Weekly Market Wrap: Will Russia Invade Ukraine? Market Seems Undecided…

Join our Telegram channel for more market analysis & trading tips: t.me/synapsetrading

For our weekly market wrap, we go through some of the trade calls and analysis from last week, which gives us valuable insights for the week ahead.

We cover 3 main markets with a total of 200+ counters, so we will never run out of trading opportunities:

- Forex, CFDs, commodities, bonds

- US stocks, ETFs, global stock indices

- Cryptocurrencies, crypto indices

By covering a broad range of markets, we can focus our attention (and capital) on whichever market currently gives the best returns.

Table of Contents

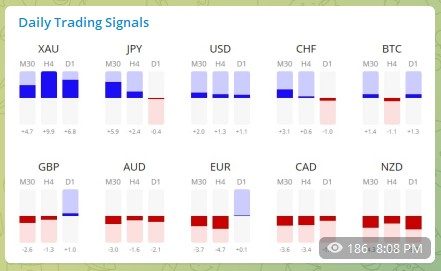

Forex Market Highlights

Product: Forex

Name: Euro / Japanese Yen

Ticker: EURJPY

Exchange: N/A

Analysis: A bit late to enter this because the move was so fast, but will keep an eye in case there is a pullback opportunity.

Product: Forex

Name: Euro / NZ Dollar

Ticker: EURNZD

Exchange: N/A

Analysis: After failing to break out of the range, there is a good chance it might try to head back down.

EP: 1.70 to 1.71, or on pullbacks

SL: 1.72

TP: 1.64 +

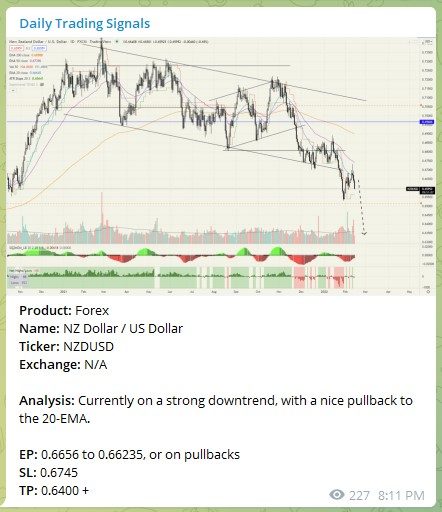

Product: Forex

Name: NZ Dollar / US Dollar

Ticker: NZDUSD

Exchange: N/A

Analysis: Currently on a strong downtrend, with a nice pullback to the 20-EMA.

EP: 0.6656 to 0.66235, or on pullbacks

SL: 0.6745

TP: 0.6400 +

USDCHF – Pullback opportunity

Commodities Market Highlights

Following up on Palladium (PALL), it is now up almost 50% from the bottom, and is now pulling back to form a neat bear flag. Might be a good chance to add positions, since we are already deeply in the money. ????

Product: Commodities

Name: Crude Oil

Ticker: WTIUSD

Exchange: N/A

Analysis: Since the bottom in mid-2020, Crude oil has run up an impressive 700+%, and is on track to test the key level of $100.

I think there is a major resistance level around the $107 area, so I will be looking to short because I am bearish on crude oil in the long-run.

Will continue to monitor.

Stock Market Highlights

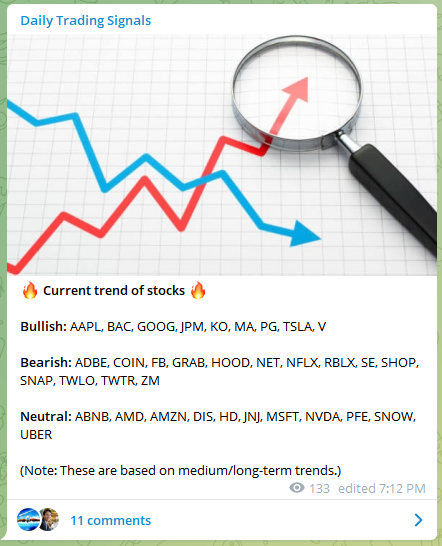

? Current trend of stocks ?

Bullish: AAPL, BAC, GOOG, JPM, KO, MA, PG, TSLA, V

Bearish: ADBE, COIN, FB, GRAB, HOOD, NET, NFLX, RBLX, SE, SHOP, SNAP, TWLO, TWTR, ZM

Neutral: ABNB, AMD, AMZN, DIS, HD, JNJ, MSFT, NVDA, PFE, SNOW, UBER

(Note: These are based on medium/long-term trends.)

Product: US Stocks

Name: Grab Holdings

Ticker: GRAB

Exchange: NASDAQ

Analysis: A potential short-term counter-trend bounce trade after falling about 70% from its highs. Broke out from a falling wedge, and formed a small pennant.

EP: Either now, or breakout from pennant

SL: $5.66

TP: $7.00++, but get out if you see a super high spike on high volume

(Update: trade did not get triggered because the pennant failed.)

Following up on the NASDAQ 100 (US 100), I have been long-term bearish on it, but I expected a higher rebound before the bears resumed.

Unfortunately, the recent influx of bad news (Ukraine invasion, inflation, Omicron surge) has accelerated the decline.

Most of the high growth stocks I suggested like SE, NET, etc are still 30-40% up from the lows after the rebound, so it might be a good time to take profits on those.

Overall, the key level to watch out for is the one highlighted in pink, if prices break below that, my suggestion is to either have no positions or be net short in stocks.

Crypto Market Highlights

Product: Cryptocurrency

Name: Avalanche

Ticker: AVAXUSD

Exchange: N/A

Analysis: After staging an impressive recovery of 80+% after the crash, it has recently broken out of the bearish trend channel, and looks to be gaining bullish momentum.

EP: Buy on any pullbacks

SL: $75

TP: $125+++

Following up on Bitcoin (BTCUSD), now would be a good time to enter. Same for Ethereum (ETH).

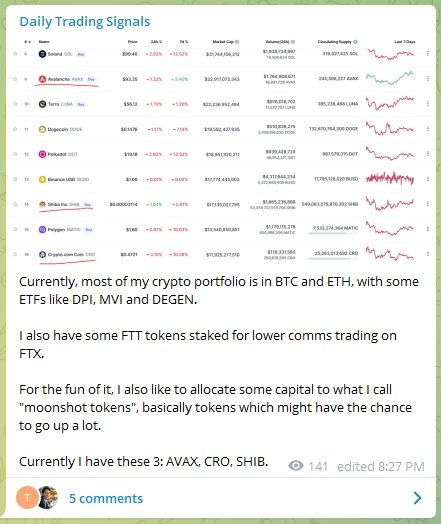

Currently, most of my crypto portfolio is in BTC and ETH, with some ETFs like DPI, MVI and DEGEN.

For the fun of it, I also like to allocate some capital to what I call “moonshot tokens”, basically tokens which might have the chance to go up a lot.

Currently I have these 3: AVAX, CRO, SHIB.

Good luck, and may next week bring more excellent profits!

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

Our flagship mentoring program is suitable for both beginners and advanced traders, covering the 4 strategies which I used over the past 15 years to build up my 7-figure personal trading portfolio.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

If you're looking for a reputable brokerage that covers all products (SG stocks, US stocks, global stocks, bonds, ETFs, REITs, forex, futures, crypto) and has one of the lowest commissions, this is what I currently use.

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.

Leave a Reply

Want to join the discussion?Feel free to contribute!