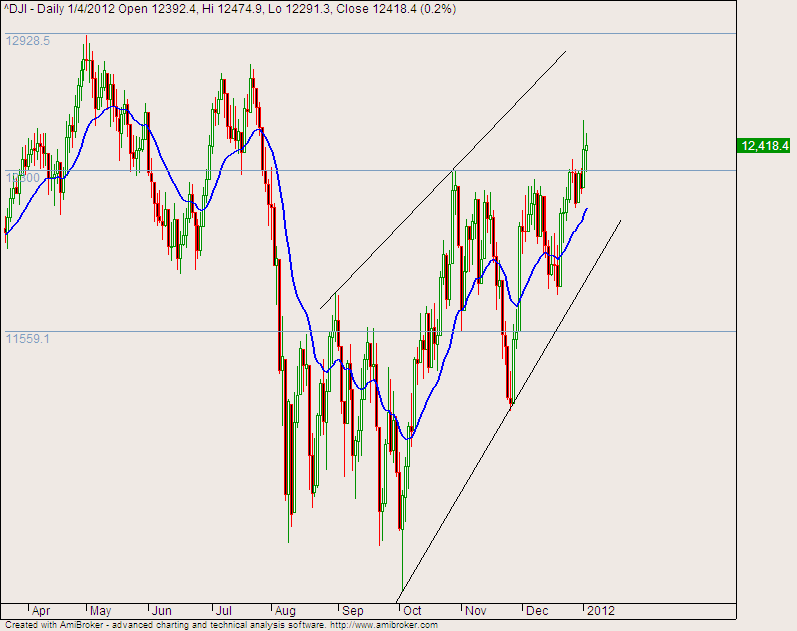

The Dow Jones is fighting upwards, forming a giant wedge as it does so. This means that it is losing power as it pushes higher. After the breakout on Tuesday which crossed the key 12,300 level, we have seen two days of hesitation in the form of two long-legged dojis (today’s doji is not shown), but they have managed to stay above 12,300. Looking at the slope of the wedge, there is a good chance it will be able to test the old high of 12930.

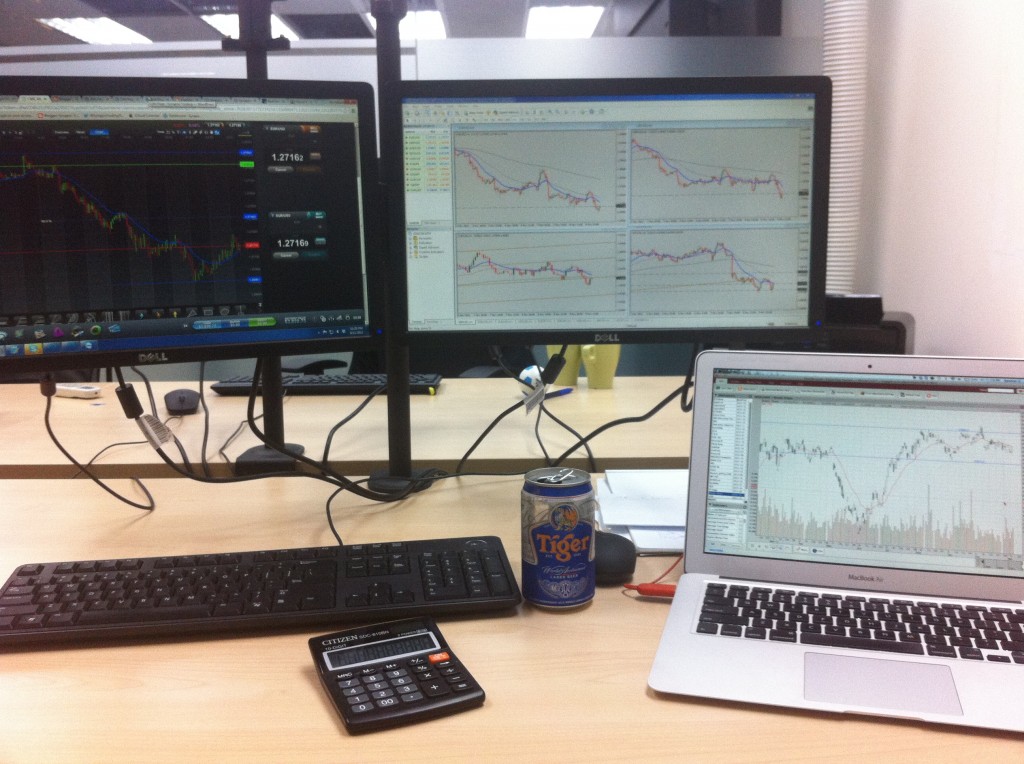

As the year draws to a close with Christmas festives and new year plans, we see liquidity in the markets drying up as there is less participation from the big players. Hence, these few days I have been taking it rather easy and trading only a few hours each day. Today was a rather good trading day for me, although it was rather boring scalping range-bound markets, and I managed to make about 40+ ticks on the DAX with a 70% hitrate. As expected, the Christmas rally has started to fizzle once Christmas was over, and the market is currently in a range/bearish mode. Based on seasonality, Nov/Dec/Jan are supposed to be the stronger months, and if these months are weak, it could be a red flag for the months to come. Let’s review some property counters.

