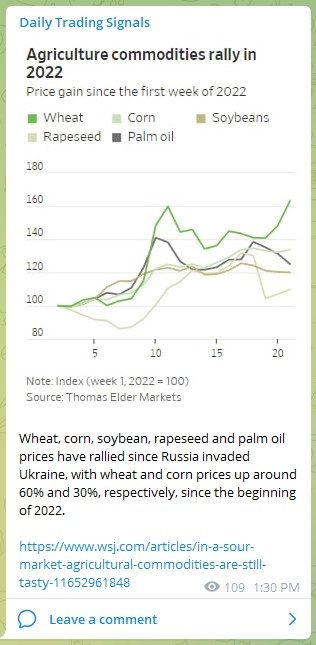

Forex & Commodities Market Highlights

https://www.wsj.com/articles/the-u-s-dollar-is-looking-a-bit-stretched-11654612600

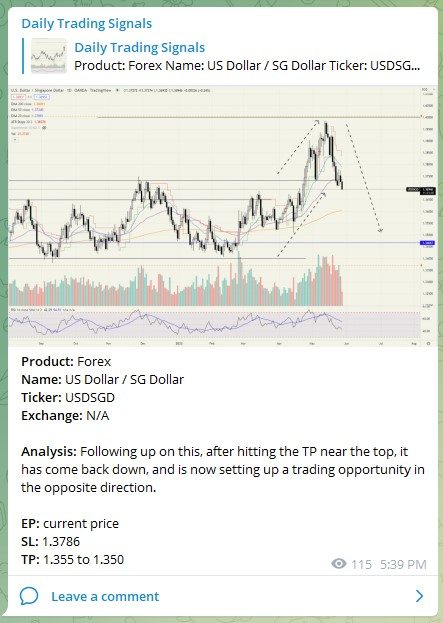

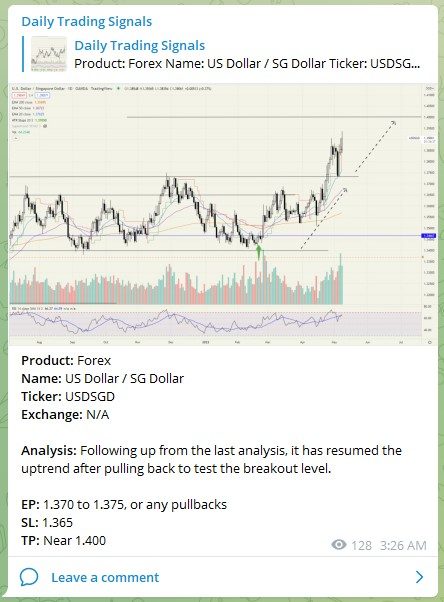

Product: Forex

Name: US Dollar / SG Dollar

Ticker: USDSGD

Exchange: N/A

Analysis: Following up, although the last trade was stopped out, it now shows that the uptrend has resumed.

EP: 1.30, or on pullbacks

SL: 1.368

TP: 1.3969, 1.4394

Product: Commodities

Name: Gold (spot)

Ticker: XAUUSD

Exchange: N/A

Analysis: After some consolidation and whipsaw, it looks like Gold is back on track, now that the market is in risk-off mode.

