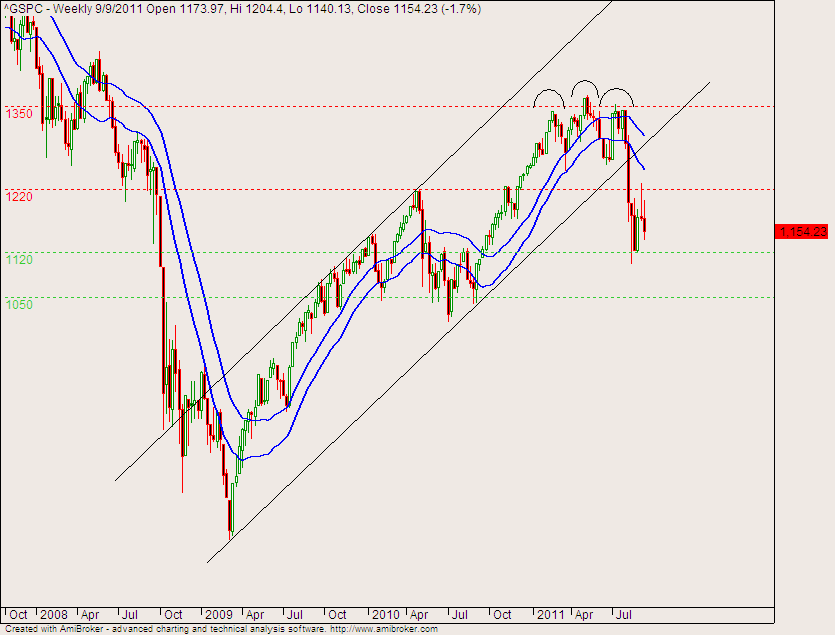

Many people have emailed me saying that I have missed this rally because I was too bearish and not flexible, but it really depends on your strategy. My strategy is to take high probability “with trend” trades, and even if I am wrong a few times, catching a strong “with trend” move more than makes up for all the wrong entries. Countertrend moves, on the other hand, is a fun gamble at picking bottoms, and easy to spot on hindsight, but definitely not easy to trade and not worth the risk. That’s my opinion.

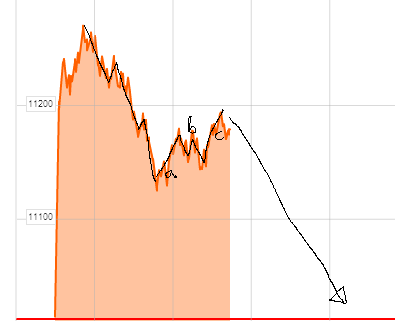

For the past 2 months, there has not been more than 3 white candles in a row on the STI chart. I thought that today might be different given that Dow that surged 330 points up the night before, but the STI gave back some gains near the close, forming a black bar. While I cannot be certain that this marks the end of the rally, I think it is worth the risk to take a small short position if today’s low is taken out tomorrow.

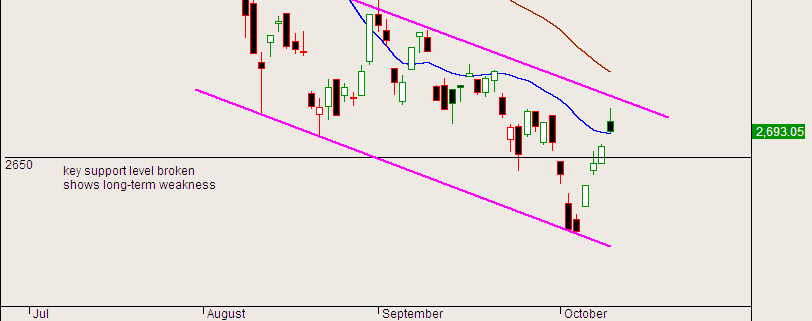

Noble is testing the middle channel line, and there was a bearish bar today on high volume. I would be watching to short if price falls below 1.360. Please read the disclaimer on my website and take note that my strategy is likely different from yours. I will cut my losses fast once I realise I am wrong, but I may not have the time to blog about it until the end of the day. Good luck!