Yanlord (Z25) Daily chart

This stock has been on a downtrend for more than two years, and has provided many shorting opportunities. One of my favourite counters for shorting. Currently still trading within the downtrend channel.

Keppel Land (K17) Daily chart

After the new regulations were announced, there was a gap-down and follow-through, which provided the price catalyst to break out of the descending triangle. The pullback now provides a good opportunity to short.

“Discipline is doing what we do not want to do.”

Conservatism bias is a mental process in which people cling to their prior views or forecasts at the expense of acknowledging new information. For example, suppose a trader receives some bad news regarding a company’s earnings and that this news negatively contradicts another earnings estimate issued the previous month.

Conservatism bias may cause the trader to under-react to the new information, maintaining impressions derived from the previous estimate rather than acting on the updated information.

It is important to note that the conservatism bias may appear to conflict with representativeness bias, but the latter refers to over-reacting to new information, while conservatism bias refers to under-reacting to new information.

The problem arises when traders cling to a particular view, behaving inflexibly when presented with new information which could signal a change in trend or underlying price action. Even when conservatism-biased traders do react, they do so more slowly, and will have increased difficulty in dealing with this new information.

What is the best solution for this?

The key here once again is adaptability and objectivity, and when the wisest course of action becomes clear, it should be implemented resolutely and without hesitation. A good trader is continually assessing and re-assessing the situation, and not getting tied down to a particular viewpoint.

Prior to the launch of the program, I ran it through some friends and volunteers to get their feedback, and this provided me idea on how to tweak and improve the program to cater to both complete newbies and experienced traders. For now, I have yet to release this program to the public.

Feedback

“This course is an excellent introduction to mastering trend analysis. It is very easy to follow and with clear objectives. This makes reading charts very easy to understand, and I find it very useful. This is very likely the most value-for-money course out there which covers all of the essential strategies, and new ones created by Spencer!”

– Wenbin (Engineer, ST Aerospace)

“Spencer has always been a very brilliant person, and his skills at analysis and understanding of the market conditions have always impressed me. Up till today, I would still go to him with regards to finding out more in depth about the market situation and also the possible advice that he can provide me with. This has proven to be very useful in my trade of managing my client’s investment and how I help them to plan financially. His daily website updates have also aided me greatly by allowing me to have a better grasp of trading and how best to identify opportunities. I would definitely recommend giving this program a shot, and you will be amazed at the insights that you can gain from it.”

– Titus Yong (Financial Consultant, Finexis)

“I have been following the updates and analysis on the Synapse Trading website for a few years now, and I have found them to be very insightful, because they provide an interesting twist to classical technical analysis that is not found elsewhere. Spencer’s analysis is simple and powerful, and I look forward to the launch of his program to the public this year.”

– Larry Lau (Dealer, MayBank Kim Eng)

“Spencer is a very talented a friend of mine. He has shared with me a lot of trading tips which turned out to be really accurate, and his insights are spot-on. He has put in a great deal of effort into making this program to share his secrets, and i’m sure anyone who uses it will benefit greatly.”

– Karl Teo (SMU Student Managed Investment Fund)

“After learning about technical analysis, this is definitely a better and more rationale way to trade than using emotion or market sentiments alone. By understanding how to read charts, I now have a better insight to the markets, instead of just relying on tips and news. This is a great course, and I will recommend to friends definitely .”

– Lee Kiok Hwa (Property Manager, Newman & Goh)

“Spencer is one of the most passionate traders I have encountered. Besides devouring trading books to shore up his knowledge, Spencer has set up Synapse Trading, a website portal which aims to educate other traders like himself with news updates, research articles, commentaries and forums. His facebook fanpage has reached over 12,000 likes, indicating Synapse Trading’s presence within the trading fraternity. His much anticipated training program should be one to look out for in 2012.”

– Edwin Siew (Banking Professional)

“This program is indeed one-of-a-kind. The explanation is clear and pace is right, making it simple and easy to understand. There is no need to use complicated indicators or rely on scanning software. It is very good for those who are new and want to start from scratch to learn about trading and technical analysis.”

– Chin Hansheng (Singapore Press Holdings)

“When I first started trading, I tried to use the traditional methods like indicators and those things I read from websites and forums, but I still could not understand what was happening on the chart. Spencer’s daily updates have given me a new way to look at charts, and the best thing is, there are no indicators required at all. Through his teachings in the forum, I have learnt much from him, and I look forward to the Synapse Program – it is a rare chance to learn from a professional trader.”