EP: current price

SL: $1820

TP: $1905, $1990, $2060

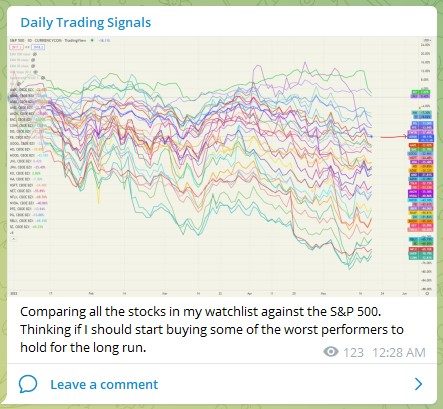

Stock & Bond Market Highlights

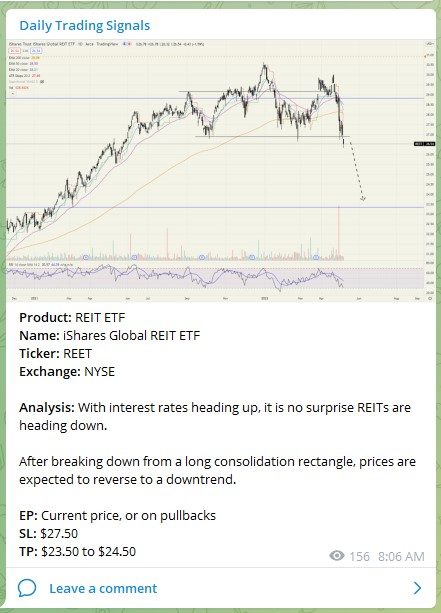

Product: REIT ETF

Name: iShares Global REIT ETF

Ticker: REET

Exchange: NYSE

Analysis: Following up on this, it has just broken down on a bear flag, and hit TP1. ????

Will continue holding towards TP2.

EP: Current price, or on pullbacks

SL: $27.50

TP: $24.50, $23.50

Product: US Stock Index

Name: NASDAQ 100

Ticker: US100

Exchange: N/A

Analysis: I was expecting another leg of rebound, but after multiple days of tight consolidation, momentum for the rebound stalled and prices continued downwards.

Now, we can expect it to test the next support.

EP: $12358, or on pullbacks

SL: $13000

TP1: $11546

TP2: $10995

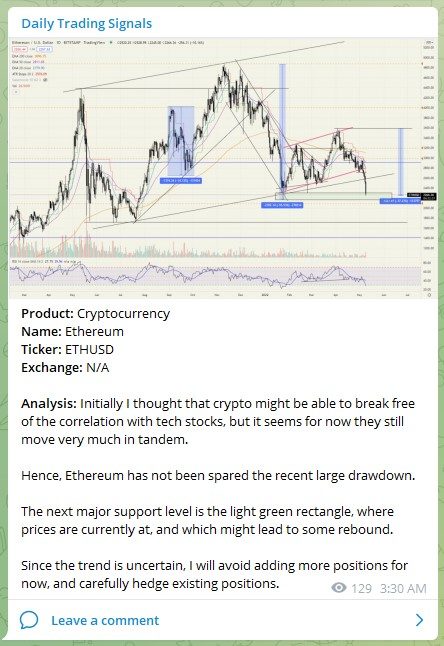

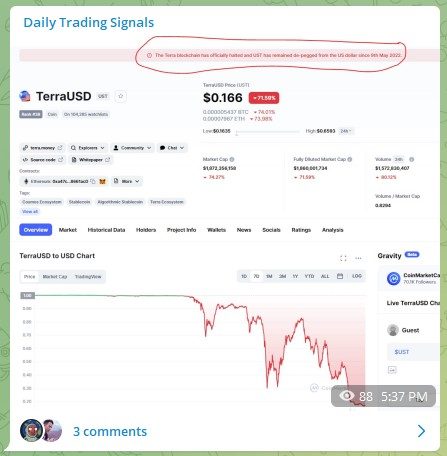

Crypto Market Highlights

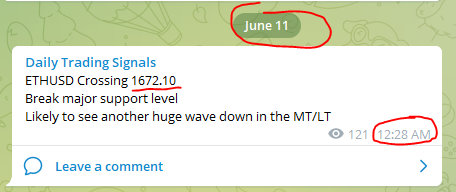

ETHUSD Crossing 1672.10

Break major support level

Likely to see another huge wave down in the MT/LT

Product: Cryptocurrency

Name: Ethereum

Ticker: ETHUSD

Exchange: N/A

Analysis: I thought there would be some rebound at this major support level, but there has been too much bearish news in the crypto market recently, and prices just broke a new 1-year low.

This does not bode well for crypto as prices could start another major leg down.

EP: Current price ($1672 based on above trigger)

SL: $1936

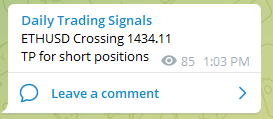

TP: $1437

TP for short positions

(Note: This was hit just 1-2 days after the signal!)

Good luck, and may next week bring more excellent profits!

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.