You might be wondering:

“There are so many trading courses, trainers, and platforms out there, how do I know which one is legit?”

It’s a fair question. And with so much hype in the industry, it’s important to make informed choices. So here’s how to assess any training program, and why ours stands apart.

Does the Trainer Have Real Trading Credentials?

- I hold double degrees in Accounting and Business Finance from a top-ranked global university (Top 50 worldwide). Always ask: Is the trainer open about where their degree is from? If not, big red flag.

- I am a Certified Financial Technician (CFTe), a globally recognized qualification from the International Federation of Technical Analysts (IFTA). Be cautious of “certificates” from unverified competitions or paid awards.

- I’ve traded professionally for both proprietary and private equity funds, and I’ve shared my trades and market analysis publicly for over a decade.

- My system has been developed and refined over 15 years, and has helped me build a multi-million dollar portfolio.

Does the Trainer Have Real Teaching Experience?

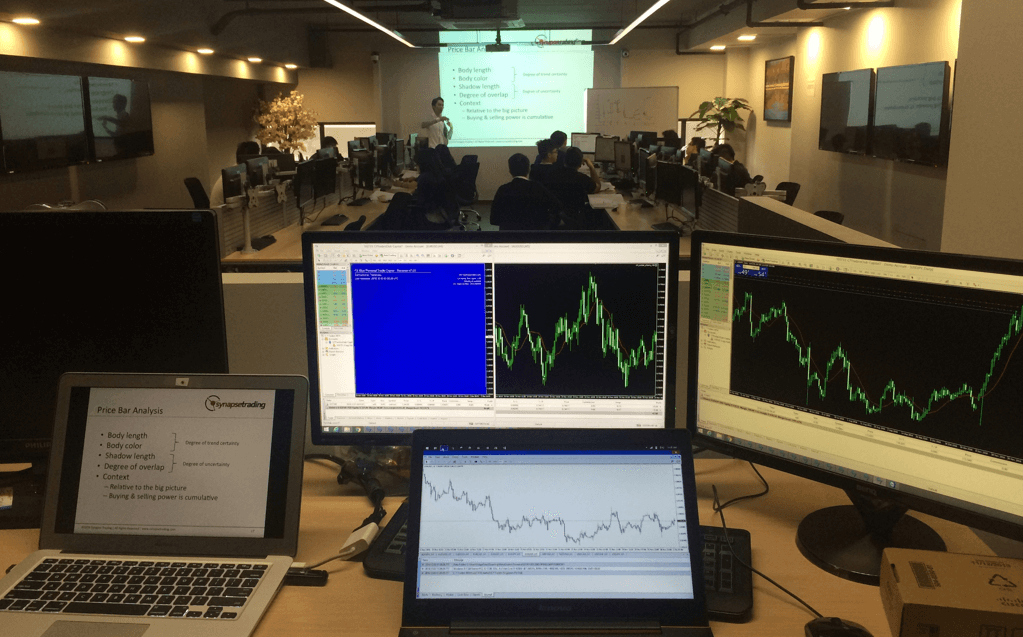

- I’ve been invited to train and speak at banks, financial institutions, universities, brokerages, and even the Singapore Stock Exchange (SGX) and Bain & Co.

- I have conducted training for SGX Academy, Skillsfuture, ShareInvestor, training more than 700 participants.

- I’ve shared the stage with global speakers at major conferences and seminars, speaking to thousands of attendees both in Singapore and internationally.

- I’ve been featured in over 20 media outlets, and have received 3,000+ real testimonials from students who’ve gone through my programs.

Has the Program Stood the Test of Time?

- Watch out for programs or gurus that appear for a few years and vanish, only to rebrand under a new name.

- Many make unrealistic promises like “25% returns a month with no effort.” That’s a clear red flag. Even top traders rarely exceed 5-10% a month consistently.

- My trading system has been running successfully through bull markets, bear markets, and even market crashes, and it works across different products and timeframes.

Are the Testimonials From Real People?

- While I do have a large social media following, I don’t rely on vanity metrics. Follower counts can be faked, but results cannot.

- All testimonials, trade records, and student feedback are available on our website, including photos, videos, and video testimonials from other respected trainers and traders.

- Be wary of anonymous screenshots with no faces or names, we prefer transparency and real human stories.

Who Is This Training Meant For?

🚫 This is NOT for you if:

- You’re looking to get rich quick. Trading can make you wealthy, but it takes time, effort, and consistency. Compounding takes time, but the results can be exponential.

- You’re chasing a “magic bullet.” There’s no holy grail or one-click strategy. True success requires learning and application, there are no shortcuts.

- You’re closed-minded. Our training may challenge what you’ve read in books or heard from others. If you’re not open to new ideas, this may not be for you.

✅ This IS for you if:

- You’re passionate about learning. Whether you’re a total beginner, a frustrated intermediate trader, or a professional looking to upgrade your edge, we’ve trained people from all levels to achieve their goals.

- You want to improve your financial situation. Whether you’re building a side income or looking to compound existing wealth, this training gives you real, actionable skills to take control of your financial future.

- You’re willing to learn and contribute. Our community thrives on shared learning. You’ll get support, but you’re also encouraged to help others grow, because when you teach, you learn twice.

What You’ll Walk Away With

- A Lifelong Skillset

Master trading and investing concepts that most people never learn. Whether for personal wealth or professional growth, this knowledge will serve you for life. - A Shift in Financial Mindset

Generate consistent monthly profits, build a long-term investment portfolio, and use your gains to create a meaningful life, not just flashy wins. - Financial Security & Freedom

Build a safety net so you’re no longer shackled by financial worries. Imagine the freedom to quit your job, start a business, travel, or simply spend more time with the people who matter.

This program isn’t for everyone. But if you’re looking for real skills, real results, and a real community, you might just find this to be one of the best decisions you’ll make for your financial future.