For subscribers of our “Daily Trading Signals”, we now also include a “Weekly Market Report”, where we provide a weekly deep-dive on the market, including fundamentals, technicals, economics, and portfolio management:

Click here for last week’s market report (15 May 2023)

Click here to subscribe for the latest market report (22 May 2023)

Click here to see the archives of all our past market reports

Market Recap & Upcoming Week

Last week was characterized by numerous significant events, both domestically and globally. Morgan Stanley announced its plans to downsize its Asia-Pacific investment banking workforce by roughly 7%, a decision driven by changing market conditions and a broader cost-cutting initiative. The decision underscored the widespread dip in global deal-making activity, with corporate buyout activity hitting a ten-year low in Q1 2023.

Despite a modest increase in consumer spending, large companies like Home Depot reported sales declines, further shaking market confidence. The looming debt ceiling deadline and the possibility of the US defaulting on its bills continued to trigger market unease.

On the other hand, positive signals also marked the week. The announcement by House Speaker Kevin McCarthy about a possible debt-ceiling deal vote led to a surge in stocks, and the resilience of the labor market was highlighted as weekly initial jobless claims fell and major tech companies saw stock highs.

In Japan, foreign investors found the country’s market appealing, leading the Nikkei 225 stock average to a 33-year high. Despite Japan’s economic challenges, its political stability, government policies, and market reforms have attracted investors.

However, the week concluded on a somewhat tense note with stalled debt ceiling talks and the Federal Reserve Chair suggesting a potential pause in interest rate hikes. Despite the uncertainties, the major indexes still managed to end the week positively.

The coming week holds numerous intriguing developments for market watchers. We are anticipating a flurry of earnings reports from major players across various sectors, which will likely shed light on the broader economic landscape.

The retail sector remains in sharp focus with prominent firms such as Lowe’s, AutoZone, Dick’s Sporting Goods, BJ Wholesale Club, Urban Outfitters, Costco, Dollar Tree, Best Buy, and The Gap all slated to report. Moreover, from the technology and banking sectors, investors will keenly look at the performance disclosures from Zoom Video Communications, Nvidia, and TD Bank respectively.

Mid-week, attention will undoubtedly shift to the Federal Reserve’s release of the minutes from its latest FOMC meeting. Policymakers had decided to raise interest rates by 25 basis points at this meeting, and the minutes will provide more context about their decision-making process.

On Friday, we will see the Bureau of Economic Analysis (BEA) issuing its Personal Consumption Expenditures (PCE) Price Index for April, which is the Fed’s preferred measure of inflation. This, along with the University of Michigan’s report on consumer sentiment, will provide vital cues about the state of the economy.

Further, new data on the housing market, including figures on new and pending home sales for April, will offer insights into the health of this critical sector.

Daily Trading Signals (Highlights)

We cover 3 main markets with a total of 200+ counters, so we will never run out of trading opportunities:

- Forex, CFDs, commodities, bonds

- US stocks, ETFs, global stock indices

- Cryptocurrencies, crypto indices

By covering a broad range of markets, we can focus our attention (and capital) on whichever market currently gives the best returns.

Subscribe for real-time alerts and weekly reports:

👉🏻 https://synapsetrading.com/daily-trading-signals

Global REITs ETF (REET) – Forming a potential H&S reversal, with a bear flag breakdown at the right shoulder.

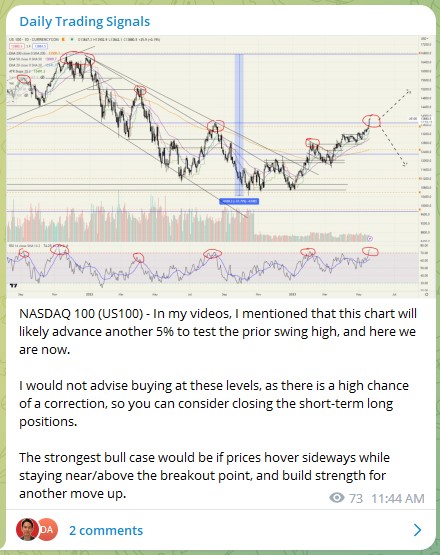

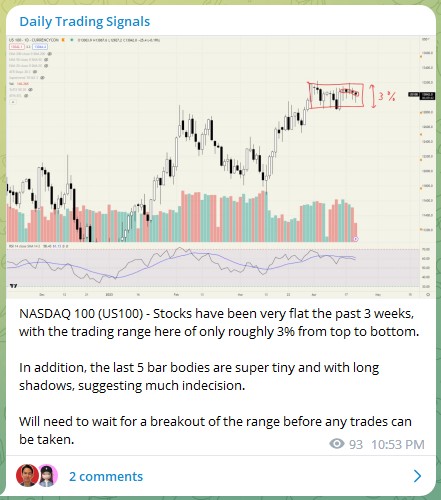

NASDAQ 100 (US100) – In my videos, I mentioned that this chart will likely advance another 5% to test the prior swing high, and here we are now.

I would not advise buying at these levels, as there is a high chance of a correction, so you can consider closing the short-term long positions.

The strongest bull case would be if prices hover sideways while staying near/above the breakout point, and build strength for another move up.

Sea Limited (SE) – Double top pattern formed at strong resistance, plus strong gap down.

USDSGD – The last few days we saw great strength in the US dollar, and we are halfway to the top of the range now.

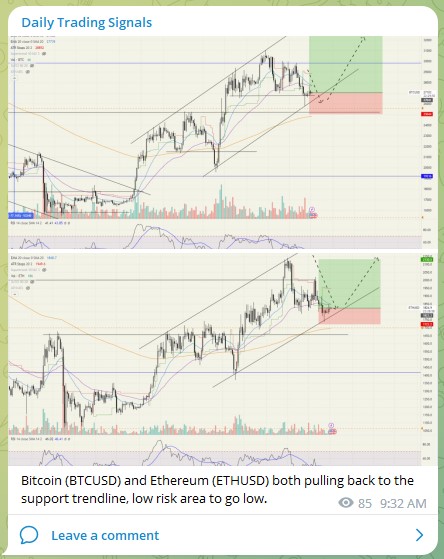

Bitcoin (BTCUSD) and Ethereum (ETHUSD) both pulling back to the support trendline, low risk area to go low.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.