– Maurice Wong (Accountant, Big 4)

“Driven by his strong interest in finance and economics, Spencer is very well-read in trading and his expertise is in technical analysis. With many years of trading experience, he has experimented with various trading strategies and developed a unique strategy. He is a practical person, straight to the point and capable of explaining complicated concepts in a simple way. I am glad that he is opening his teachings to the public.”

– Lee Cheah Chong (Ministry of Finance)

To see more testimonials, click here.

https://synapsetrading.com/testimonials/

Discipline ‘key to success in trading’

Last week, I was interviewed by Teh Shi Ning, one of the reporters from the Business Times, to share my trading journey and his success story.

“Having spent over 7 years in the markets, and spending at least 5 hours a day to practice, I am glad that I am able to pursue my dream as full time proprietary trader. Hopefully, after sharing my experiences, you will get a better idea of what trading is about, and do away with the misconception that it is simply risky gambling.”

Q: What got you interested in investing?

A: I actually got interested during my army days. My first foray was into options trading, where I blew my first account, but that got me hooked. My family is quite frugal and my parents advocate saving and investing prudently so they take a more long-term and passive approach to investing, such as dollar-cost averaging or buying unit trusts. Hence it was no surprise they were not very supportive of my trading. I built up my portfolio using my own capital and savings, and I worked as a financial planner after my national service. There, I learnt more about personal finance and investments. During this time, I also read widely and voraciously to stock up my knowledge database. When I went to university (SMU), I joined the investment club where I met many other enthusiastic traders. Eventually, I became the head of research and started teaching the classes.

Q: What’s your motivation?

A: Besides the obvious reasons like financial abundance and freedom (of time), I would say the main reason is that I cannot resist a good challenge. I used to be a national chess player in my younger days, and trading reminds me a lot of it, since it is an intellectual challenge that requires great mental discipline. Trading is challenging because of the discipline to wait and stay out till an opportunity comes, and then having the confidence to execute without hesitation, and most importantly mental grit to cut losses. But it’s also boring because 95% of the time is just spent waiting and observing.

Q: What’s your risk appetite like?

A: Risk is actually a very debatable concept. It really depends on what your definition of risk is. On one hand, I am a risk-taker because trading futures is conventionally deemed risky. On the other hand, my risk appetite is low because I am willing to let go of sub-optimal set-ups and only wait for the best opportunities before I place a trade. In addition, because I do not hold my positions for long periods of time, I am able to reduce the volatility and risk. To a trader risk management is very important, such as calculating optimal capital allocation, minimising drawdowns, and being aware of net exposure.

Q: How would you describe your trading style?

A: My style is largely inspired by market legends such as Jesse Livermore and Richard Wyckoff, and I specialize in price action and psychology. I aim to consistently seek out high-probability and low-risk setups, varying my strategy according to the different market scenarios and being aware of price catalysts. I also apply multiple timeframes, to enter the market when there are weak fluctuations against the main trend. Getting the timing right is the crux, and this comes with experience and gut feel.

Q: Any tips to share?

A: It is crucial to start investing or trading only when you have a sound strategy and methodology for analysis, taking into account your personal finances, risk profile and time horizon. As a new trader, do not be impatient. Take your time to master the skills and knowledge, and apply it slowly to gain experience, keeping your expectations on returns realistic. Once you understand the psychology and principles behind trading and apply them, you will start evolving as a trader.

Q: What other interests do you have besides trading?

Beside trading, my other great passion is tennis, and I find that there are quite some similarities between these two art forms. Yes, trading is also an art. In both games, consistency is the key to success. Take the tennis serve and strokes for example. Anyone can get lucky and hit a few power shots, but that does not make him a good player. Just the same a few windfall trades does’t make one a good trader. The idea is to be able to perform consistently over the long-run. To be able to do so takes a lot of discipline and practice.

My other hobby is travelling, and trading is the perfect job because it allows me the freedom to travel whenever I want, and I can trade from anywhere as long there is an internet connection. In addition, trading also allows me to blend knowledge across different disciplines, and understand what goes on around the world.

Latest Blog Posts

A Deeper Look at the US-China Trade War & Possible SolutionsApril 18, 2025 - 10:49 pm

A Deeper Look at the US-China Trade War & Possible SolutionsApril 18, 2025 - 10:49 pm Best Assets to Invest in Under President Donald TrumpNovember 10, 2024 - 10:55 pm

Best Assets to Invest in Under President Donald TrumpNovember 10, 2024 - 10:55 pm The 2024 U.S. Presidential Election: What to Buy if Donald Trump or Kamala Harris Wins?November 2, 2024 - 12:38 am

The 2024 U.S. Presidential Election: What to Buy if Donald Trump or Kamala Harris Wins?November 2, 2024 - 12:38 am

Contact Us

Synapse Trading Pte Ltd

Registration No. 201316168H

FB Messenger: synapsetrading

Telegram: @iamrecneps

Email: info@synapsetrading.com

Disclaimer

Privacy policy

Terms & Conditions

Contact us (main)

Partnerships