Would you like to learn how to create a 2nd source of income in your spare time?

With our unique 7 Step Formula and 4 Proprietary Trading Strategies, 15 minutes a day is all we need to start making consistent profits, and create a 2nd source of passive income.

We are proud to announce that another batch of successful graduates have learnt the original 15 Minute System and how professional traders time the market! Now it is time for them to put what they have learnt into practice, and start reaping profits from the market!

And once again, we have 100% positive reviews and a strong YES! when asked if they would recommend their friends and family.

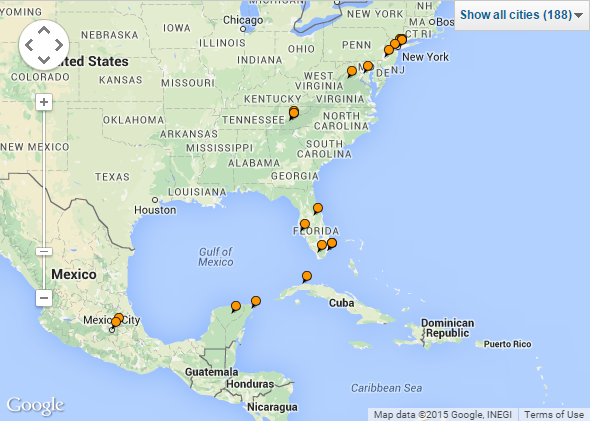

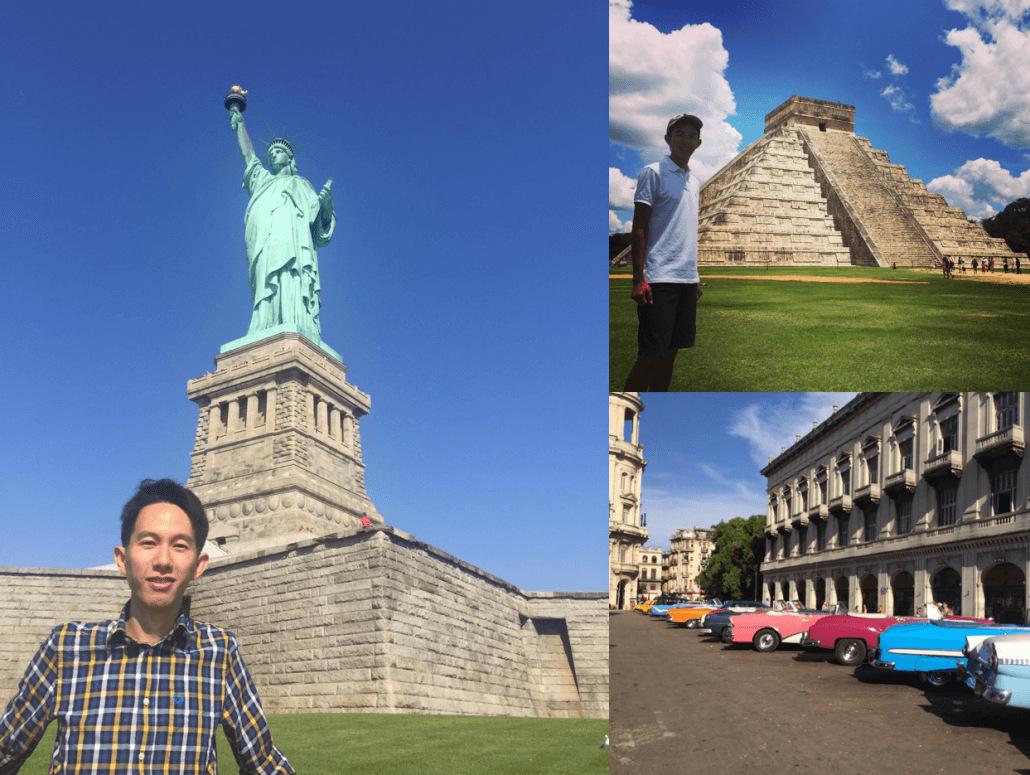

Here at Synapse Trading, our goal is not to sell you some magical blackbox software, but to impart real professional trading skills which can stand the test of time and work under all market conditions. As the head trainer, I have traded professionally at private equity and proprietary funds, and I am an internationally certified CFTe under the IFTA. This is why I am the youngest professional trainer for SGX, helping to train both retail and seasoned traders.

We take special pride in our post-course support and training, with our ongoing monthly LIVE! market workshops, and daily discussions in our private forum and live chat groups, which is why most of our new students come from referrals from past graduates, and we have a long waiting list of people eager to join our exclusive network. Unfortunately, there is one of me, and I only have time to train 20 new traders each quarter.

Q3 2015 Training Program Feedback (Real Results from Real People!)

“Very good course. The 7-step process and the setups covered are very useful to my next trading journey.” – Calvin Ang, Self-employed

“Pace is good, I have a clearer picture now of the market. Concepts are simple to understand, and looks easy to apply in real life!” – Patsy Khoo

“Spencer has simplified a system which allow us to identify trade opportunities from the chart. The step by step identifying the market and setups helps making technical analysis simpler to understand.” – Siong Boon

“You make it so easy to trade, just by following the 4 setups.” – Tan Jiansen

“Course is awesome with key examples and setups to start trading!” – Robert Tan

“Spencer gives clear and concise teaching. The length of the course and content is good.” – Hong Wen, Aerospace

“The trainer explanation is clear. After 2 days of workshop, I have gain much confidence to enter the market with the skill I learnt, setups, money management.” – Zen Ng, Finance

“Spencer is very knowledgeable about markets and trading and is able to present the key concepts of trading in an understandable and effective manner. It is a very good course and I would recommend to others to join.” – Wei Hong, Citibank

“The course is easy to understand for pure beginners. I guess Synapse is a good starting point to learn trading.” – Claire

“Like the flow of the course. Clear, concise advice that I could use in the real world.” – Tan Tay Shyan

“Simplifies the analysis of the stock market.” – Karen Ling

“Course is comprehensive. Food is good. 4 setups strategy are good. Spencer seems very knowledgeable and confident in his trading. He reads a lot and varied. Spencer is a good trader.” – Eve

“Gd. Anyone who want to trade profitably should attend this program.” – Jason Tan

“I learn how to read charts more accurately without tedious drawing of charts and proper money management techniques. 2 thumbs up!” – Joel

“It is a very overall course, especially with the position sizing and money management part.” – Erica

“From zero to hero in two days! Great course!” – William Yeo

“Excellent course for beginners to expert traders. Simple, effective setups explained for beginners to pick up trading. Good confidence builder for everyone and gain financial freedom earlier!” – Neo Yi Xiang

“Comprehensive course from basics to techniques for trading in the market. Good info on setups and putting it all together in the case studies.” – Tammy

Would you like a taste of success too?

To see more testimonials, please visit https://synapsetrading.com/testimonials/

To find out more about our training program, please visit https://synapsetrading.com/the-synapse-program/

After trading for 18 years, reading 1500+ books, and mentoring 1000+ traders, I specialise in helping people improve their trading results, by using tested trading strategies, and making better decisions via decision science.